As the total market value of crypto assets approaches 3 trillion dollars, with over 300 Layer2 solutions existing simultaneously, and hundreds of yield assets (such as LST) alongside more than 30 stablecoins coexisting, the on-chain capital ecosystem appears prosperous but is actually fragmented:

- Assets and strategies are distributed across different chains, making coordination difficult

- Stablecoins have diverse designs, preventing liquidity concentration

- Governance and participation mechanisms are weak, lacking a positive feedback loop

River (formerly Satoshi Protocol) officially announces its upgrade to a complete on-chain capital circulation system, focusing on solving these structural problems. Through three modules Omni-CDP, Yield, 4FUN, River establishes a cross-chain integrated, community-driven capital cycle from asset generation, liquidity enhancement, yield distribution to contribution governance, and redefines stablecoins as a hub for on-chain value flow

- Omni-CDP: Supports assets like BTC, ETH, BNB as collateral for cross-chain stablecoin minting

- Yield: Returns protocol revenues and collaborative strategy returns to satUSD stakers

- 4FUN: Serves as the Contributions Layer with a dynamic incentive mechanism based on user behavior, community interaction, and on-chain participation

Through this three-layer design, River establishes a circulation system from asset generation → liquidity enhancement → yield distribution → governance participation, enabling on-chain capital to flow organically and sustainably across multiple ecosystems

Omni-CDP: The Foundational Layer for Capital Generation and Cross-Chain Minting

River is based on Omni-CDP, which is not just a stablecoin module, but a multi-chain deployable capital and liquidity aggregation layer

Users can deposit BTC, ETH, BNB, or their LST (such as solvBTC, wstETH) on any supported chain (like Ethereum, BNB Chain, Hemi) and mint satUSD natively on another chain

Omni-CDP integrates LayerZero's OApp communication protocol, with satUSD adopting the OFT standard, to achieve real-time circulation, collateral information synchronization, and liquidation mechanism coordination across multiple chains, eliminating the need for third-party bridges or additional liquidity, significantly improving asset circulation efficiency and security

