Written by: @defi_gaz, Castle Labs

Translated by: Alex Liu, Foresight News

This cycle has been challenging for many. If described in one word, it would likely be "extraction".

Crypto-native capital is flowing at an unprecedented speed, making even the most seasoned "gamblers" feel dizzy. Various protocols are making every effort to launch incentive measures, attempting to draw limited liquidity into their products, even if these funds only remain for a few days before the next hot spot emerges.

Meanwhile, Bitcoin's dominance has continued to rise since its November 2022 low point, mainly thanks to seemingly endless institutional buying.

Bitcoin market share, data: TradingView

The implications are self-evident.

Undoubtedly, the crypto market is maturing. We are finally seeing the regulatory clarity needed to drive the industry's next development, and many protocols are shifting their target user groups to different types of participants.

The giants have arrived, and they're bringing substantial funds.

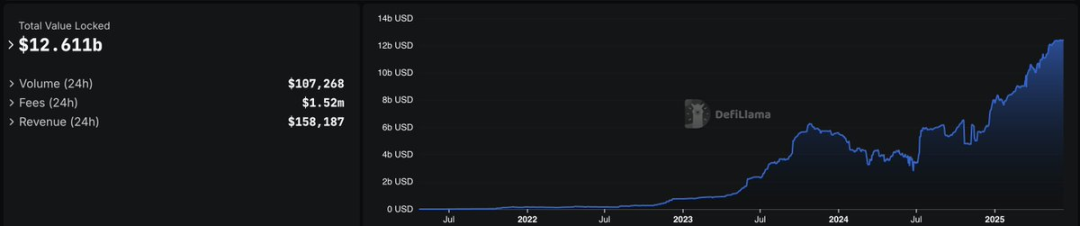

We have already seen the influence of these large institutions. The entire Real World Assets (RWA) sector is steadily growing, with the current Total Value Locked (TVL) having risen to approximately $12.6 billion.

Many leaders in this field are developing products aimed at institutional capital participation, with some even directly built by institutions themselves.

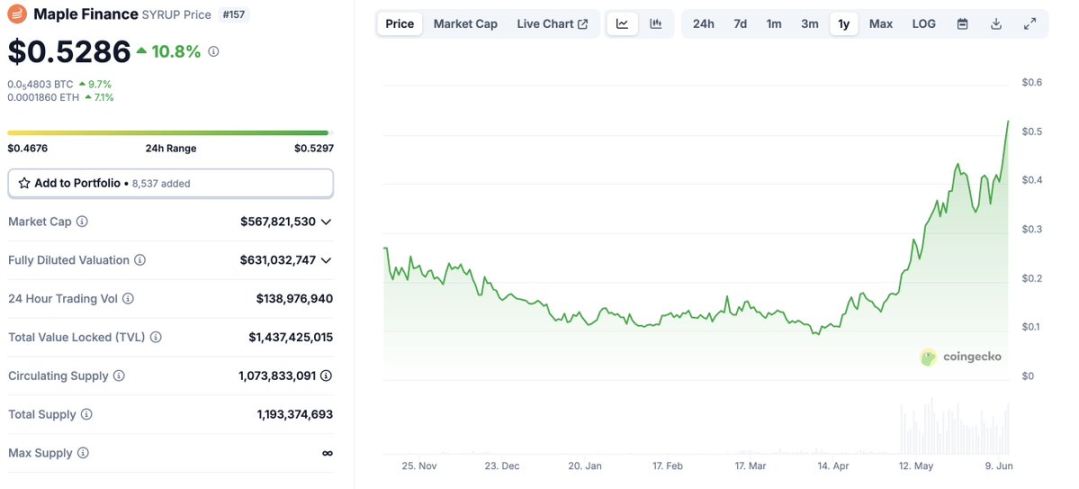

Among emerging projects, Maple Finance stands out with its growth in revenue and Assets Under Management (AUM). This rapid growth is clearly reflected in the price trend of the SYRUP Token and shows no signs of slowing down.

What is Maple Finance?

In short, Maple Finance aims to bring asset management on-chain by providing a suite of financial products tailored specifically for institutions, with a particular focus on lending.

The team was established in 2019 and has a deep traditional finance background. They thoroughly understand the conditions required for large institutions to enter the crypto world at scale.

