meme continues, but market enthusiasm seems to have reached its limit.

Although new memes are launched daily, how long has it been since you last saw a phenomenal large MC memecoin compared to last year?

meme is struggling, but this seemingly does not affect the continuous advancement of meme launch platforms.

On June 4th, according to Blockworks, Pump.fun plans to launch a token, raising $1 billion with a fully diluted valuation (FDV) of $4 billion, selling approximately 25% of the tokens.

This token launch, targeting public and private investors, is rumored to potentially include an airdrop, with the token possibly named "$PUMP", but specific details remain unclear.

Although Pump.fun has not officially confirmed the authenticity of this token launch plan, in comparison, Circle, the issuer of the stablecoin USDC, is seeking an IPO on the US stock market with a public valuation of only $7.2 billion.

Currently, the market's reaction to this news is beginning to diverge.

Upon the news, the ALON token on Pump.fun (with the same name as Pump's founder @a1lon_9) briefly surged by 102%, with pure gambling logic continuing.

Some are optimistic about Pump.fun's ability to attract funds, expecting token dividends or governance benefits; others scoff, believing the $4 billion valuation is absurd and barely conceals the intention to "cut leeks".

Frenzy and fatigue coexist, opportunities and risks intertwine.

If this meme launch platform, closest to trading, gambling, and volatility, truly launches a token, will it be the savior of a depleted market or the final cut without looking back?

The answer may be hidden in its valuation logic and market pulse.

Advancing Pump.fun, Worth $4 Billion?

If the token launch plan disclosed by Blockworks is true, with PUMP's FDV around $4 billion, is it worth this price?

We might explore the valuation logic through some data.

