Top 10 Cryptocurrency Exchanges in 2025

Top Cryptocurrency Exchanges to Watch

The following are well-known cryptocurrency exchanges worth paying attention to: LBank, Binance, MEXC, Bitget, Gate.io, Bybit, OKX, HTX, Coinbase, and Kraken.

Key Points

• Cryptocurrency exchanges are platforms for trading digital assets, supporting spot and derivatives trading, and providing value-added services such as staking

• Exchanges are divided into two categories: centralized (CEX) and decentralized (DEX). CEX platforms hold user assets, while DEX allows traders to complete transactions under the premise of self-custody of assets.

• Centralized exchanges are usually more user-friendly and provide convenient channels for fiat-to-cryptocurrency exchange

Cryptocurrency Exchange Overview

As the main place for digital asset transactions, cryptocurrency exchanges play an important role in the ecosystem. They promote the popularization of cryptocurrency by lowering the transaction threshold. They are mainly divided into two types:

Centralized Cryptocurrency Exchanges (CEX)

This article focuses on centralized exchanges that hold user assets. CEXs are particularly suitable for beginners because they support the exchange of fiat currencies and cryptocurrencies, significantly lowering the barrier to entry. Such exchanges usually provide a one-stop service: fiat currency exchange, spot and derivatives trading, as well as revenue-generating functions such as staking and Launchpool. Currently, transparency measures such as Proof of Reserves (PoR) audits have become the standard for mainstream CEXs to build user trust.

Common functions of centralized exchanges include:

• Fiat currency deposit channel: support the direct purchase of cryptocurrencies with fiat currency

• Initial Token Launch Platform: Participate in the initial token launch through Launchpad, or lock designated tokens through Launchpool/Airdrop to get new tokens for free

• Pledged financial management: Earn income by locking assets for a flexible/fixed period

• Pre-sale market: trading unlisted tokens on supported platforms

Decentralized Cryptocurrency Exchanges (DEX)

Decentralized exchanges allow users to trade freely under the premise of self-custody of assets. However, they face challenges such as insufficient liquidity (in most cases), lack of fiat currency channels, and the need to manage private keys and seed phrase by themselves.

This article will review the current mainstream centralized cryptocurrency exchanges sorted by 24-hour trading volume at the time of writing.

LBank: A top exchange leading the Memecoin market - known for its fast listing and deep liquidity

Founded in 2015, LBank has served more than 15 million users in more than 210 regions around the world, providing more than 800 crypto asset transactions, especially with the rapid listing of Altcoin and top liquidity of Memecoin (meme coin) as the core advantages. The platform covers spot and derivative transactions, and is equipped with multiple income tools such as copy trading, Launchpad first launch platform, Launchpool staking mining and airdrops.

According to platform data, Memecoins such as GOAT, TRUMP, and RFC that were launched earlier have created 50 to 299 times of returns for LBank users. The exchange helps users avoid high gas fees through the on-chain synchronous listing strategy. As stated in the Forbes article, LBank uses Memecoin as a cultural and financial entrance and is committed to lowering the threshold for cryptocurrency participation.

"Our mission is to provide users with easily accessible digital assets and tools to promote inclusive growth in the industry." - Eric He, LBank Community Ambassador

LBank has been certified by many authoritative media: it was awarded the title of "Best Centralized Exchange" by the 2024 Crypto.News Awards, and in the same year, it was selected as the "Best Altcoin and Memecoin Exchange" by the Hong Kong Wiki Finance Expo.

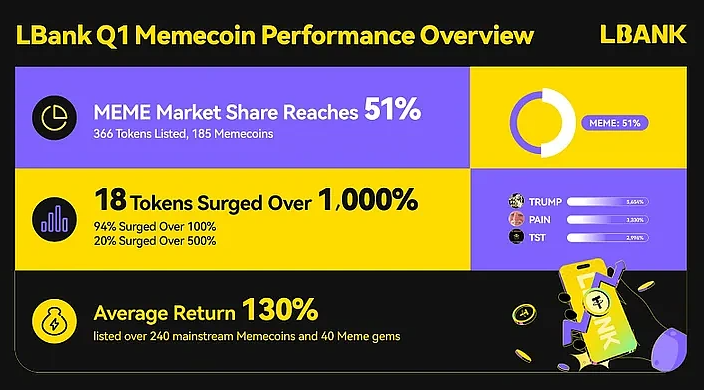

Memecoin explosive power

In the first quarter of 2025, LBank listed 366 new assets, 51% of which were Memecoin, confirming its commitment to "Memecoin liquidity first". Some currencies have seen amazing increases after listing, such as TST (6,842%), TRUMP (5,654%) and PAIN (3,329%).

