Cryptocurrency market participants are closely monitoring several US economic indicators this week, which will influence Bitcoin (BTC) price action.

While inflation data has long dominated market sentiment, labor market indicators are now emerging as a key factor driving the next major BTC movement.

US Economic Indicators Crypto Traders Need to Watch This Week

The following US economic indicators could impact investor sentiment and drive Bitcoin volatility this week.

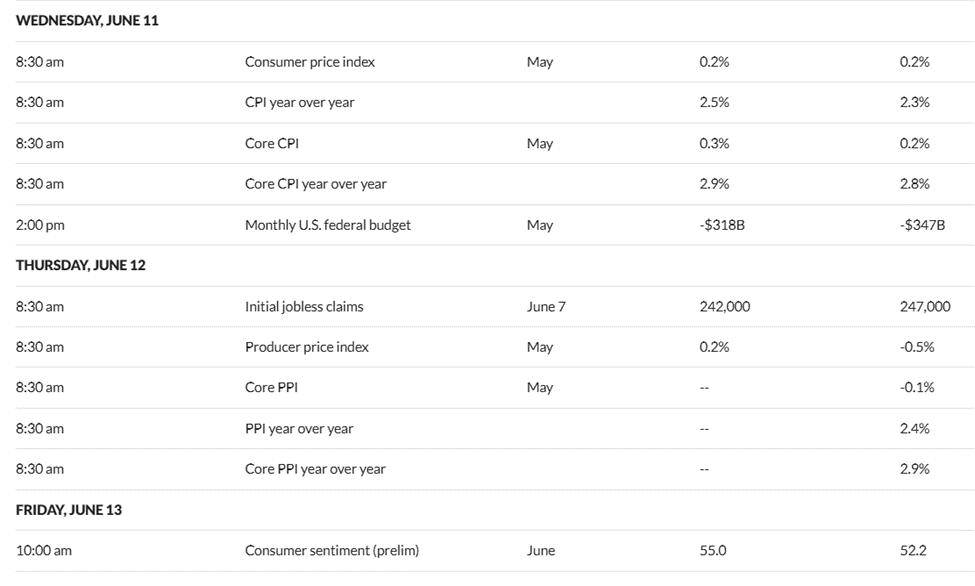

US Economic Indicators This Week. Source: MarketWatch

US Economic Indicators This Week. Source: MarketWatchCPI

US CPI (Consumer Price Index) data will be released on Wednesday, June 11, by the Bureau of Labor Statistics (BLS). CPI measures the medium change over time in prices urban consumers pay for a basket of goods and services.

This US economic indicator is a key inflation metric, reflecting living costs and purchasing power of typical households. As a lagging indicator, US CPI is the primary focus for inflation targeting and aligned with the Federal Reserve's 2% target.

