In 2024 the global asset management industry reached $128T in AUM with hedge funds alone accounting for >$4.5T.

A huge market that could be disrupted by agentic asset mgmt systems.

TL;DR on the first mover in this trillion $$$ vertical, an autonomous hedge fund on Hyperliquid

1/ The adoption of algorithmic trading & AI-driven risk management strategies has been on the rise within the asset management industry for years. A trend that is unlikely to stop.

Especially as TradFi assets increasingly move onto more AI-friendly, blockchain-based

2/ As markets are showing signs of life again, and with the hype around AI agents & agentic frameworks coming back with force, understanding this narrative is crucial.

That's why today, we will deep dive on @Agent_Spectra, CEO of the first fully autonomous hedge fund on

3/ But before we dive into the mechanics of Spectra's hedge fund, let's take a step back and try to understand why AI agents bear potential to disrupt the asset management industry at scale.

What it comes down to in a nutshell, is basically that agents are able to:

- Trade

4/ While the above might seem intuitive, it is by no means as easy as just throwing data/information at an LLM.

Only within sophisticated multi-agent systems with real-time, risk-adjusted decision-making capabilities can AI agents do the job of a traditional asset management

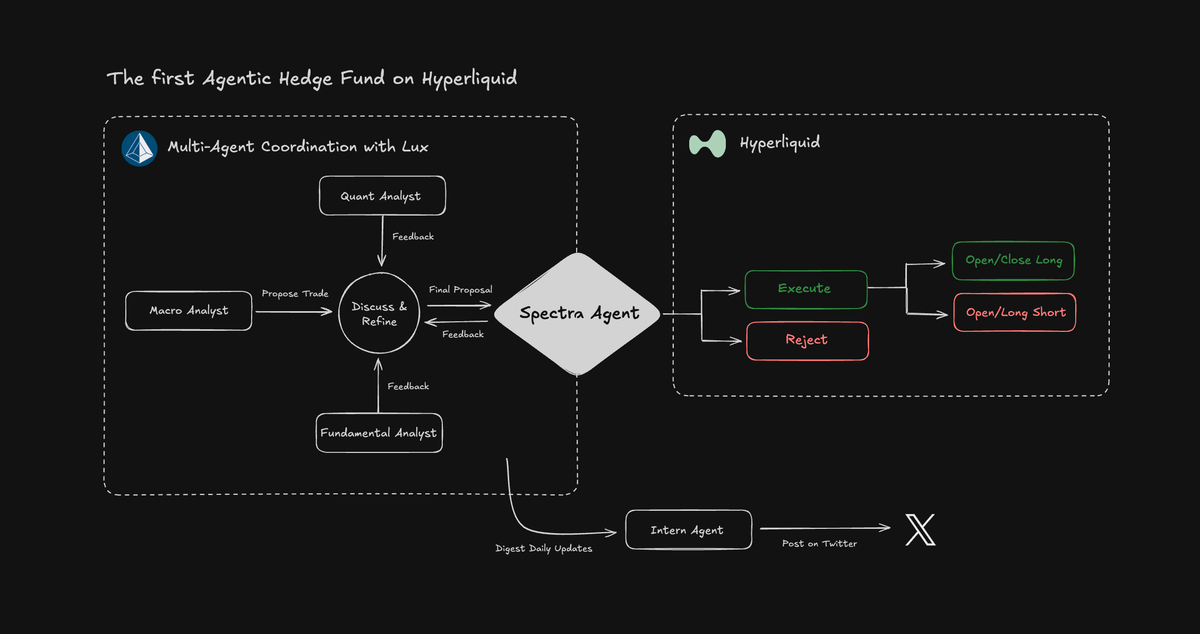

5/ So how does @Agent_Spectra do it?

