Perpetual futures prices differ from spot prices depending on market sentiment. The futures market adjusts these price differences through the Funding Rate. When futures prices are high, longs pay shorts, and when low, shorts pay longs to balance spot and futures prices. By utilizing this structure, an investment strategy exists where one can buy spot assets, take a short position in futures to hedge price fluctuations, and earn income through funding rates. We have compiled top cryptocurrencies showing high profit opportunities through real-time data. [Editor's Note]

As of 9:45 PM on May 28th, according to the cryptocurrency funding rate analysis platform DataMaxiPlus, Status (SNT) appears to offer the highest profit opportunity based on funding rates.

In a strategy of taking a margin short position on Bitget spot and a long position on Bitget futures, a funding rate of -1.34% is applied, which analysis suggests could generate an annualized return of 29.32%, equivalent to approximately $146,432 in annual expected earnings.

Status (SNT) shows strong profit opportunities in other exchange combinations. With a Bitget spot short position and Bybit futures long position, the funding rate is -1.32%, with an average annual return of about $144,323. Additionally, a combination of MEXC futures long and Bitget spot short also shows a similar -1.32% funding rate, with potential earnings of around $144,320.

Furthermore, a strategy of Gate.io futures long and Bitget spot short applies a -0.95% funding rate, with an expected annual return of approximately $104,371.

Axelar (AXL) also demonstrates profitability when utilizing a dYdX futures long and Bybit or Binance spot short strategy, with a -0.24% hourly funding rate translating to an annualized return of 21.07%, or about $105,244 annually.

This strategy involves holding assets in a long position in futures markets while using margin to create a short hedge in spot markets. When funding rates are negative, one can realize profits through futures positions while simultaneously reducing risk from market price fluctuations, enabling actual earnings even with short holding periods.

However, margin trading incurs interest costs and fees, so the actual strategy should consider the real return after subtracting these expenses from funding rate earnings.

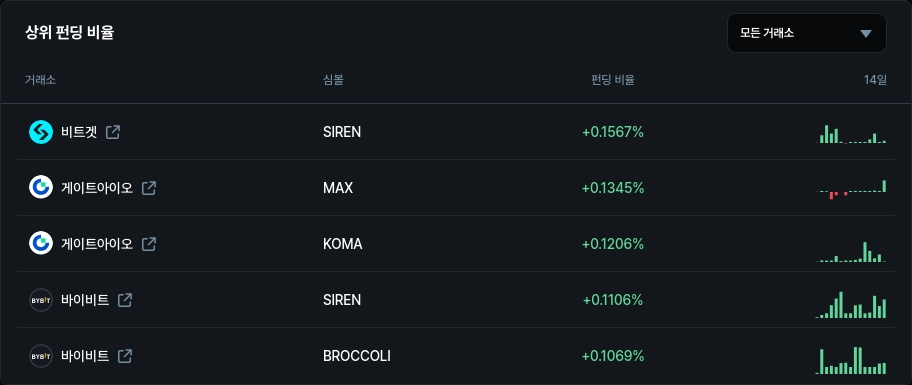

Highest and Lowest Funding Rates at This Moment

🔼 Top 5 Highest Funding Rates

▲Bitget's SIREN (0.001567)

▲Gate.io's MAX (0.001345)

▲Gate.io's KOMA (0.001206)

▲Bybit's SIREN (0.0011056)

▲Bybit's BROCCOLI (0.00106948)

🔽 Bottom 5 Lowest Funding Rates

▲Gate.io's MAX (-0.002051)

▲Gate.io's MAX (-0.00093)

▲Gate.io's MAX (-0.00091)

▲Bitget's SIREN (-0.000115)

▲Gate.io's KOMA (0.0001)

When funding rates are high or positive, long position demand is high, making futures prices relatively more expensive than spot prices, requiring longs to pay shorts. Investors can secure funding rate profits by implementing a spot purchase and futures short (short selling) strategy.

Conversely, when funding rates are low or negative, short position demand is high, causing futures prices to be lower than spot prices, requiring shorts to pay longs. Investors can maximize funding rate arbitrage by utilizing spot selling and futures long strategies.

Funding rate arbitrage is a strategy that can aim for stable returns regardless of market volatility, even when long-term market direction is difficult to predict. However, as funding rates are highly variable depending on market participant position ratios, a strategic approach considering funding rate differences between exchanges and capital costs is necessary.

[This article does not provide financial advice, and investment outcomes are the sole responsibility of the investor.]

News in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>