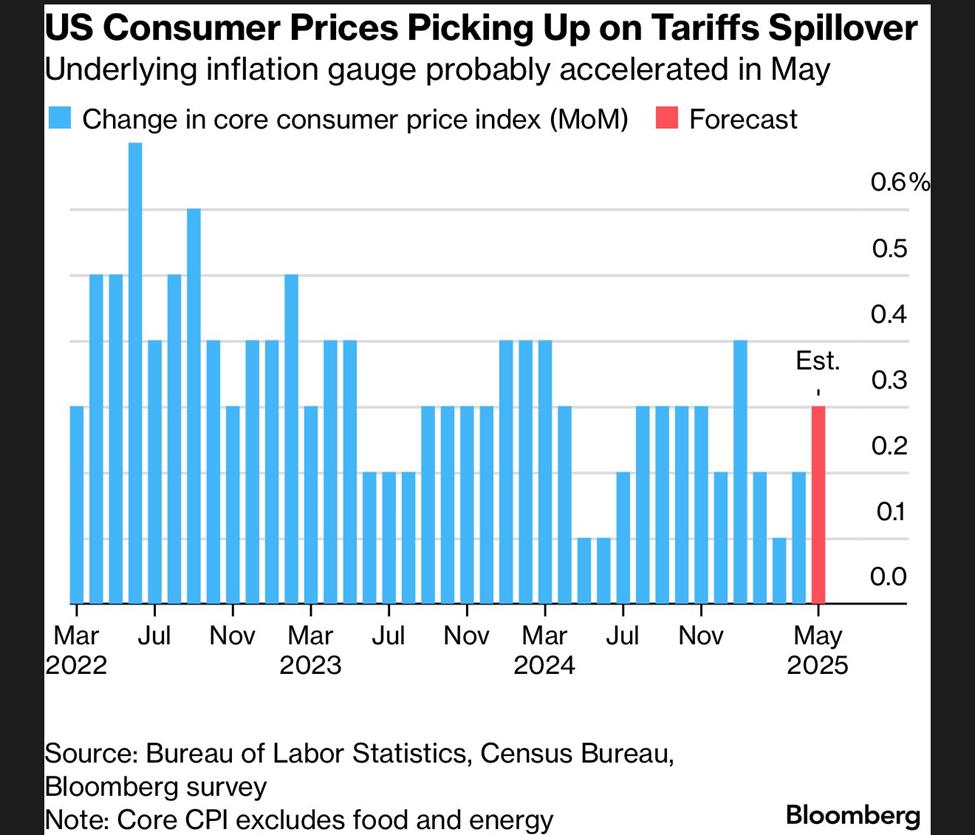

Bloomberg's survey indicates inflation might have surged in May amid US tariff chaos. Specifically, the survey shows a potential 0.3% increase for Core CPI after 0.2% in April.

US CPI Change Forecast for May. Source: Bloomberg Survey

US CPI Change Forecast for May. Source: Bloomberg SurveyBeInCrypto previously reported that US CPI data showed US inflation increased at an annual rate of 2.3% in April, slightly lower than the rate seen in March. This means it cooled down in April compared to the previous month.

This US economic indicator will be released on 11/06. Crypto traders and investors will watch to see if May data extends the three-month consecutive decline in headline inflation to a fourth month.

Bitcoin is often considered a potential hedge against fiat uncertainty. Therefore, if CPI data shows inflation cooled in May, signaling a more dovish Fed stance or supportive policy, this would reduce the likelihood of aggressive rate hikes.

Such a result would enhance investor appetite for risky assets like Bitcoin, potentially driving prices higher. It's also worth noting that if inflation significantly cools, it might reduce Bitcoin's appeal as an inflation hedge, as investors might prefer traditional assets like bonds or stocks. This is especially true as Bitcoin recently shows a negative correlation with gold.

However, according to MarketWatch data, economists predict CPI inflation will rise to 2.5% year-over-year (YoY). This would indicate a slight inflation increase, potentially reversing the cooling trend.

Specifically, this would keep the Fed cautious, reducing the likelihood of rate cuts in June or September 2025, as higher inflation signals persistent price pressures. The Fed might maintain or even consider tightening policy to contain inflation.

This would strengthen the USD and increase Treasury bond yields, potentially causing Bitcoin prices to drop. However, investors concerned about fiat currency devaluation might shift capital into Bitcoin.

A CPI showing 2.5% annual inflation would indicate that while inflation is rising higher, it remains below the 3.1% peak seen earlier in 2024. This is still close to the Fed's 2% target, so it might not immediately signal aggressive policy tightening. However, it could dampen short-term rate cut expectations.

"Despite these forecasts, I believe it's too early to expect a significant increase in Core CPI... I predict the first signals of rising inflation will appear in July," Andrea Lisi of Lisi Quant Analysis said.

Initial Jobless Claims

BeInCrypto has reported how labor market data is gradually overtaking inflation as the next macroeconomic catalyst for Bitcoin. Initial jobless claims, a US economic indicator measuring unemployment insurance applications, will be released on Thursday, June 12.

As a measure of economic growth, initial jobless claims can also influence Bitcoin price volatility.

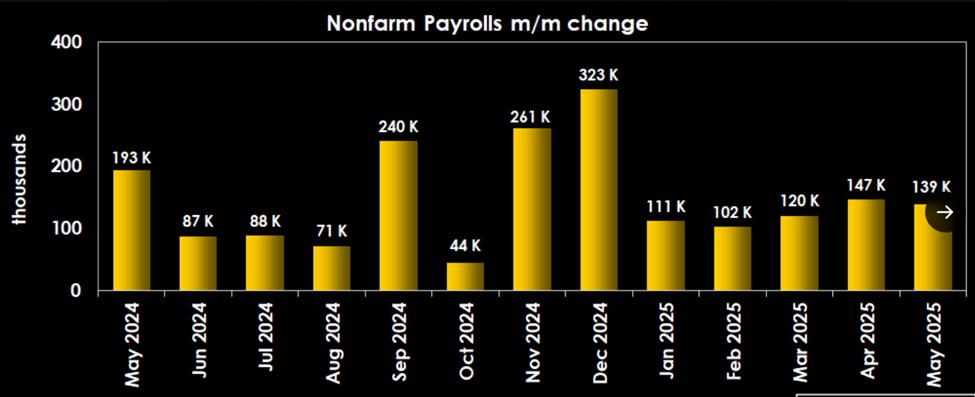

In the week ending May 31, initial jobless claims were reported at 247,000, with economists currently forecasting a decrease to 242,000. This optimism follows the Non-Farm Payrolls (NFP) report last Friday showing the US added 139,000 jobs in May, exceeding the estimated 126,000.

