1/ @MarinadeFinance recently passed MIP.11, a proposal to initiate MNDE buybacks.

The proposal was traded on through futarchy, hosted by @MetaDAOProject

Here are the details 🧵

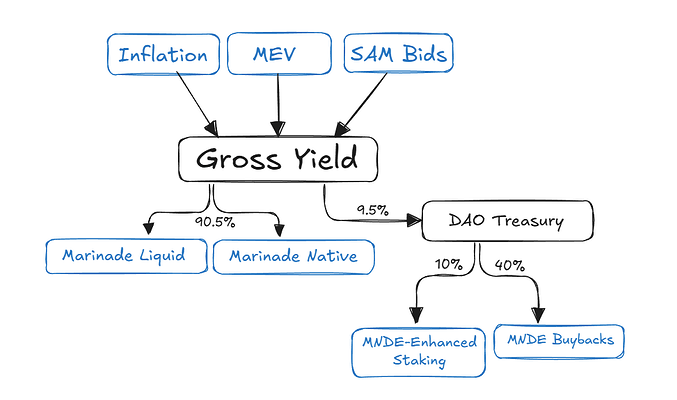

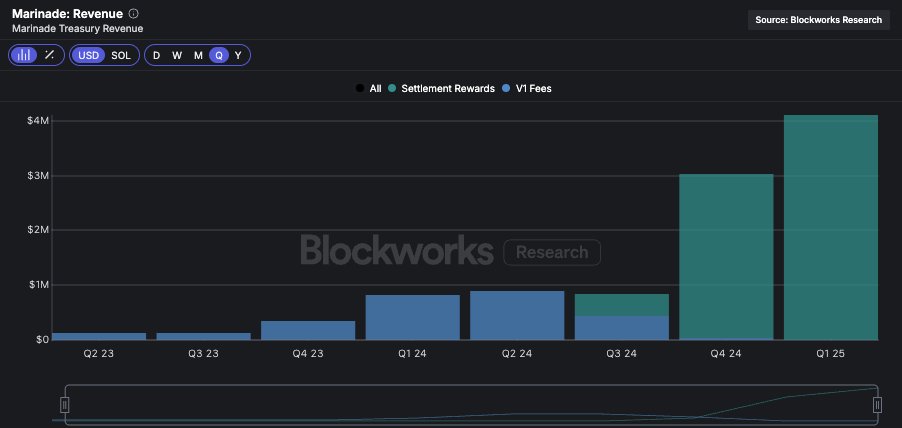

2/ Marinade earns its revenue from SOL inflation, MEV, and the Stake Auction Marketplace (SAM).

While 90.5% of this revenue is allocated to stakers, 9.5% accrues to the DAO Treasury.

MIP.11 proposed that 40% of the DAO revenue be used to fund MNDE buybacks.

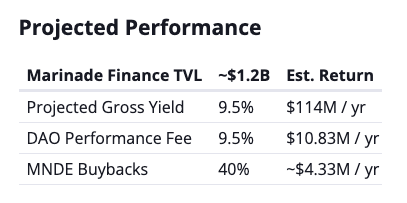

3/ Marinade's DAO revenue has run between $7.2M and $16.4M, annualized.

This buyback program could acquire $2.9M-$6.6M in MNDE/yr.

This equates to 5.8%-13.2% of MNDE's $50M market cap.