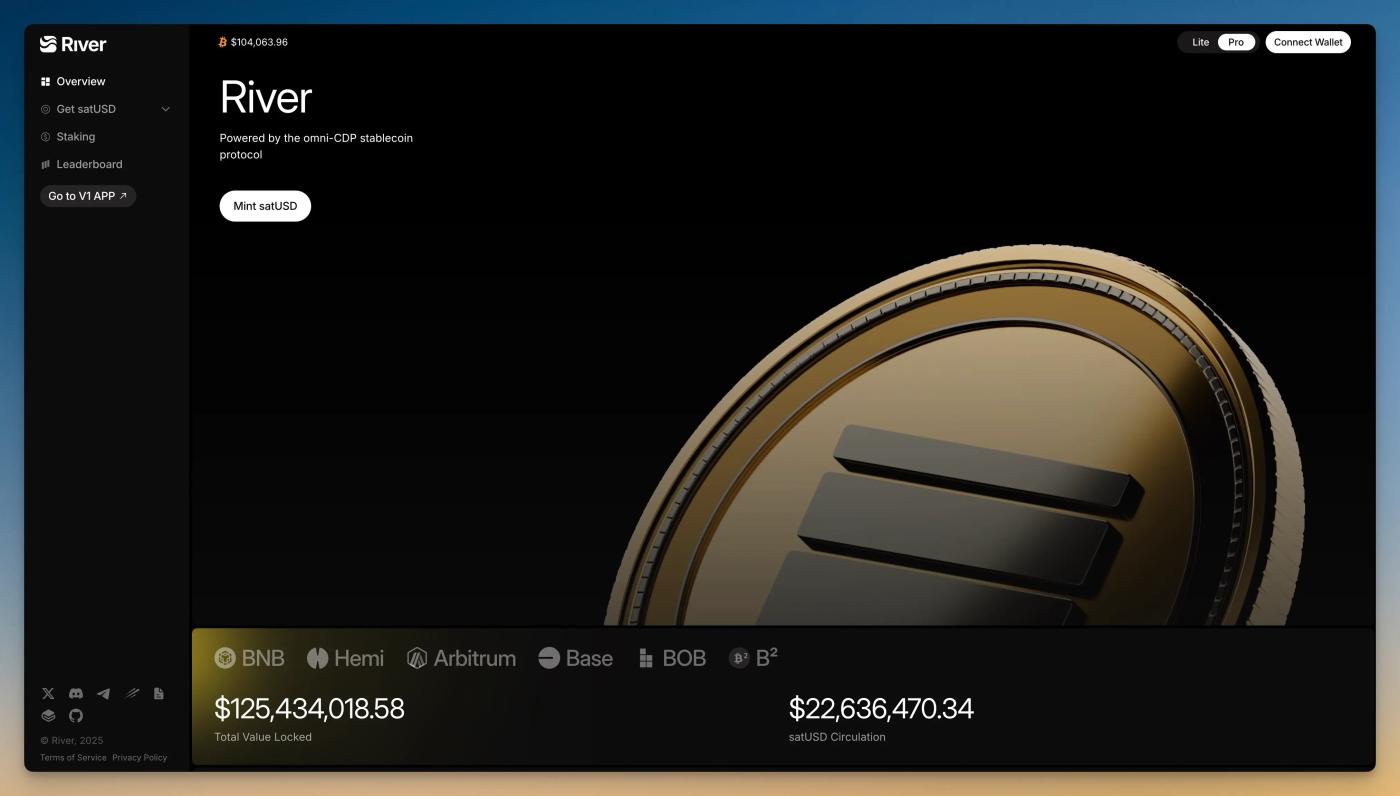

This design makes River's Omni-CDP the only truly "A-chain collateral, B-chain minting" stablecoin protocol that can manage liquidity in real-time; the protocol is currently deployed on BNB Chain, Arbitrum, Base, with a TVL of $125 million and satUSD circulation exceeding $20 million

satUSD: A Stablecoin Supporting Yield with Cross-Chain Liquidity

satUSD is an over-collateralized stablecoin, currently supporting BTC, ETH, BNB (110%–120% collateralization ratio) and mainstream LST (120–150% collateralization ratio) with 0% minting interest to maximize user capital efficiency and strategy flexibility

