Welcome to the US Crypto News Morning Brief—where we provide the most important cryptocurrency information for today.

Enjoy a cup of coffee while reading what experts say about Bitcoin (BTC) versus the dollar index (DXY) amid Trump's tariff uncertainty and ongoing geopolitical tensions in the US. Investors view Bitcoin as a hedge against currency devaluation, but recent developments raise questions about this perspective.

Cryptocurrency News of the Day: All Money Will Flow into Bitcoin When Fiat Collapses, Max Keiser Says

In a recent report, Coinbase indicated that Bitcoin's upward trend will continue in the second half (H2) of 2025. According to the US-based exchange, favorable factors will come from macroeconomic elements and corporate acceptance.

The report highlights the key trends that Coinbase believes will shape the cryptocurrency market in H2.

Focusing on improving macroeconomic prospects, Coinbase cites the decreasing recession risk as the first trend. The platform notes a more optimistic US economic growth outlook, especially as the Federal Reserve (Fed) is likely to cut interest rates by the end of 2025.

It cites increasing liquidity indicators such as the US M2 money supply and expanding balance sheets of global central banks.

"...conditions are unlikely to return asset prices to 2024 levels," reads a passage in the report.

This implies that Bitcoin's upward trend is likely to continue. Coinbase also points to strong demand from businesses in the short term. The report emphasizes that companies are increasingly viewing cryptocurrencies as an asset allocation tool.

With nearly 228 public companies holding 820,000 BTC globally, and other companies investing in ETH, SOL, and XRP, Coinbase predicts Bitcoin will continue to grow. In this context, BeInCrypto reached out to experts for deeper insights.

Speaking with BeInCrypto, Bitcoin pioneer Max Keiser agreed with this view, calling it an example of Bitcoin entering a new era of price discovery led by institutions.

"Every wallet sitting in private accounts, corporate, institutional, and sovereign will convert to Bitcoin when the 300-year experiment of fiat and central banking collapses," Max Keiser told BeInCrypto.

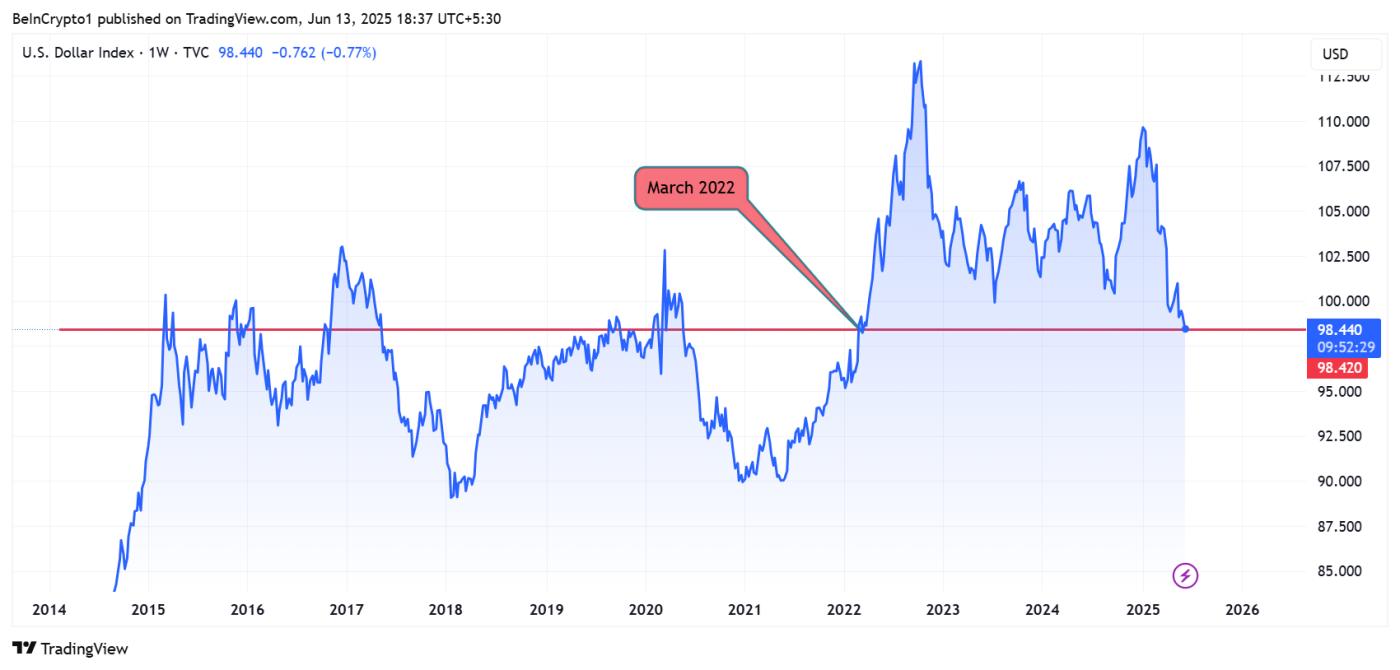

Meanwhile, recent developments align with Keiser's assertion about fiat collapse. TradingView data shows the US dollar index (DXY) is declining, testing levels last seen in 2022.

The recent decline recalls April headlines when Trump pushed for the removal of Federal Reserve Chairman Jerome Powell.

As emerged this week, this topic resurfaced, with rumors that current US Treasury Secretary Scott Bessent could be a potential candidate.

These rumors remain unconfirmed. However, as reported in a recent US Crypto News publication, other forces may be at work, including the uncertainty of US-China trade deals.

Additional factors include the Israel-Iran conflict, which, as another US Crypto News publication explains, threatens to exacerbate US inflation by impacting oil prices.

Meanwhile, amid geopolitical tensions, Bitcoin's status as a safe haven during crises is being questioned, with gold proving to be a more preferred choice for investors.

Chart of the Day

Dollar Index (DXY) Performance YTD. Source: TradingView

Dollar Index (DXY) Performance YTD. Source: TradingViewThis chart shows the steady decline of the US dollar index since January, recording a progressive downward slope to 98.46 on June 13.

US DXY drops to March 2022 levels. Source: TradingView

US DXY drops to March 2022 levels. Source: TradingViewThis chart shows the US DXY index has dropped to levels last seen in March 2022 after crossing 122 in 2023 and peaking around 110 in January 2025.

Alpha Byte Size

Below is a summary of some US cryptocurrency news to watch today: