Written by: Dave's hot money perspective

Chapter 2 of the Level 2 Demystification Series: The Art of War. In the previous chapter, we clarified the Level 2 concepts and three major framework models. This article will continue to explore in a simple and easy-to-understand way and enrich our arsenal of demystification weapons. This article will be very hard. People actually hate tepid articles. They are either purely for fun or they are absolutely dry. But don't be afraid. In the article, I will talk about the logical deduction of the principles, the characteristics that can be memorized directly, and also bring interesting stories.

The Art of War is a military book written by Sun Wu during the Spring and Autumn Period. It consists of 13 chapters, each focusing on a different aspect of military strategy. Wang Anshi called it "a far-reaching strategy that goes beyond military tactics." Drawing on the wisdom of predecessors, [Pan Bing Fa] has a total of 5 plates, which summarize some common trends. Table of Contents:

Contract

American Strong Market

Open Dealer

Wyckoff Development Model

Miscellaneous Talk

In the "Attack and Offensive" chapter of Sun Tzu's Art of War, it is said, "Know thy enemy and know thyself, and you can fight a hundred battles with no danger of danger." Without further ado, the generals followed the orders and the main film began.

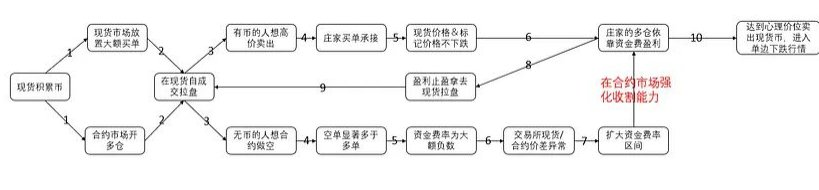

1. Contract disk

Let's fill in the holes in the first chapter and talk about how traders make profits through the linkage between contracts and spot, and the signals we can see. First, I will send you two posts. The two masters talked about the process and principle of the banker's short squeeze in great detail.

https://x.com/wublockchain12/status/1805786970515537973

https://x.com/Michael_Liu93/status/1916131432193527842

Let me start from the beginning, the first stage: accumulating funds and starting the trading.

If you have read my first chapter carefully and still remember it, you will remember what I said in it, that the secret of the manipulation story lies in liquidity. For most dealers, the way they make money is to drive up the price, and there must be a link to raise the price . Since there is a link to raise the price, the chips must be concentrated during the raising stage, otherwise the selling pressure from above is too great and the dealer risks too much, and may lose money. Therefore, the first stage is to organize and absorb chips, and all dealer coins cannot be separated from this stage.

I will use UMA as an example in this part, because I just bought this coin when I was writing this article. First, there is the accumulation stage. You can see that UMA has been falling from around December 24 to March 25. This stage is the end of the previous round of dealer operations. Now the chips are very loose and allowed to fall. However, since the end of March, it has been trading sideways with large volume, and the bottom has been consolidated for nearly 3 months, completing a relatively full box structure. This is the accumulation stage.

What tasks did the dealer complete in the first stage?

