- Whales are strongly shorting BNB as buying pressure decreases compared to the previous week.

- BNB has escaped the accumulation phase, reaching a higher level with support above $652 and resistance around $700.

Binance [BNB] increased slightly by about 1.59% in the past 24 hours, despite significant whale shorting and considerably reduced buying pressure.

BNB Whale Activity and Reduced Buying Pressure

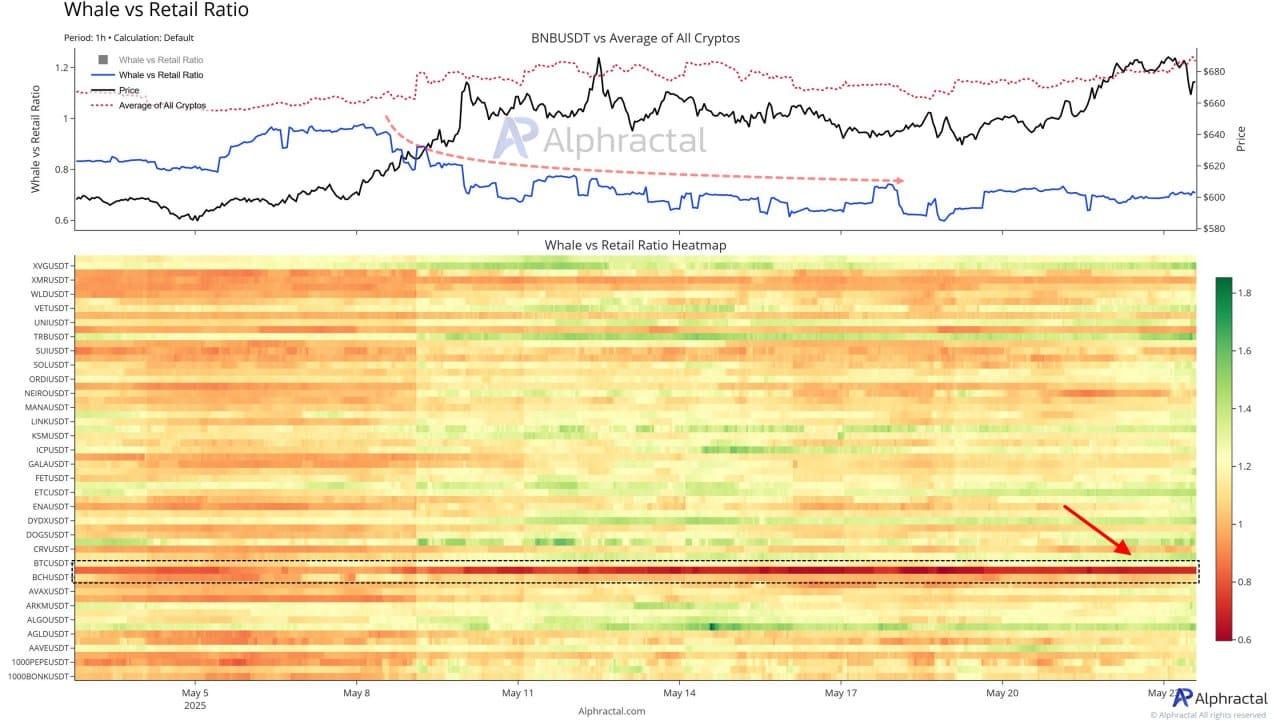

On Alphractal's "Whales vs. Retail" heat map, red dominates the Binance row, indicating that whales are shorting BNB more than small retail investors.

However, BNB's price remains stable and shows a slight increase, as seen on the chart.

In fact, the growth coincides with the increased activity of BNB Chain, reaching a three-year high, which may alleviate shorting pressure.

Source: Alphractal

Therefore, whales can benefit from spot positions while using Futures Contracts to offset downside losses.

By shorting through Futures Contracts and maintaining long-term spot positions, they can neutralize risks during price increases, potentially misleading retail investors about the trend.