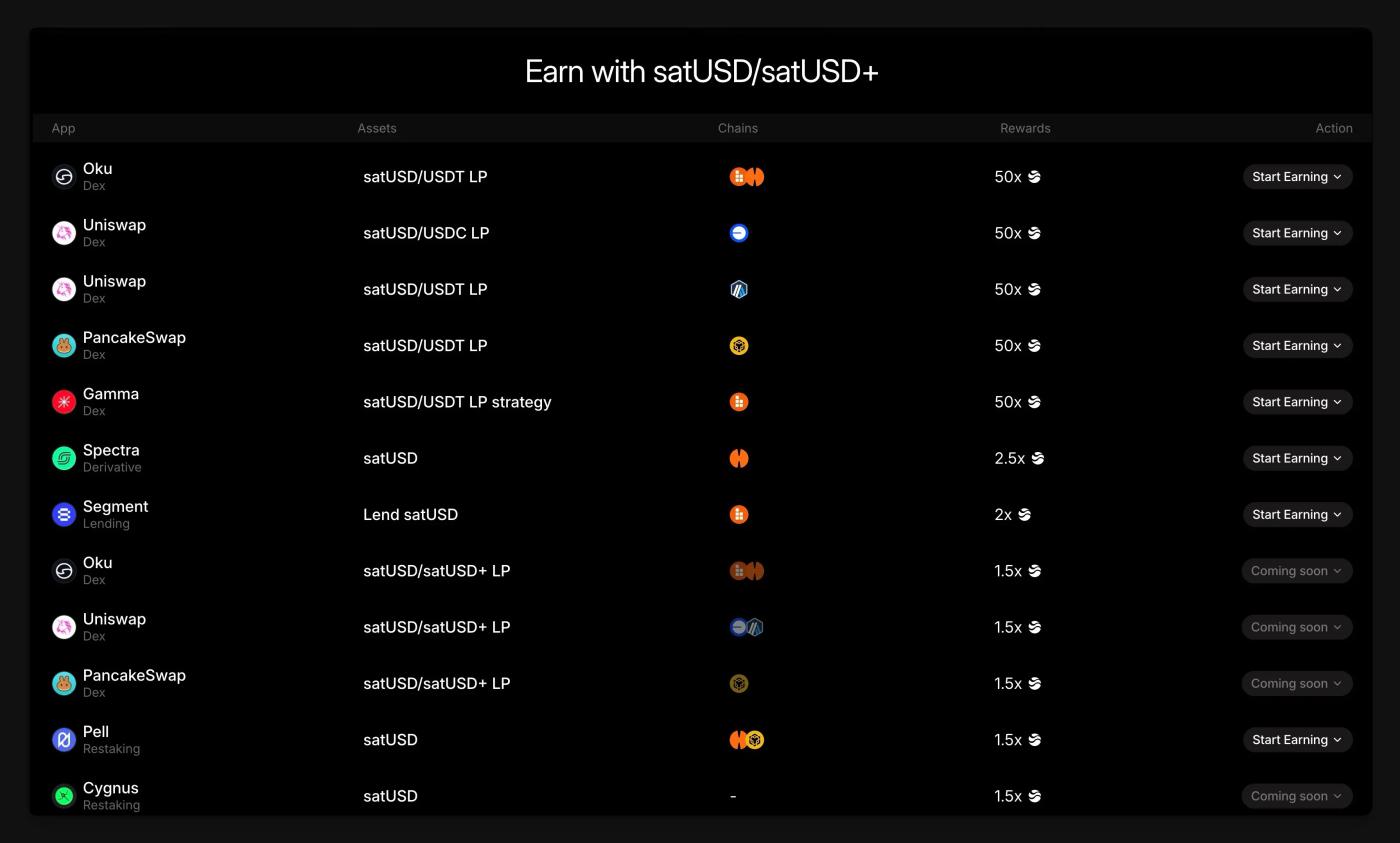

satUSD is currently deployed in ecosystems like BNB Chain, Arbitrum, Base, Hemi, and provides liquidity on DEXs such as PancakeSwap and Oku, and can be used as collateral on lending platforms to borrow USDT for interest rate arbitrage, combining stability with flexible yields

Additionally, satUSD can be further staked as satUSD+, sharing protocol-generated revenues including minting, liquidation fees, and redemption costs, allowing users to participate in the protocol's positive value cycle while maintaining liquidity

With the S2 Airdrop launch, providing satUSD-USDT stablecoin liquidity pool now offers 50x points; details can be found on River's Staking page.

4FUN: River's Contribution Layer, Turning Influence into Assets

In traditional finance and most DeFi protocols, participation and rewards are almost exclusively focused on capital investment. However, a product or protocol's growth and spread often stem from community-initiated participation and promotion

4FUN is the Contributions Layer in the River protocol, designed to measure and reward community contributions.

Users only need to link their X account and share content related to River or supported ecosystem projects to earn River Pts based on reach, interaction, and stability, without any staking or on-chain operations.

River Pts will be converted to $RIVER governance tokens during TGE, representing users' participation and influence in product and protocol promotion, thereby earning future airdrops and governance rights.

4FUN fills the blind spot in the on-chain capital system, allowing community volume and content influence to become part of governance and value distribution, transforming participation into substantive ownership

Current Progress and Future Plans

As of May 2025, River has achieved the following milestones:

- Total Value Locked (TVL) exceeded $125 million

- satUSD circulation reached $20 million

- Over 5,000 stablecoin holders

- Supported collateral assets: BTC, ETH, BNB, solvBTC, etc.

- Deployed chains: BNB Chain, Base, Arbitrum, Hemi, BSquared, etc.

- Integrated over 20 protocols including Oku, PancakeSwap, Spectra, LayerBank, Pell, Segment

In the future, River will continue to expand satUSD application scenarios and deploy to various Layer2 ecosystems; in the near term, it will release 4FUN to encourage users to connect X and participate in token distribution and governance rights

About River

River is an on-chain capital circulation system built on the Omni-CDP architecture, supporting cross-chain collateral, stablecoin minting, yield distribution, and community contribution governance. The stablecoin satUSD integrates LayerZero technology and is issued under the OFT standard, achieving cross-chain liquidity circulation, and completes a full cycle from assets, yields to influence contributions through satUSD+ and 4FUN.