PI dropped 17% in the past 24 hours, falling below $1 despite Pi Foundation's announcement of a $100 million startup fund. Pi Network Ventures was newly launched to promote real-world adoption by investing in companies integrating PI into AI and fintech fields.

Although this initiative created excitement in the ecosystem, technical indicators are sending warning signals. Momentum is weakening across multiple signals, suggesting that profit-taking and broader adjustment may have begun.

Pi Network Launches $100 Million Fund as Momentum Shows Signs of Slowing

After generating some attention, Pi Foundation launched Pi Network Ventures, a $100 million startup investment fund to promote real-world adoption of the PI token.

Funded through 10% of the PI supply, this initiative will invest in companies from early stages to Series B that integrate PI into areas like AI, fintech, e-commerce, and consumer applications.

Most investments will be made using PI tokens instead of fiat, aligning with the project ecosystem's long-term goals. After months of decline, PI recently recovered, rising 85% in the past two weeks amid new investor interest and rumors of Binance listing.

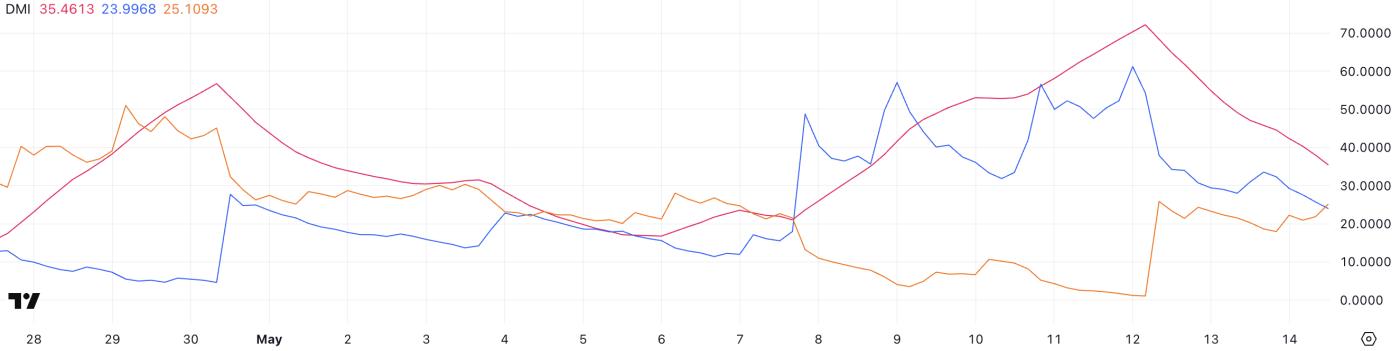

PI DMI. Source: TradingView.

PI DMI. Source: TradingView.Despite the price increase, Pi's technical indicators suggest the upward momentum may be losing strength. The DMI chart shows its ADX dropped from 72 to 35.46 in two days, signaling a strong weakening in trend strength.

An ADX value above 25 indicates a strong trend, while dropping below 20 typically suggests trend exhaustion. Meanwhile, +DI (upward pressure) decreased from 61 to 23.99, and -DI (downward pressure) increased from 1.2 to 25.

This intersection suggests that downward momentum is overtaking upward strength, and unless buying pressure returns, PI may enter a consolidation or correction phase.

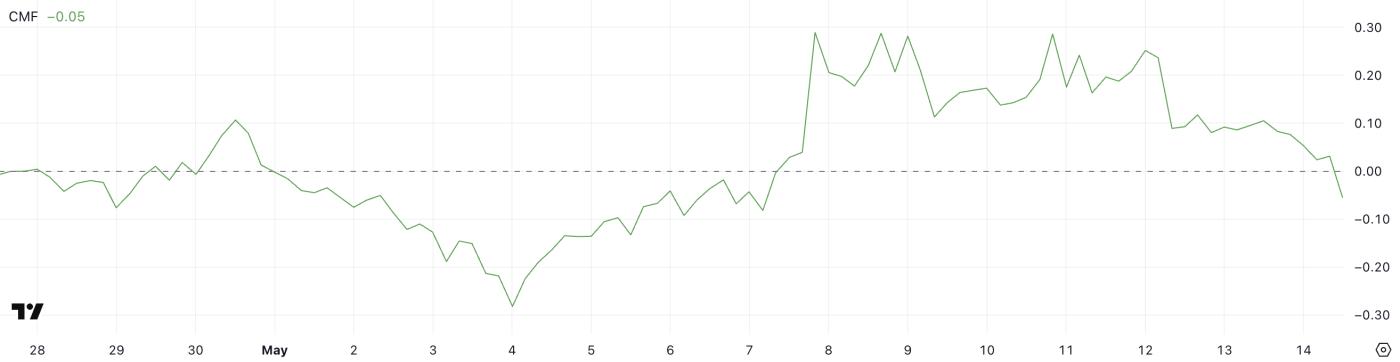

Chaikin Money Flow Decline Warns of Potential PI Profit-Taking

Pi Network Chaikin Money Flow (CMF) significantly dropped from 0.24 to -0.05 in just two days. This change indicates buying pressure has quickly faded, and distribution may be starting to dominate.

CMF is a volume-weighted indicator measuring money flow in and out of an asset. A positive value signals accumulation (buying pressure), while a negative value suggests distribution (selling pressure).

PI CMF. Source: TradingView.

PI CMF. Source: TradingView.A -0.05 indicator is not overly negative. However, the decline from a strong positive zone may indicate weakening investor confidence, especially after the excitement surrounding the $100 million Pi Network Ventures fund announcement.

If CMF continues to decline, it could suggest a short-term price correction as traders take profits after the recent rise.

PI Drops Below $1 as EMA Signals Turn Bearish

PI price dropped 17% in the past 24 hours, falling below $1 and erasing most recent gains.

The current price action aligns with technical weakness, with EMA lines tightening and suggesting a Death Cross—signals typically associated with further price decline.

PI Price Analysis. Source: TradingView.

PI Price Analysis. Source: TradingView.If the correction continues, PI may test support at $0.90, and if breaking below that could open the way to $0.78 or even $0.636.

However, a reversal is not impossible. If bulls regain control, PI could bounce back to test resistance at $1.23. A clear move above that could pave the way for further price increases to $1.67 and $1.798.