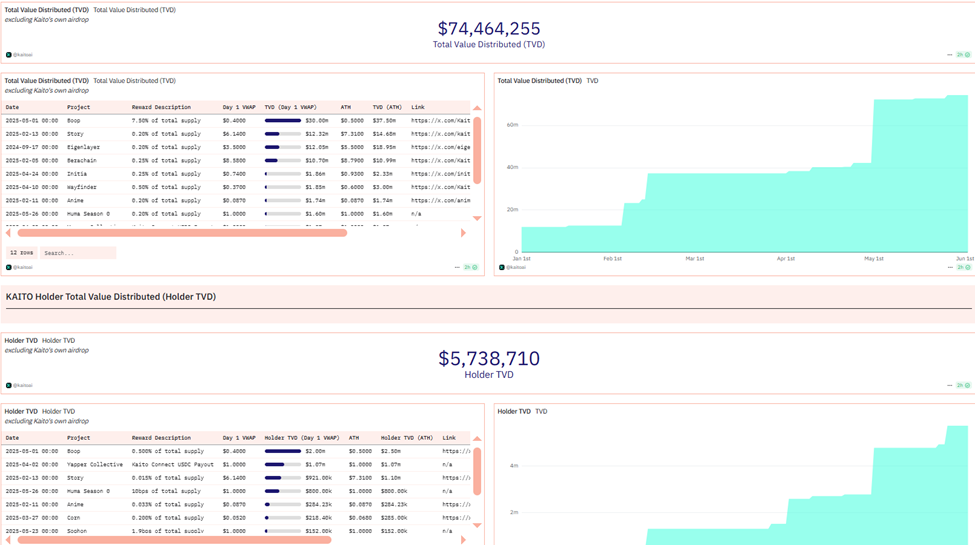

Web3 AI platform Kaito has quietly become one of the largest distributors of on-chain incentives. According to Dune Analytics data, the total distribution value airdropped to over 5.7 million wallet holders exceeded $74 million.

This occurred within the emergence of a new narrative in cryptocurrency: the attention capital market. This is a niche term originating from Solana's internet capital market.

Kaito's Attention Economy... Airdrops, Incentives, Network Effect

According to Dune's data, Kaito has distributed over $74 million in airdrops to 5.7 million wallets. Meanwhile, the platform's token KAITO has rebounded by over 150% since early May.

Key factors include increased Staking participation and alignment with a new attention-based economy.

Meanwhile, over 28 million KAITO Tokens are currently being Staked, accounting for more than 10% of the circulating supply. These Stakers or platform users seek additional airdrop exposure and returns through Kaito's Staking and farming programs.

These figures position Kaito at the forefront of a new trend in cryptocurrency of monetizing attention through attention-based content creation and identity building.

One of Kaito's most vocal power users is Simon Dedic, CEO and partner of Moonrock Capital. In his X (Twitter) post, he mentioned that the platform has transformed how he generates and engages online.

"I've been using Kaito AI for almost a year, and honestly, it's one of the most impactful tools I've adopted in crypto. Not just because I could earn nearly $200,000 doing almost nothing, but because it fundamentally changed how I generate content, engage, and the direction of my career." – Simon Dedic, Moonrock Capital CEO said.

He connected his X account and contributed to Kaito's "yap" system, receiving a massive KAITO airdrop.

Subsequently, he Staked to earn additional rewards from projects like Wayfinder, Boop.fun, and Huma Finance. Beyond financial benefits, Dedic emphasized Kaito's behavioral impact.

"Kaito's launch provided a genuine reason for me to become more consistent, intentional, and thoughtful in how I tweet, with yaps, leaderboards, and visibility metrics. That alone started a virtuous cycle of tremendous growth... The founders realized I'm helping to capture attention, not just throwing bags." – Simon Dedic, Moonrock Capital CEO added.

From Passive Income to Influence... How Kaito Rewards Participation

Kaito's founder Yu Hu describes this movement as part of a deeper "infofi" vision, arguing that attention is now the core driver of value and valuation in cryptocurrency.

"In the attention economy, attention is inherently valuable. The value of attention varies depending on retention, consensus, underlying topics (i.e., product), quality, and several other factors." – Yu Hu, Kaito Founder explained.

He also explained how Kaito's infrastructure connects attention to action. Specifically, Kaito Earn enables user conversion, and the upcoming Capital Launchpad is for capital formation.

The goal is to convert high-quality content and engagement into network growth and investment opportunities.

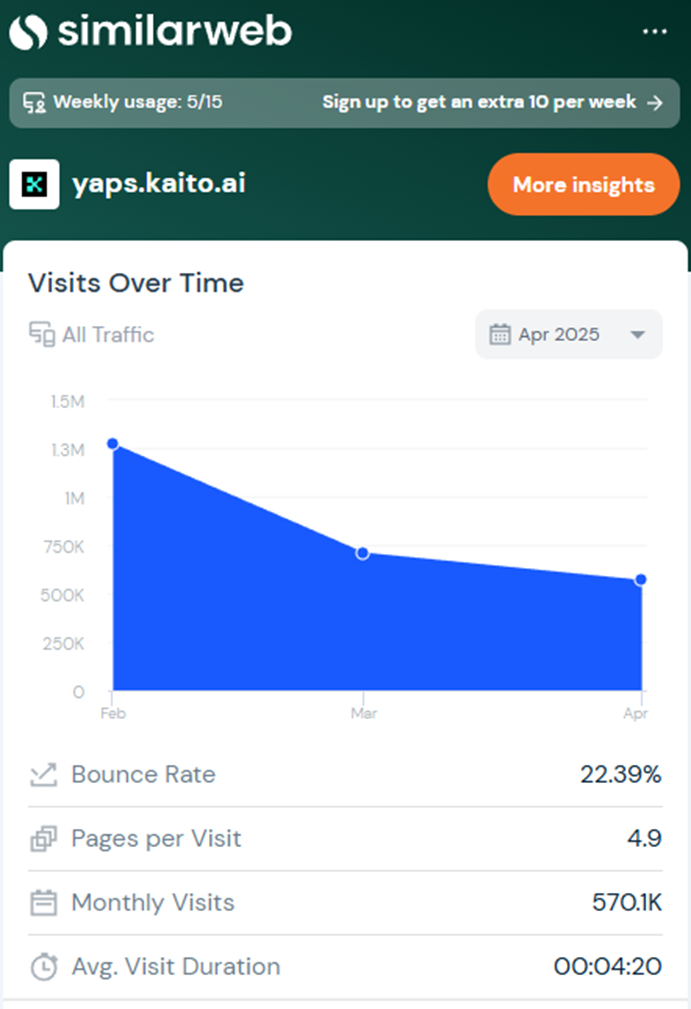

However, not all indicators are positive. According to Similar Web data, Kaito's traffic decreased from 1.3 million monthly visits in February to 570,000 in April. The 56% decline suggests a decrease in interest or changes in user behavior.

Additionally, with KAITO's Token unlock paused until August, analysts warn that selling pressure might reappear in late summer.

Nevertheless, as attention becomes increasingly commodified in Web3, Kaito's growth signals a new meta for revenue, on-chain identity, influence, and long-term alignment.