Despite the overall bullish sentiment in the cryptocurrency market, Ethereum (ETH) has experienced minimal price fluctuations over the past two weeks.

This slowdown comes amid strong selling activity. These factors suggest a cautious approach to Ethereum's short-term prospects.

VX:TZ7971

Ethereum Investors Take Profits

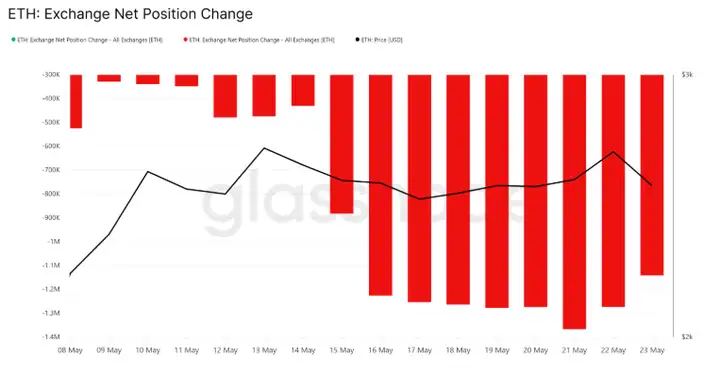

The latest data from glassnode shows a sharp increase in ETH selling pressure. Over the past 48 hours, investors have sold over 225,779 ETH tokens, equivalent to approximately $576 million in supply, reflecting a rapid profit-taking pace.

Such a massive sell-off indicates declining investor confidence. Many entities appear to be preserving profits due to doubts about further price increases. This behavior typically signals a short-term shift towards risk aversion.

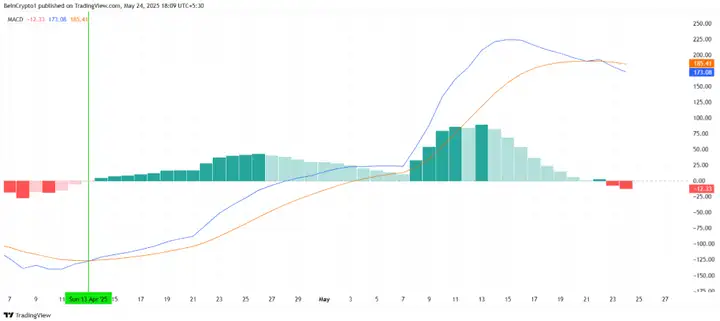

Technical indicators have intensified bearish sentiment around Ethereum. After nearly 7 weeks of bullish momentum, the MACD line has formed a bearish crossover. Such a change typically occurs before price declines or increased volatility.

The loss of growth momentum weakens Ethereum's support. Without emerging buyer interest, ETH may face further downward pressure as traders adjust positions based on technical signals.

ETH Price Stagnation

Ethereum (ETH) is currently trading around $2,490, below the key support level of approximately $2,500.

With ongoing bearish pressure, Ethereum has fallen below $2,500 and even dropped below the $2,344 support level. However, if buying power recovers, ETH might consolidate between the $2,500 and $2,654 resistance levels in the short term.

To alter the short-term bearish outlook, Ethereum must break through the resistance level near $2,654. Breaching this level could potentially push the price to $2,814, thereby inspiring investor optimism and further supporting upward momentum.