Stablecoins helped bootstrap DeFi, offering stability, liquidity, and composability across protocols.

But a new class of assets has emerged: synthetic dollars - programmable, collateral-backed, and increasingly tied to real-world economic activity.

🧵👇

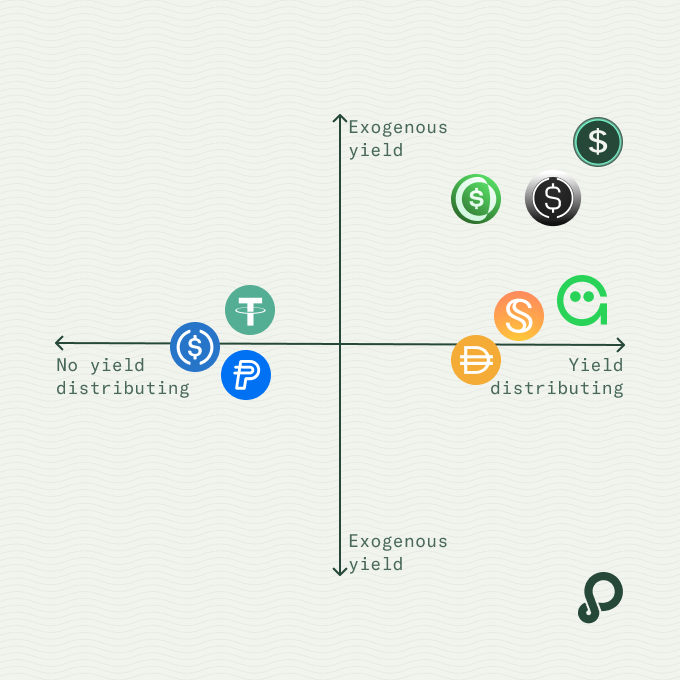

Unlike stablecoins like $USDC, which passively hold reserves, these assets are designed to generate on-chain returns. Two distinct models have emerged:

👉 Endogenous (internally generated): yield from protocol-native mechanisms like fees and incentives

👉 Exogenous (externally

Credit-backed synthetic dollars turn stable assets from static to dynamic 🚀

They unlock capital efficiency, integrate RWAs into DeFi, and redefine how yield is created and distributed on-chain.

Read the full article! 👇 paragraph.com@pareto/synthetic-dollars-rwa-private-credit…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content