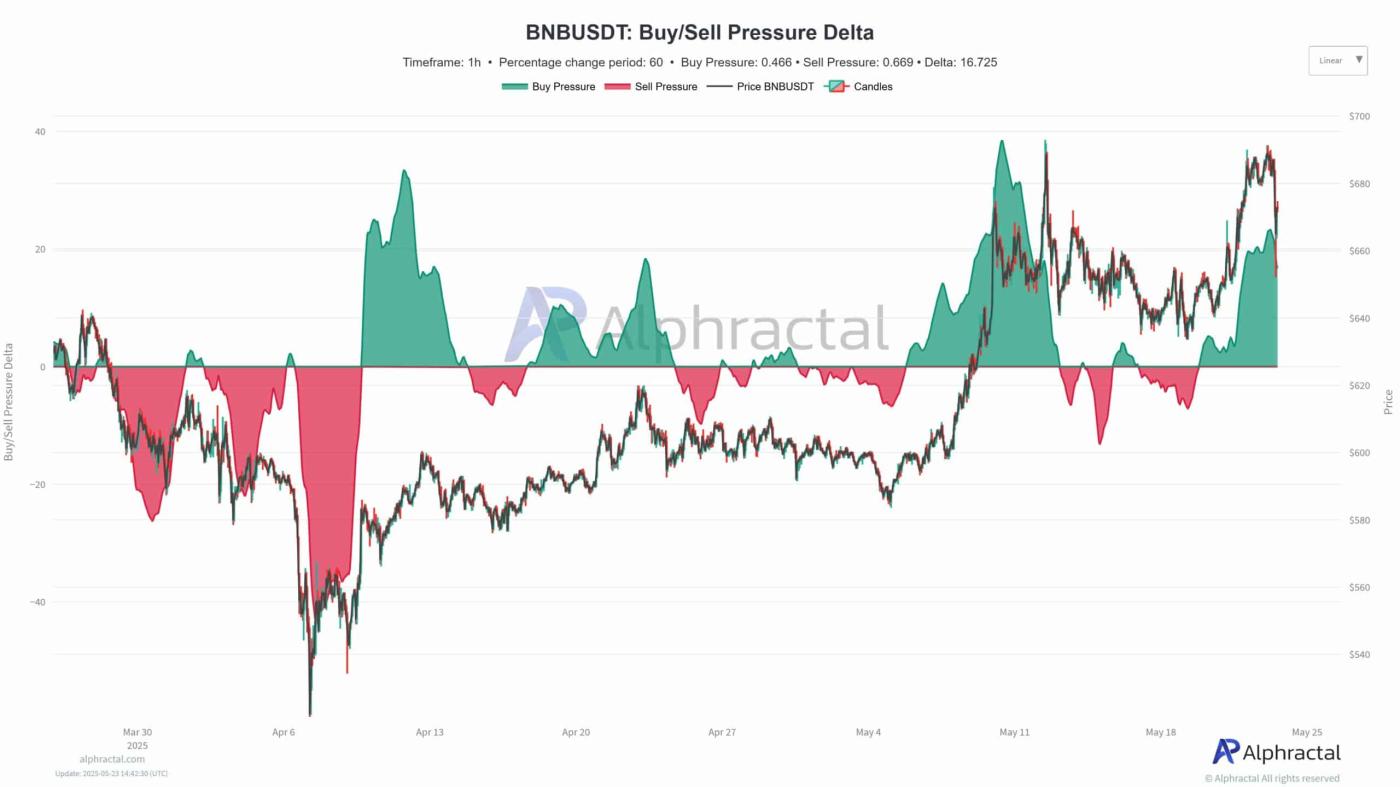

However, the pressure has clearly decreased.

The latest data shows reduced pressure on BNBUSDT – the green area in the latest small chart segment is much smaller compared to the previous week.

Buying Pressure at 0.466 and Selling Pressure at 0.669 form a negative Delta of -0.203, decreasing compared to the stronger increase in the previous week.

Source: Alphractal

BNB is trading around $670–$690, with reduced buying pressure suggesting bulls may soon give way to bears. The price will not move unidirectionally unless buyers support the market again.

Can the Price Reclaim $700?

Notably, Binance increased by 18.9%, from $581.00 to $691.31, then entered a temporary stabilization phase.

After this phase, BNB reached a secondary peak at the resistance level, then the price adjusted, creating a solid support at $652 for bulls to defend.

If bulls successfully break above $660, BNB could target $667, then $684, and potentially reach $705. However, if the price drops below $644, the price increase structure might break and accelerate losses.

From the first accumulation breakout and price increase, continued growth is expected. The buying volume ensures that the market still maintains interest.

If $667 becomes the new support, the price could quickly rise towards above $700.

Source: TradingView

Failing to hold above $660 could lead to retesting the $652 level and potentially dropping below $644. Due to the narrow entry range, risks and profits are easily predictable.

The price has increased strongly and quickly broke out, with the first signal showing bulls are dominant, but the next phase will depend on the momentum's acceleration and how the trend approaches the resistance level.