Coinbase, the largest US cryptocurrency exchange, which is about to be the first cryptocurrency company to be included in the S&P500 index, was hacked, causing a decline in major cryptocurrency prices. The US Securities and Exchange Commission (SEC) is reportedly investigating allegations of false user number reporting by Coinbase.

According to the global cryptocurrency market site CoinMarketCap on the morning of the 16th, BTC was trading at $103,514.13, the same as the previous day. At the same time, the altcoin leader Ethereum (ETH) recorded a 2.05% drop to $2,542.17. XRP plummeted by 6.37%, trading at $2.387 per coin. Solana (SOL) fell 4.31% to $168.42.

Related Articles

- Bitcoin adjusts to $103,000 range... Ethereum drops 3% [Decenter Market Conditions]

- Coinbase, first cryptocurrency company to enter S&P500... Major cryptocurrencies rise [Decenter Market Conditions]

- Bitcoin falls to $102,000 range despite US-China tariff reduction [Decenter Market Conditions]

- Altcoins drop despite US-China negotiation announcement... Bitcoin rises slightly [Decenter Market Conditions]

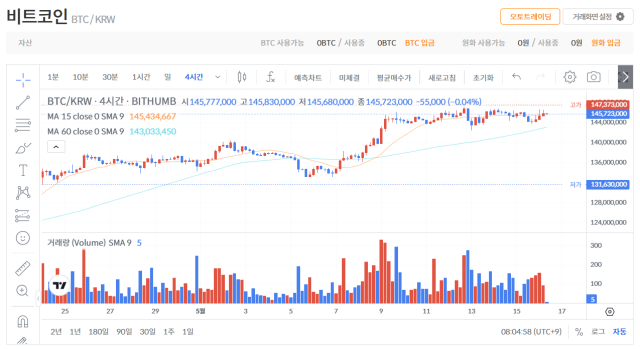

Major cryptocurrencies are also showing a downward trend on domestic exchanges. On Bithumb, BTC recorded a 0.1% drop to 145,794,000 won. ETH fell 2.21% to 3,581,000 won, and XRP was trading at 3,352 won, down 6.81%.

Coinbase reported in its submission to US regulatory authorities that customer data was stolen due to a system hack. According to Coinbase, hackers obtained customer account information on the 11th and demanded $20 million (approximately 2.8 billion won) in exchange for not disclosing the stolen data. The hacked information includes customer names, postal and email addresses, phone numbers, and the last four digits of users' Social Security Numbers (SSN).

Coinbase stated, "Hackers obtained this information by bribing contract employees from regions outside the US who had internal system access" and "We will not pay the money demanded by the hackers." Coinbase estimated that customer compensation costs due to this hack would range from approximately $180 million (about 252 billion won) to $400 million (about 560 billion won).

According to the New York Times, the SEC is also investigating allegations of false user number reporting by Coinbase. When Coinbase went public on Nasdaq in 2021, it claimed to have "over 100 million verified users," and the SEC is looking into whether this number was inflated.

The Crypto Fear and Greed Index from cryptocurrency data analysis firm Alternative.me dropped 3 points to 70 points, indicating a state of "greed". This index means that the closer it is to 0, the more constrained the investment sentiment, and the closer to 100, the more overheated the market is.

- Reporter Kim Jung-woo

- woo@sedaily.com

< Copyright ⓒ Decenter, reproduction and redistribution prohibited >