To Those Feeling Lost in the Blockchain Revolution

Some say Crypto is a Ponzi scheme, a bubble, a speculative game destined to be worthless.

Others say Web3 is a revolution, a paradigm shift, a new stage of civilization built upon technological continuity.

Two voices, a narrative torn apart.

Without rushing to take sides, let's first draw a more straightforward conclusion:

The underlying logic of business has never changed.

Whether it's Web2 from portals to Apps, or Web3 from token issuance storytelling to infrastructure competition, the prosperity behind it follows the same old path - this time, the narrative is wrapped in protocols, and capital is hidden in code.

Looking back at the past decade, China's internet path is clear: concept-driven, financing running ahead of user growth; subsidies to attract traffic, capital-driven growth; then layoffs, efficiency improvements, profitability; followed by platform transformation and technological reconstruction. Today's Web3 is treading a similar development rhythm.

In the past year, competition between project teams has evolved into a competition arena using TGE and Airdrop to acquire users, with no one wanting to fall behind, but also no one knowing how long this "user exchange" competition will continue.

So, I'm writing to try to break down those seemingly chaotic narratives into several more traceable stages.

Let's follow the footprints of history and see how Web3 has arrived at today and where it might be heading.

[The rest of the translation continues in the same manner, maintaining the specified translations for technical terms and preserving the original structure and meaning.]Competition between platforms is no longer a battle for users, but a contest of ecosystem capabilities. As head platforms gradually close their growth paths, the industry enters a phase of structural stability, resource concentration, and collaborative ability dominance. The true moat is not necessarily leading in a single function, but whether the internal system circulation is efficient, stable, and self-consistent.

This is a for system-players. With the basic pattern largely set, new variables can only break through by finding structural edge gaps and technical breakpoints.

At this stage>, almost all high-frequency essential tracks have been bounded by giants. where In the past, one could compete by being early and burning money, but now, growth must be embedded within system capabilities. Platform logic has also been upgraded: from multi-product stacking to ecosystem flywheel, from single-point user expansion to organizational-collaboration.

Tencent connects WeChat, mini-programs, and advertising systems, constructing an internal circulation loop; Alibaba reorganizes Taotian, Cainiao, and DingTalk, horizontally connecting business chains, attempting to rediscover efficiency leverage. Growth is no longer driven by new user acquisition, but by structural compound interest brought by system self-operation.

As user paths, traffic entry points, and supply chain nodes are gradually controlled by a few head platforms, the industrial structure begins to become increasingly closed, leaving increasingly space for new ententrants.

ByteDance became an exception.It did not attempt to compete for resource positions within existing ecosbut overtook by taking a shortcut, starting from underlying technology, reconstructing content distribution logic through recommendation algorithms. Against the backdrop where mainstream platforms still rely on social relationship chains for traffic scheduling, ByteDance built a distribution system based is on user behavior, thereby establishing its own user system and commercial closed loop.

This is not an improvement of the existing pattern, but a technical breakthrough that bypasses existing paths and rebuilgrowth structures.

ByteDance's emergence reminds us: Even when industrial patterns tend to solidify, as long as structural fault lines or technical blanks exist, new is players can still emerge. It's just that this timeer path, faster rhythm, and higher requirements.

Web3 today is precisely in a similar similar critical interval.

[The rest of the translation follows the same professional and precise approach, maintaining technical terminology and preserving the original text's nuances.]I am not denying the Airdrop. The essence of Airdrop is user acquisition behavior, an effective way to attract new users without consuming financing funds. However, its marginal effect is rapidly declining. Many projects are trapped in a formulaic Airdrop user acquisition cycle, and whether your business scenario and product capabilities can retain users is the true value return and the only solution for project survival. (Note: Projects surviving through secondary market manipulation are not discussed in this context)

Ultimately, bribing users to purchase is not the core of growth. Without establishing a business foundation in a specific scenario, Airdrop ultimately consumes the interests of the project or users. When the business model is not closed-loop, Token becomes the only reason for user action. Once TGE is completed and rewards stop, users naturally leave.

3. Business Verification Stage - Real Scenario, Narrative Verification

I often advise project teams to think clearly before distributing tokens:

What problem are you solving for which scenario? Who are the most critical contributors? After TGE, will this scenario still exist, and will people genuinely stay to use it? Many project teams tell me they can quickly achieve user growth through Token incentives. I always ask: "And then?"

Usually, project teams will pause and smile: "Oh..."

And then, nothing. If you only hope to gain interactions by "issuing incentives", you might as well release a meme. At least everyone knows it's an emotional game without expectations of retention.

Finally, everyone starts looking back: What structure do these traffic, interactions, and distributed tokens ultimately lead to? In the end of token distribution, I've become the clown🤡.

