Expectations for the Altcoin season are fading as recent indicators show weakening momentum. Although FTX's upcoming repayment of $5 billion on May 30 could inject new liquidation into the market, capital is flowing back into Bitcoin.

BTC's dominance has recovered, and the ETH/BTC ratio has decreased, both indicating altcoins are losing strength. The Altcoin Season Index has dropped to 25, confirming that Bitcoin is still strongly in control.

FTX's $5 Billion Repayment Could Boost June Altcoin Season — But Momentum Is Declining

FTX will distribute over $5 billion to approved creditors on May 30, marking one of the largest payments in cryptocurrency bankruptcy history.

Many analysts believe this sudden liquidation could spark momentum for altcoins in June, as recipients may seek to reinvest in the market.

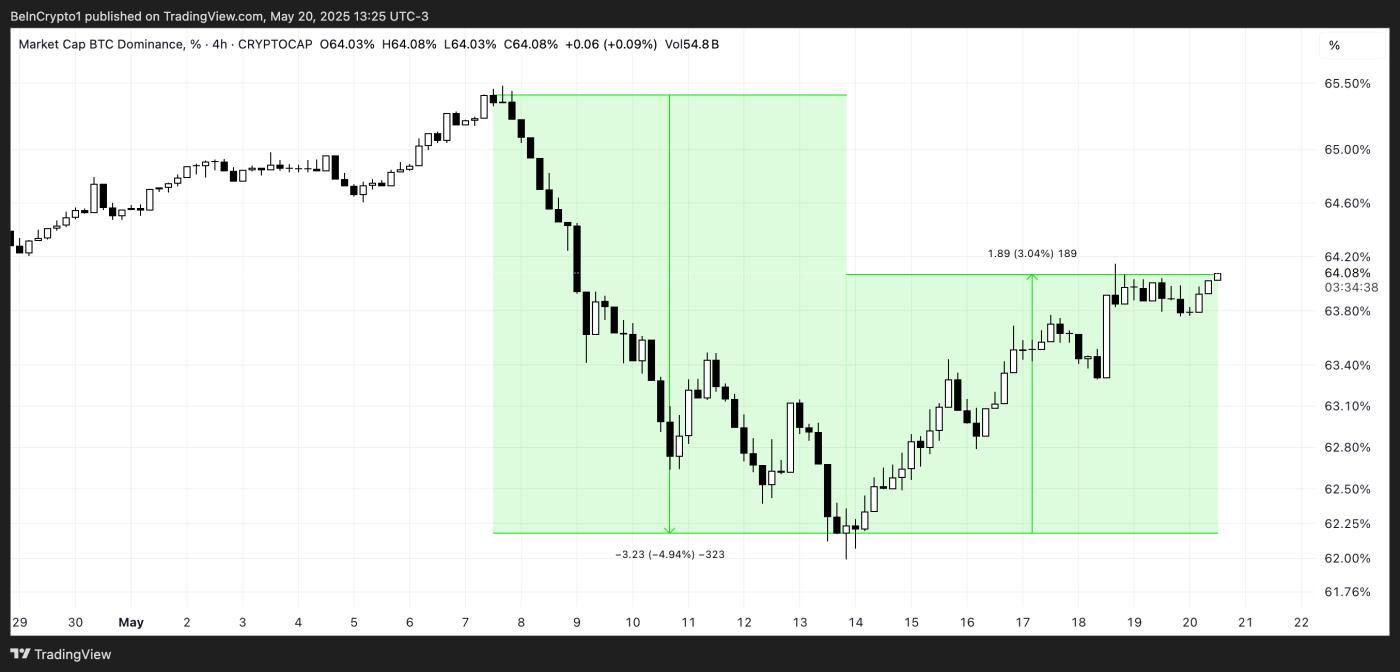

BTC Dominance (%). Source: TradingView.

BTC Dominance (%). Source: TradingView.That optimism temporarily aligned with market structure—from May 7 to May 13, Bitcoin's dominance sharply dropped from 65.5% to below 62.2%, with a nearly 5% decrease fueling speculation that an altcoin season was occurring.

However, that sentiment cooled: from May 14 to May 20, BTC's dominance increased by 3%, reversing most of the previous week's change and indicating capital is returning to Bitcoin.

