Market conditions have changed significantly. The reduction of trade tensions between the US and China and the cooling relationship between Trump and Musk have helped transform investor sentiment from negative to positive.

However, this optimistic sentiment could be a cause for concern compared to previous market reactions. Let's explore the details.

How can market sentiment indicators be a double-edged sword?

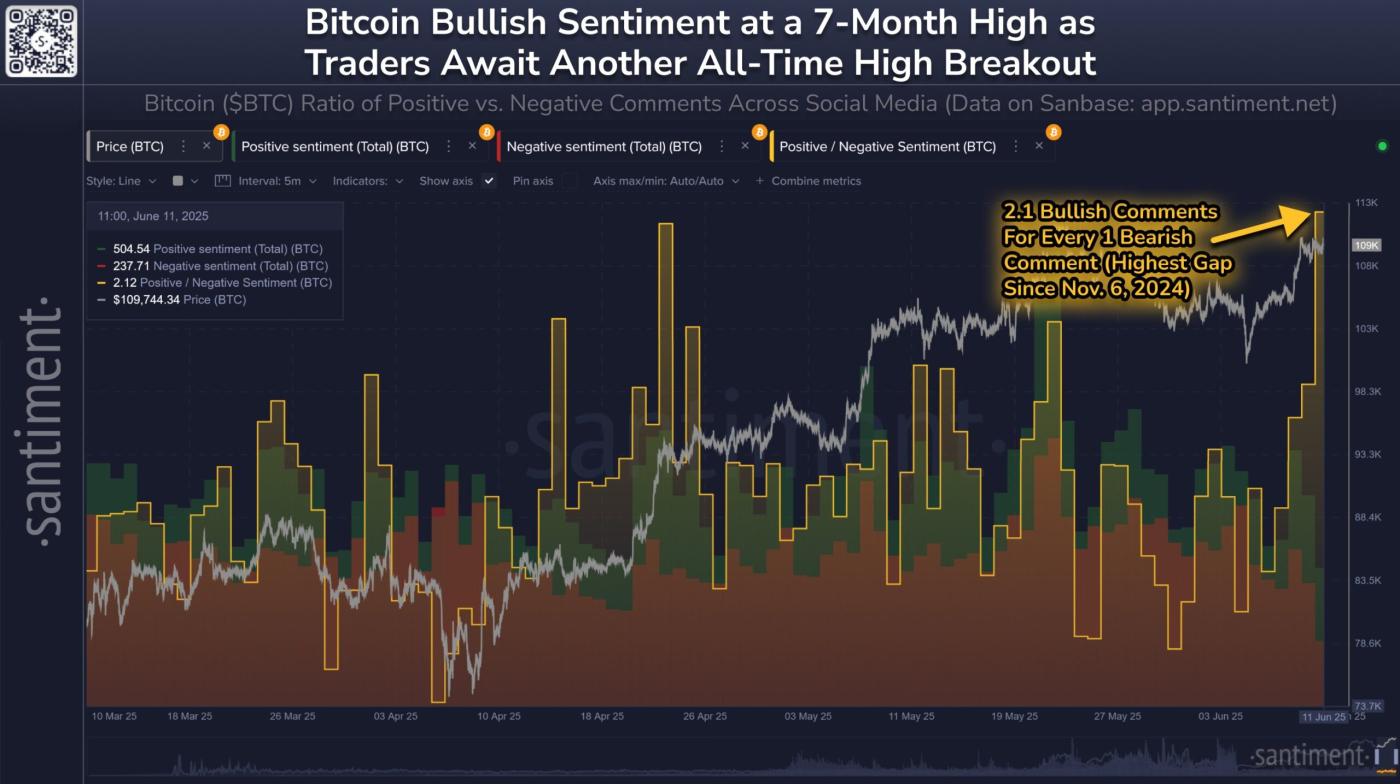

According to Santiment, a leading blockchain analytics platform, there are more than twice as many positive comments about Bitcoin (BTC) on social media compared to negative comments.

This 2:1 ratio is the highest since the US presidential election in November 2024, when Donald Trump's victory stimulated interest in cryptocurrency.

Retail investor sentiment compared to Bitcoin price. Source: Santiment

Retail investor sentiment compared to Bitcoin price. Source: Santiment"With Bitcoin challenging the All-Time-High of 112,000 USD in recent days, retail investors have become optimistic," Santiment noted.

