TRUMP, the meme coin that attracted attention after the TRUMP dinner, is facing difficult price fluctuations in recent days. This Token has lost momentum, with prices falling and negative sentiment creeping into the market.

As prices continue to struggle, the possibility of further decline is currently greater than any recovery potential, putting traders in a difficult position.

TRUMP Traders Face Losses

The liquidation map for TRUMP reveals data related to traders. Approximately $31 million in short-term contract value is at risk of being liquidated if TRUMP's price rises to $14.52. This is a critical threshold for short positions, as their positions will be liquidated if the price crosses this point.

The decreased demand indicates that many investors no longer believe in further growth potential. Instead, they are preparing for a price drop, showing diminishing optimism in the short-term prospects for TRUMP.

TRUMP Liquidation Map. Source: Coinglass

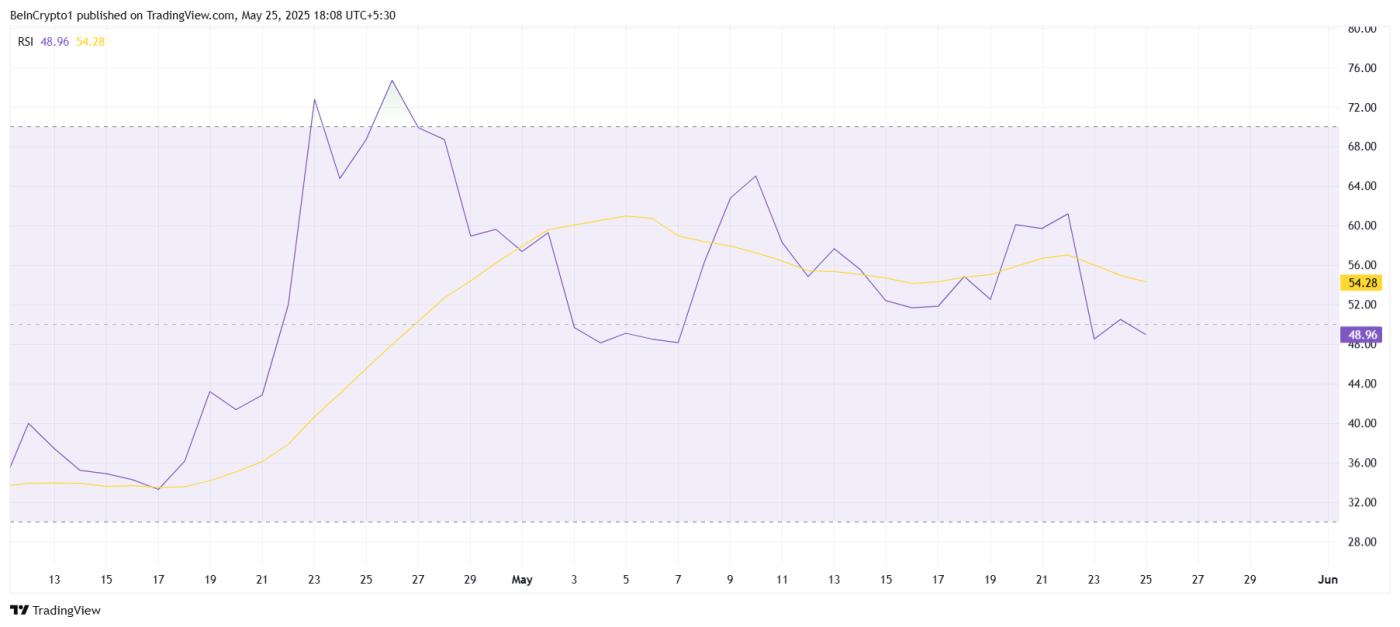

TRUMP Liquidation Map. Source: CoinglassOn a macro level, technical indicators paint a negative picture for TRUMP. The Relative Strength Index (RSI) recently slipped below the neutral 50 level, signaling a shift into negative territory. The RSI decline suggests TRUMP is vulnerable to further downward pressure if negative momentum intensifies.

As the RSI continues to trend downward, TRUMP becomes increasingly susceptible to price drops. The inability to regain upward momentum leaves the token in a precarious state, with potential for further losses if the current trend continues.

TRUMP RSI. Source: TradingView

TRUMP RSI. Source: TradingViewTRUMP Price Awaits Recovery

At $12.65, TRUMP is currently struggling with a lack of price momentum. Despite the hype surrounding the TRUMP dinner, the token has dropped nearly 15% since the event, indicating the market could not sustain its initial enthusiasm.

This decline reflects broader skepticism about the token's future performance.

For TRUMP to recover, a strong surge is needed, requiring an increase of nearly 15% to reach $14.53. However, given the current market conditions and overall sentiment, this level seems difficult to achieve.

Instead, TRUMP is likely to break its current support at $12.18, leading to a further decline to $10.97.

TRUMP Price Analysis. Source: TradingView

TRUMP Price Analysis. Source: TradingViewHowever, if there is a sudden change in demand due to new investors, TRUMP could see a strong surge. A powerful push above $13.36 could create conditions for a rise to $14.53, triggering the liquidation of $31 million in short-term position value.

Such a move would cause significant market volatility, potentially bringing a strong recovery for this altcoin.