Speaking at Bitcoin 2025, MicroStrategy Chairman Michael Saylor refused to disclose the company's wallet address.

Although he cited security reasons, this refusal sparked a fierce reaction from industry critics.

Michael Saylor Prioritizes Privacy Over Transparency at Bitcoin 2025

At the Bitcoin 2025 conference on 05/26/2025, MicroStrategy's CEO Michael Saylor firmly refused to disclose the company's Bitcoin wallet address. This stance triggered a wave of criticism from transparency advocates and cryptocurrency influencers.

Saylor compared disclosing the company's wallet to "publicly sharing your child's bank account and phone number." He argued that this would make MicroStrategy vulnerable to hacker attacks and "every imaginable type of troll."

In a lengthy response on stage, he claimed that proof-of-reserves (PoR) is a "crypto industry trick" that does not account for liabilities and introduces unnecessary risks for holding organizations.

"The current standard method of publishing proof-of-reserves is an insecure proof-of-reserves. No enterprise-level security analyst thinks wallet disclosure is a good idea," Saylor argued.

Instead, Saylor supports U.S. regulatory compliance and traditional corporate audits as the gold standard.

"Best practice is to have a Big Four auditor verify assets, following Sarbanes-Oxley, with criminal liability for executives if they lie. That's what my company is doing," he said.

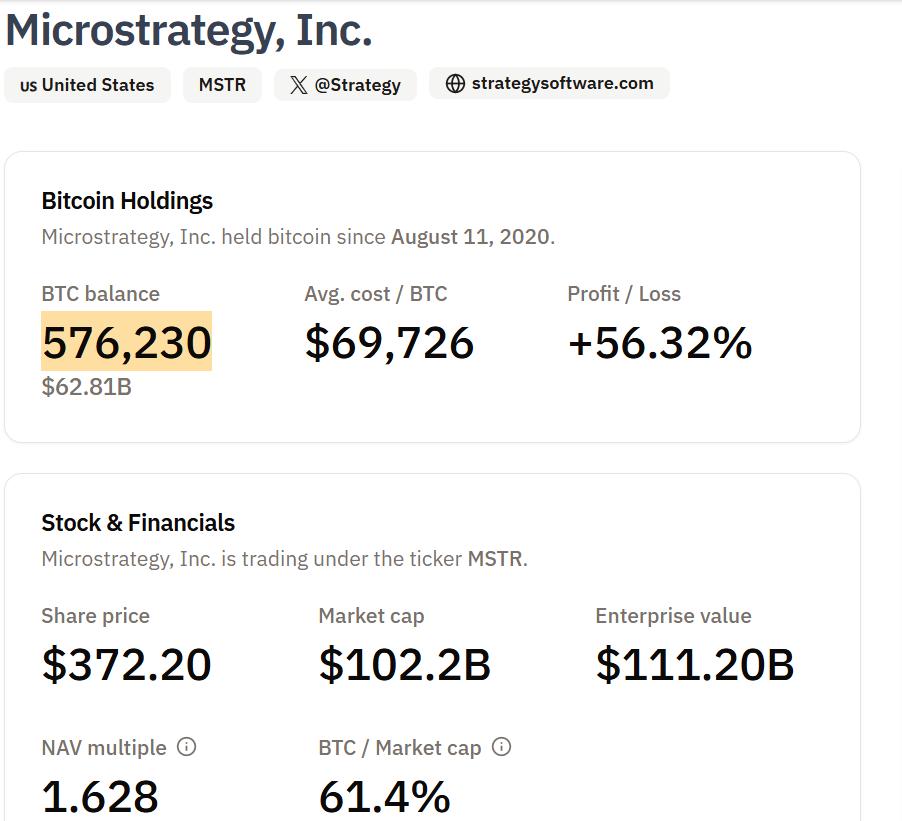

Currently, MicroStrategy holds 576,230 BTC, valued at approximately $62.84 billion. However, despite this significant exposure, the company has never disclosed its wallet address, causing skepticism in the cryptocurrency community.

MicroStrategy Bitcoin Holdings. Source: Bitcoin Treasuries

MicroStrategy Bitcoin Holdings. Source: Bitcoin TreasuriesAnalysts Criticize Saylor's Statement That Wallet Disclosure Reduces Security

Some cryptocurrency commentators praised Saylor's perspective, arguing that "his response silenced the haters." However, not everyone agreed.

Duo Nine, founder of Your Crypto Community (YCC), criticized Saylor's statement as "a major red flag."

"His reason sounds like he's buying paper Bitcoin... Calling proof-of-reserves a bad idea starts to sound like Saylor is hiding something," Duo Nine wrote on X.

Duo compared MicroStrategy's leveraged Bitcoin strategy to the bankrupt Terra Luna model in another series of posts. Notably, Strategy funds this model by issuing additional MSTR and preferred shares,

"Saylor is using leverage with BTC up to billions. At some point, he will either sell Bitcoin or default. That's how you create a death spiral," Duo Nine warned.

Jacob King, CEO of WhaleWire, also questioned Saylor's motives. This analyst argued that Bitcoin's entire premise is built on transparency, security, and traceable ownership.

"They're hiding their wallet because they don't want the public to see when they dump after luring in retail investors," King stated.

This fierce reaction reflects the growing divide in the Bitcoin community between institutional security practices and on-chain transparency demands.

On one side, some investors accept third-party audits and SEC records as sufficient. Meanwhile, others view refusing to disclose on-chain data as a betrayal of Bitcoin's core principles. For his part, Saylor remains steadfast.

"...if you're in the crypto industry, keep your own crypto. And if you're an institutional investor, let me tell you, I've had this social armor since 1998... What's absolutely critical in the stock market is that CFOs, CEOs, outside directors, outside auditors, and risk managers must be trusted," Saylor emphasized.

But with over half a million BTC under MicroStrategy's control and critics drawing parallels to past collapses, pressure may continue to mount.

With the debate on transparency versus security unlikely to subside, MicroStrategy's (now Strategy's) opaque stance could become a prolonged hot topic.

Meanwhile, Saylor's bold perspective aligns with Paolo Ardoino, who declared in an April 2024 interview that the company relies on attestations for its reserves.

This follows a letter from Consumers' Research to Washington Governor Jay Inslee, aimed at protecting consumers.

The letter criticizes Tether for not conducting an audit to prove that their USDT stablecoin is 1:1 backed by US dollars, despite promising to do so nearly 10 years ago.