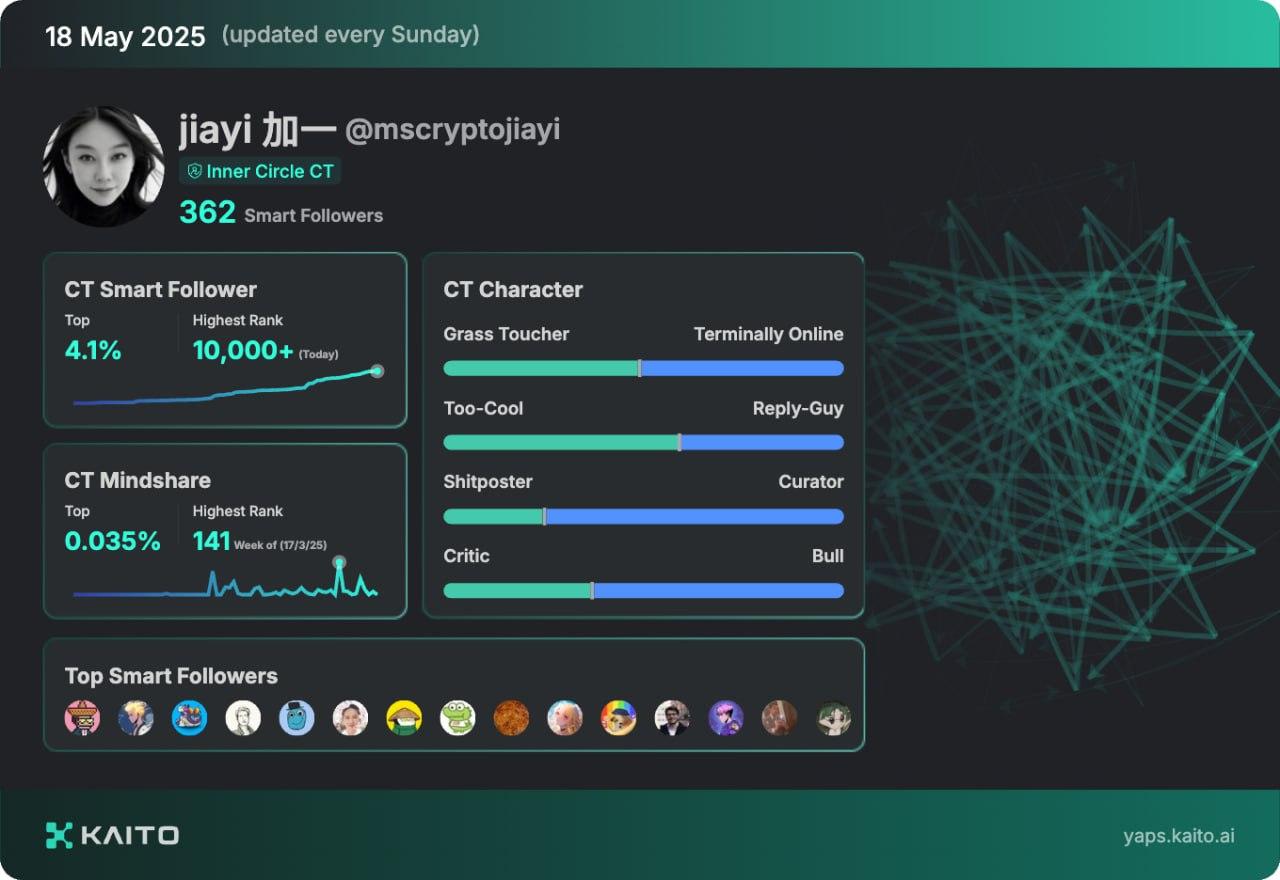

So the key words in this stage become: Use scenarios, user needs, product structure. Only through real scenarios and clear structures can you forge your own growth path. Honestly, I personally don't like Kaito's business logic - it's more like the ultimate form of a "bribery culture", implying a high degree of incentive mechanism utilization, and can even be said to be a repackaging of platform and content relationships.

However, it's undeniable that Kaito succeeded. It's an actual business scenario where pre-TGE expectations became a market occupation accelerator, and the performance continues after TGE. Because Kaito provides a business logic where KOLs expose projects, the wool comes from the pig, and key figures remain on the Kaito platform itself.

Although many KOLs might be aware that this logic will ultimately backfire, in a market ofstructural opportunism, "strategic compliance" becomes the most rational choice.

Although many KOLs might be aware that this logic will ultimately backfire, in a market ofstructural opportunism, "strategic compliance" becomes the most rational choice.

I'm also pleased to see more and more projects beginning to build around real scenarios, whether in trading, DeFi, or foundational capabilities like identity systems.

Those teams that choose the right direction at the right time and polish real products are gradually taking root through the positive cycle of vertical scenarios - from usage to retention, from retention to monetization - constructing their own industrialization paths.

The most typical example is exchange-type products: they transform high-frequency needs into structural traffic, then complete the closed loop through assets, wallets, and ecosystem linkage, walking the "structural evolution line" in Web3 projects.

4. Structural Sedimentation Period - Platform Finalization, Variable Contraction

A truly positively cyclic business scenario is the entry ticket for a project to gain industrial discourse power.

For example, Binance started from trading, gradually connecting liquidity, asset issuance, chain expansion, and traffic entry, forming an end-to-end scheduling system from off-chain to on-chain; Solana ignited and inherited through lightweight assets, precipitating a feedback structure of community, developers, and tool systems.

This is a cycle where the industry transitions from project experimentation to structural sedimentation - no longer competing for speed, but beginning to compete on system completeness.

But this doesn't mean new projects lose breakthrough opportunities. Projects that truly can break out are not those with the largest voice or broadest narrative, but those that can "fill positions" structurally or "reconstruct" models.

Remember ByteDance in the mobile internet era?

I believe that in the post-blockchain era, a new cycle driven by AI is approaching. There will definitely be projects like ByteDance that quickly establish structures in the right cut and complete industrial breakthroughs and self-closure through AI.

Web2's platformization stage left giants and flywheels, and also left niche disruptors like ByteDance; Web3's structural period can similarly nurture next variable projects that "break out from the edges" with the right structure.

Let me speculate a bit: if it's infrastructure, it should be infrastructure built for the native AI era, driving the technological product development of this era, just like Ethereum's mission in the blockchain 1.0 era;

If it's a DAPP, it must be an application that uses AI to break down existing user access barriers (Web3 user barriers are too high) and disrupt existing business order.

If someone asks me how Web3 will develop in the future?

I would say: "Like the internet of everything, its true potential is in the post-blockchain era, reconstructing usage paths, lowering collaboration barriers, and giving birth to a batch of truly functional products and systems."