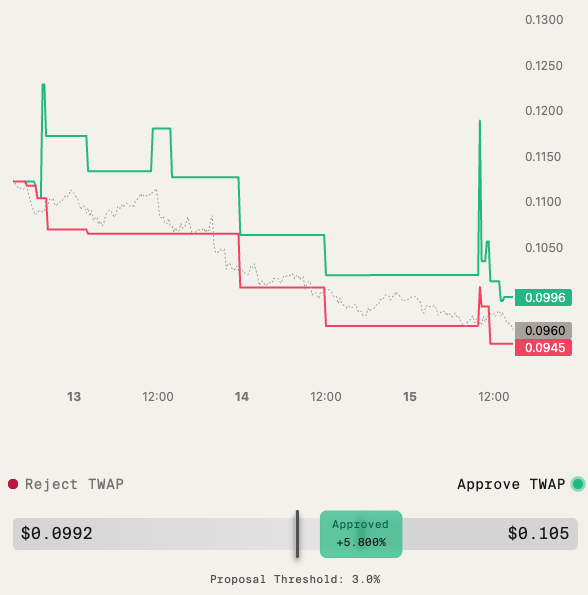

4/ The futarchic market for this proposal passed, with a 5.8% spread between the Fail TWAP and the Pass TWAP.

The Fail TWAP settled at $0.0992, and the Pass TWAP settled at $0.105, while the spot MNDE price was trading at $0.096.

The market traded $33k in volume across 50

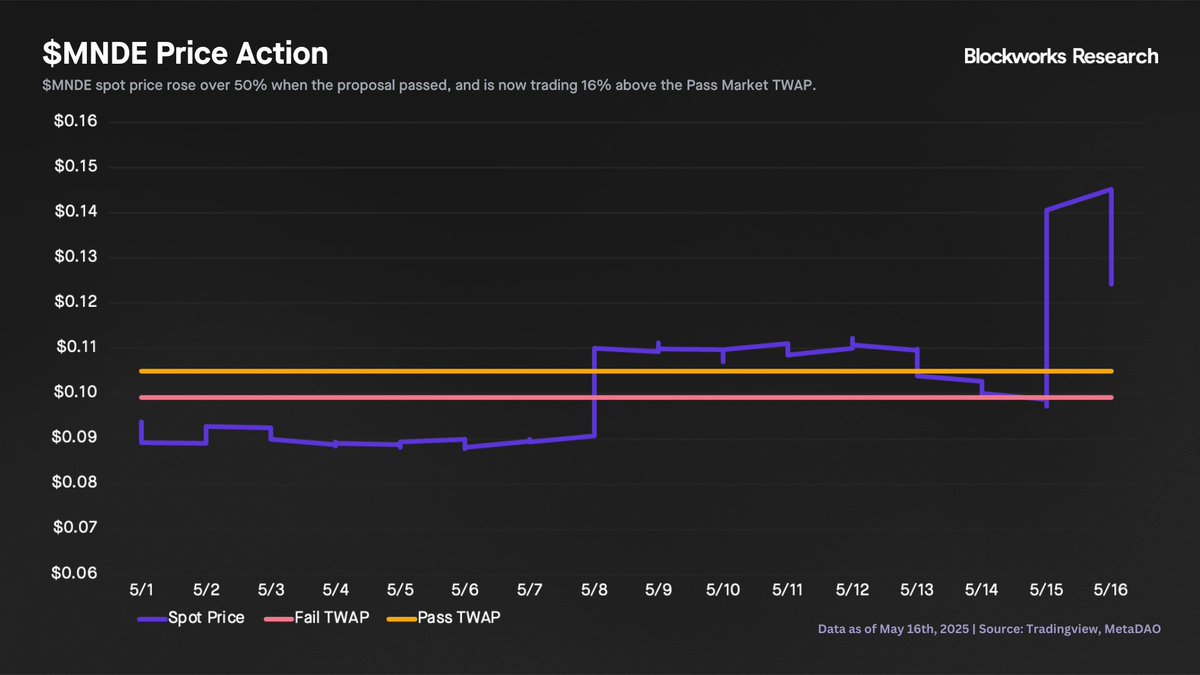

5/ When the proposal passed, the spot MNDE price rose over 50%, and is now trading 16% above the Pass market TWAP.

@MarinadeFinance has effectively employed futarchy to make decisions that are accretive to tokenholders.

6/ For more insights into @MarinadeFinance's financials, check out our full dashboard on @blockworksres.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content