Kraken has launched perpetual futures for the native token of Pi Network, PI, allowing traders to take buy or sell positions with leverage up to 20x.

This move provides traders with a new way to speculate on PI's price without holding the asset. This is also the first time PI has appeared on a major derivative platform, although the token is still not listed on top exchanges like Binance or Coinbase.

How PI Perpetual Futures Work on Kraken

Perpetual futures are derivative contracts without an expiration date. Traders can open positions tracking PI's price and settle profits or losses based on price fluctuations over time.

On Kraken Pro, users can access these contracts with over 40 collateral asset options and across more than 360 markets.

This flexibility allows for both hedging and speculative strategies. Traders optimistic about Pi Network can go long, while skeptics can short the token—betting that its price will decline.

With 20x leverage, small price movements can lead to significant profits or losses.

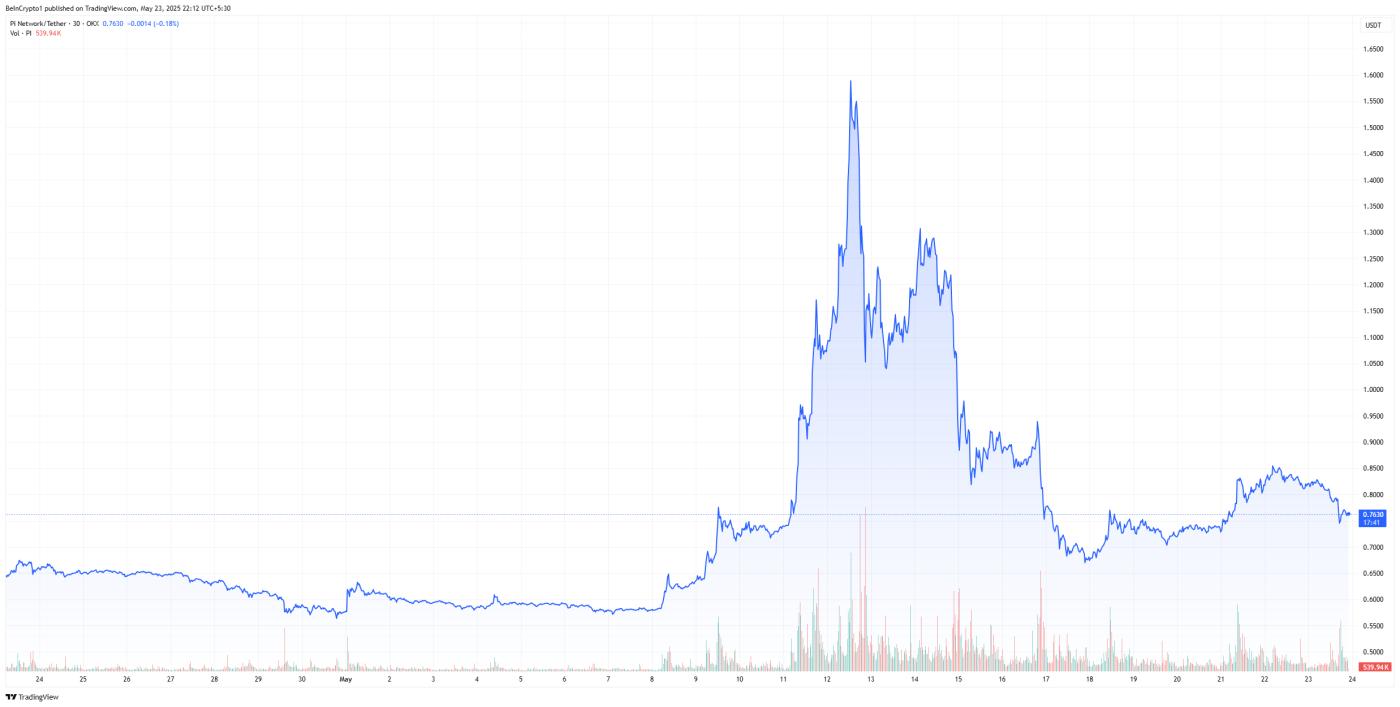

Meanwhile, after a brief rise to $1.57 earlier this month, PI has dropped 10% this week. Despite the ongoing price increase cycle in the market, this altcoin has shown high volatility and failed to meet expectations.

Will Futures Trading Affect PI Network's Price?

This listing brings more liquidation to the PI market. Increased trading activity could reduce long-term volatility. However, in the short term, leverage may increase price volatility.

Market sentiment around PI remains fragile. Concerns exist about concentration—60% of token supply remains under the core team's control.

Moreover, as BeInCrypto previously reported, the high concentration of nodes in Vietnam has raised doubts about the project's stability. Vietnam's increasingly strict cryptocurrency regulations add further pressure.

PI Network price chart for 05/2025. Source: TradingView

PI Network price chart for 05/2025. Source: TradingViewWith current futures contracts, pessimistic traders can open leveraged short positions, potentially accelerating PI's decline.

Meanwhile, increased volatility could trigger liquidation on both sides, causing sudden price spikes or drops.

Although futures listing opens new opportunities, it also increases risks. Traders should monitor funding rates and open interest to assess the strength of directional bets.

Overall, Kraken's move brings new attention to Pi Network. But currently, significant doubts remain about this altcoin's direction in the spot market.