Bitcoin spot ETF recorded an outflow exceeding $250 million yesterday, retreating from its upward momentum. This occurred after a 77% drop in inflows the previous day.

This adjustment happened after BTC fell below the psychological price level of $105,000 during Thursday's trading session.

BTC Spot ETF Capital Outflow...Price Drops to $101,000 Level

On Thursday, Bitcoin spot ETF recorded a net outflow of $278.44 million. The capital outflow extended the decline in bullish sentiment that began with a 77% decrease in inflows the previous day.

The ETF sell-off occurred following the BTC price drop that day. The major coin fell below the $105,000 support line, dropping to an intraday low of $101,201, weakening investor sentiment.

The continued net outflow of BTC spot ETF indicates weakening investor confidence and a shift in market sentiment. This could add additional selling pressure on BTC, exacerbating the price decline.

Yesterday, ARK 21Shares' ARKB recorded the highest daily outflow of $102.02 million in a single day. At the time of reporting, the total historical net inflow is $4.67 billion.

Bitcoin Decline...Futures Market Cooling

As of Friday, BTC has fallen an additional 2% in a day. During the same period, the futures open interest also decreased by 1%, suggesting that traders are closing positions rather than adding new leverage.

Open interest represents the total number of unsettled derivative contracts such as futures or options. When it decreases, it indicates that traders are closing existing positions, reducing market participation. This puts BTC at risk of further price declines.

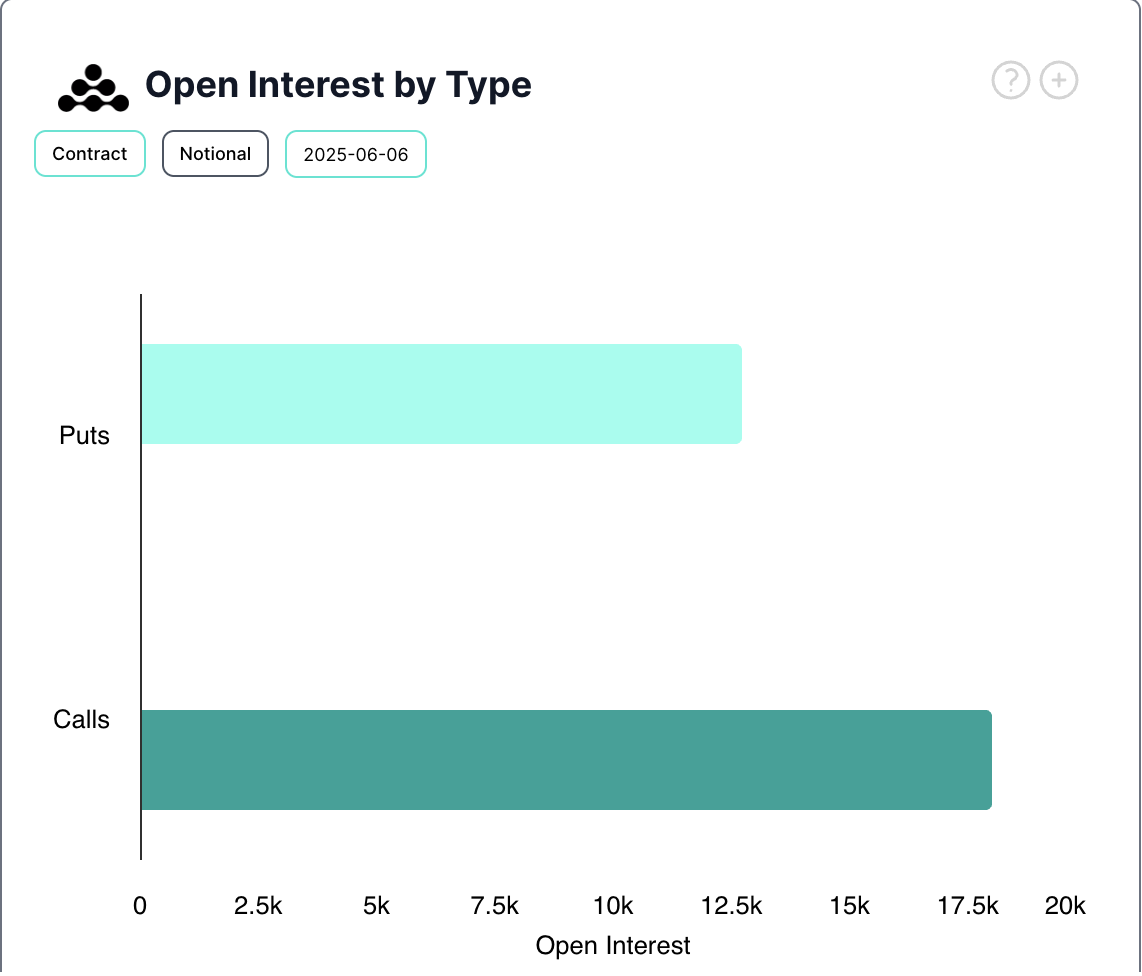

Interestingly, despite the downtrend, the options market remains notably robust. Demand for call options (bullish bets) continues to exceed put options. This suggests that traders are anticipating price increases and preparing for a potential rally.

The comprehensive reading of ETF flows and options sentiment indicates that while institutional capital is retreating, derivatives traders are keeping an eye on potential upside.