Author: Macro Hedge付鹏

In the new wave of digital finance, stablecoins are not disruptors of the old system, but more like a "digital relay station of the Bretton Woods system" - carrying U.S. dollar credit, anchoring U.S. Treasury assets, and reshaping the global settlement order.

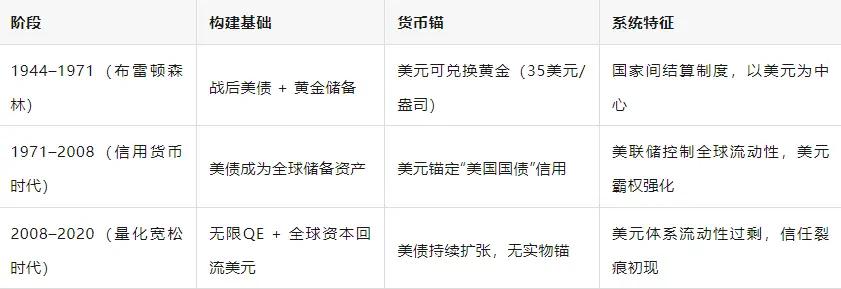

I. Historical Perspective: Three Structural Leaps of U.S. Dollar Hegemony

The new phase after 2020 is a process of reconstructing the digital, programmable, and fragmented basis of U.S. dollar credit, with stablecoins being the key connecting body.

II. The Essence of Stablecoins: On-chain "Dollar-Treasury" Anchoring Mechanism

Stablecoins, especially those pegged to the U.S. dollar like USDC, FDUSD, and PYUSD, have an issuance mechanism of "on-chain dollar certificates + Treasury or cash reserves", forming a simplified "Bretton mechanism":

This indicates: The stablecoin system actually rebuilds a "digital Bretton Woods framework", with the anchor shifting from gold to U.S. Treasuries, and from national clearing to on-chain consensus.

III. The Role of U.S. Treasuries: The "New Reserve Gold" Behind Stablecoins

In the current reserve structure of mainstream stablecoins, U.S. Treasuries, especiallyshort-term T-Bills (1-3 month Treasury bills), have the highest proportion:

USDC: Over 90% of reserves allocated to short-term U.S. Treasuries + cash;

FDUSD: 100% cash + T-Bills;

Tether is also gradually increasing U.S. Treasury weight and reducing commercial paper.

▶ Why have U.S. Treasuries become the "hard currency" of on-chain finance?

Extremely liquid, suitable for handling large on-chain redemptions;

Stable returns, providing interest margin for issuers;

Backed by U.S. dollar sovereign credit, enhancing market confidence;

Compliance-friendly, can be used as a compliant reserve asset.

From this perspective,stablecoins are the "new Bretton token with T-Bills as gold", embedding the credit system of U.S. Treasury.

IV. Stablecoins = Extension of U.S. Dollar Sovereignty, Not Weakening

Although on the surface, stablecoins are issued by private institutions and seem to weaken central bank control over the dollar, but in essence:

Each USDC issuance must correspond to 1 U.S. dollar in Treasuries/cash;

Each on-chain transaction is priced in "U.S. dollar units";

Each stablecoin global circulation expands the U.S. dollar usage radius.

This meansthe U.S. no longer needs SWIFT or military projection to "airdrop" dollars into global wallets, representing a new paradigm of monetary sovereignty outsourcing.

Therefore, we say:

Stablecoins are the "unofficial contractors" of U.S. monetary hegemony

—— It does not replace the dollar, but pushes the dollar onto the chain, to the global stage, and into the "bankless zone".

V. Bretton 3.0 System Prototype Emerges: Digital Dollar + On-chain U.S. Treasuries + Programmable Finance

In this architecture, the global financial system will evolve into the following model:

This means:The future Bretton Woods system will no longer occur at the Bretton Woods conference table, but will be negotiated and consensualized between smart contract codes, on-chain asset pools, and API interfaces.

VI. Risks and Uncertainties: How Far Can This System Go?

VII. Conclusion: Stablecoins Are Not the Endpoint, But a "Mid-Journey Resupply Station" for U.S. Global Governance

Stablecoins may seem like private sector innovation, but are actually becoming the "covert bridge" ofthe U.S. government's digital currency strategy:

It connects old finance (U.S. Treasuries) with new finance (DeFi);

It extends U.S. financial sovereignty to the smart contract layer;

It ensures the U.S. dollar maintains its dominant position during digital transformation.

Just as the Bretton Woods system established U.S. dollar credit through gold anchoring, today's stablecoins are attempting to rewrite monetary governance structures through "on-chain T-Bills + U.S. dollar clearing consensus".

Stablecoins are not a revolution, but a reconstruction of U.S. Treasuries, a reshaping of the U.S. dollar, and an extension of sovereignty.