Recently, James Wynn has become famous for large leverage trades, betting billions of USD on Bitcoin and meme coins like PEPE on the Hyperliquid platform.

Is he a bold trader with a passion for big bets, or simply a sophisticated marketing strategy to put Hyperliquid on the DeFi map?

James Wynn in the eyes of investors

James Wynn is a trader on the Hyperliquid (HYPE) platform. He earned profits up to 100 million USD but quickly lost it all. However, his recent moves suggest this could be a smart marketing campaign.

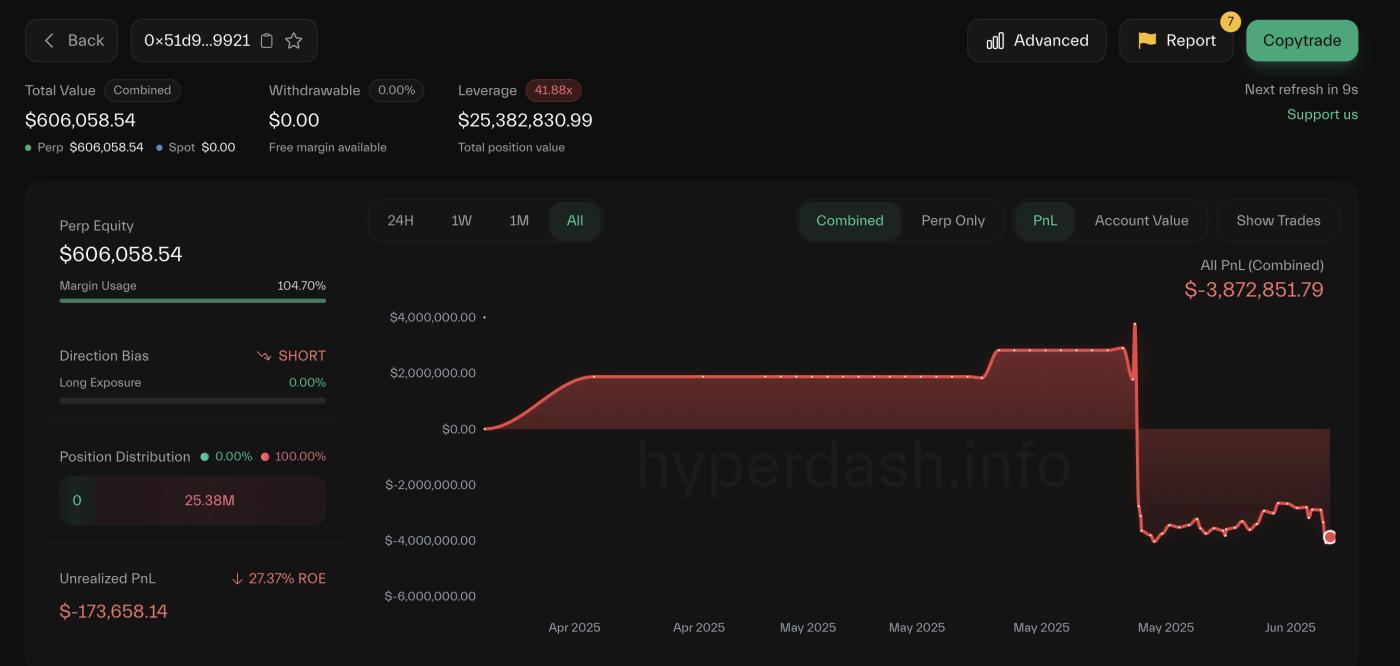

James Wynn's Investment Performance. Source: hyperdash

James Wynn's Investment Performance. Source: hyperdashTraders on HyperDash have called James Wynn a delta-neutral trader. This means James always keeps his portfolio positions at a total Delta of 0.