Previous Week's NFP. Source: Econoday on X (Twitter)

Previous Week's NFP. Source: Econoday on X (Twitter)Meanwhile, the unemployment rate remained stable at 4.2%. An increase in unemployment claims indicates a weakening labor market, raising expectations that the Fed might cut rates to stimulate the economy. This benefits Bitcoin and cryptocurrency as lower rates weaken the dollar and increase demand for risky assets like Bitcoin.

PPI

The US PPI (Producer Price Index) is another economic indicator to watch this week. It measures the prices that producers receive at the wholesale level. This US economic indicator also helps forecast future consumer inflation and is usually considered a leading indicator. However, it is noteworthy that it is not directly linked to the Fed's 2% target.

In April, PPI inflation increased at an annual rate of 2.4%, lower than the 2.5% target and even lower than the 3.4% recorded in March. If this trend continues, it will be beneficial for Bitcoin and cryptocurrencies.

"CPI on Wednesday along with PPI on Thursday will give us a very good idea of what we will see with PCE prices at the end of the month. Notably, if there are no major surprises, we are likely to see a significant acceleration in core numbers this month," a prominent X user noted.

Consumer Sentiment

The consumer sentiment report on Friday is also an important US economic indicator that affects Bitcoin prices. Economists predict this macro data will reach 55.0 for June after reaching 52.2 in May.

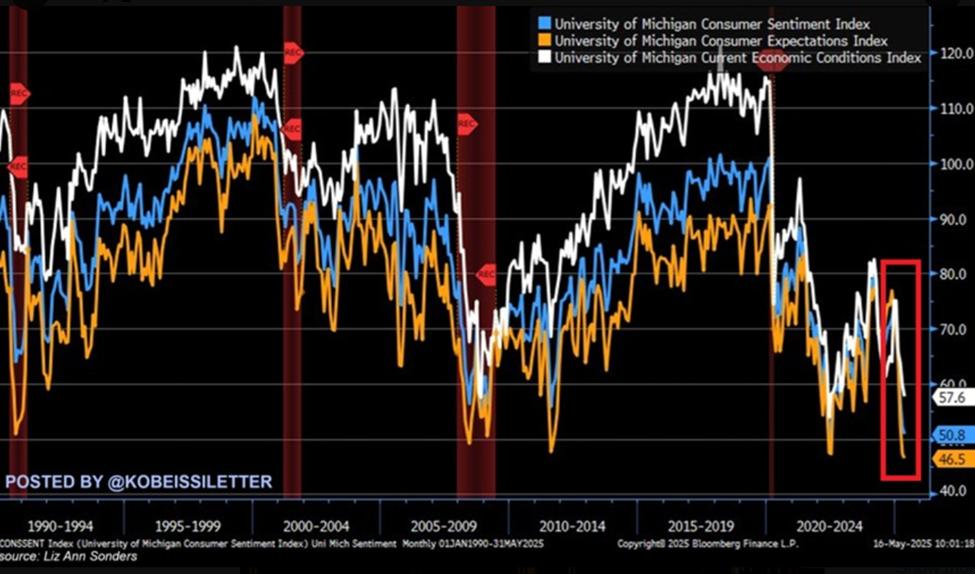

Looking back, the May consumer sentiment report showed that US consumer sentiment is becoming worse. Specifically, the Consumer Sentiment Index dropped 1.4 points to 52.2, the second-lowest level in survey history, lower than both 2008 and the 1980s recession.

US Consumer Sentiment. Source: The Kobeissi Letter on X

US Consumer Sentiment. Source: The Kobeissi Letter on XThe Consumer Sentiment Index, which measures US consumer confidence, impacts Bitcoin (BTC) by reflecting economic optimism or pessimism, affecting risk appetite and Fed policy expectations.

Higher sentiment (for example, above 76.0, as in May/2025 at 76.0) compared to May's 52.2 would signal economic strength, potentially reducing the likelihood of rate cuts and strengthening the dollar, which could put downward pressure on BTC.

Conversely, low sentiment, potentially below the expected 55.0, would increase expectations of Fed easing, supporting risky assets like BTC.

These four US economic indicators summarize consumer confidence and long-term inflation expectations, and can impact overall economic spending and growth.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoData from BeInCrypto shows Bitcoin is trading at 105,448 USD at the time of writing, down 0.09% in the past 24 hours.