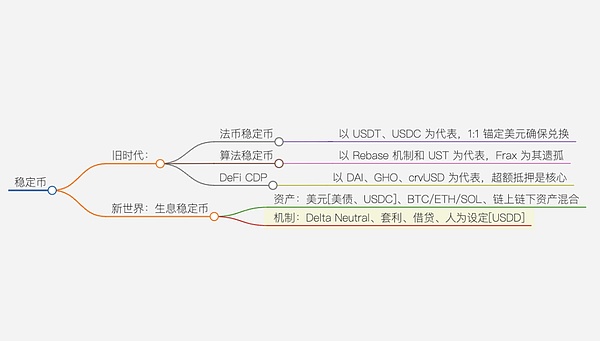

Stablecoins are becoming a market consensus.

Stripe's acquisition of Bridge is just the beginning. Huma is using stablecoins to replace bank intermediaries, Circle has become a new star in the crypto after Coinbase with USDC, all of which are clumsy imitations of USDT.

Ethena is ahead of the curve. MakerDAO renamed to Sky and shifted to interest-bearing stablecoins. Pendle, Aave, and others are rapidly moving towards USDC--PT/YT--USDe, which is a summary of recent on-chain stablecoin stories.

At least for now, YBS (Yield-Bearing Stablecoin) is still subordinate to the stablecoin concept. It's difficult for people to understand the fundamental difference between USDe and USDT. In my view, YBS projects like USDe attract users through yield-bearing mechanisms by distributing part of the asset income to users, completing deposit acquisition and continuing to earn asset income.

Previously, USDT issuance was a process of creating new assets. It's important to know that USDT's reserves are managed by regulators or project parties, with no relation to users. Users can only passively accept that USDT represents 1 dollar and hope that others will recognize its value.

YBS follows the deposit-lending logic of on-chain banking, deconstructing asset issuance power. Circle's creation of USDC requires political and business cooperation and exchange support, but YBS is already experiencing explosive growth.

Let me reiterate,the history of the crypto industry is a history of asset issuance model innovation, just this time it's slightly more moderate under the name of stability, not as intense as the on-chain PVP of ERC-20, Non-Fungible Token (ERC-721), and MEME Coins.

[The translation continues in the same manner for the rest of the text, following the specified translation rules.]Here must be clarified that WLFI issued by the Trump family is more like USDT, not closely related to yield-bearing stablecoins, and will not be discussed.

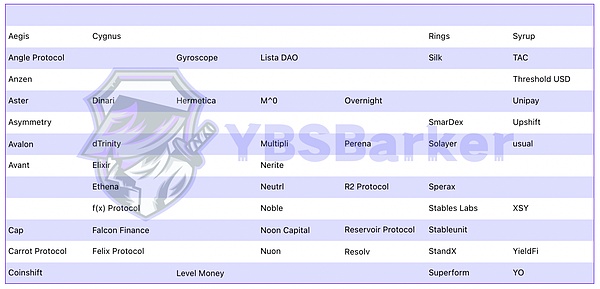

These 52 projects are the lineup competing for the remaining positions in the yield-bearing stablecoin track. For example, we directly exclude Hydration from Polkadot - who would still expect Polkadot to revive?

Moreover, YLDS issued by Figure Markets is the opposite of an on-chain yield-bearing stablecoin, but it has obtained legal registration qualifications, suitable for traditional financial customers with special compliance requirements. Detailed exclusion reasons can be found in the Feishu document.

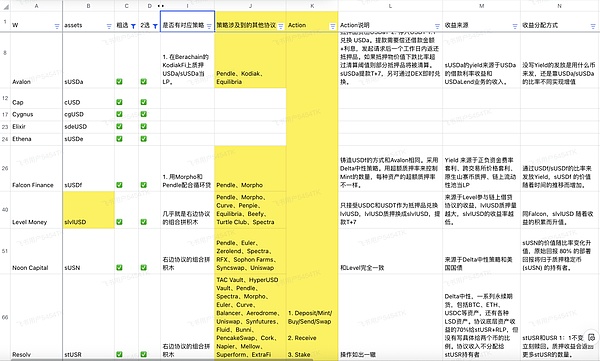

After rough selection, examining details from three dimensions: fundamentals, yield-bearing methods, and APY

Fundamentals: Official website, Twitter, CA

Yield-bearing Methods: Strategy and Action, revenue sources, revenue distribution method, Rewards

APY Calculation Method

A small note: Strategy and Action refer to YBS's corresponding financial strategy, Action is the concrete operational steps, revenue source is where protocol income comes from, revenue distribution method is generally through stablecoin staking, but specific cases require specific analysis.