This strategy has achieved remarkable results: in Q1 2025, Memecoin’s daily average trading volume accounted for 7.42%, an increase of more than 50% over the same period in 2024. In April 2025, the top five Memecoins on the platform increased by an average of 3,166%, of which LAUNCHCOIN’s peak return reached 15,194%, accounting for 36.69% of the spot market; GOONC’s increase also exceeded 2,199%.

Fee System

- Spot trading : 0.1% handling fee is charged for both Maker and Taker orders

- Contract trading : 0.02% for placing orders/0.06% for taking orders

- Deposit and withdrawal fees : Deposit is free, withdrawal rates vary by asset and blockchain network

Features

- Pre-sale guarantee plan

- Users can purchase unlisted tokens in advance. The guaranteed cash-out rate in Q1 2025 is 90%, with the highest return of the RED project exceeding 20,000 times. If the price of the token falls below the pre-sale price after listing, users can receive a subsidy of up to 50 USDT.

- $100 million contract risk protection fund

- When the price fluctuates violently within 1 minute (needle-shaped K-line) and causes a margin call, the affected users will receive full compensation and additional rewards.

- Copy Trading

- Ordinary users can copy the strategies of leading traders. As of the time of writing, the historical returns of top traders exceed 6,000%, and they enjoy profit sharing rights.

- Ecological MatrixLaunchpad : Use USDT to participate in the initial token subscription and allocate quotas according to the investment ratioLaunchpool: Lock assets to mine new coins, covering GameFi, AI, RWA and DeFi. Currently, 5 phases have been launched, attracting 200,000 participants, and the highest return of the CELA project is 2,900%Airdrop: Coin holders can receive new tokens for freeFlexible/regular financial management: Supports deposit and withdrawal (flexible) or fixed term (locked position) to earn APY

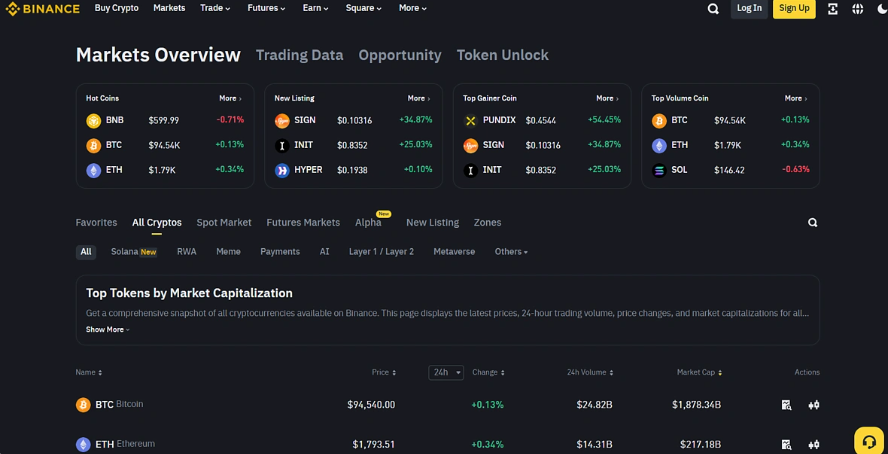

Binance: The world's largest cryptocurrency exchange

Founded in 2017, Binance has expanded to more than 150 countries around the world and claims to serve more than 250 million investors. Binance is the world's largest cryptocurrency exchange by daily trading volume, with a 24-hour trading volume of more than $14 billion. As of writing, the platform offers spot and derivative trading services for more than 480 crypto assets.

Buy cryptocurrencies with fiat currency

Binance supports more than 10 fiat currencies including GBP, USD, EUR and BRL. In approved regions, users can purchase cryptocurrencies directly on the platform using credit cards. For direct fiat top-ups, the platform supports multiple methods including SEPA bank transfers, credit/debit card top-ups, and through third-party platforms such as Zen.com.

