JPMorgan, Chainlink, and Ondo Finance have successfully completed a cross-chain payment transaction, marking an important step in connecting traditional finance with real-world asset (RWA) markets.

Chainlink, the leading blockchain oracle company, along with JPMorgan's Kinexys branch and digital asset company Ondo Finance, have noted a notable milestone by completing a cross-chain "delivery versus payment" (DvP) transaction.

This is the first time a licensed payment system like Kinexys can interact and seamlessly settle with a public blockchain specialized in RWA, specifically the Ondo Chain testnet.

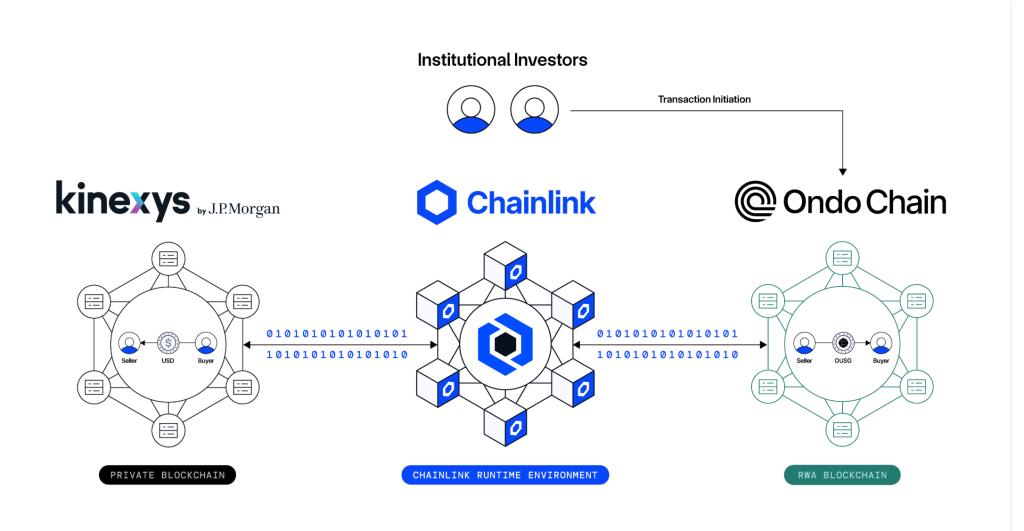

This complex payment process was coordinated by the Chainlink Runtime Environment (CRE), an off-chain processing layer aimed at effectively connecting different financial systems. In this test transaction, Ondo's tokenized US Treasury bond fund (OUSG) was transferred on the Ondo Chain, with the corresponding payment simultaneously executed on JPMorgan's Kinexys network.

Source: Chainlink

The highlight of the transaction is that only transaction instructions were transmitted between the two networks, with no actual assets moving back and forth, significantly reducing risk and ensuring integrity for both systems.

The success of this transaction is not only a technical demonstration but also provides a viable solution in the rapidly developing RWA market.

According to a Binance Research report, the RWA market has seen a significant boom with growth of over 260% in just the first half of 2025, reaching a total value exceeding $23 billion. This creates an urgent need for safe and efficient cross-chain payment solutions.

Kinexys's expansion of payment capabilities beyond private networks to interact with public blockchains shows that traditional financial institutions are ready to accept and prepare for the future of digital assets.

The flexible configuration capability of CRE, as described by Chainlink, allows for the deployment of more complex DvP transaction types, thereby reducing counterparty and payment risks, which have been major barriers to widespread blockchain technology adoption in traditional finance.