Author: Frank, PANews

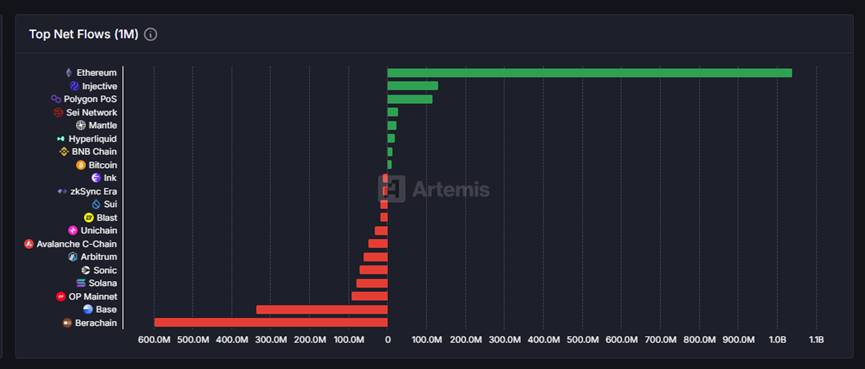

In the past month, the veteran public chain Injective has once again returned to the public eye with its second-place ranking in net fund inflows. According to Artemis data, Injective has seen a net inflow of approximately $142 million in the past 30 days, second only to Ethereum.

PANews also observed other data about Injective and found that this net fund inflow is not an isolated phenomenon. There have been significant improvements in on-chain fees, active users, and token trading volume. After being dormant for a long time, will this former public chain star Injective usher in an ecological explosion, or is it just a fleeting moment?

Monthly Inflow of $142 Million: Is It "Honey" or a "Flare"?

As of June 4th, Injective achieved a net fund inflow of $142 million in the past month. Although the amount is not high, it still ranks second in recent data among all public chains. A careful observation of the data reveals that the notable net inflow is due to Injective experiencing a rapid large-scale fund inflow on one hand, and extremely low net outflows of only $11 million on the other. Therefore, the reason for Injective's high net inflow ranking is not due to exceptionally active overall fund movement. In fact, its pure fund inflow volume ranks around tenth when compared horizontally with other public chains. Its outstanding performance in the 'net inflow' indicator is primarily due to the minimal fund outflows during the same period.

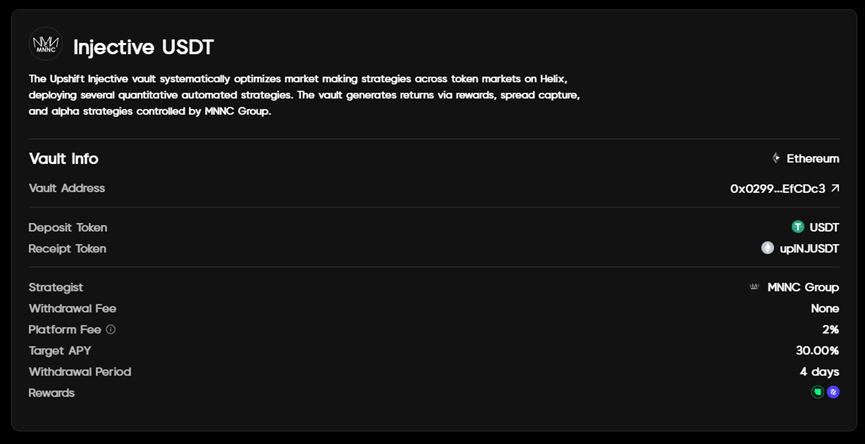

However, this on-chain fund movement is rare for the Injective network. Of the $142 million inflow, $140 million was completed through the Peggy cross-chain bridge, accounting for 98.5%. Market analysis firm Keyrock noted in its May 26th report 'Key Insights, Bond Appetit' that this large-scale fund inflow is mainly due to the launch of the institutional-level yield platform Upshift on Injective. It is understood that Upshift's vault on Injective has an APY of 30%, which could indeed be a key reason attracting funds to transfer assets to Injective.

However, PANews discovered through investigation that Upshift's vault on Injective has a hard cap of $5 million and cannot fully utilize this inflow of funds. Those unable to participate in this vault investment may potentially flow out again in the short term.

From Derivatives Setback to RWA Hopes: Can Injective Open a New Chapter?

[Rest of the translation continues in the same professional and accurate manner]