Abraxas Capital, a $3 billion investment management company, has allocated $837 million to Ethereum (ETH), raising its total portfolio value to over $950 million. This bold move reflects growing institutional confidence in ETH and has sparked speculation among analysts about the potential start of an altcoin season.

Notably, the company's decision to increase its holdings comes amid growing interest in Ethereum. Traders are increasingly buying ETH, leading to a significant reduction in exchange reserves to the lowest level in nine months.

Why are investors buying Ethereum?

Ethereum, which faced challenges in 2025 due to unimpressive price performance and increasing selling pressure, underwent a change after the Pectra upgrade. This implementation boosted prices and stimulated investor interest in the asset.

A recent BeInCrypto report highlighted that over 1 million ETH was withdrawn from exchanges in the past month. Additionally, data from CryptoQuant shows exchange reserves have dropped to unprecedented levels since late August 2024, signaling a potential price increase prospect.

Ethereum Exchange Reserves. Source: CryptoQuant

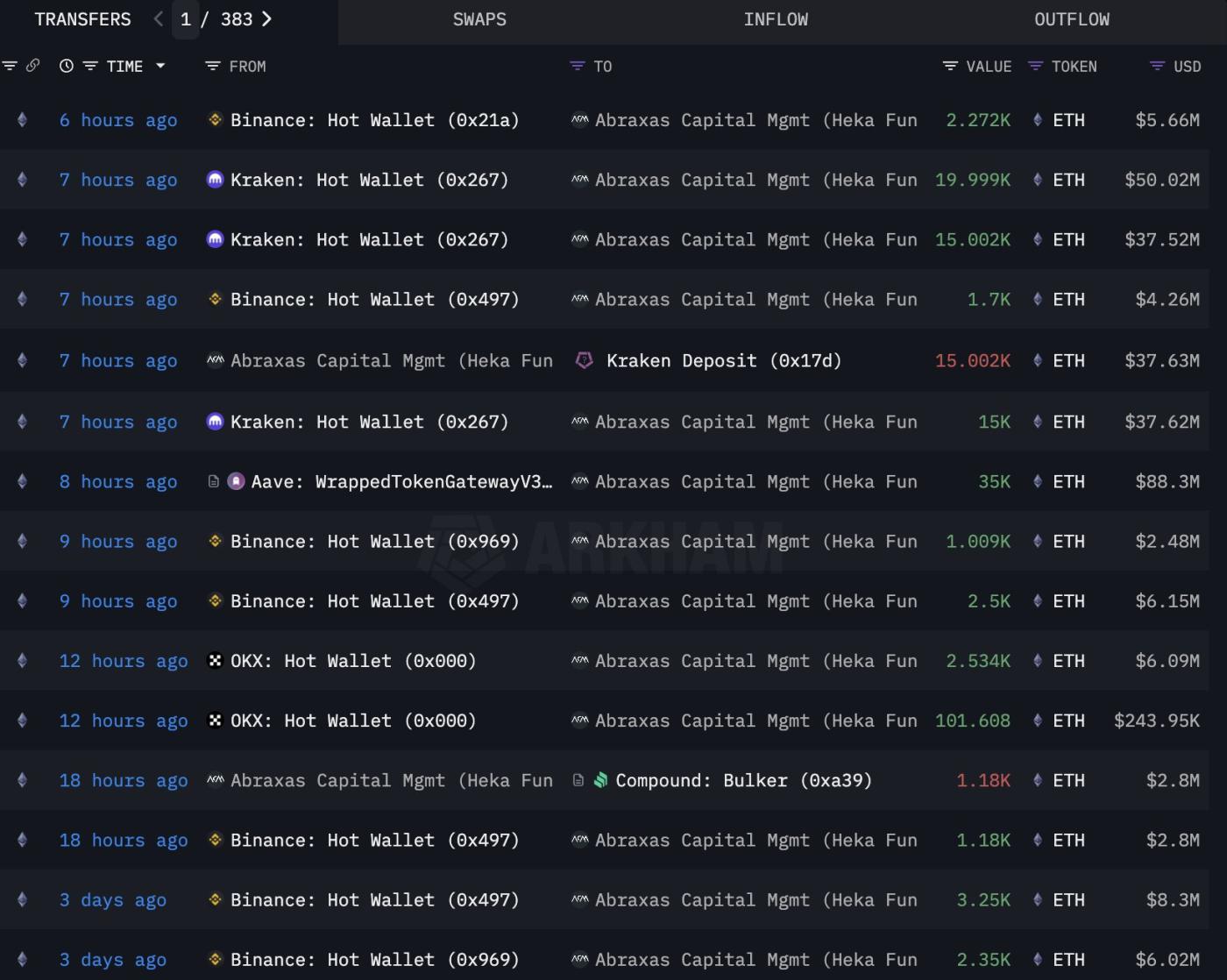

Ethereum Exchange Reserves. Source: CryptoQuantAmong the buyers, Abraxas Capital stands out with its aggressive accumulation strategy. According to Lookonchain data, the company bought 46,295 ETH worth $115.3 million today.

This purchase follows a brief three-day pause. Importantly, the investment manager has consistently increased ETH holdings since the beginning of the month.

From May 7th to date, the company has accumulated 350,703 ETH worth $837 million, with an average purchase price of $2,386. This has generated an unrealized profit of $50 million.

The company's ETH strategy is further supported by a shift away from Bitcoin. BeInCrypto previously reported that Abraxas significantly reduced its Bitcoin holdings, redirecting capital to Ethereum.

Abraxas Capital Buying Ethereum. Source: X/Lookonchain

Abraxas Capital Buying Ethereum. Source: X/LookonchainAbraxas Capital's focus on Ethereum aligns with the Ethereum Alpha Fund, launched in July 2023. This fund, using conditional leverage through options and profit-generating strategies, aims to outperform ETH's base price performance. In 2024, the Ethereum Alpha Fund increased by 62.7%, surpassing Ethereum's 50.9% increase.

Does ETH Accumulation Signal an Upcoming Altcoin Season?

Meanwhile, Abraxas Capital's focus on Ethereum has not gone unnoticed in the crypto community. Some even believe these moves could lead to an altcoin season.

Atlas, an analyst, suggests that Abraxas's ETH activity is not a typical high-risk speculative play. It's a sign of institutional interest. The analyst believes Ethereum is on track to become the "institutional favorite" in this cycle.

He added that the company is following a familiar scenario, similar to Alameda Research in 2021, by buying Ethereum early, driving positive market narratives, and then moving to altcoins to stimulate an altcoin season.

"The ETH shift is a signal – altcoin season is the real move. The 2021 machine is returning with deeper pockets," he said.

The return of the altcoin season is something many in the industry are anticipating. Tracy Jin, COO of MEXC, told BeInCrypto that initial signs have emerged: BTCD has significantly decreased, altcoin market capitalization has increased, USDT dominance is declining, and altcoin charts are showing improved price structures.

"Ethereum's performance is another signal indicating the potential start of an altcoin season. While large short positions among ETH traders and previous persistent bearish sentiment suggested a continuation of the downtrend, increased risk appetite has renewed interest in ETH and smaller altcoins," Jin revealed to BeInCrypto.

She added that while it's technically still a "Bitcoin season," the foundation for an altcoin shift is clearly forming. If capital continues to flow in this direction, the first phase of the altcoin season may begin earlier than expected.