Transaction and other fees

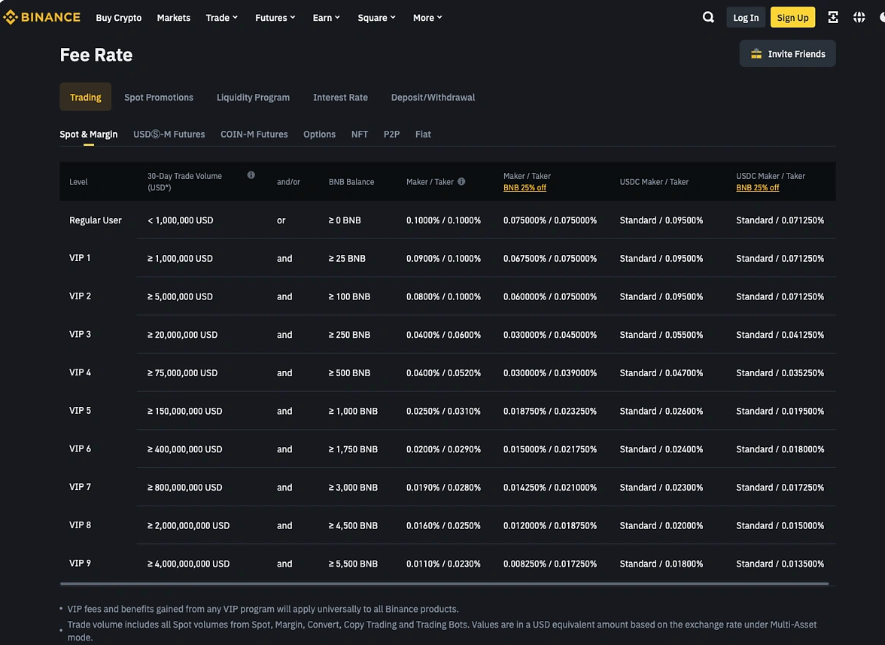

Binance's trading fees vary based on user tier:

- Spot trading : Ordinary users are charged a 0.075% handling fee for both Maker and Taker orders. High-level users or those who pay with BNB can enjoy lower fees.

- Contract trading : 0.05% for taker, 0.02% for maker

- Fiat currency top-up : Credit/debit card, Google Pay and Apple Pay channels charge a maximum fee of 2%, while bank transfers and third-party channels such as Zen.com charge lower rates

- Cryptocurrency top-up : Free (withdrawal may incur fees, please refer to the platform description for specific rates)

Security System

Binance ensures the safety of your funds through the following measures:

- Deposit Insurance Fund (SAFU)

- Hot wallet asset decentralized storage strategy

- Public 1:1 Proof of Reserves

Features

- Token issuance platform Launchpool : pledge designated tokens to receive new coin airdrops Launchpad: invest USDT and other assets to participate in token pre-sales HODLer airdrops: users who meet the holding requirements can receive airdrop rewards

- Binance Earn Coins Flexible/Regular Investment: Earn APR with Different Lock-in Periods Advanced Yield: High-risk, High-return Investment Options

- Lending service : support cryptocurrency pledge loans

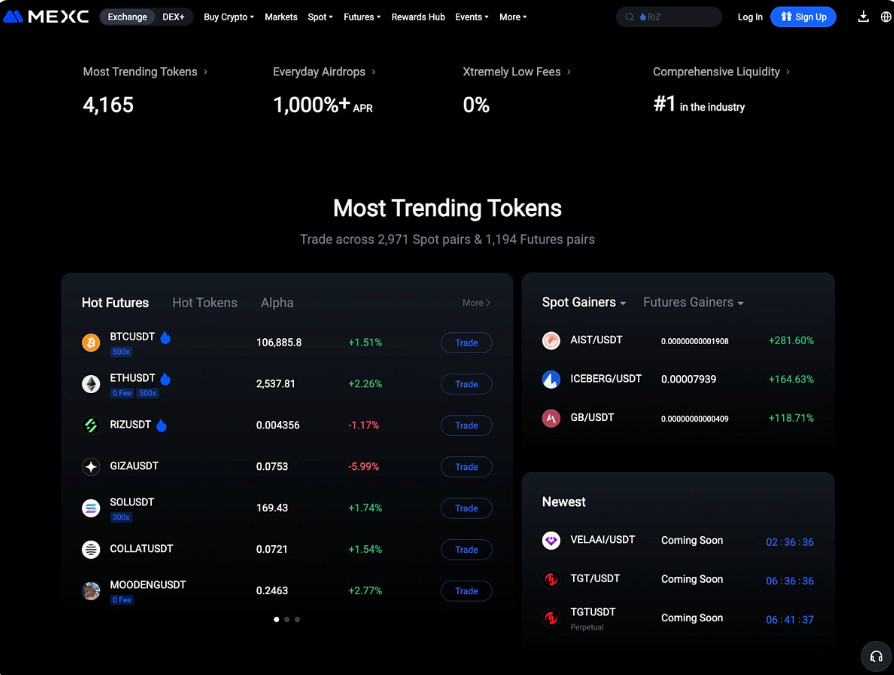

MEXC: An exchange that supports zero transaction fees for pending orders

Founded in Seychelles in 2018, this platform is known for covering more than 2,200 crypto assets (including Bitcoin and Memecoin), serving more than 10 million investors in more than 160 countries around the world, and providing spot and derivatives trading.

