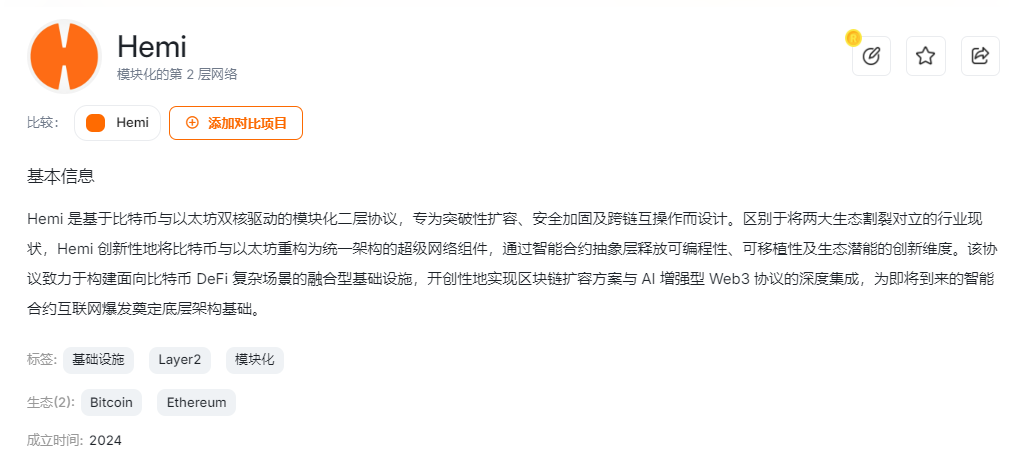

In the wave of convergence between the Bitcoin and Ethereum ecosystems, Hemi Network is becoming a market focus with its "modular Layer 2" positioning. Led by Binance Labs and backed by multiple top-tier capital firms, this project attempts to break the fragmentation between the two ecosystems by building a super network with security, scalability, and programmability. As the mainnet approaches launch, Hemi's token economic model and ecosystem potential are drawing high market attention.

I. Project Positioning: The "Super Connector" of Bitcoin and Ethereum

Hemi Network defines itself as a "Layer 2 tunnel between Bitcoin and Ethereum", with its core goal of achieving seamless interoperability between the two ecosystems through a modular architecture. Unlike traditional cross-chain bridges or sidechain solutions, Hemi chooses to use Bitcoin's security as the underlying guarantee and embed Ethereum's smart contract functionality, forming a "1+1>2" synergy. This design solves the pain point of Bitcoin ecosystem's lack of programmability while avoiding Ethereum Layer 2's over-reliance on centralized sequencers.

From a technical perspective, Hemi's modular architecture contains three core layers:

- Security Layer: Based on Bitcoin network's computing power, inheriting its anti-attack capability through Proof-of-Proof (PoP) consensus mechanism;

- Execution Layer: Compatible with Ethereum EVM through Hemi Virtual Machine (hVM), supporting developers to seamlessly migrate smart contracts;

- Interoperability Layer: Building trustless cross-chain tunnels to achieve free flow of assets and data.

This layered design allows Hemi to meet Bitcoin native applications' security needs while providing Ethereum developers with a familiar development environment, becoming a "middleware" connecting the two ecosystems.

II. Team and Financing: Double Endorsement from Bitcoin Veterans and Capital Giants

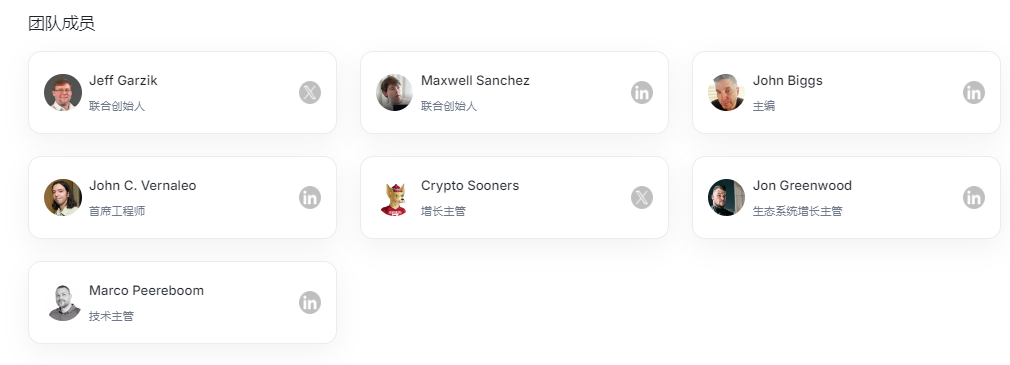

Hemi's founding team is a "all-star lineup" in the blockchain field:

- Jeff Garzik: Bitcoin core developer, Linux kernel contributor, who once maintained Bitcoin code library with Satoshi Nakamoto, known as "Satoshi's most trusted comrade". His company Bloq was an early enterprise-level blockchain solution provider, serving giants like Microsoft and IBM.

- Max Sanchez: Blockchain security expert, former chief architect at ConsenSys, who led the design of over 20 EVM-compatible chains, with his "quantum-level encryption" technology adopted by multiple financial institutions.

50% of the team members come from the Bitcoin core development group, and 30% have Ethereum Foundation backgrounds, this fusion of technical genes provides solid guarantee for project implementation.

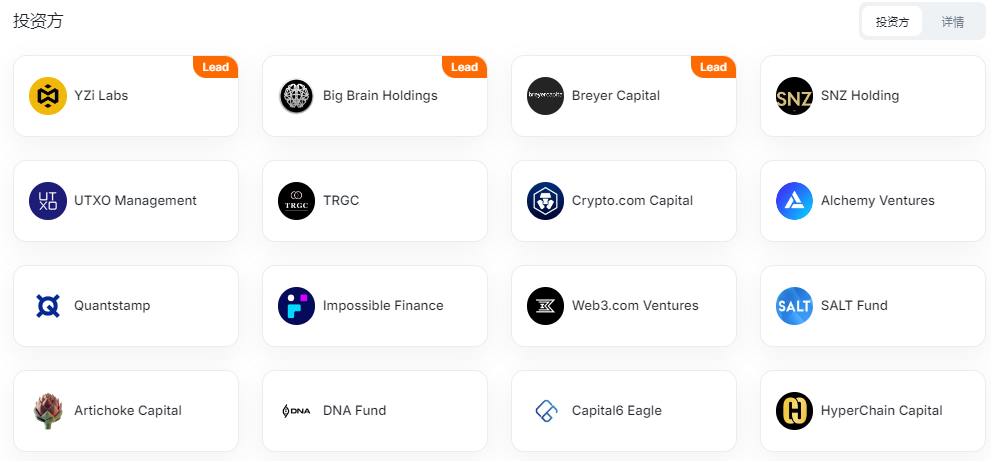

In terms of capital, Hemi completed a $15 million strategic financing in September 2024, led by Binance Labs, Breyer Capital (Tesla's early investor), and Big Brain Holdings, with participants including Crypto.com, Alchemy, and BitDeer under Wu Jihan's banner. Notably, traditional financial institutions (such as Goldman Sachs-affiliated funds) accounted for 35% of this round, reflecting mainstream capital's long-term optimism about Bitcoin ecosystem infrastructure.

III. Core Technology: Four Major Innovations Breaking Ecosystem Boundaries

1. Hemi Virtual Machine (hVM): Ethereum EVM's "Bitcoin-Enhanced Version"

hVM embeds a complete Bitcoin node in the Ethereum virtual machine, allowing smart contracts to directly read Bitcoin chain states (such as UTXO, Ordinals protocol data) without relying on oracles or third-party bridges. This design enables developers to build Bitcoin-native DeFi applications, such as UTXO-based staking protocols and BRC-20 asset lending markets, filling gaps in the Bitcoin ecosystem.

2. Bitcoin Programmability Kit (hBK)

hBK provides a standardized smart contract library, supporting developers to call Bitcoin data through simple API calls. For example, when developing lending protocols, developers can directly verify Bitcoin address asset balances or implement cross-chain atomic swaps based on time locks. Currently, over 80 open-source projects are developed based on hBK, covering DeFi, Non-Fungible Tokens, DAOs and other fields.