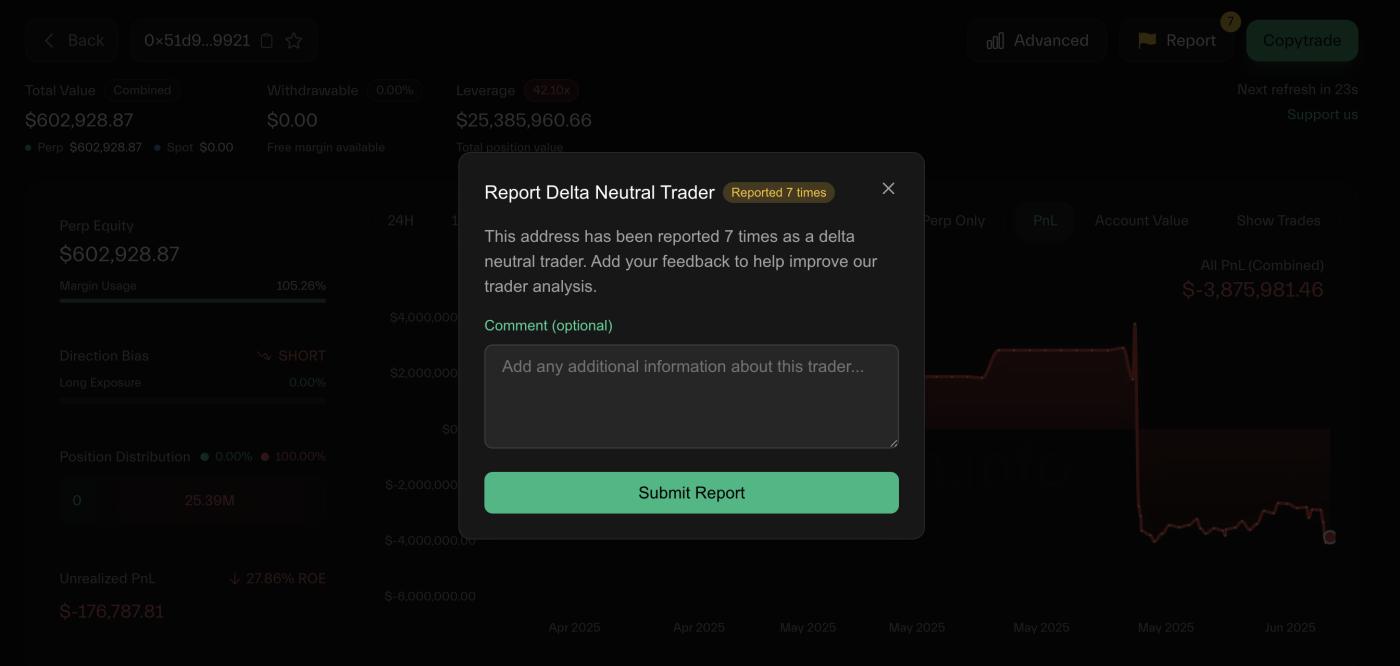

James is reported as a delta-neutral trader. Source: hyperdash

James is reported as a delta-neutral trader. Source: hyperdashBesides being an individual trader who favors high-risk, high-leverage trades, James has also shown confidence by opening positions despite short-term losses. However, he has often announced trading pauses only to return with new positions shortly after.

Notably, James opened new positions after returning from his most recent trading pause. Facing liquidation pressure, he called for community donations and quickly received over 20,000 USD.

Is the James Wynn Effect a Staged Marketing Campaign?

After repeated and strange actions, many question the real purpose behind James Wynn's trades.

Evgeny Gaevoy, Wintermute's founder, publicly stated on X that the James Wynn phenomenon could be a "carefully planned Hyperliquid marketing campaign." Gaevoy even praised Wynn's intelligence and the quality of his X posts, suggesting this could be a strategy to attract attention to the Hyperliquid platform.

"But overall, I think 'wynn' is just a well-executed HL promotion campaign, well played" Evgeny Gaevoy shared.

This perspective is reinforced by the fact that Hyperliquid has recently attracted significant attention due to Wynn's billion-dollar trades, helping the platform stand out in the fiercely competitive DeFi market.