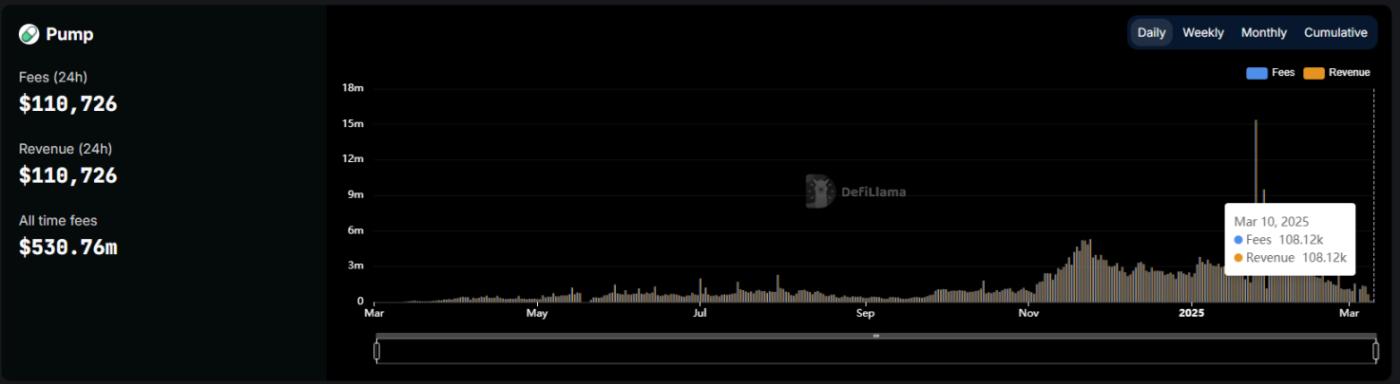

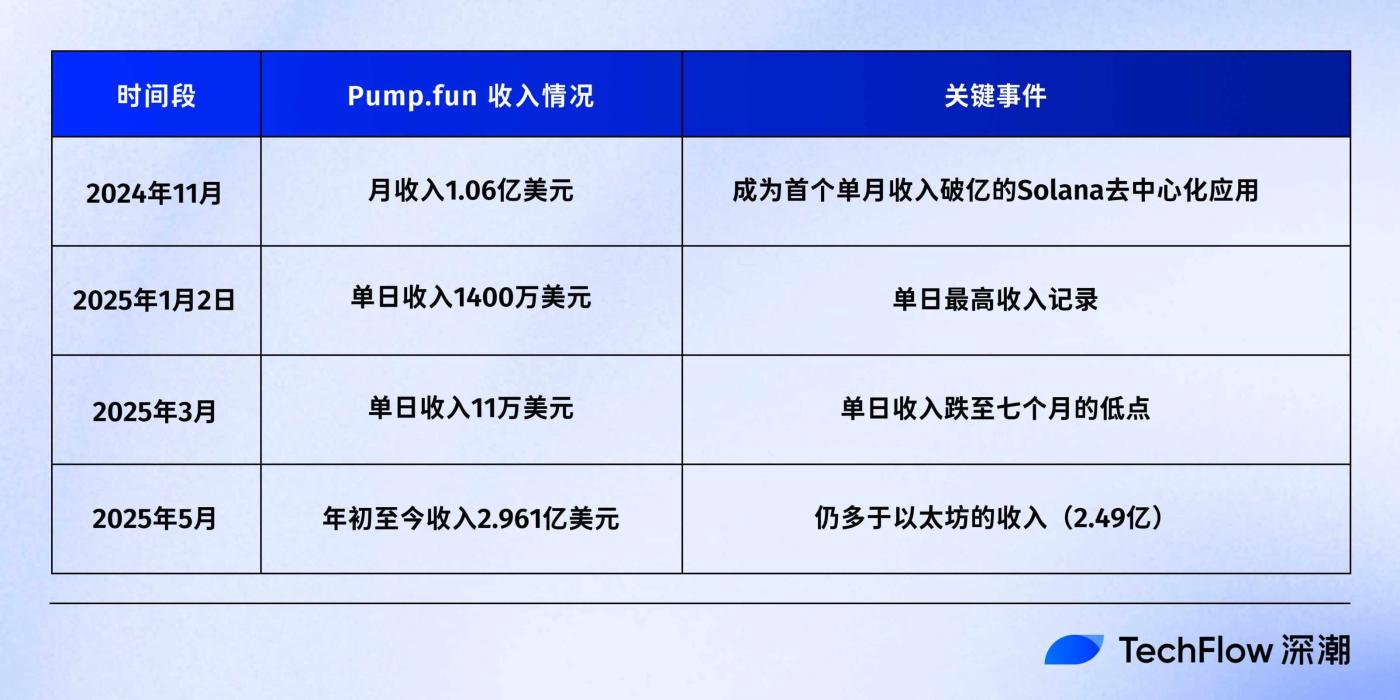

Public data shows that as of May this year, Pump.fun's total annual revenue is $296 million. If calculated under the same conditions, the annualized revenue is approximately $710 million (296.1 million ÷ 5 × 12).

Based on this revenue, using traditional valuation methods, the price-to-sales ratio (P/S, valuation of $4 billion divided by annual revenue) is 5.63, meaning the market pays $5.63 for each dollar of revenue, traditionally used to measure growth potential, similar to DeFi projects like Uniswap.

If the PUMP token has revenue distribution rights, assuming the token can take half the revenue ($350 million), the price-to-earnings ratio (P/E, valuation divided by profit) is about 11.4, lower than the average of US tech stocks.

However, the issue is that meme-related businesses do not really follow traditional valuation methods, and the valuation of meme launch platforms is related to revenue, but FOMO and market sentiment changes are the bigger factors.

Circle has a stable and compliant USDC business, with an IPO valuation of $7.2 billion; but Pump.fun's $4 billion valuation corresponds to the top meme launch platform, exceeding half of Circle's valuation, which indeed seems unreasonable.

Moreover, Pump.fun's revenue is not very stable. At its worst, daily revenue was only around $110,000.

From breaking $100 million in monthly revenue in November 2024, to the peak of $14 million daily revenue on January 2nd, 2025, to the low of $110,700 on March 9th this year... the platform's revenue fluctuates nearly a hundredfold, highlighting the cyclical nature of the meme market.

The revenue low point in March 2025 is actually a microcosm of the meme market's market value evaporation and waning enthusiasm, with emotion-driven businesses having fragile revenue.

