XRP has been steadily declining over the past few weeks, causing significant losses for many investors. Despite the price drop, some major holders are actively working to halt the downward trend.

Their efforts could play a crucial role in stabilizing and potentially reversing XRP's decline.

XRP Investors Remain Optimistic

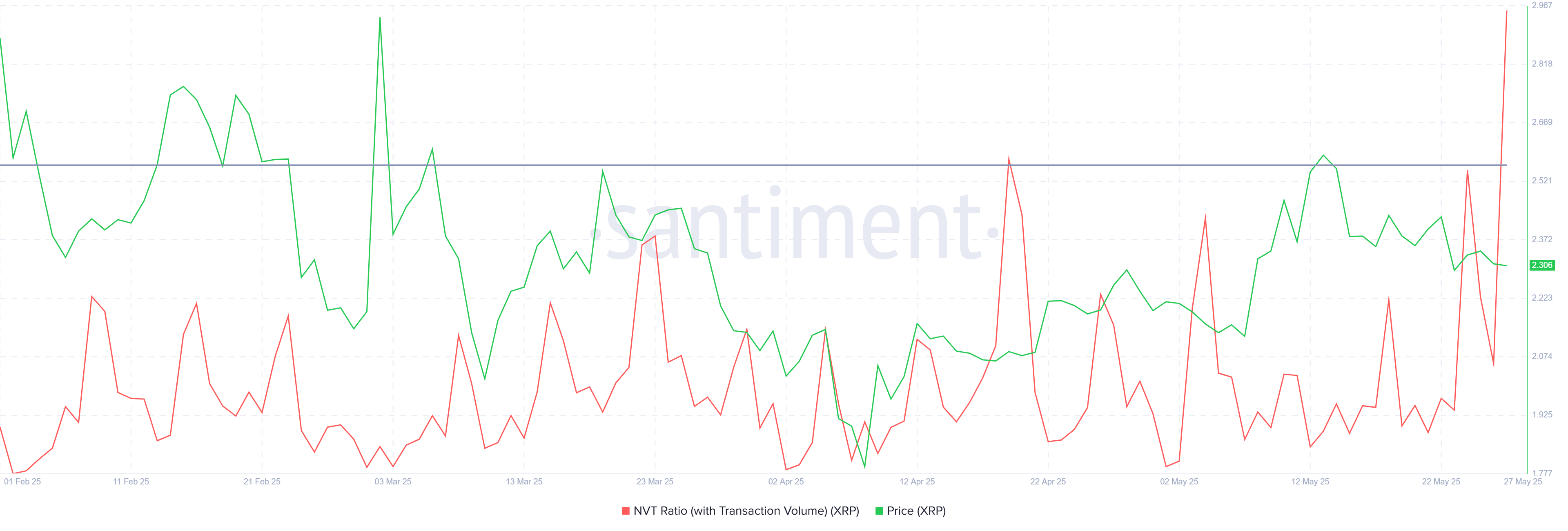

XRP's Network Value to Transactions (NVT) ratio has surged to its highest level in a month. The rise in the NVT ratio typically indicates that the network's valuation exceeds its trading activity, suggesting an imminent price adjustment. This indicator warns that XRP may be overvalued relative to its current usage.

However, XRP has previously rebounded after being overvalued. Investors and holders are expecting a similar rebound this time due to new buying interest.

XRP's liveliness indicator is showing a decline, indicating active accumulation by long-term holders (LTH). The drop in liveliness suggests that these investors are holding onto their tokens despite the price decline, showing an intention to stabilize the market. This is in contrast to an increase that would indicate rising selling pressure.

LTH accumulation during price drops demonstrates confidence in XRP's long-term prospects. They are positioning themselves to absorb selling pressure and potentially profit when the price recovers, providing a critical support layer.

XRP Price Nearing Major Support Line Loss

XRP is currently trading at $2.30, reflecting a two-week decline. It is positioned just above a key support line at $2.27. Securing this support line is crucial for the altcoin to prevent further decline and maintain a potential platform for gains.

If bullish factors continue to strengthen, XRP could rebound from the $2.27 support line. Breaking through the downtrend could allow XRP to convert $2.38 into a new support line and open the way to rise to $2.56. Such a recovery would signify a restoration of investor confidence.

Conversely, if XRP loses the $2.27 support line, the price could drop further to $2.12. Such a decline would invalidate the bullish outlook, extend the continuous downward trend, cause greater losses for investors, and maintain downward price pressure.