1. Accumulate funds at low levels to control circulation.

2. Raise funds and gain the ability to control the market.

3. Repeatedly test the market temperature.

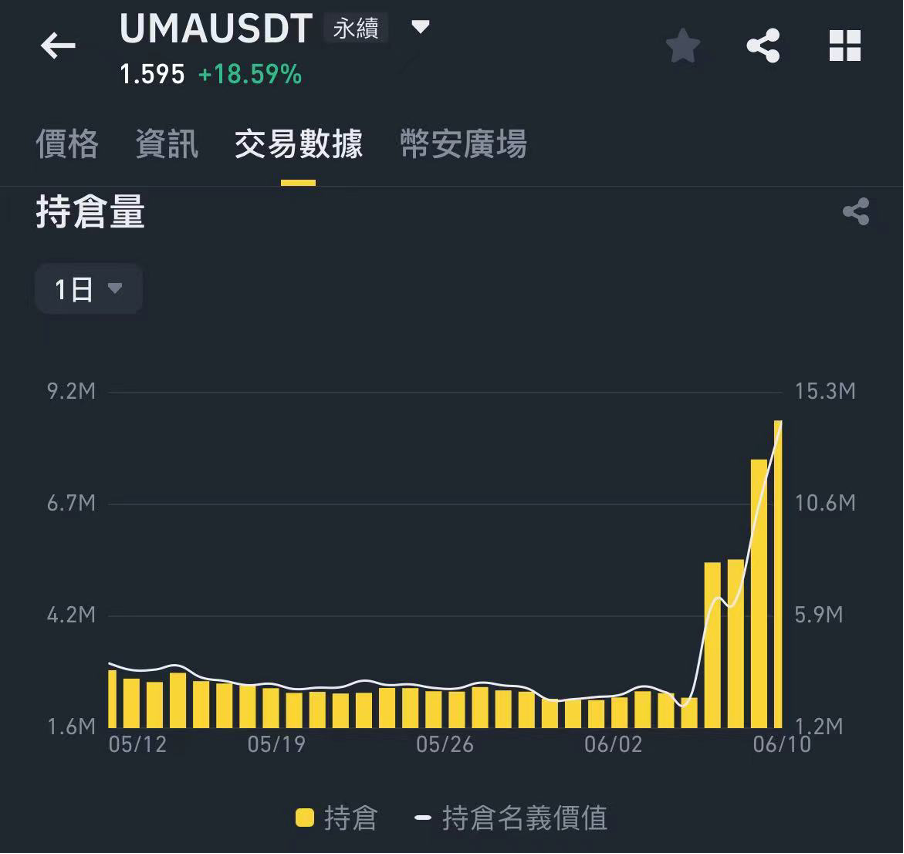

Next, the dog dealer can start the second stage of operation. The second stage: establish long positions in the contract. This is the dealer's entry method and the beginning of the operation. Here I must tell you about the OI (open interest) indicator, which means open contracts. At the beginning of the article, I said that I would tell you both the principle and the characteristics of rote memorization. I don't want to deduce it here. I will directly tell you the conclusion of the operation. When oi fluctuates abnormally, especially when it rises sharply, everyone needs to be vigilant. This is a signal to start a war. Compared with the accumulation stage we mentioned, this signal is more direct. First, you don't know how long the consolidation will last for accumulation. Second, sideways trading is more common. You can't tell whether there is really a dealer behind it? But the surge in oi is a simple and rough signal. So you can simply remember: small coins and monster coins, oi surges, sufficient consolidation, and the market is about to start.

Use uma again, and the market will rise after a while after OI surges. Although it is not a strong causal relationship, I just want to show that they are highly correlated. Because holding long positions is a key step for bankers to make profits, how do bankers make money?

Next comes the third stage, where the funding rate increases and short positions are breached .

In order to avoid being decoupled from the latest spot transaction price, the latest contract transaction price will be paid by long position users to short position users, or short position users to long position users, in the form of funding fees every 8 hours (now 1 hour), and the gap between the latest spot transaction price and the latest contract transaction price will be narrowed. Therefore, for long dealers, since the number of short positions in the contract market is far greater than that in the spot market, after all, the sell orders in the spot market are in the hands of the dealers themselves, the funding rate is negative, and the short positions will pay fees to the long positions. For such small coins, the funding rate is usually very considerable, and the dealer can make a lot of money just by relying on this cash flow income. At the same time, with the continuous flow of money from the funding rate, the dealer will transfer the money received to the spot market to pull the market, so that the short orders of the contract will be blown up, and the profit of the dealer's own long orders will also increase. Finally, don't forget that the dealer has spot in his own hands, and buying low and selling high is always the main theme.

So we can summarize the dealer's way of making money:

Funding rate, market pull-up and short selling, and chip shipments.