Fiat currency deposit channels

Supports 30 fiat currencies including Euro and US dollar. You can purchase cryptocurrencies in the following ways:

- Direct credit/debit card purchases

- SEPA/Non-SEPA Bank Transfer

- MoonPay, AlchemyPay and other third-party payment gateways

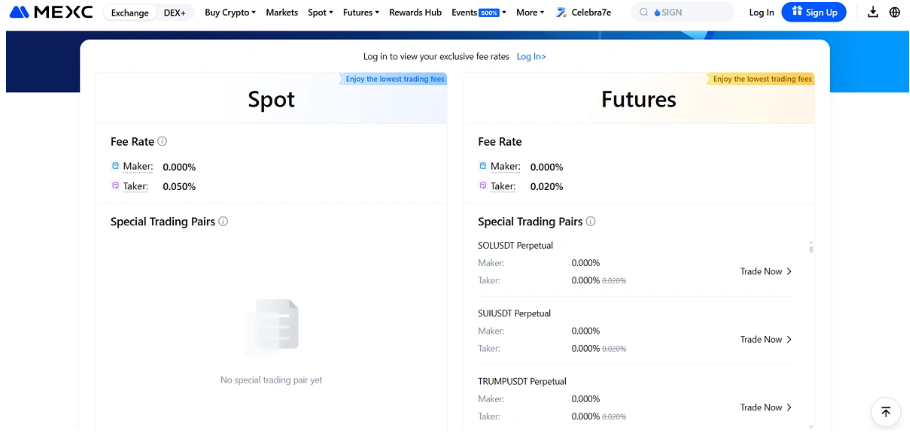

Transaction and other fees

MEXC implements a unique zero-fee policy for pending orders:

- Spot/contract trading : Makers are free of charge, while Takers are charged 0.05% (spot) and 0.02% (contract) respectively.

- Fiat currency deposits and withdrawals : Additional fees from third parties or platforms may be incurred

- Cryptocurrency deposits and withdrawals : Deposits are free, withdrawal fees vary by asset type and blockchain network (see platform announcement for specific rates)

Safety Mechanism

MEXC adopts triple protection:

- The reserve ratio is maintained above 100% for a long time to ensure repayment capability

- Cold and hot wallet separation storage solution

- 507 million USDT futures insurance fund to compensate for losses caused by liquidation

Features

- Pre-listing trading : Support early trading of tokens that have not yet been officially launched

- Launchpool Mining : Stake designated tokens to get new coin rewards

- Airdrop+ Plan : Complete the recharge/trading tasks to share the reward pool tokens

- Kickstarter crowdfunding : Stake MX tokens to get project rewards in proportion

- Earn Coins : 3-30 days lock-up period pledge financial management service

- DEX+Aggregator : Smart routing transactions integrating multiple decentralized exchanges

Bitget: An all-round exchange integrating Web3 ecosystem

Founded in 2018, the platform serves over 100 million users in more than 150 countries around the world, supports spot and contract trading of 800+ cryptocurrencies, and has built a complete Web3 service system including 60 million user wallets, DEX aggregators and dApp browsers.

Fiat Deposit

Supports multiple channels such as credit/debit cards, bank transfers, third-party payments, etc. (depending on the region)

Fees

- Spot trading : 0.1% fee for both maker and taker orders (discounts available for payment with BGB tokens)

- Contract trading : 0.02% for placing orders, 0.06% for taking orders

- Fiat currency top-up : No fees charged by the platform (third parties may charge fees)

- Cryptocurrency withdrawal : only network mining fee is charged

Security system

- Release Merkle Tree reserve proof every month (reserve rate reaches 191% in April 2024)

- $630 million risk protection fund to combat cybersecurity threats

Ecological Matrix

- Web3 services : Bitget wallet, Swap cross-chain exchange, dApp application store

- Smart copy trading : a full set of quantitative robots from moving average fixed investment to complex indicator trading

- Financial services : flexible/regular interest-earning on holding coins at different risk levels

- Launchhub : A one-stop token issuance platform integrating pre-sale transactions, Launchpool, and Launchpad

Gate.io: A huge selection of Altcoin

As an established exchange founded in 2013, Gate.io supports more than 3,800 token transactions, providing users with a rich selection of long-tail tokens. It is said that its services cover more than 150 countries around the world, with more than 20 million users.

Fiat currency deposit channels

Users can purchase cryptocurrencies in the following ways:

- Direct credit/debit card purchases

- Support bank transfer

- Banxa and other third-party payment channels

- It also supports direct conversion of cryptocurrencies into cash and legal currency withdrawals through SEPA, MasterCard and Visa channels.

