Macroeconomic fluctuations from China and the US have brought Bitcoin (BTC) into the spotlight, creating favorable conditions for its narrative as a hedge against traditional financial (TradFi) instability.

The impact of macroeconomic factors and forces on Bitcoin has increased from 2024 to 2025, after a downturn in 2023.

Bitcoin Benefits from China's Interest Rate Cut and US Credit Downgrade

On Tuesday, the People's Bank of China (PBOC) cut its benchmark lending rate for the first time in seven months. Specifically, they lowered the 1-year Loan Prime Rate (LPR) from 3.10% to 3.00% and the 5-year LPR from 3.60% to 3.50%.

This move injects new liquidity into global markets. It aims to stimulate the sluggish economy due to weak domestic demand and stabilize the shaky real estate sector, all amid recent trade tensions with the US.

"PBOC cuts... to support the economy amid slowing growth and trade pressure from the US. Essentially, this pumps more momentum into risky assets by providing cheaper liquidity and boosting risk sentiment," Axel Adler Jr., a chain and macro researcher, commented.

While China's easing measures aim to promote domestic borrowing and spending, they can also spill over into global asset markets, including cryptocurrencies.

Often seen as a high-beta asset, Bitcoin typically benefits from such liquidity flows. This is especially true when combined with fiat currency weakness or broader economic instability.

Meanwhile, the US is facing its own credibility crisis. Moody's downgraded the US sovereign credit rating from AAA to AA1. They cited persistent fiscal deficits, soaring interest costs, and federal debt expected to reach 134% of GDP by 2035.

This is only the third major downgrade in US history, following similar moves by Fitch in 2023 and S&P in 2011. Nick Drendel, a data integrity analyst, highlighted the volatile market response to previous downgrades.

"[Fitch's downgrade in 2023] led to a 74-day trading correction (-10.6%) for Nasdaq before closing above the pre-downgrade closing level," Drendel noted.

This downgrade reflects concerns amid massive debt, political gridlock, and increasing default risks.

Moody's Downgrade, US Financial Issues Boost Bitcoin's Attractiveness as a Safe Haven

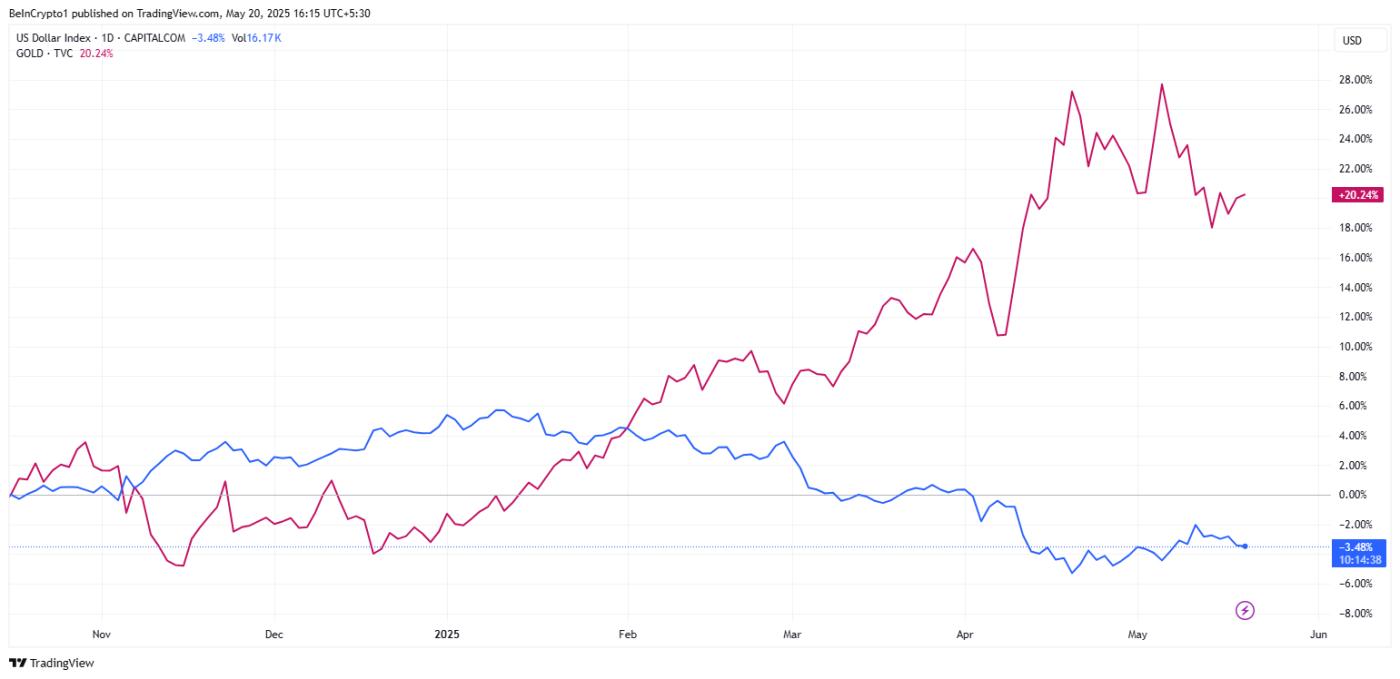

Chain analyst Adler points out that the market response was swift. The US Dollar Index (DXY) weakened to 100.85, while gold rose 0.4%, signaling a classic flight to safety.

DXY weakens as gold rises. Source: TradingView

DXY weakens as gold rises. Source: TradingViewBitcoin, often called digital gold, has attracted new interest as a non-sovereign value store.

"...despite prevailing 'risk-off' sentiment... Bitcoin may find itself in a relatively stronger position in the current environment thanks to the 'digital gold' narrative and the supportive impact of a weaker dollar," Adler commented.

Ray Dalio, founder of Bridgewater Associates, criticized credit ratings for underestimating broader monetary risks.

"...they only assess the risk of governments not repaying debt. They do not include the larger risk that indebted countries will print money to repay debt, thus causing bondholders to suffer losses from the reduced value of the money they receive (instead of from the reduced amount of money they receive)," Dalio warned.

In this context, Dalio concludes that the risk to US government debt is larger than rating agencies are conveying.

Agreeing with that view, economist Peter Schiff argues that inflation risk should be prioritized when rating sovereign debt. According to him, this is especially true when foreign investors, who lack political leverage, hold most of the debt.

"...when a country owes much debt to foreigners, who cannot vote, the potential for default on foreign-owned debt should be considered," he noted.

Two macro changes, China's liquidity injection and the US showing financial cracks, provide Bitcoin with a unique tailwind. History shows that BTC has thrived in similar conditions – increasing inflation fears, weakening fiat credibility, and global capital seeking sustainable alternatives.

Despite market volatility, the combination of China's easing policy and new doubts about US financial discipline could drive institutional and retail investors towards decentralized assets like Bitcoin.

If the dollar continues to lose appeal and central banks adopt more accommodative policies, Bitcoin's value as a politically neutral, non-inflationary asset will become hard to ignore.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoData from BeInCrypto shows that BTC is trading at $105,156 at the time of writing. This represents a slight increase of 2.11% over the past 24 hours.