3. Proof-of-Proof (PoP) Consensus Mechanism

Hemi's unique PoP mechanism transforms Bitcoin computing power into the network's security foundation: PoP miners periodically write Hemi network state proofs into Bitcoin blocks, with any malicious attack requiring simultaneous overturning of both Bitcoin and Hemi's double verification. Test data shows that this mechanism can increase 51% attack costs by over 100 times compared to the Bitcoin network while shortening transaction confirmation time to 2 hours (compared to Bitcoin's 6 hours).

4. Trustless Cross-Chain Tunnels

Unlike traditional cross-chain bridges relying on multi-sig wallets or centralized custody, Hemi's Tunnels verify cross-chain transaction authenticity through zero-knowledge proofs. When users transfer assets, Tunnels generate Bitcoin SPV proofs and Ethereum state roots, ensuring atomic synchronization between the two chains. This solution has processed over 280,000 cross-chain transactions on the testnet, with average fees below $0.1.

IV. Product Progress: Ecosystem Explosion from Testnet to Mainnet

Hemi's development roadmap is divided into three phases:

- Testnet (2024 Q3-Q4): Launch incentive program, attract over 100,000 users, complete core function verification of cross-chain and contract deployment;

- Mainnet Launch (2025 Q1): Start PoP miner node election, integrate top protocols like Uniswap and Aave;

- Ecosystem Expansion (from 2025 Q2): Launch innovative applications like Bitcoin-native stablecoins and MEV auction markets.

Currently, Hemi Staking TVL has exceeded $300 million, with an average daily transaction volume of 120,000, becoming the most active Layer 2 network in the Bitcoin ecosystem. Its incentive testnet adopts a dual-track point system:

- On-chain Interaction: Cross-chain assets, liquidity mining participation, contract deployment can earn base points;

- Community Contribution: Promotion content, development tutorials, organizing offline activities can earn bonus coefficients.

- According to community estimates, early participants may receive 8%-12% token airdrop, far exceeding similar project standards.

V. Token Economics: Triple Logic of Value Capture

Although Hemi has not yet announced an official token model, the core functions of its token (HEMI) can be inferred from its technical architecture and ecosystem needs:

1. Network Fuel

- Gas Payment: Hemi adopts a "dynamic fee" model, with HEMI used to pay for contract execution, cross-chain transactions, and other operation fees;

- PoP Staking: Miners need to stake HEMI to participate in state proof generation, with rule violations triggering confiscation mechanisms.

2. Governance Rights

- Holders can vote on protocol upgrades, fee distribution, ecosystem fund usage, with governance weight linked to staking amount.

3. Ecosystem Incentives

- Part of the tokens will be used for liquidity mining, developer subsidies, and community activity rewards to promote ecosystem positive cycle.

Referencing similar projects (like Arbitrum and StarkNet), HEMI might adopt a deflationary model, controlling circulation through transaction burning and staking locks. If TVL reaches $5 billion after mainnet launch, HEMI market value may enter top five Layer 2 tokens, with estimated price range of $3-5 (FDV $3-5 billion).

VI. Investment Expectations: Risks and Opportunities Coexist

1. Short-term Catalysts

- Binance Initial Listing Expectation: As a key project of Binance Labs, HEMI is highly likely to be listed on Binance Alpha section, with initial circulating supply possibly less than 10%, which may trigger liquidity premium;

- Bitcoin Ecosystem Explosion: Ordinals and Runes protocol activation of billions of dollars in BTC liquidity, Hemi as an infrastructure entry point will directly benefit.

2. Long-term Value Support

- Technical Barriers: The combination of hVM and PoP has no competitors yet, especially forming a monopolistic advantage in Bitcoin native application fields;

- Capital Synergy: Binance ecosystem resources (such as BNB Chain traffic, Launchpool) will provide continuous traffic for Hemi.

Conclusion: Redefining Blockchain Interoperability Paradigm

Hemi's ambition is not just to become another Layer 2, but to build a super network with "Bitcoin as a shield, Ethereum as a spear". At the turning point of Bitcoin moving towards a programmable era, Hemi's technological innovation and capital momentum have won it a first-mover advantage. Although token economics details are not yet clear, its modular architecture and ecosystem openness have shown the potential to become a "cross-chain infrastructure". For investors, while participating in airdrop hunting, they need to pay more attention to real user growth and protocol revenue after mainnet launch, which will determine whether HEMI can move from conceptual hype to value precipitation.