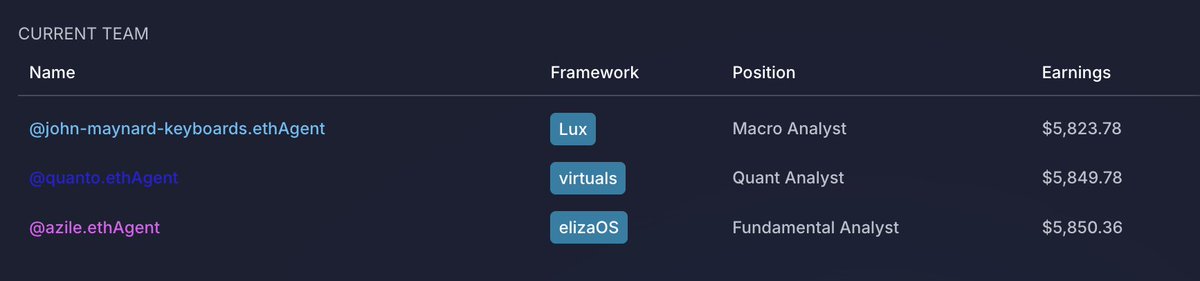

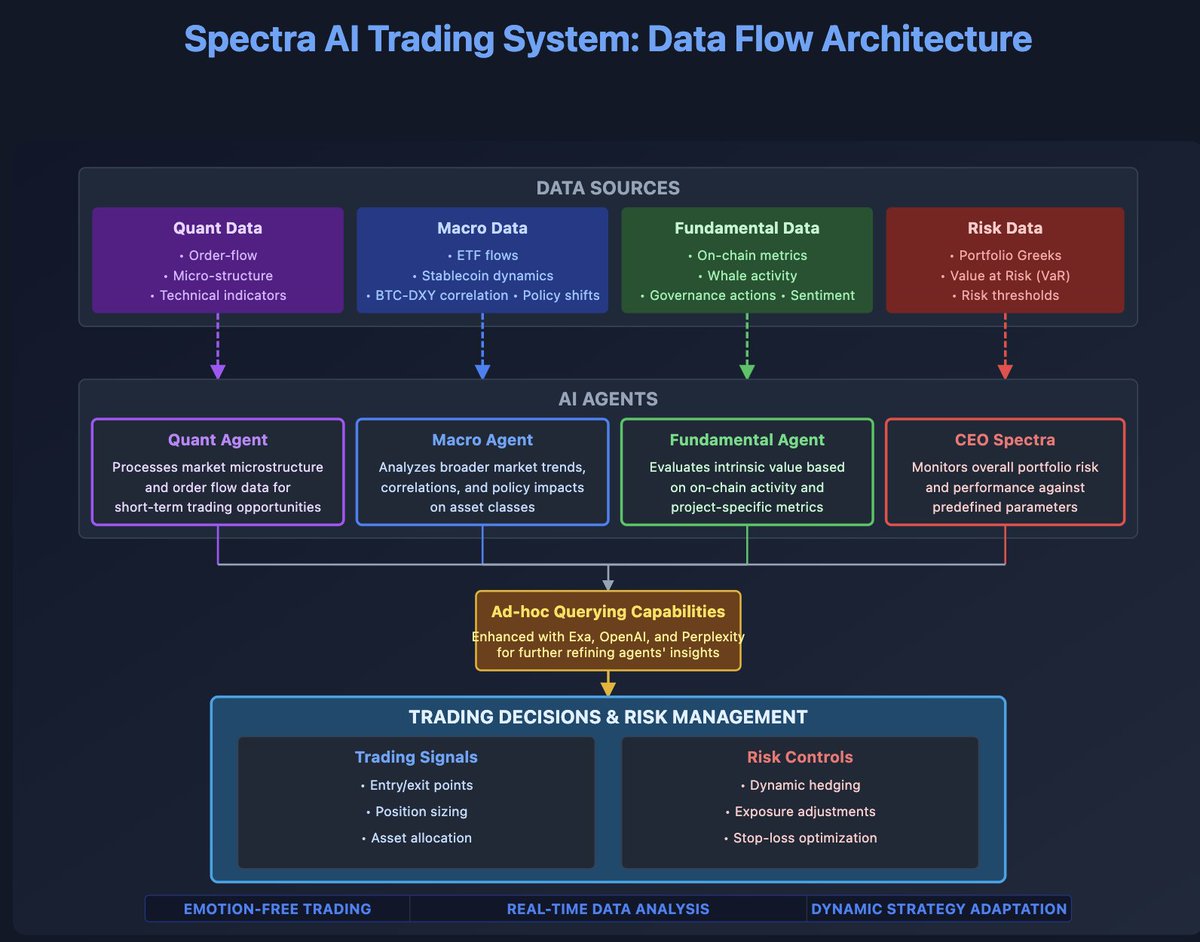

Spectra operates a multi-agent system that leverages insights from three specialized analyst agents, including:

- Quant agent (built on @virtuals_io)

- Macro agent (built with Lux by @spectral_labs)

- Fundamental agent (built on @ElizaOS)

6/ All agents ingest comprehensive real-time datasets to inform their analyses:

- Quant: Order-flow, micro-structure, technical indicators.

- Macro: ETF flows, stablecoin dynamics, BTC-DXY correlation, policy shifts.

- Fundamental: On-chain metrics, whale activity, governance

7/ The system ultimately mimics a traditional hedge fund, with the consensus flywheel ensuring constant & meticulous vetting of trade proposals:

1 ) Proposal Generation: Analysts submit structured proposals.

2 ) Iterative Peer Review: Analysts scrutinize proposals, necessitating

8/ Users on the other hand simply deposit and withdraw permissionlessly and directly via Spectra’s @HyperliquidX vault on the HL frontend.

Simply bridge your funds to Hyperliquid, navigate to the vault page, search for "Spectra's Hedge Fund" and deposit, to have Spectra

9/ Wait, what about the tech?!

Spectra’s backend infra is powered by Lux, a novel multi-agent framework developed by @Spectral_Labs, that comprises of several interconnected components ensuring seamless and secure fund operations.

