Ethereum (ETH) is making headlines as leverage betting and institutional fund inflows are concentrated. This synergy effect is pushing the network's futures market to new extremes.

Analysts are monitoring Ethereum within the narrative of the altcoin summer, with Ethereum emerging as a promising frontrunner.

Leverage and Institutions Drive Ethereum's Market Momentum

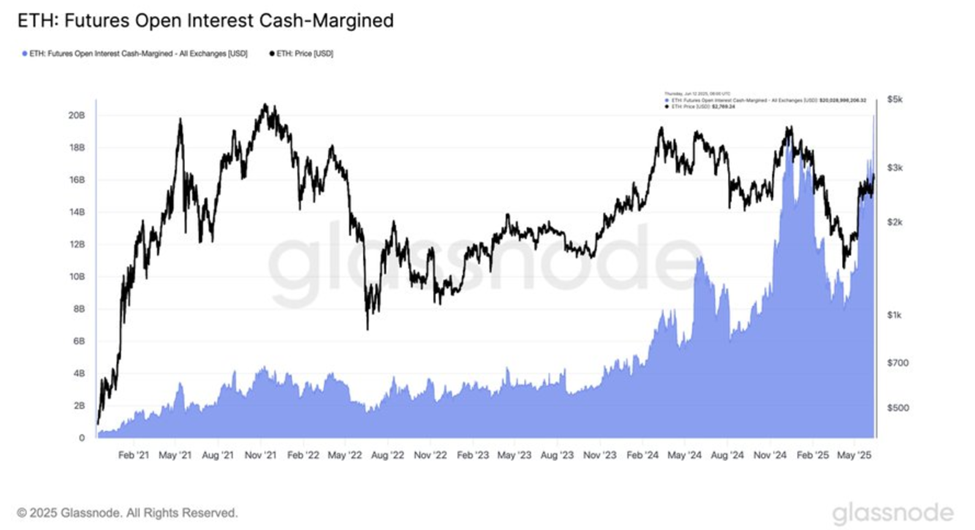

According to blockchain analytics firm glassnode, Ethereum futures open interest (ATH) has surpassed an all-time high of $20 billion, with Ethereum spot prices below $2,800, yet futures open interest still reaching a record high.

"Ethereum futures open interest (cash margin) has surpassed $20 billion, marking an all-time high... Leverage continues to increase as traders fund positions using stablecoins," glassnode wrote in a post.

Glassnode's statement came just two days after crypto quant analysts noted that Ethereum futures uncleared commitments reached an all-time high of 7.17 million ETH. Thus, this extension indicates a continued desire for speculative positions.

According to the report, cash margin contracts are driving a significant portion of this activity, amplifying exposure and market volatility.

On-chain data also shows that individual investors are turning to derivatives even as Bitcoin's on-chain activity stagnates.

"Small investors' futures trading frequency has surged above the annual average... The Bitcoin network feels like a ghost town... On-chain activity and retail trading volume are low, while Ethereum open interest trading volume hit ATH and retail trading frequency has surged," CryptoQuant said.

BlackRock's Ethereum Purchase, Deepening Institutional Bet on Ethereum

This risk appetite coincides with a new wave of institutional purchases by BlackRock. On Wednesday, the asset manager additionally purchased $163.6 million in Ethereum, buying for two consecutive weeks.

BLACKROCK HAS BOUGHT ETHEREUM FOR 2 WEEKS STRAIGHT

— Arkham (@arkham) June 11, 2025

BlackRock has purchased a total of $570M ETH in the past 2 weeks.

They have been buying every day for over 2 weeks straight. pic.twitter.com/9AIyDGecN3

Blockchain analysis company LookOnChain also reported that whales have been accumulating Ethereum by withdrawing millions of dollars worth in recent days.

Institutional player Abracas Capital withdrew 44,612 ETH ($123 million) from Binance and Kraken on Wednesday.