Although this seems like a strong signal, historical patterns show that such interest often precedes significant market corrections.

Santiment also reports that keywords like "All-Time-High" are appearing more frequently in Bitcoin-related discussions than at any other time this month.

Social volume compared to Bitcoin price. Source: Santiment

Social volume compared to Bitcoin price. Source: SantimentCompared to Bitcoin's price, periods of high retail investor interest this month typically precede price corrections.

"As the market moves contrary to retail investor expectations, sudden spikes in discussions related to BTC's ATH are a solid peak signal, indicating greed," Santiment added.

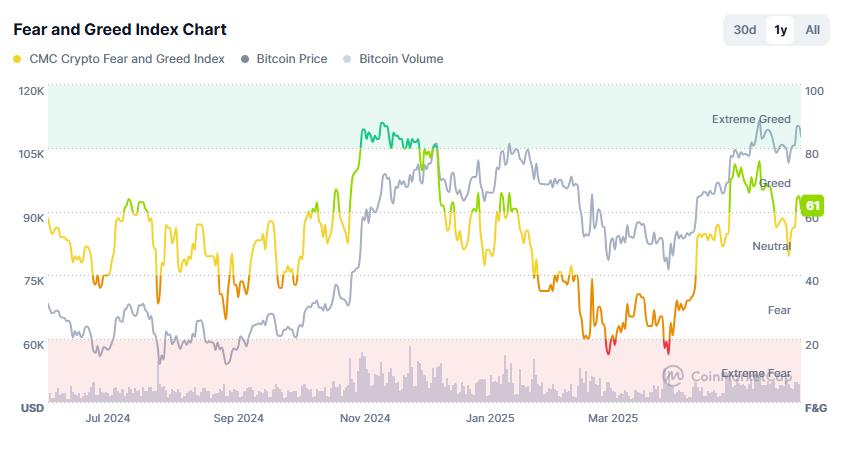

This trend aligns with CoinMarketCap's Fear & Greed Index, a widely tracked measure of cryptocurrency market sentiment. As of June 2025, the index has entered the "greed" zone, with a reading above 60.

Fear and Greed Index Chart. Source: CoinMarketCap

Fear and Greed Index Chart. Source: CoinMarketCapIn the past year, such high readings have typically served as warning signs. They suggest the market may be overheating and could need a correction.

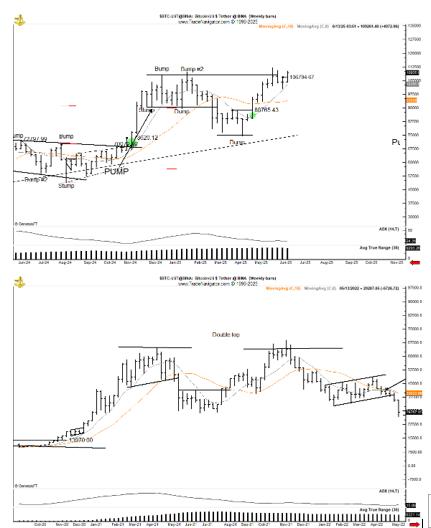

Veteran Trader Peter Brandt Questions Double Top Pattern

Veteran trader Peter Brandt recently expressed concerns about the potential repeat of Bitcoin's 2022 bear market. He pointed out the possibility of a 75% drop following a "double-top" pattern.

Bitcoin and Double-Top Pattern. Source: Peter Brandt

Bitcoin and Double-Top Pattern. Source: Peter BrandtAlthough he did not make a definitive prediction, his comments suggest a significant downturn may be approaching, similar to the deep decline in 2022 when Bitcoin plummeted from its high.

Brandt's observations indicate that financial markets often repeat behavioral patterns. The current chart structure is very similar to the setup that occurred before the previous collapse.

One of the strongest arguments against this bearish view is the significant difference in the current cycle. An X (formerly Twitter) user named Death Ca₿ to QE attracted attention by pointing out that previous Bitcoin cycles were primarily driven by retail investor sentiment. But today, retail investor sentiment may not be the primary force.

Bitcoin price structure across cycles. Source: Death Ca₿ to QE

Bitcoin price structure across cycles. Source: Death Ca₿ to QEInstead, Bitcoin's price is now primarily driven by corporate and institutional investors.

This change makes predicting how long the institutional FOMO (Fear of Missing Out) will last or when it will end difficult. There are no historical precedents for comparison.