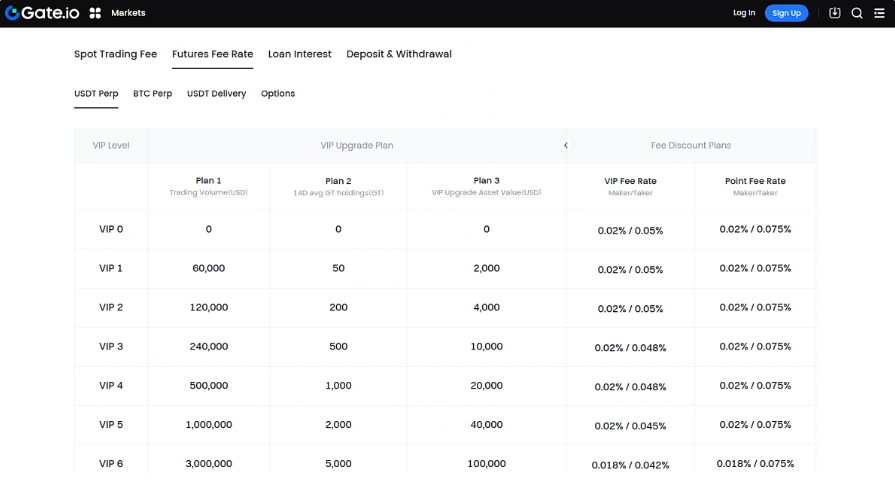

Transaction Fee Standard

- Spot trading : ordinary users are charged a 0.1% handling fee for both Maker and Taker orders (high-level users have lower fees)

- Contract trading : 0.02% for placing orders, 0.075% for taking orders

- Fiat currency top-up : third-party fees may be incurred

- Cryptocurrency deposit and withdrawal : Deposit is free, withdrawal is subject to network fee (see platform fee table for details)

Security System

Gate.io adopts multiple security measures:

- The reserve ratio reaches 128.58% (verified by Merkle Tree and zk-SNARKs technology)

- Proof of Reserves audited by Hacken

- Cold and hot wallets are stored separately, and most assets are stored in offline multi-signature cold wallets

Features

- Launchpool : Stake tokens to get new coinsHODLer Airdrop: Holders of platform tokens GT can participate in airdrop distributionLaunchpad: Early token subscription

- Investment and financial management, simple earning coins, automatic investment, dual currency investment and other structured products

- Crypto lending : Support digital asset mortgage loans

- Staking service : earning interest on holding coins

- Pre-listing trading : the trading market before the token is officially launched

- Web3 Ecosystem

Gate.io Web3 wallet (supports dApp interaction)

Web3 airdrop event (need to connect to the wallet and maintain a minimum position, the higher the balance, the greater the chance of winning)

OKX: A crypto exchage integrating Web3 wallet and DeFi ecosystem

(Formerly OKEX, founded in 2017, it was renamed OKX in 2022) In addition to providing spot and derivatives trading, the exchange also focuses on developing Web3 wallets and DeFi ecology.

Fiat currency deposit channels

It supports more than 40 fiat currencies and provides multiple deposit methods such as SEPA, FAST and international wire transfer according to the region. Users can also purchase cryptocurrencies directly through credit/debit cards or third-party payment providers.

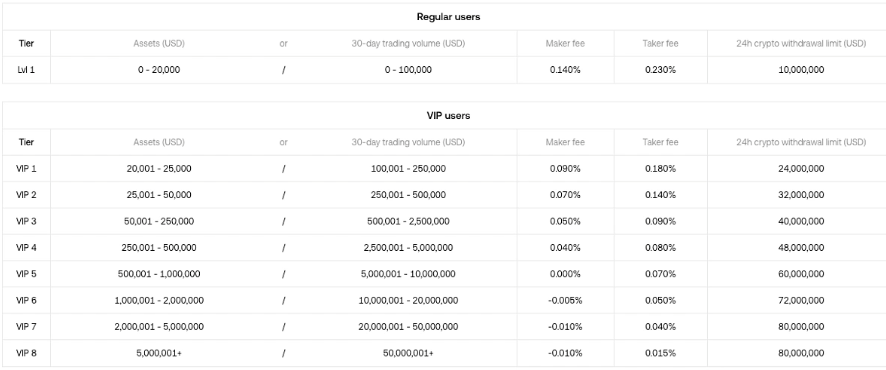

Transaction Fee Standard

- Spot trading: 0.08% for maker orders/0.1% for taker orders (lower rates for VIP users)

- Contract trading: 0.02% for placing orders/0.05% for taking orders

- Fiat currency recharge: The platform does not charge additional fees (the bank may charge a handling fee)

- Cryptocurrency withdrawal: only network mining fee is charged

Safety Mechanism

As of April 2025:

- Proof of Reserves Using zk-STARKs Technology Shows $2.31 Billion in Assets

- The reserve ratios of 22 major assets all exceeded 100%

- Cold and hot wallet hybrid storage solution

Special features (depending on the region)

- Jumpstart new coin mining:

- Stake designated tokens to get new project token rewards

- Participate in the initial coin subscription

- Earn coins on the chain:

- Support PoS protocol and DeFi protocol staking

- OKX Wallet:

- Self-hosted wallet supports 130+ protogenesis links

- Built-in token exchange and staking functions

Bybit: Professional derivatives trading platform

This exchange, founded in 2018, specializes in derivatives, has over 60 million users worldwide and an average daily trading volume of US$36 billion.

Fiat currency deposit channels

Supports more than 20 fiat currencies, deposit methods include:

- SEPA/Non-SEPA Bank Transfer

- Zen.com/QuickPay/SWIFT

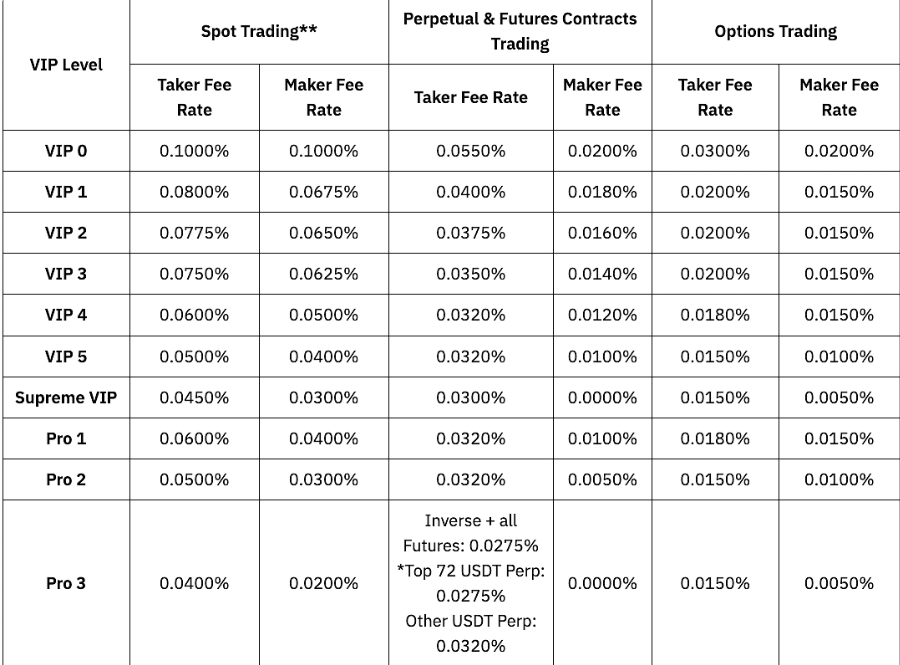

Transaction Fee Standard

- Spot trading: unified rate of 0.1%

- Contract trading: 0.02% for placing orders/0.05% for taking orders

- Fiat currency recharge: different fees are charged depending on the channel

- Cryptocurrency withdrawals: by asset and network

Safety Mechanism

- Monthly release of Hacken audited reserve reports

- Offline cold storage of funds

- In February 2025, SafeWallet was hacked due to the theft of its developer equipment, but users were able to withdraw their funds in full.

Features

- Pre-IPO Transaction

- Coin earning products:

- Flexible savings

- On-chain staking

- Liquidity Mining

- Copy Trading

- Quantitative Robot

- Bybit Card (selected areas)

- Web3 Ecosystem:

- Decentralized wallet

- Web3 earning coins

- DEX Pro

HTX (Huobi): A long-established exchange with a cumulative trading volume of US$33 trillion

Founded in 2013, HTX has developed into a blockchain ecosystem covering digital asset trading, financial derivatives, research, investment and incubation. According to platform data, it has more than 47 million registered users and a cumulative trading volume of 33 trillion US dollars. Justin Sun, founder of TRON, serves as an advisor to HTX.

Fiat currency deposit channels

Supports fiat currency top-ups for users in Europe, the United Kingdom, Brazil, Russia, India, Ukraine, and Kazakhstan. Users can purchase cryptocurrencies via credit/debit cards or third-party operators.

Transaction Fee Standard

- Spot trading: ordinary users are charged a uniform fee of 0.2%

- Contract trading: 0.02% for placing orders/0.06% for taking orders (high-level users can enjoy lower rates)

- Fiat currency deposits and withdrawals: handling fees may be incurred

- Crypto withdrawals: Fees vary by asset and network

Safety Mechanism

- Merkle Tree technology is used for users to verify assets

- The reserve certificate shows that the reserve rate of all listed cryptocurrencies is not less than 100%

- Funds are stored in exchanges and custodial wallets

Features

- Crypto lending:

Support flexible mortgage loans up to 90 days

Providing over-the-counter lending services for professional traders

- Launchpool new coin mining:

Lock up platform tokens HT to participate in new token airdrops

- Coin earning service:

Stake tokens to earn income

- Copy Trading:

Copy the best traders

- Quantitative Robot:

Provides two trading robots: spot and contract

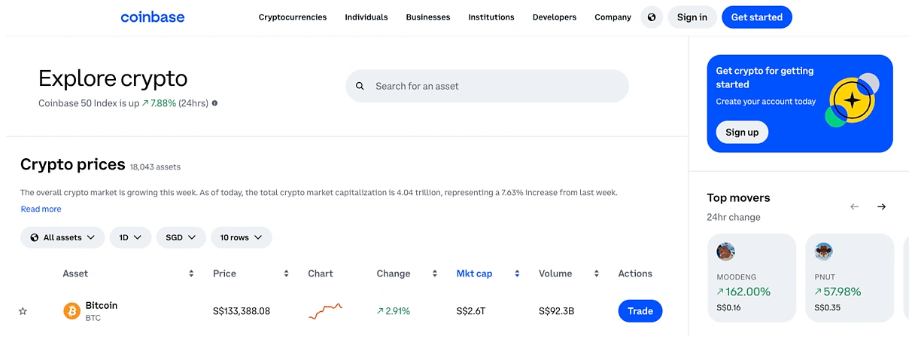

Coinbase: A compliant crypto trading platform listed on Nasdaq

As the largest listed cryptocurrency exchange in the United States, Coinbase focuses on providing compliant spot and derivatives trading services, with operations in more than 100 countries around the world and a quarterly trading volume of US$439 billion.

Fiat currency deposit channels

It supports users from multiple countries to top up their accounts in fiat currency through different payment methods. The specific deposit method varies depending on the region.

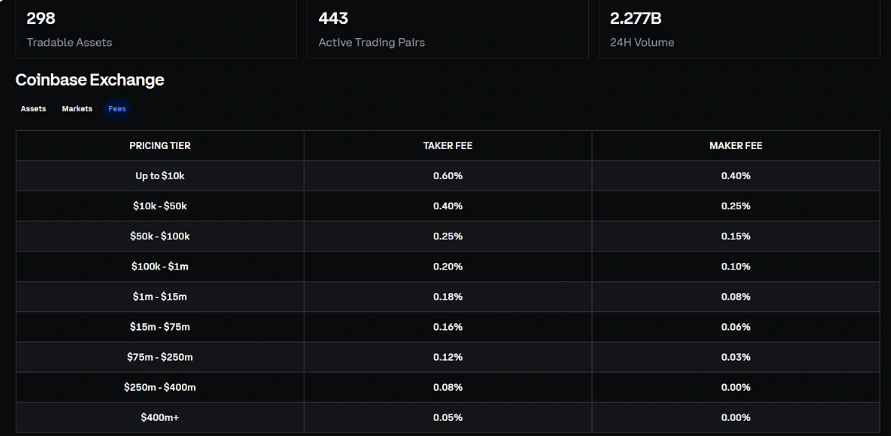

Transaction Fee Standard

- Spot trading: ordinary users place orders 0.4% / take orders 0.6% (high-level trading users can enjoy lower rates)

- Fiat currency top-up: Depending on the payment method, a handling fee may be incurred

- Cryptocurrency withdrawals: processing fee and blockchain network fee required

Safety Mechanism

As a public company, Coinbase is subject to strict financial supervision:

- Publish financial statements audited by an independent third party on a quarterly basis

- Submit annual audit report to the US SEC

- Providing excess reserve proof for cbBTC (anchored to Bitcoin) to ensure that BTC reserves are always higher than cbBTC circulation

Features

- Coinbase One Member Services:

No transaction fees

Dedicated customer support

The first 30,000 USDC can enjoy an annualized return of 4.5%

- Staking to earn coins:

Idle asset interest-earning service

- Coinbase Debit Card:

Support 8 cryptocurrency consumption

Provide cash back for consumption

- Coinbase Wallet:

Self-Hosted Web3 Wallet

Support token buying, selling, exchange and staking

Mintable NFT Collectibles

USDC Rewards Program

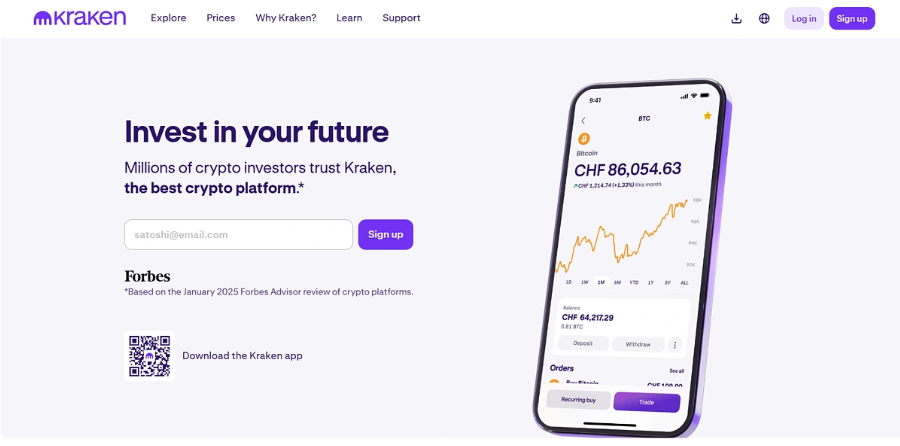

Kraken: A customer-centric trading platform

Founded in 2013, this US exchange serves more than 190 countries around the world and provides spot and derivative trading of more than 400 crypto assets. Kraken is known for its customer-first philosophy, and its customer service team is active in forums such as Reddit to directly solve user problems.

Fiat currency deposit channels

Supports deposits in USD, EUR, CAD, AUD, GBP, CHF, JPY and BRL. See the instructions for deposit methods and processing times for each currency. It also supports instant purchases of cryptocurrencies with credit/debit cards.

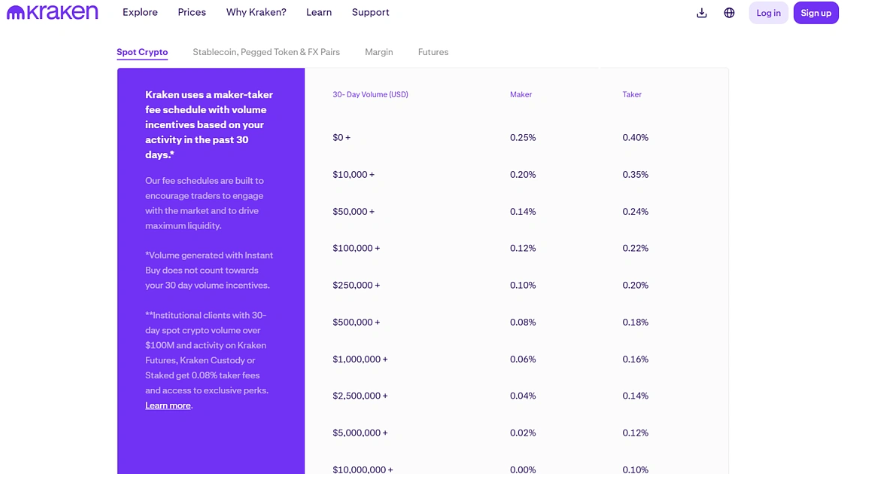

Transaction Fee Standard

- Spot trading: 0.2% for placing orders/0.4% for taking orders

- Fiat currency top-up: SEPA transfers are free, SWIFT may incur fees

- Crypto withdrawals: Fees vary by asset and network

Safety Mechanism

- Regular reserve audits (third-party accountants verify that key assets are 100% fully reserved)

- Users can verify their personal assets through Merkle Tree

Features

- Pledge service:

- Flexible staking (5-8% annualized)

- 3-day lock-up pledge (13-16% annualized)

- Support ETH re-staking via EigenLayer

- Profits are distributed weekly

Summary and recommendations

The exchange lowers the barrier for new users to participate in the crypto space, without having to master private key management or multi-dApp connection technology:

- Cryptocurrency trading

- Pre-trading of unlisted tokens

- Get new tokens through Launchpad/Launchpool/Airdrop

- Use quantitative robots and copy trading tools

When choosing an exchange, please refer to:

- Platform reputation

- Safety measures

- Liquidity Depth

- Fee Structure

- It is recommended to use Coingecko's "Trust Score" (which assesses the authenticity of transaction volume based on indicators such as liquidity, operating scale, and network security) to assist in decision-making.