Whale/institution 0xFC82 withdrew 33,500 $ETH($93.5M) from #Binance over the past 2 days.https://t.co/fqx0FAPCaP pic.twitter.com/CaOeJVzeYu

— Lookonchain (@lookonchain) June 12, 2025

While centralized exchange (CEX) retail trading volume is at its lowest in years and Bitcoin long-term holders are increasing hidden assets, Ethereum appears to be experiencing momentum shifting towards active retail and institutional speculation and accumulation, as traders and analysts are noting.

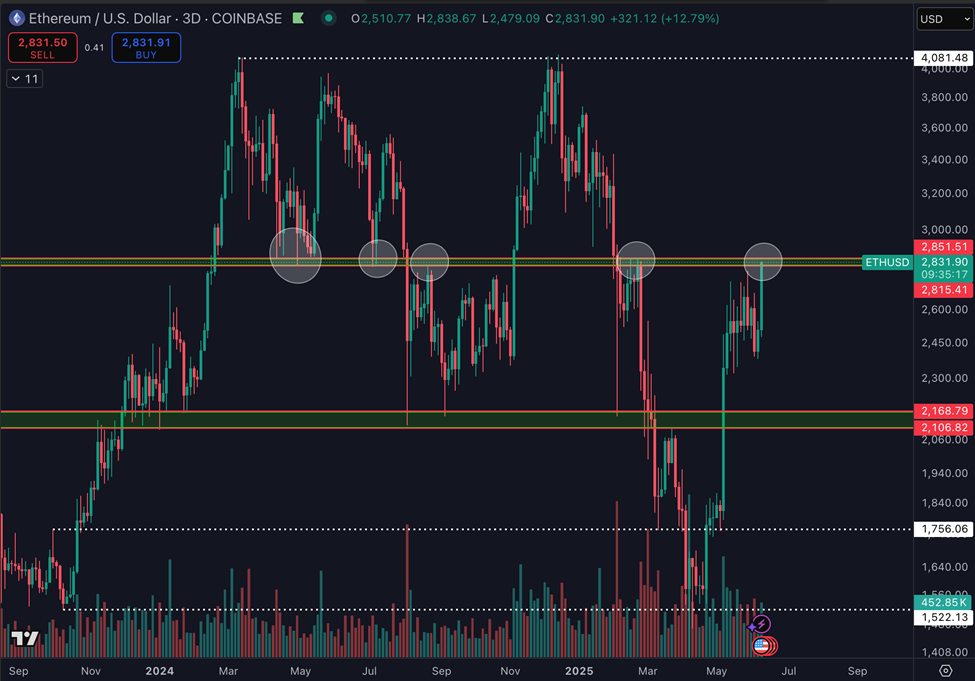

"$2,800 is crucial in this cycle. This level has triggered the largest movements after retesting or breaking above/below," analyst Daan Crypto Trade observed.

Analyst Duo Nine reflected this sentiment, suggesting Ethereum is preparing for a sharp rally beyond $3,000.

Ethereum actually looks good here. Clear higher highs.

— Duo Nine ⚡ YCC (@DU09BTC) June 12, 2025

Once $2,800 breaks, 3k and beyond opens up.

Ethereum will be the last major altcoin to pump before the bear market starts. pic.twitter.com/n03TZmk0Ki

The general mood among analysts is that Ethereum could be a definitive play for now, with positive sentiment likely to continue shaping the dominant narrative around Ethereum.

However, this surge in leverage comes with risks. Historically, high open interest levels and excessive retail positions have preceded sharp liquidations. In line with this outlook, LookOnChain emphasizes that some traders are initiating short positions on Ethereum.

Smart trader 0xcB92, who made $5.18M on $ETH, is shorting $ETH again.

— Lookonchain (@lookonchain) June 11, 2025

An hour ago, he opened a short position of 21,963 $ETH($60.8M), with an unrealized profit of $187K and a liquidation price of $2,948.https://t.co/Opb4WaSUwU pic.twitter.com/Q7oi6VsXvS

Due to many stablecoin-backed positions in cash margin futures, volatility can lead to a cascading decline when market fluctuations occur.

At the time of writing, $ETH is trading at $2,755, down 0.27% over the past 24 hours.