Author: Hotcoin Research

I. Introduction

Pump.fun has ignited an unprecedented MEME coin issuance frenzy, allowing users to deploy tokens and start trading with a single click without technical skills, triggering a new "token minting boom", and as a pioneer, Pump.fun has almost monopolized the MEME Launchpad market. Other blockchain networks have also launched MEME launchpads, with SunPump on the TRON network rapidly growing under the strong promotion and support of Justin Sun; Four.meme became the MEME launchpad officially supported by Binance, driving the prosperity of MEME on the BNB chain.

As the Pump.fun team continuously sells the SOL they earn, becoming the second-largest selling pressure source in the Solana ecosystem after FTX/Alameda. Raydium once had about 41% of its Swap fee income from Pump.fun's liquidity, but with Pump.fun launching PumpSwap, Raydium's revenue significantly decreased. Therefore, Raydium launched LaunchLab and began direct competition with Pump.fun. Additionally, the on-chain aggregator Jupiter also tried to launch a similar one-click token issuance service, and Moonshot developed by the veteran DEX tool DexScreener also attracted some players, but the overall effect was not good, with Pump.fun maintaining absolute dominance in MEME issuance quantity and user trading volume. However, recently, with the famous NFT collector Dingaling launching Boop.fun, the BONK community launching the LaunchLab-based launchpad LetsBonk.fun, and Believe returning after a name change, the one-click token issuance platform track has entered a competitive stage of multiple contenders, and Pump.fun is no longer the only option. A reshuffle battle around the "token issuance rights" has thus begun.

However, behind the booming development of one-click token issuance platforms, there are hidden issues and challenges such as token proliferation, KOL manipulation, frequent Rug Pulls, and regulatory gray areas. How will this war around "token issuance rights" develop? Where will the track's future lead? This article will deeply analyze the current landscape and future direction of the one-click token issuance platform industry, revealing the true logic behind the MEME Launchpad war.

Here's the English translation:In summary, traditional Launchpads are more like "investment bank + exchange" roles, carefully selecting and conducting IPO-style launches for a few projects; while MemePad is an endless creative experiment ground or casino, where massive tokens bloom simultaneously, with hit coins and scams coexisting.

III. Industry Status: Data Insights and Industry Landscape

1. On-chain Data Insights: Token Issuance, User Portraits, and Capital Flow

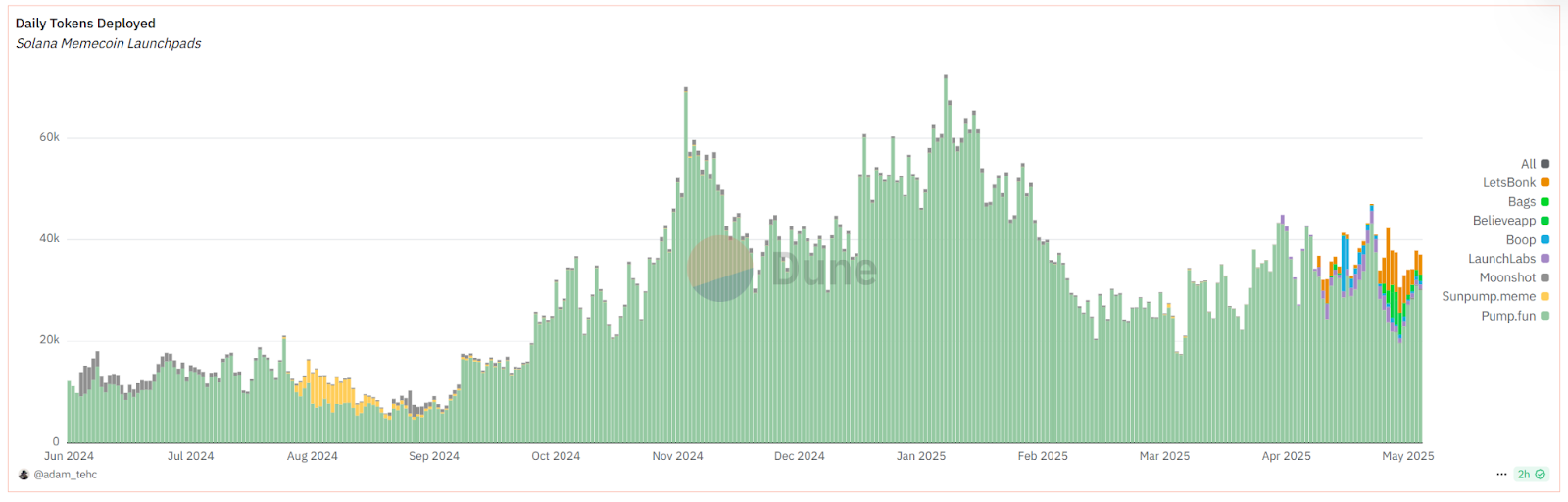

Source: https://dune.com/adam_tehc/memecoin-wars

Token Issuance and Trend: The daily one-click token issuance on Solana began climbing in mid-2024, peaking in October. At that time, almost all tokens came from Pump.fun, with up to 36,000+ new coins emerging in a single day. Subsequently, while the overall issuance remained high, it showed a oscillating downward trend, clearly cooling down by early 2025. This indicates that the early extensive explosive phase is near its end, and the market is returning to rationality. Even after cooling, one-click token issuance still maintains thousands to tens of thousands of new tokens daily, showing the platform's long-tail prosperity and resilience.

User Portrait and Distribution: From platform user data, Pump.fun's early users were mainly Solana native community speculators chasing hundred-fold and thousand-fold coin myths; LaunchLab, backed by Raydium, attracted many returning DeFi veteran users, with daily active users continuously rising after launch; Believe, due to its social media token issuance characteristics, attracted many Web2 entrepreneurs and KOLs, with a user composition more skewed towards creators and opinion leaders, while Boop.fun centered around NFT player circles.

Token Market Cap Changes: Observing typical tokens born from these platforms reveals that most meme coins experienced rapid rise and fall cycles: for example, many tokens surged dozens or even hundreds of times upon launch, only to fall back to zero within days. 99% of meme coins are short-term speculation, with "long-lived coins" being extremely rare.

On-chain Gas and Transaction Situations: The one-click token issuance boom also brought significant transaction volume and fee changes to underlying public chains. Solana experienced frequent network congestion during the 2024-25 meme coin carnival, due to massive small-amount transactions causing block load intensification. Solana's weekly fee income once reached $55 million in early 2025, a historical peak. As Pump.fun slowed down, this figure dramatically dropped, indicating that a considerable portion of Solana's network activity was driven by meme coin transactions.

Lowering Graduation Threshold: Requires raising 85 SOL (approximately $11,000) to transfer to the Raydium external trading pool, which is easier to achieve compared to Pump.fun's fixed market value threshold, and LaunchLab supports a minimum launch mode of 30 SOL, further lowering the barrier.

Creator Revenue Sharing: Introduces a 10% fee sharing mechanism where project founders can continuously receive 10% of token transaction fees after graduation, improving creator retention.

Ecosystem Integration: 25% of fees are used to repurchase Raydium platform token RAY, supporting LP locking and quote diversity, binding platform incentives with the Raydium ecosystem.

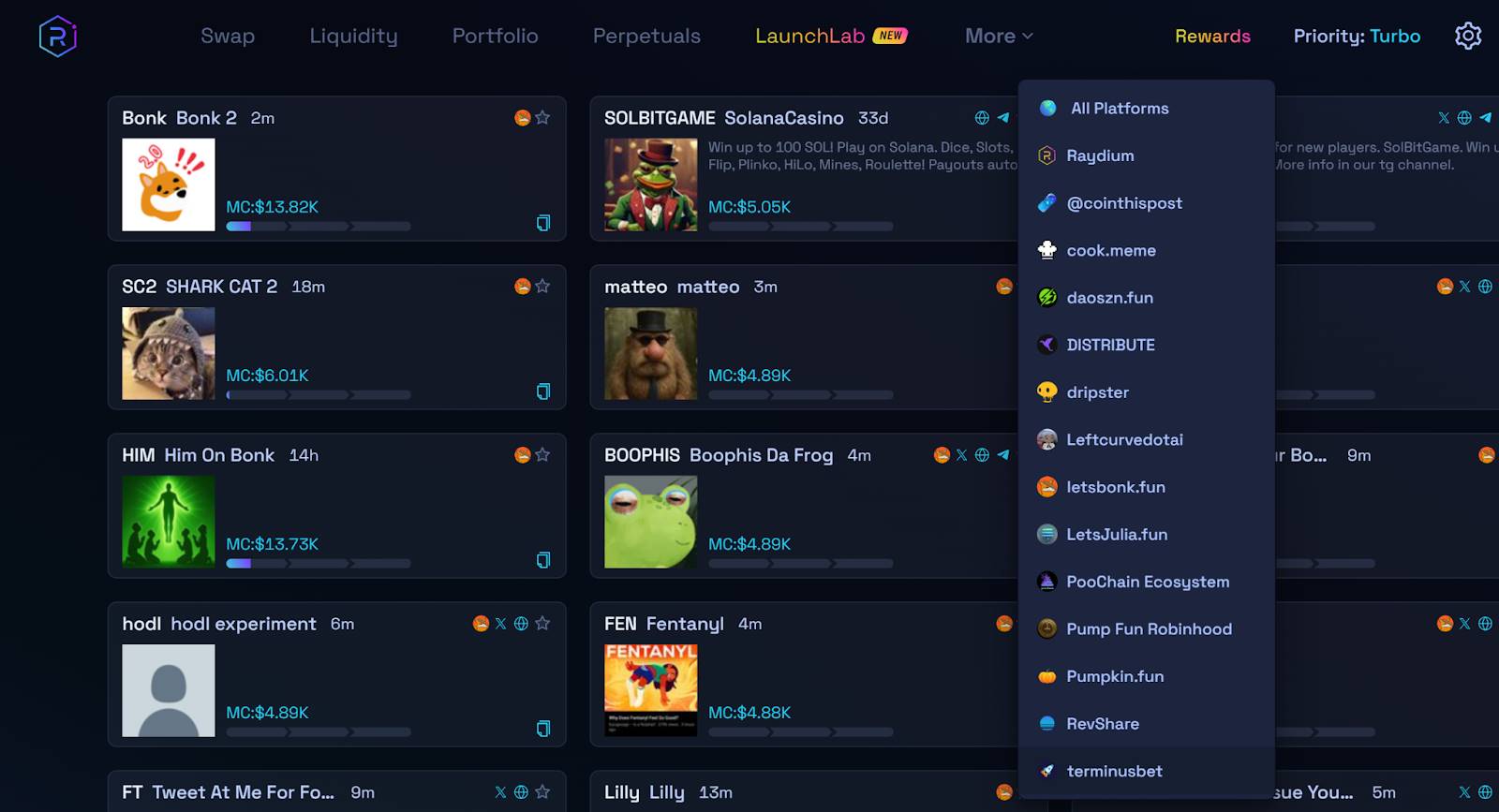

LaunchLab's advantage lies in leveraging Raydium's brand and pool depth, successfully attracting projects to its platform and weakening Pump.fun's dominance. According to on-chain data, LaunchLab's daily active users are growing rapidly, with 14 token issuance platforms currently based on LaunchLab, accounting for approximately 10% of Solana's daily token issuance volume.

Source: https://raydium.io/launchpad/

3.LetsBonk.fun

LetsBonk.fun is a one-click token issuance platform built on the Raydium LaunchLab technical framework by the Solana popular meme coin BONK community, specifically serving BONK community and its derivative creative token issuance needs. The token issuance process and rules on LetsBonk.fun are similar to LaunchLab, such as the default 85 SOL graduation and 1% fee, with just a more BONK-style interface and community orientation.

LetsBonk.fun made a significant impact upon launch, once successfully capturing about 17-20% of daily issuance, even surpassing Pump.fun as the platform with the most daily graduated tokens in some periods. This was seen as a community power victory against giants: BONK, as a spontaneously emerging meme coin in the Solana community, used its appeal to build its own Launchpad, forming a "wolf pack tactics" to attack Pump.fun.

LetsBonk.fun's popularity demonstrates the value of well-known meme coin IPs in platform competition, bringing inherent traffic and user base, ensuring attention from the start. However, its sustainability remains to be observed, currently appearing more like a part of LaunchLab's auxiliary strategy.

(Translation continues in the same manner for the rest of the text)Regulatory Gray Area: From a legal perspective, one-click token issuance platforms essentially provide an unregulated ICO market. Due to their decentralized and anonymous attributes, these platforms are currently not direct targets of regulatory crackdowns. However, when widespread user losses trigger social opinion, platform operators may be held accountable, and if regulatory red lines are crossed, they could face regulatory impacts. Users also face difficulties in rights protection.

VI. Future Prospects: Sustainability and Development Direction of One-Click Token Issuance Platforms

Looking ahead, can this track of one-click token issuance platforms sustain development, and where will they head in the next phase? We can consider this from market, technology, and narrative perspectives:

1. Market Sustainability: Returning to Project Value

After nearly a year of crazy growth, the MEME token issuance fever has clearly cooled down, and the "get-rich-quick effect" is difficult to replicate on a large scale. After being sifted through, one-click token issuance platforms may distill a few stable platforms that continue to provide services for new projects. From a revenue model perspective, the early Pump.fun's "harvesting-type" profitability is unsustainable. Now, new platforms are exploring more healthy win-win models, such as guiding creators to improve project quality, supporting promising projects, and eliminating pure scam Tokens.

2. Evolution Direction: From MEME Frenzy to Empowering Innovation

The essence of one-click token issuance platforms is a combined application of blockchain issuance and liquidity. Future evolution may have several directions:

Multi-chain interoperability and layered abstraction, allowing users to issue and trade tokens without perceiving underlying chain differences;

Introducing more smart contract functions, such as options and DAO governance modules, giving new tokens more functionality from birth;

Integration with identity and content systems, such as automatically generating NFT badges for first-release creators or binding decentralized social identities, making tokens a form of reputation proof.

These technical improvements represent a vision: in the future, Launchpad will be more than a speculative tool, but an incubator for Web3 innovation. If the narrative can successfully transform and win the trust of mainstream developers and entrepreneurs, one-click token issuance platforms will undergo qualitative change.

3. New Paradigm of Web3 Entrepreneurship: Cold Start Infrastructure for Projects

Previously, a developer or creative person with a new Web3 project idea might have had to write a white paper, raise investment, and form a team to create an MVP. Now, they can directly issue a token on an issuance platform, package the idea into a story, and test community interest through market trading. If the token receives enthusiastic response, they can obtain initial funding to recruit a team and develop the product; the community will also become early users and promoters by holding tokens. This is almost a new paradigm that subverts traditional startup financing: no VCs, no crowdfunding websites, just an open market discovering and funding good ideas. This will attract more serious entrepreneurs to try this approach, and token issuance platforms will upgrade from "token issuance tools" to "project cold start infrastructure", becoming part of the Web3 entrepreneurial ecosystem.

4. Compliance and Governance: Finding a Balance

If one-click token issuance platforms want to go far, they must find a balance between complete disorder and over-regulation. Possible directions include: community self-discipline + protocol governance, where platforms introduce community guidelines and DAO governance mechanisms to vote on or mark warnings for obviously fraudulent or illegal projects; introducing optional KYC/real-name channels to allow founders to prove their identity for higher trust, while meeting basic anti-money laundering monitoring requirements. Additionally, technical enhancements like strengthening security audits and real-time monitoring of abnormal transactions can reduce the frequency of malicious events.

Conclusion: From Pump.fun's monopolistic wild growth to the current landscape of one dominant and many strong platforms, we have witnessed the amazing power of "decentralized creativity" in the crypto world. It has delegated the power of financial experiments to the masses, allowing countless wild ideas to flash on the chain through tokenization. Future winners may not be platforms with the lowest fees, but those that can build content flywheels, community consensus, and platform trust mechanisms, growing into fertile ground for innovation. When every good idea can be freely experimented with in token form, perhaps this is the future of infinite possibilities that Web3 pursues.

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We build a three-in-one service system of "trend judgment + value mining + real-time tracking", offering precise market interpretation and practical strategies for investors of different levels through in-depth analysis of crypto industry trends, multi-dimensional assessment of potential projects, and all-weather market fluctuation monitoring, combined with bi-weekly "Hotcoin Selection" strategy live broadcasts and daily "Blockchain Today's Headlines" news updates. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower new investors to build cognitive frameworks and help professional institutions capture alpha returns, jointly seizing value growth opportunities in the Web3 era.