But in actual operation, not all three are necessarily present. In the final collapse process, when the dealer has sold all his goods and his long positions have been closed (oi decreases), they will decisively abandon this worthless city like a cold-blooded general.

For example, after the operation of Alpaca Coin, the chips were very scattered and fell on their own. Here is a question for everyone to think about. What is the operation process of Alpaca Coin and the change of chip structure? Welcome to discuss in the comment area.

This is the end of the first article on contract trading. We welcome more professional market maker groups to give us advice.

2. American style strong market

American style often means violent aesthetics. This type of development model is classified as American style strong market maker, on the one hand because they are indeed violent aesthetics pulling the market, and secondly because it is often very coincidental that their bankers are groups from North America. This is a market pattern that must be mastered.

The characteristics of American strong farms are:

The market is strong. Buying power is strong and the increase is considerable.

The duration is relatively long. For all currencies, the main rise usually takes 3 days, and the US currency is no exception, but they will not plummet quickly, and often fall sideways or even rise in small steps.

There is no comfortable position to get on the train. The callback is weak, the rise is large, and the technical rules on the candle chart can be ignored, resulting in only waiting and not daring to get on the train.

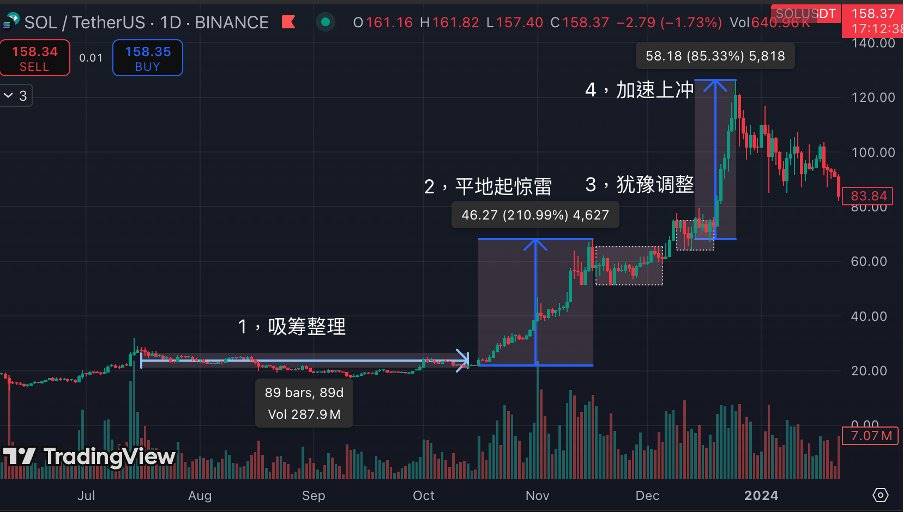

The above is the strategy, let’s take a look at the actual combat: SOL

The first part of Solana is American style strong market, and the latter part is mixed rotation, because the ecosystem has been established. Let's look at the first part and sort it out.

First, there is the accumulation phase, so all the market cannot escape the accumulation phase , just like the college entrance examination, all the conic section questions cannot escape the simultaneous equations, there is a way to cheat points is to list the equations first, no matter what, you can always get partial credit if you guess one right. The early stage is also a classic negative decline accumulation phase. During the negative decline, retail investors are more likely to lose patience. The second retracement clearly represents the accumulation phase. The entire accumulation zone has an up and down range of about 30%, which is actually not large, and it lasts for a long time. Unless you are a firm holder, you usually sell it.

The American physique is revealed. When we trade in cryptocurrencies, how can we tell what type of plate it is? It is in this place. As the market starts, Sol suddenly shows a very strong momentum to lead the rise. In the development of the market, if you only look at the candlestick chart, you will find several termination patterns. In other words, this place should be bearish from the technical analysis of the candlestick chart, but he doesn't care about the technology at all and goes straight up. At the same time, the ecological fundamentals seem to have not changed much, and there seems to be no decisive negative news, but the overall increase has reached 210%. This is generally the entry of institutions, such as the foundation raising a large sum of money to start pulling the market.

During the hesitation adjustment period, there are two platforms in the entire correction period. Basically, there is no decline. It is a small shock and no decline can be seen. Especially the second platform of the adjustment period, it started a beautiful sideways trading at the previous high position. This place is very attractive, indicating that it is not a false breakthrough. If it is not a false breakthrough, it means that the market is still very strong. The dealer may have plans to ship, but it will not come to A-shaped cut . In this case, you can ride the bubble and bet on the last wave.

Finally, it accelerates upward . The dealer launches the last wave purely to follow the general trend of the market, and then it expects and takes over. The higher the sentiment, the higher the rise.

Reflecting from the perspective of trading, first of all, the second stage of thunder and lightning is the characteristic stage of this plate. Not every plate can make a complete three waves like sol. So we should actually catch it in the second part. At this time, you go back and look at the second section. Didn’t you find a suitable place to get on the train? No, that’s right. This is the characteristic of American style. Don’t dare to get on https://x.com/0xDave852/status/1918142304105427063

The link above is another long article of mine, which specifically analyzes SUI, which is also an American strong bank. You can go and have a look. The position I found was at the end of the second stage, and if it couldn’t get up in the third quarter, I would have to gamble.

Sol's third stage is very important, he gives us a lot of confidence to move forward.

When I was analyzing just now, I mentioned a word called A-shaped cut . You may not know what it means. Let me show you what A-shaped cut means.

Layer:

It is a standard American strong banker followed by an A-shaped cut . In the previous process of pulling up the market, you can't find a place to get on the bus at all. It moves upward like a bulldozer, and the last line directly smashes half of it. However, the banker's cost is very low. If you have traded this coin yourself, you will know that their trading level is above that of ordinary coins. It is a very gorgeous combo, so everyone must be careful on the battlefield.

In the third stage, I want to remind everyone that you may think it is easy to do on paper, but if you do it in real life, you are very likely to lose money because you will always be hurt by the pins.

So how to operate? After we judged from the strength of the market that it is an American strong market, the best strategy is to seize the stage of thunder and lightning . Don't be afraid here, you must dare to chase high. If you can't find the logic, and everyone can't explain the reason, that's right, go for it. The second method is to find the team and background information . You can read my article "The Seventh Market of the Night" carefully, and analyze the development potential from the dimension beyond the technical and fundamental aspects. Finally, try to make breakthrough transactions . You have read the third stage of SOL and think it is a very sweet entry. Look at the layer again. If you enter the market during the consolidation above, wouldn't it be a waste? Then would it be better to have a stop loss? If there is a stop loss, it is easy to be inserted in the consolidation stage. This really requires personal participation in the battle to know that there are many upward and downward scams at this stage. So you want to take over the bottom of the range, give a conservative stop loss, or make a breakthrough.

You must be a little tired after reading so much, but a very interesting tidbit is that the teams and main institutions of the three currencies issued above are from North America, so it does make sense to call them American strong market makers.

The above-mentioned disk pattern appears in a relatively wide range, is profitable, and has obvious characteristics, so it is worth your attention.

3. Open Dealer Betting

The name of the open-card dealer is very interesting. The dealer is hiding behind the scenes, so how can it be called open-card? The third type of market pattern judgment mainly relies on off-site tricks , or comprehensive judgment , relying on logical reasoning and catching clues of funds. The open-card dealer market belongs to the interpretation from the perspective of the designated person mentioned in the second level of the first chapter.

The principle of the market is that there is such a designated dealer group, and in order to achieve a certain purpose, it must raise the price of a token. Because we know that manipulating prices is not just for profit , it can also "pull out faith". Pulling the price has many benefits, such as attracting attention , but of course the cost needs to be controlled.