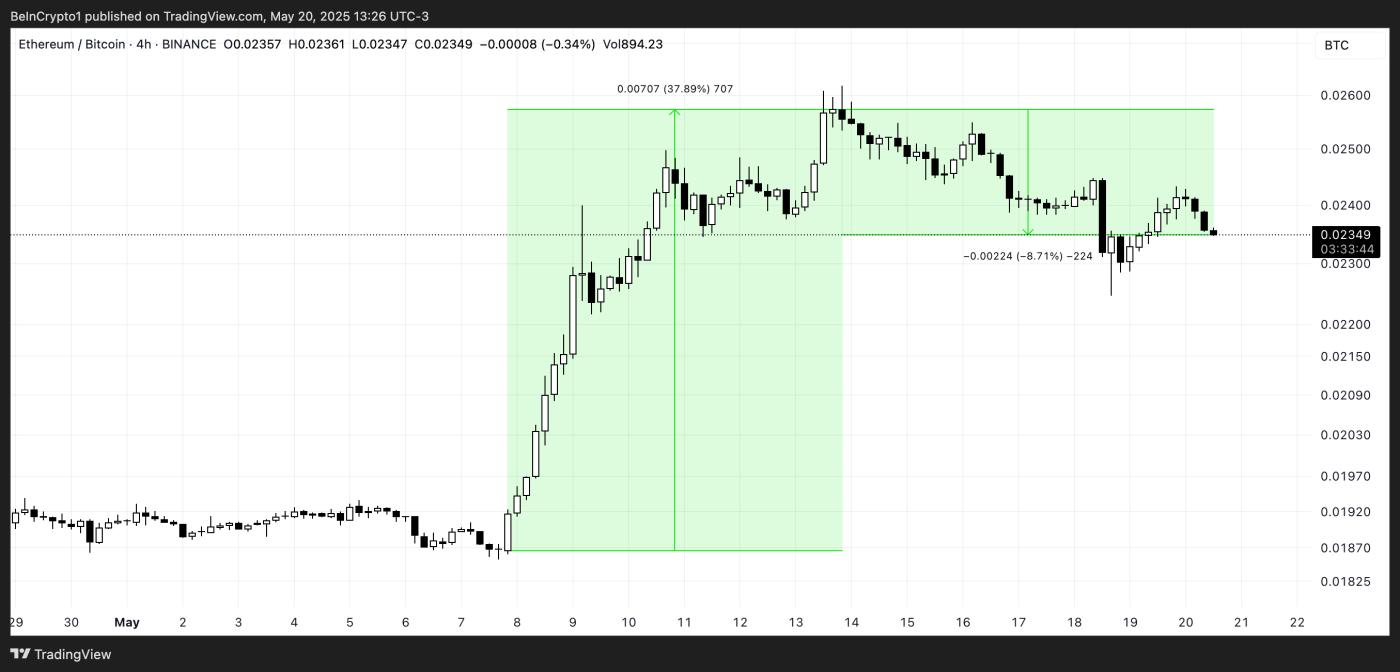

Another key signal, the ETH/BTC ratio, tells a similar story. From May 7 to May 13, Ethereum significantly increased against Bitcoin, with a nearly 38% rise, further boosting confidence that a broader altcoin surge was beginning.

ETH/BTC Ratio. Source: TradingView.

ETH/BTC Ratio. Source: TradingView.But in the following week—from May 14 to May 20—that ratio dropped 8.7%, showing ETH's relative strength weakening and reducing altcoin season expectations.

These changes indicate that despite FTX's payment potentially injecting new capital, the altcoin season narrative is losing momentum—at least for now.

Altcoin Momentum Declines as Index Hits 25 — Will FTX Liquidation Change That?

The cryptocurrency market's total capitalization, excluding Bitcoin, is currently $1.17 trillion, increasing from $1.01 trillion on May 7 but sharply dropping from $1.26 trillion on May 13.

This trend shows that although altcoins experienced a short-term capital inflow in early May, momentum has weakened, with nearly $90 billion leaving the space in just one week. This withdrawal emphasizes the lack of sustainable confidence in a comprehensive altcoin price surge.

Total Crypto Market Cap (Excluding BTC). Source: TradingView.