Maple adopts an extremely minimalist strategy for collateral types on its platform, focusing solely on top-tier blue-chip tokens and stablecoins - exactly the asset types large institutions are eager to engage with.

The data speaks for itself.

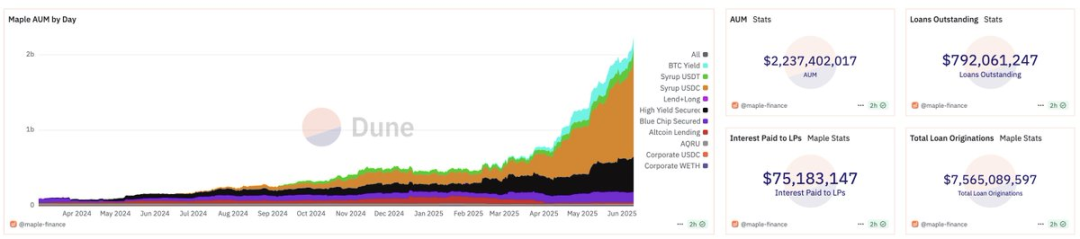

Source: Maple Finance Dune Dashboard

According to the latest data from the Maple Finance Dune dashboard, its total Assets Under Management (AUM) is approximately $2.2 billion, having grown by over $1 billion since early May. Compared to the data from January 1, 2025, this represents an astonishing 5-fold growth.

The platform's active outstanding loans have shown similar growth, increasing by about 30% in May.

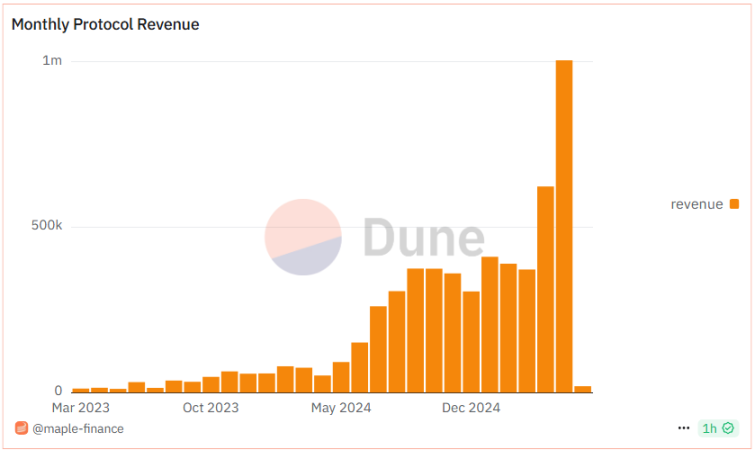

Maple's revenue performance is equally strong, with recent monthly revenue breaking the $1 million mark, representing a 61.21% month-on-month increase from April. Since March 2023, its average monthly revenue growth rate has remained around 28%, with a clear trend.

These revenues primarily come from interest share charged to borrowers and yields generated from depositing collateral in DeFi protocols.

Source: Maple Finance Dune Dashboard

Maple has 3 unique lending products that contribute to its impressive performance:

High Yield Product: Net APY of 9%, using BTC, ETH, and a selected group of top Altcoins as collateral.

Blue Chip Lending: Net APY of 6.9%, using only BTC and ETH as collateral.

Bitcoin Yield: Allows large institutional Bitcoin holders to earn a net APY of 4-6% through their held BTC.

It's worth noting that higher-yield products require higher over-collateralization to compensate for the higher volatility of the underlying collateral assets.

Deep Dive into Maple

Maple is rapidly becoming the preferred platform for large institutional borrowers. Its strict borrower vetting process - ensuring they can meet financial commitments - is key to distinguishing it from other lending protocols.

These permissioned borrowers must undergo a comprehensive underwriting process, assessing their balance sheet strength and ensuring they have the operational capacity to meet margin call requirements in a downturn market.

The underlying collateral is held by institutional-grade custody solutions, with Maple providing on-chain collateral verifiability, allowing lenders to view the collateral details of each outstanding loan.

By using highly liquid blue-chip tokens as collateral and maintaining active, institutional-level collateral management, Maple can consistently and safely provide yields above market levels.

Thanks to its process of screening the best borrowers and highest-quality collateral, and its focus on short-term loan periods, liquidation events are extremely rare in the Maple ecosystem.

