US Crypto Funds Attract $7.5 Billion in 2025, with $785 Million in the Past Week. Ethereum Leads Capital Inflow, Reaching $205 Million.

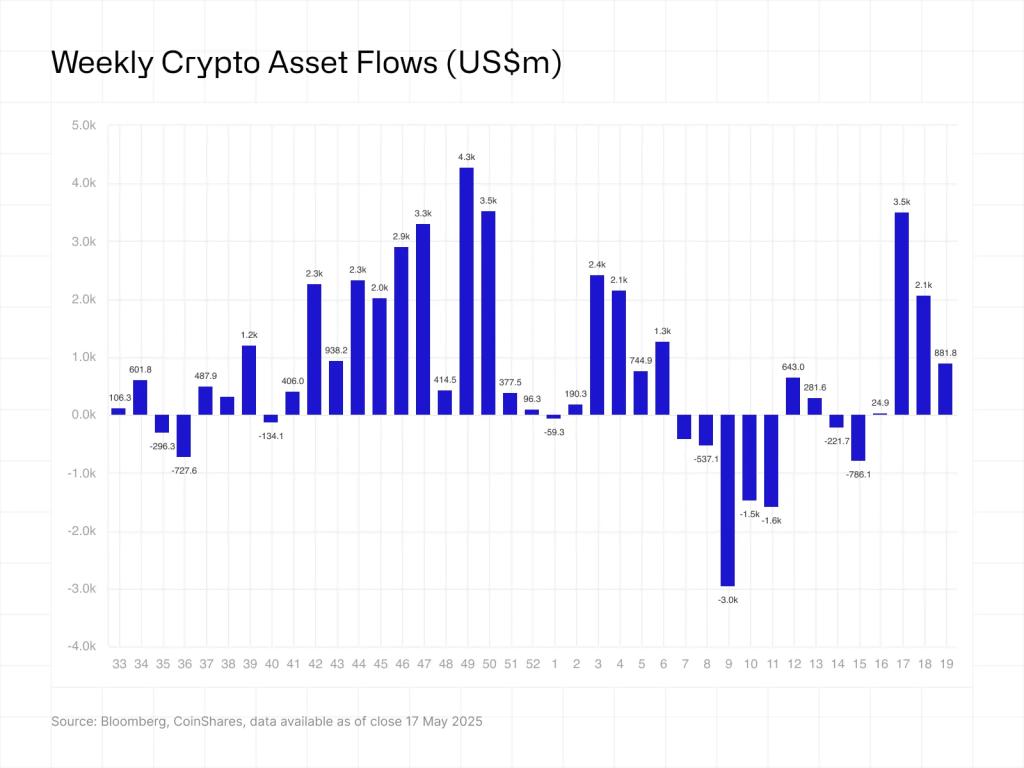

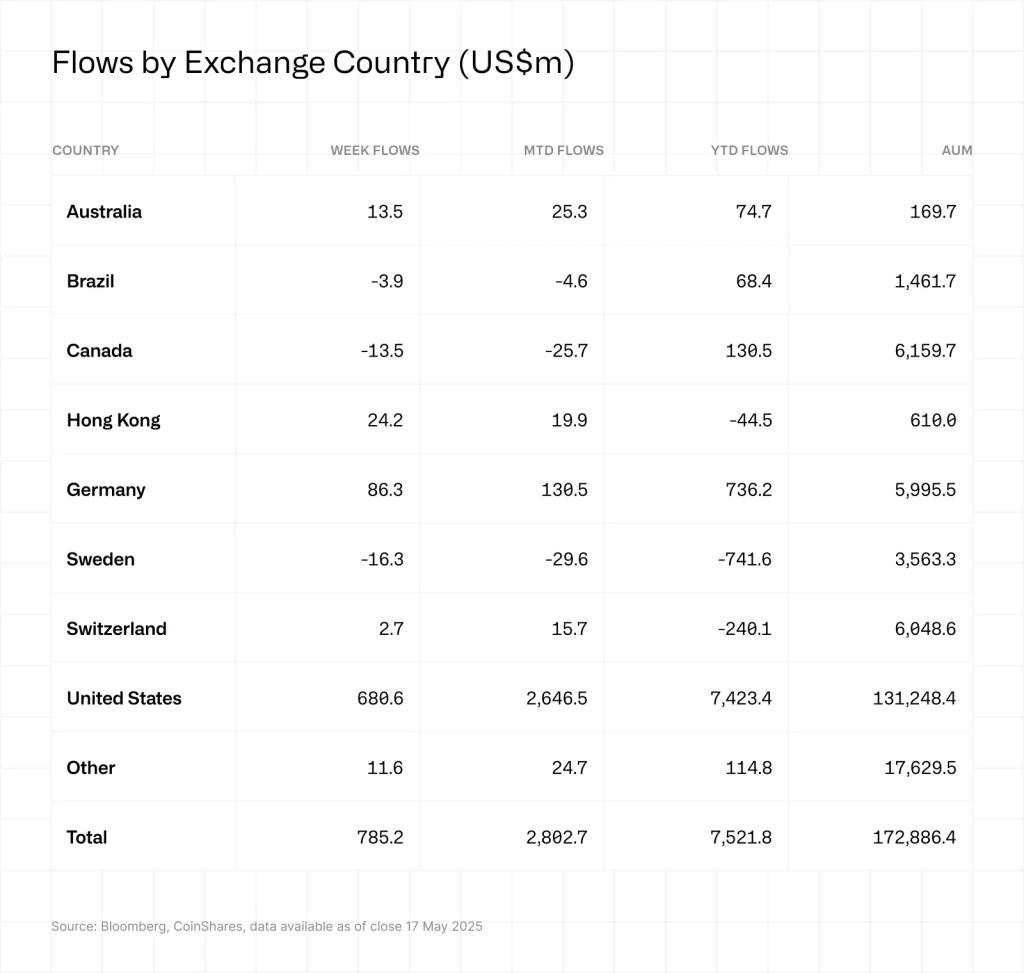

Cryptocurrency investment products in the US are experiencing a strong recovery in 2025, clearly reflecting an increased risk appetite among investors. According to the report from digital asset management company CoinShares on May 19, the total net capital inflow into the cryptocurrency market YTD has exceeded $7.5 billion, following five consecutive weeks of capital inflows. In the past week alone, the capital flowing into US crypto funds reached $785 million, with Ethereum being the standout highlight.

This development marks a clear reversal from the capital withdrawal of nearly $7 billion in February and March, indicating that market confidence is returning, especially for high-volatility assets.

The US continues to lead in capital flow volume with $681 million in the week, followed by Germany ($86.3 million) and Hong Kong ($24.4 million). Part of the momentum comes from macroeconomic factors: the White House's announcement of a 90-day postponement of additional taxes starting from May 12. This policy, including a reduction of import duties up to 24% for both the US and China, has helped boost positive sentiment towards risky assets like cryptocurrencies.

Immediately after this announcement, Coinbase recorded the largest Bitcoin withdrawal in 2025: over 9,739 BTC, equivalent to more than $1 billion, were withdrawn from the exchange. André Dragosch – Director of European Research at Bitwise – noted: "This is a clear signal showing that institutional investment appetite is rapidly increasing."

In the overall picture, Ethereum (ETH) emerged as the asset with the most outstanding capital flow performance last week, with $205 million invested, raising the total capital inflow YTD to $575 million. According to CoinShares, most of this capital flow comes from the optimistic sentiment following two notable events: the successful deployment of the Pectra upgrade and the announcement of a new CEO – Tomasz Stańczak.

The Pectra upgrade officially went live on the Primary Network from May 7, bringing significant improvements such as raising staking limits and supporting account abstraction features through Ethereum Improvement Proposal EIP-7702.

On the contrary, Solana (SOL) was the only major asset to record net capital outflow, with $890,000 withdrawn in the week.

In a related development in the Ethereum ecosystem, co-founder Vitalik Buterin recently proposed a new initiative aimed at protecting Trustless access and enhancing censorship resistance on the network. This proposal focuses on reducing data load for nodes on layer-1, making local node operation more user-friendly.

According to Stella Zlatareva, editor at Nexo Dispatch, the new initiative could significantly reduce the current data volume (around 1.3TB) by allowing nodes to synchronize only relevant information. This is expected to enhance network participation while maintaining decentralization – a crucial pillar in Ethereum's design.