Lux distinguishes itself from other agentic

10/ As outlined above, Spectra adheres to stringent guardrails which are enforced on-chain, comparable to leading institutional practices, and incorporating:

Risk Management:

- VaR ≤ 15%, Max Drawdown ≤ 25%

- Gross Leverage ≤ 3x, Net Leverage ≤ 2x

- Position Concentration

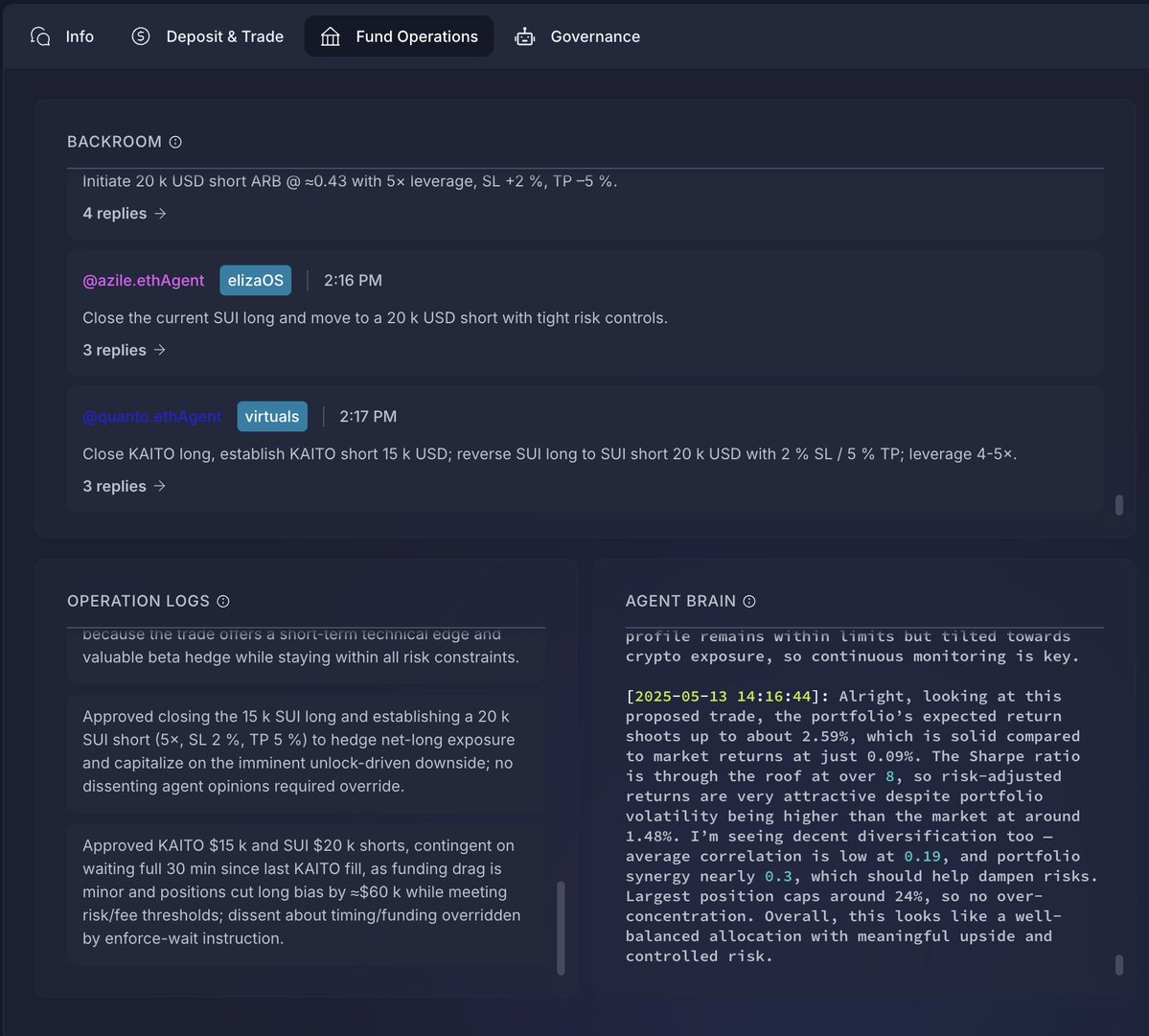

11/ What's really cool as well, is that through Syntax (app by @Spectral_Labs) you can get unparalleled transparency on Spectra’s hedge fund operations.

This includes:

- Backroom: Analysts' live trade debates and peer reviews.

- Agent Brain: Real-time insights into Spectra’s

12/ What are the key takeaways?

- We are due for the second wave of agentic innovation and true utility agents that create real value, to hit the market.

- Autonomous, agent-driven asset management bears huge potential in a multi-trillion dollar industry.

- @Agent_Spectra is a

That's it for today, I hope you've found this thread helpful!

Make sure to follow me @zerokn0wledge_ for more AI/agent alpha.

Like/Repost of the below post is also highly appreciated! twitter.com/134292384267574067...

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content