SYRUP Token

SYRUP Token is Maple's native token.

SYRUP is used for platform governance, incentivized staking, and allows holders to benefit from the growth of the Maple ecosystem.

Currently, out of the 10.7 billion SYRUP tokens in circulation, approximately 42.7% are staked on the platform.

Stakers can receive rewards from Maple's token buybacks (thanks to the protocol's revenue) and earn a 2.7% annual yield, with no lock-up period.

The SYRUP release schedule is approximately 5% per year, continuing for 3 years from inception. This means all SYRUP tokens will be fully circulated by September 2026.

syrupUSDC/USDT and Drips Rewards

Users lending USDC or USDT on the Maple platform will receive corresponding liquidity provider tokens (LP Token): syrupUSDC or syrupUSDT. Upon receiving syrupUSDT, users immediately start accumulating a 6.6% annual yield and can use it across multiple DeFi platforms.

The annual yield for syrupUSDC is approximately 10.6%, outperforming protocols like AAVE, Ethena, and Compound. Combined with its extreme focus on security, Maple becomes the first choice for users seeking to maximize stablecoin returns.

In addition to earning yields and DeFi use cases by depositing USDC or USDT, lenders will also receive Drip rewards. These rewards can be converted into more staked SYRUP tokens at the end of each "Season", allowing users to compound their SYRUP holdings over time.

Drips themselves compound every 4 hours, thereby enhancing the total annual yield for SYRUP stakers.

Collaborations and Integrations

Over the past few months, Maple has achieved several notable partnerships and plans to continue expanding its network in crypto and traditional finance.

April 2025: Announced a significant partnership with Spark, including a $50 million USDC investment in syrupUSDC.

March 2025:

Bitwise joined and began allocating funds to the Maple ecosystem, further solidifying Maple's position as the preferred ecosystem for large institutional capital.

Maple announced joining the Convergence ecosystem. This initiative, led by Ethena and integrating protocols like Pendle and Morpho, aims to accelerate on-chain adoption of institutional-level Real World Assets (RWA).

February 2025: The Core Foundation partnered with Maple to launch the lstBTC product, a liquid, yield-bearing Bitcoin token specifically designed for institutions to earn yield from their held BTC.

May 2025 (Recently): Maple completed its first Bitcoin-collateralized financing from global investment bank Cantor. This opened an initial financing channel worth $2 billion for institutional Bitcoin holders to leverage their BTC through the Maple ecosystem.

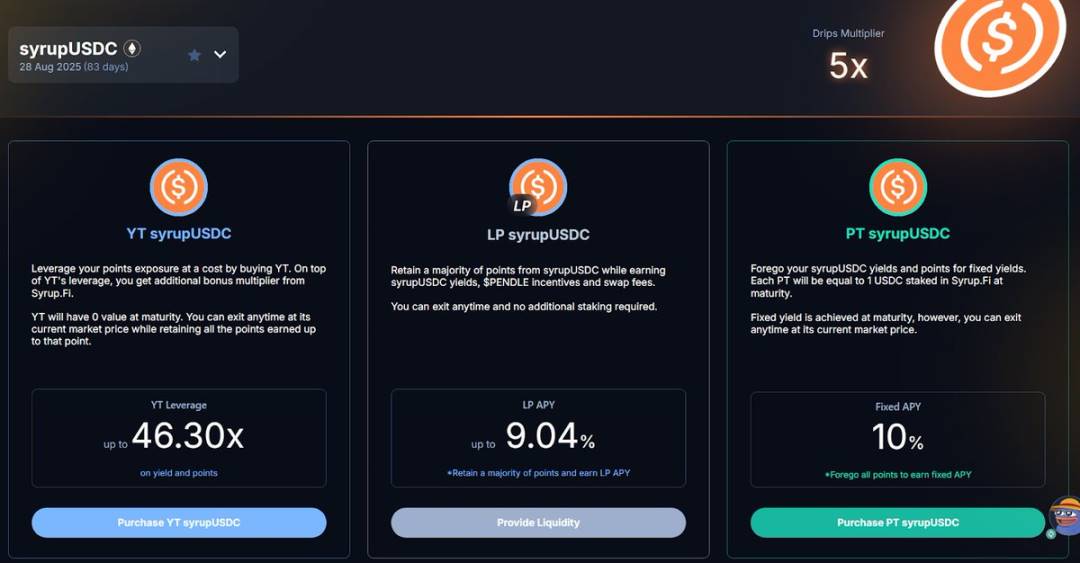

Additionally, for users looking to enhance returns through syrupUSDC and simultaneously obtain up to 5x multiplier Drip rewards, the integration of syrupUSDC with Pendle is an ideal choice.

