This article is machine translated

Show original

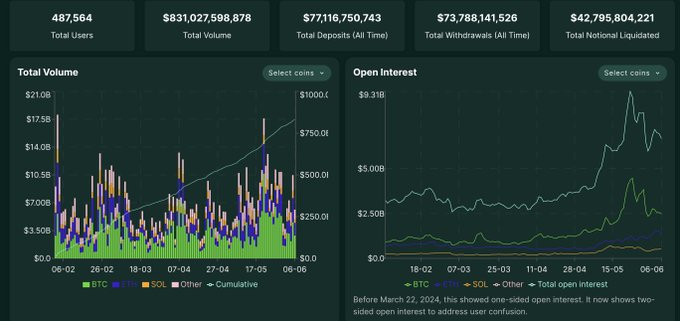

After the big gambler James was liquidated, the uncleared contracts on Hyperliquid indeed decreased somewhat, but still remain slightly higher than Huobi.

James's identity, besides being a real gambler, has two other interpretations.

One is a business collaboration. Today, James himself said he has not received any money, indeed sought payment twice but failed to get it, and even supported CZ's statement that the dark pool DEX would eliminate Hyperliquid.

Hyperliquid probably has no budget for him. If they did pay, would that mean charging a fee every time a big whale opens a position? That would not be reasonable.

The other interpretation is money laundering, currently without clear evidence. Mainly, his positions seem randomly opened, with leverage too high, not appearing like normal behavior. Additionally, he claims all his CEX accounts have been frozen.

Of course, even if true, I don't think it affects $hype. Money laundering is also an important practical attribute. BTC was also initially prioritized for money laundering.

Hyperliquid has well proven that the platform's liquidity can handle such large positions, and money laundering issues would only occur on CEX.

Continue dollar-cost averaging.

Thanks for sharing @MirraTerminal

Hype might break into the top ten!

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content