Taking Avalon as an example, its stablecoin is USDa, yield-bearing stablecoin is sUSDa, with the following dimensional details:

• Revenue Source: USDa loan interest rate income + USDa Lend business income

• Strategy: Berachain ecosystem KodiakFi staking USDa/sUSDa LP group

Moreover, Avalon is particularly typical, involving Pendle. In the current YBS ecosystem, the Pendle and Aave combination is the highest earner, surpassing Curve's peak period - a pit to be filled later.

Of course, this naturally involves assessing and classifying the security and stability of emerging protocols, with Sui's Cetus as a cautionary tale, a double pit (can Cetus be compensated today?).

From DeFi Lego to YBS Building Blocks

Successfully reaching the new continent does not mean victory; survival crisis will be more urgent.

Still too many, we attempt to start with the end in mind, selecting to reduce numbers. Referencing YBSBarker's data and on-chain data from various protocols, we selected the following 12 protocols based on underlying assets, core mechanisms, and quantitative data like TVL.

Must note, this is just a current market status analysis, not implying these projects will automatically win. Beyond DeFi giants and institutional adoption, these 12 projects mainly compete in retail markets for interest-bearing, pricing, and payment scenarios - also the most difficult and highest-yield track.

Perhaps Ethena most envies Sky, backed by government bond yields and Dai's existing market, combining yield-bearing and stablecoins, transforming into Ethena's strongest competitor.

Looking at the remaining 12 contestants, yield-bearing is indeed a customer acquisition method.

Similar to early DeFi Lego blocks, YBS protocols continuously combine other protocols. Multi-chain, multi-protocol, and multi-pool are standard, with each YBS organizational method and each YBS yield farmer ultimately contributing TVL and income to Pendle.

Remember the asset-created leverage mentioned earlier? In the YBS field, it's approximately equivalent to Pendle, not Ethena or other YBS, working hard to make a wedding dress for Pendle.

These projects still have significant issues. Considering YBS is in its early stages, it's somewhat acceptable. However, the sustainability of each protocol's returns remains questionable. Sky distributed $5 million in revenue to USDS holders for profit-sharing, resulting in essentially no protocol profit - selling at a loss.

Additionally, most YBS protocols will issue a protocol governance token, like ENA or recently TGE-listed Resolv, whose prices must be supported by protocol income and profit-sharing capabilities. Once the token price declines, it will inversely drag down the yield-bearing stablecoin issued by the protocol.

In other words, yield-bearing stablecoin scale expansion does not necessarily mean governance token appreciation, as the protocol may have low net profit. Conversely, if the protocol governance token price drops, risk-averse sentiment will cause yield-bearing stablecoin liquidity to withdraw, entering a death spiral similar to UST.

This gives us the insight that we must focus on the protocol's continuous profitability. Since YBS projects are deposit-lending crypto banks, principal safety is crucial. YBSBarker's Protocol Revenue will continuously monitor protocol safety, and YBSBarker's Yield Sharing Ratio will continuously monitor protocol profit-sharing proportions.

Now entering the realm of bold statements, purely subjective views.

Besides Sky and Ethena, which few new YBS protocols might become the next big opportunity?

I choose Resolv, Avalon, Falcon, Level, and Noon Capital - with no scientific reasoning, just a project intuition.

There's a misconception that YBS projects rushing to issue tokens are bad projects - not necessarily. Many are fishing in troubled waters, but for YBS, protocols need governance token secondary market liquidity. Similar to Ethena introducing mainstream exchanges' subsidiary VCs, forming a de facto interest alliance, essentially transferring USDe's minting rights.

However, USDe's minting rights are represented by ENA. Various institutions want to make money and don't need to dump USDe, as that would make their investments go to waste. Stablecoins only have 0 and 1 states, but ENA can be slowly sold or staked for yield - Ethena's top-tier brilliant strategy.

Circle aggressively gives money to Binance and Coinbase, while Ethena adopts a more crypto-characteristic "bribery mechanism", like Curve War, brilliantly reusing game theory.

Conclusion

Today is just an appetizer. After organizing an overall project review, we hope everyone gains a comprehensive understanding of the current YBS market. At least you won't think creating a YBS is as distant as creating a USDT, but also don't consider YBS as a new Meme Coin.

The credibility and capital reserves required by YBS are beyond Meme's reach. Always remember that YBS is a form of currency, especially true YBS not dependent on government bonds or US dollars, and its recognition is not far from creating BTC/ETH.

Next, I will elaborate on the yield-bearing stablecoin issuance guide from a more granular perspective, fully explaining mechanisms and details that couldn't be expanded upon in this article.