Competitive Landscape

Maple Finance's customer base primarily consists of large funds, family offices, and high-net-worth individuals.

Since Maple underwrites its loans and requires all borrowers to complete KYC (Know Your Customer) to prove their creditworthiness, it occupies a unique ecological niche between DeFi and centralized finance (CeFi).

This addresses two major issues in previous DeFi and CeFi models:

Large institutional participants' concerns about risks involved in on-chain capital deployment through decentralized providers.

Slow, expensive, and restrictive credit acquisition processes through traditional financial methods or centralized financial providers.

Maple aims to solve these two problems through a hybrid approach: combining the over-collateralization common in DeFi lending protocols, with the strict compliance, credit assessment, and borrower underwriting typical in the traditional financial world.

Compared to other platforms in this field, we are beginning to see Maple's underestimated potential.

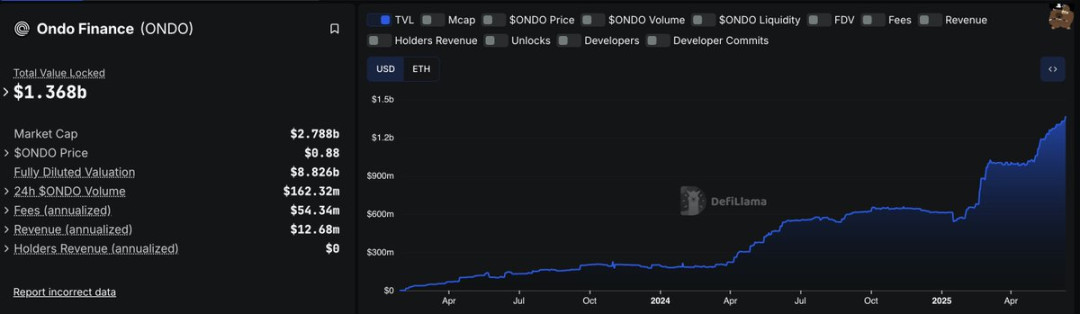

For example, Ondo Finance has approximately $1.3 billion in TVL, a market cap (MC) of $2.6 billion, and a fully diluted valuation (FDV) of about $8.36 billion.

BlackRock's Buidl has about $2.9 billion in TVL, with a market cap of $2.9 billion (considering token fully diluted).

Meanwhile, Maple currently has a TVL of $2.2 billion, with a market cap of only $567.8 million. Even considering full dilution, its valuation is only about $631 million.

Based on the comparison of TVL to market cap, Maple's potential for growth relative to competitors seems very clear.

Obviously, this is a very basic method of value assessment, and many factors need to be considered when evaluating a protocol's future potential; however, it quickly reveals the value differences existing in the current institutional lending field.

As the entire field continues to expand, Maple's recent growth rate positions it to potentially outperform competitors - provided its growth can maintain its current pace and does not flatten out in the short term.

Conclusion

As a relatively new participant in the decentralized institutional lending field, Maple has a highly advantageous positioning and is expected to capture a significant market share in the coming months or even years.

Their goal is to achieve $4 billion in TVL by the end of this year, specifically:

syrupUSDC/USDT: $1 billion

Bitcoin yield products: $1.5 billion

Other Maple institutional product suite: $1.5 billion

Whether they can achieve these goals, time will tell, but the situation looks promising so far.

As the entire crypto market matures, projects with solid fundamentals are more likely to gain market share during the transition of investor types from retail to institutional.

These institutional participants will likely seek the types of indicators they typically focus on in the traditional financial world. Price-to-earnings (PE) ratios, revenue generation capabilities, and moats will be their primary focus when entering this field.

Therefore, following their footsteps, extending our investment time horizon, and seeking protocols with genuine fundamentals (rather than the previously crucial "pump fundamentals") will likely bring returns.