Total Crypto Market Cap (Excluding BTC). Source: TradingView.However, the upcoming $5 billion liquidation from FTX's repayment on May 30 could restore the capital that altcoins need to spark momentum and potentially kickstart an altcoin season in June.

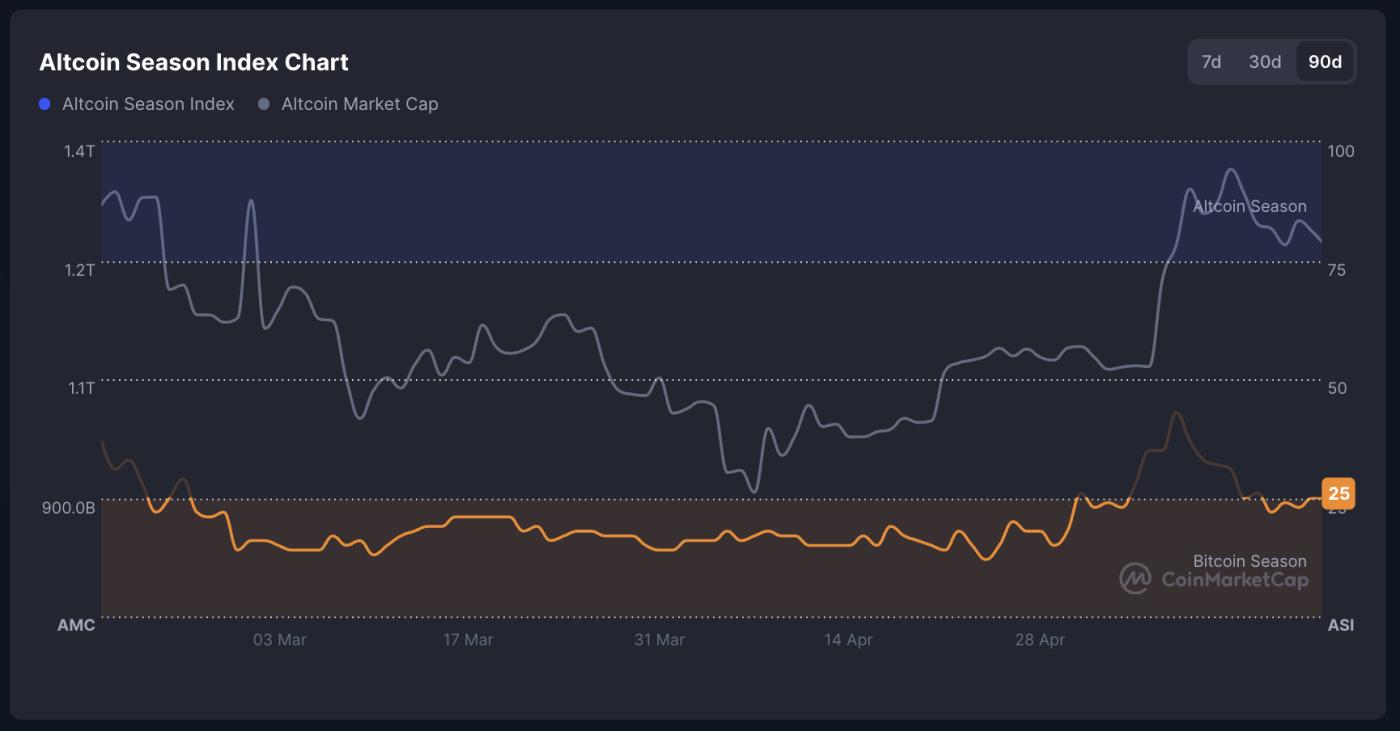

Meanwhile, the Altcoin Season Index, tracked by CoinMarketCap, has dropped from 43 on May 9 to 25—officially entering Bitcoin season territory.

Altcoin Season Index. Source: CoinMarketCap.

Altcoin Season Index. Source: CoinMarketCap.This index measures how many of the top 100 coins (excluding stablecoins and wrapped assets) have outperformed Bitcoin in the past 90 days. A score above 75 signals an Altcoin Season, while below 25 indicates Bitcoin's dominance.

With only a quarter of top coins outperforming BTC, this index confirms Bitcoin is regaining control, although the upcoming liquidation could still reverse the trend.