Ethereum has experienced a week of price increase, pushing its price closer to the anticipated $3,000 milestone.

However, this increase is facing resistance from large investors selling, putting pressure on the continued rise of this cryptoasset.

Ethereum Investors Increase Selling Pressure

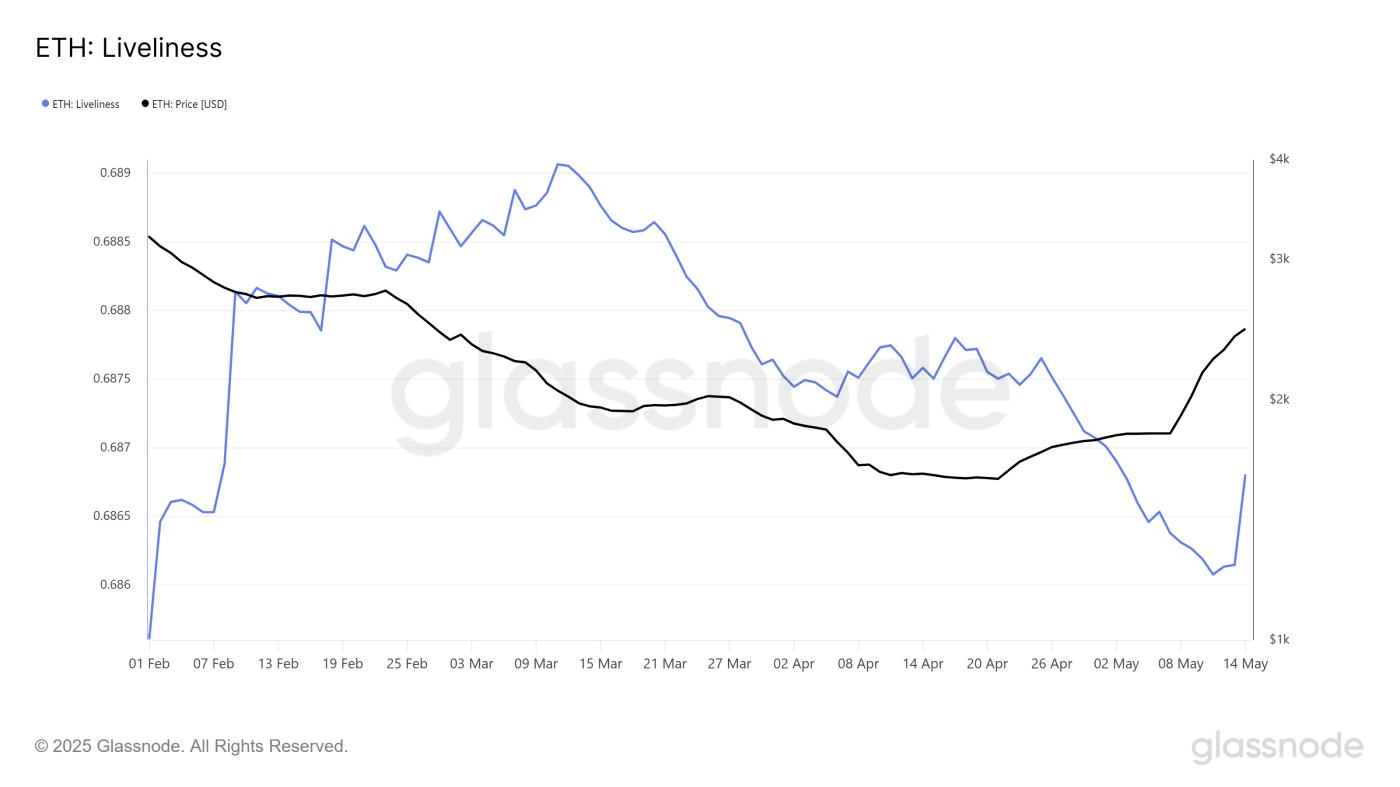

Ethereum's Liveliness index is showing a strong increase, signaling rising selling activity from long-term holders (LTHs). This is the first significant increase in three months, indicating key investors are taking profits at the current price. As LTHs are considered the backbone of an asset, their selling can put downward price pressure on Ethereum.

Selling behavior from long-term investors typically reflects skepticism about short-term price increases. This cautious perspective can create obstacles, potentially limiting Ethereum's recent price rally and challenging higher resistance levels.

Ethereum Liveliness. Source: glassnode

Ethereum Liveliness. Source: glassnodeEthereum's In/Out of the Money Around Price (IOMAP) identifies an important support zone between $2,345 and $2,421. Over 64 million ETH tokens, valued at approximately $164 billion, were purchased in this price range. The concentration of these investors is unlikely to sell at a loss, providing strong price support.

This support is crucial as it can prevent Ethereum from dropping sharply even if short-term selling increases. Investors who bought in this range have little motivation to liquidate their assets, helping to stabilize price action and limit any potential declines.

Ethereum IOMAP. Source: IntoTheBlock

Ethereum IOMAP. Source: IntoTheBlockETH Price Needs to Find Support

Ethereum's price has increased 42% over the past seven days and is currently trading at $2,577. Holding above the $2,500 support level, Ethereum is aiming to break through the $2,654 resistance to continue its upward momentum.

Just 16% away from $3,000, ETH is facing challenges from LTH selling, but the aforementioned solid support zone may prevent a decline. Therefore, when selling stops, ETH will have an opportunity to increase further, provided it can secure $2,814 as support.

Ethereum Price Analysis. Source: TradingView

Ethereum Price Analysis. Source: TradingViewIf broader market conditions deteriorate, Ethereum risks increased selling pressure as investors seek to minimize losses. Dropping below $2,344 could trigger further declines to $2,141, weakening price increase prospects and potentially halting the rally.