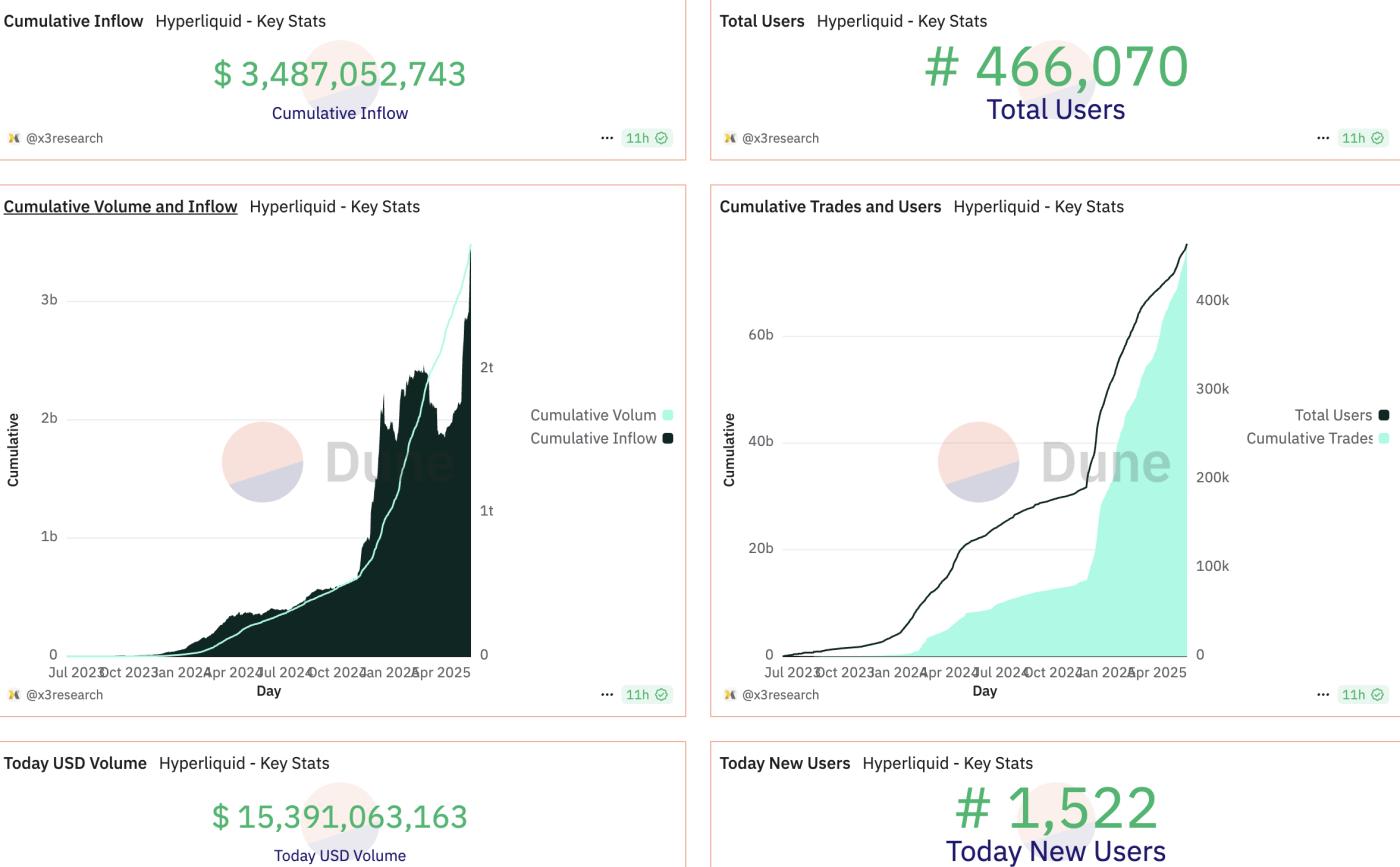

Data from Dune Analytics also shows that Hyperliquid's total trading volume and user numbers have reached an All-Time High (ATH). The price of Hyperliquid's HYPE token has increased 73% in the past 30 days, reaching 32.93 USD on 03/06, with a market capitalization exceeding 10.99 billion USD.

Hyperliquid's performance. Source: Dune

Hyperliquid's performance. Source: DuneFrom another perspective, agreeing with Evgeny Gaevoy, BitMEX co-founder Arthur Hayes also hypothesized that Wynn might have used risk-hedging trades at an anonymous address to optimize benefits from Hyperliquid's next airdrop.

"I'm starting to think this might go down in crypto history as one of the best exchange marketing campaigns ever. $HYPE for the win. Also, this guy is probably just farming the next airdrop by trading back on another dark address." Arthur Hayes stated.

However, some voices question Hyperliquid's transparency, especially after the market manipulation scandal involving the JELLY token in March 2025. They worry about the risk of Hyperliquid becoming "a second FTX."

Meanwhile, Hyperliquid co-founder Jeff Yan posted a long response on X to address criticisms about the "market transparency scandal." He affirmed that the platform operates transparently and does not engage in manipulation. However, these responses have not yet allayed doubts about James Wynn's real role.

As BeInCrypto has reported, Changpeng Zhao proposed a dark pool-style DEX for perpetual futures to combat front-running and enhance trading privacy. CZ's idea emerged amid James Wynn's volatile trades on Hyperliquid, sparking debate about transparency risks in leveraged crypto trading.