Bitcoin trades with a 1.43% difference in South Korea, equivalent to 1,500 USD, along with ETH, XRP, and Solana all exceeding international prices.

The South Korean cryptocurrency market continues to operate at its own "price rhythm" by maintaining a stable premium compared to global exchanges in the past 17 days, reflecting strong domestic demand and the impact of strict capital control policies.

According to data from Upbit and CoinMarketCap, as of 9:55 AM Eastern time on 8/6, Bitcoin is trading with a 1.43% premium in South Korea. Specifically, while the global BTC price is 105,896 USD, South Korean exchanges like Upbit list it at 107,412 USD, a difference of 1,516 USD.

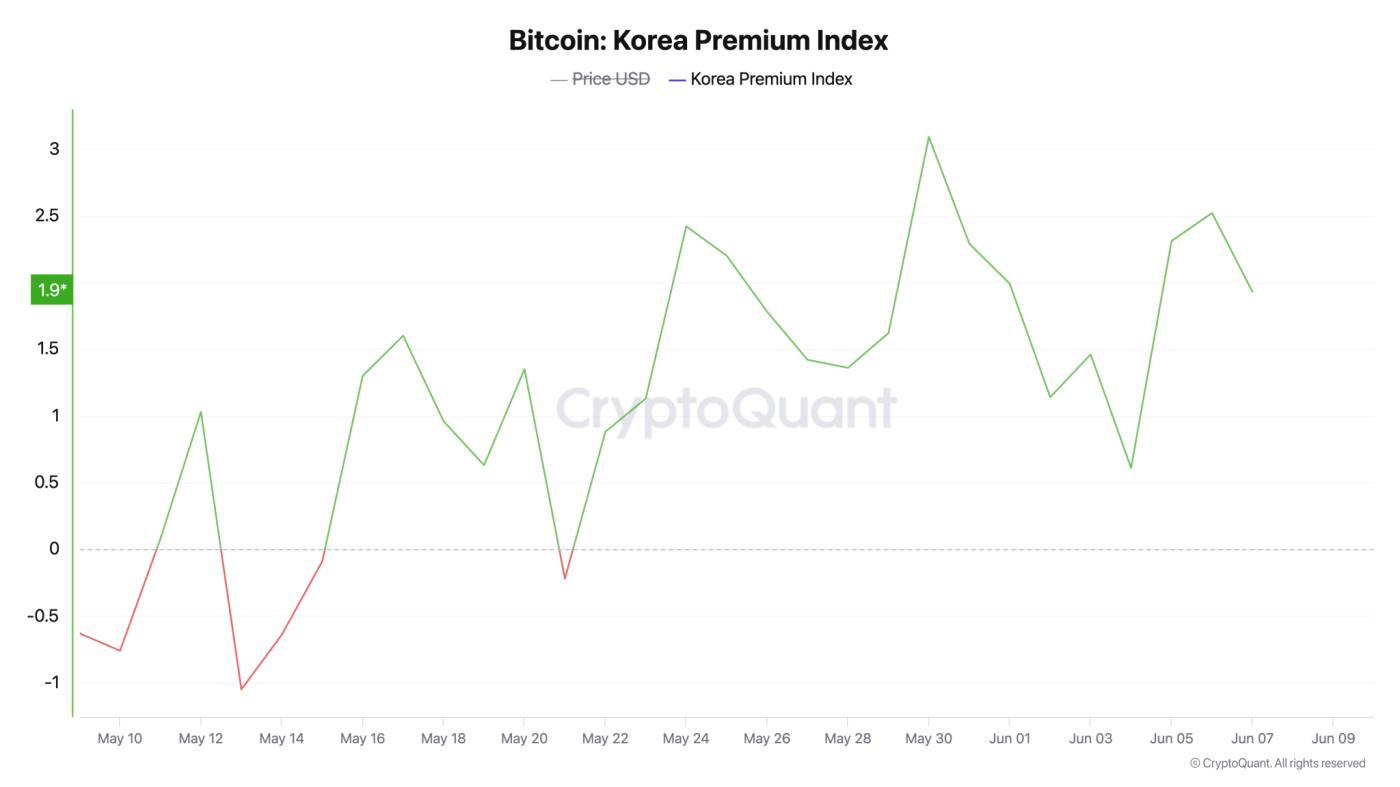

This shift began in late May when crypto prices in South Korea transitioned from a discount to a premium. On 5/21, CryptoQuant recorded a reverse difference of 0.22% with global BTC at 106,786 USD compared to 106,551 USD on South Korean exchanges. Since then, the price difference has shifted to a premium and peaked at 3.09% on 5/30.

The peak of the "kimchi premium" occurred on 5/30 when the global BTC price was 103,998 USD but reached 107,118 USD in South Korea, a difference of 3,120 USD per Bitcoin. This phenomenon originates from South Korea's strict capital control policies and financial regulations, limiting cross-border capital flows and making the Bitcoin supply on domestic exchanges scarce.

Premium trend spreads to altcoins

The premium trend is not limited to Bitcoin but has spread to many other digital assets. Ethereum is currently trading 1.71% higher than the global average on South Korean exchanges. XRP shows a similar pattern with a price of 2.31 USD in South Korea compared to 2.27 USD globally, a difference of 1.76%.

Solana is also not exempt from this trend, trading 1.49% higher on platforms like Upbit and Bithumb compared to international prices. The consistency of multiple assets showing a premium reflects strong domestic demand regulating independent price behavior.

These price differences demonstrate the stable demand from South Korean investors in a context where global and regional markets react differently to policies and market access. South Korea's continued consistent premium over the past nearly three weeks reinforces the country's position as a cryptocurrency market with unique characteristics in the global crypto economy.