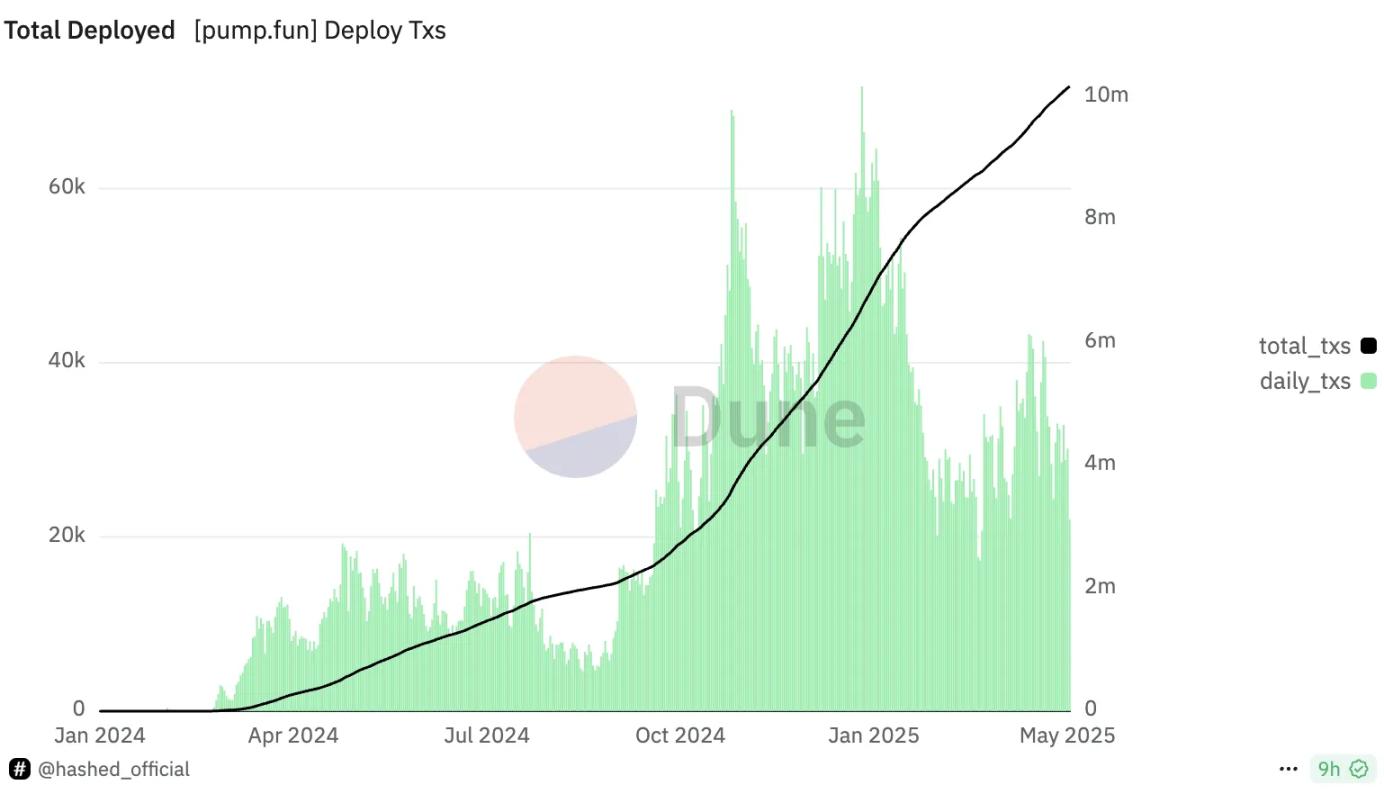

However, even so, the platform never lacks supply. Pump.fun launches an average of 30,000 new tokens daily, occupying half the trading volume of Solana DEX.

This continuous token launch contrasts sharply with the fluctuating market sentiment, making it difficult to find a stable anchor for its valuation.

Depleted Market, Final Cut?

Pump.fun continues to advance, whether through rumored token launch or previous attempts to create its own AMM and innovative live streaming features, showing the platform itself has not stagnated.

But the entire market, especially the meme market, seems to be running out of steam.

Market "depletion" is already showing signs. In December 2024, the overall meme market value dropped from $137 billion to $96 billion, with $40 billion evaporating.

In 2025, Solana DEX trading volume has shrunk by 20% compared to last year, with most new tokens quickly going to zero, and their life cycle further shortened, with PVP now at hellish difficulty.

Occasional large MC memecoins provide support, but fail to restore past glory.

Retail investors have shifted from frenzied chasing to waiting, with community discussions full of fatigue. The market craves a new narrative - next wave of AI, stablecoins, listed companies' crypto asset reserves... rather than high-valuation gambling by old platforms.

Meanwhile, Pump.fun's past raises eyebrows. In 2024, the platform repeatedly sold SOL earned for USDC; and January data shows that Pump.fun has sold approximately $182 million in SOL tokens since January this year.

Earning SOL, draining liquidity; selling SOL, somewhat affecting price and confidence.

The community currently widely doubts Pump's token launch. For example, researcher Haotian believes: "It's hard to imagine a meme launch platform's valuation exceeding most DeFi blue-chip protocols. This may be both a sign of meme economy maturity and a signal of industry value collapse."

After token launch and fundraising, what will Pump.fun actually do? Can it bring a fundamental upgrade to the meme market?

Based on current information, the answer seems negative; not to mention that last month already saw multiple launch platforms challenging the position of this once-top launch platform.

The last top platform, or the final cut?

Before the answer is revealed, caution is the best approach.