The secondary characteristics of this kind of plate are quite different, but the development logic can be summarized. Among them, the more classic idea is the " one leads the whole nest" approach. After pulling up a certain designated token, the entire plate or ecological token can be driven by the wealth-creating effect, achieving large returns from a long-term perspective. At the same time, there is also a more classic idea that "the arrow is on the string and has to be pulled." If the price of a certain asset is not pulled up, the entire front may suffer a blow, such as MSTR. I have been paying attention to this stock and have a strong sense of it. We all know that when MSTR rises, the multiple is much higher than that of Bitcoin, but when it falls, it is not very tight. Even at the bottom, you can feel the obvious strength of MSTR. This may be because if the stock price is allowed to fall, it will cause chain liquidations, so there is a force to protect the market.

We will give examples for the above two types. In fact, to be honest, things on the secondary market are easier to quantify. When it comes to the capital market and the emotional market, it is a bit mysterious. But this is also where the level of traders is widened. Let us feel it together from the examples!

3.1 Pulling out faith: BGB

BGB is the platform currency of Bitget Exchange. Currently, it only has spot trading pairs on Bitget & MECX. It is also jokingly called a stand-alone currency to some extent. From the end of October to the end of December 2024, the price of BGB rose more than six times, which is a strong and obvious pull.

Next, let’s sort out several key signals for judging BGB opportunities:

1. Subjective pull logic: Pull out the heat in the fierce competition . Back to the end of last year, the competition among exchanges officially entered the white-hot stage. The existing users fought hard, and the bottleneck of incremental users restricted every CEX in the market. In addition, Hyper emerged suddenly, and the competition for the share of centralized exchanges was very fierce. Major exchanges have also started self-rescue plans one after another, such as the wealth creation explosion of BGB. There are really many friends around me who have benefited from this wave. The exchange pull-up platform currency almost became a hot spot at the time. I remember that when it was the most exaggerated, it could be seen on Xiaohongshu, saying that her boyfriend made 800,000 by relying on BGB. The vigorous first-level news and the linkage of the second-phase market really pushed Bitget out of the circle. At the same time, it also injected a lot of confidence into everyone. A good example is that many friends around me who bought BGB at a low price did not sell it at the high point, but sold it 40% 50% below the high point. This shows that at the high point, everyone really had faith.

2. Objective reasons for pulling the price: to save the reputation of the accident . Bitget had a major accident on October 7. A big investor sold his BGB, causing the token price to plummet by 50% instantly. Although the exchange subsequently recovered all the losses, this incident seriously caused everyone to worry about the liquidity and depth of the exchange. At the same time, the real trading volume of BGB and the value judgment of BGB were greatly challenged. Although the exchange did a good job in public relations and rescue, we still have to rely on facts. The accident means that the level is not good. Everyone will naturally have great doubts about the platform currency and even the future of the entire trading platform. Therefore, pulling the price of BGB is also a measure to save the reputation of the accident, diluting everyone's concerns through unreasonable get-rich-quick effects and overwhelming and thorough publicity.

3. Special considerations: The chip structure is excellent. As mentioned earlier, BGB is a stand-alone coin to some extent, which means that a large number of chips are in the hands of exchanges and related institutions, and they can control the selling volume. It is very easy to increase the price if the chips are controlled. In addition, the market-making team can let go and rush up without hesitation. In fact, everyone can feel that they are making money from the market value of this coin, but compared with trust, the money spent is negligible.

I showed you an example of an offensive pull, and I hope you can get a taste of my tricks. I would like to state that I do not mean to criticize the Bitget platform in this example . On Pizza Day, Twitter was very lively, with people showing off gifts from exchanges, but only @Yuanzhuo_labs @TokenPocket_CN and @xiejiayinBitget brother @BitgetWalletCN sent me gifts, so from my point of view, no matter how much criticism people have of BG, I am quite grateful to them, hahaha. At the same time, this pull could have been an event that could have entered the history of platform currency trading models and marketing.

3.2 The Final Battle: TST

TST is the leading meme coin on the BSC Binance Chain. It is a coin that has increased 100 times in on-chain meme craze. It is also the only increase I have benefited from. The development of TST has twists and turns, but the final violent pull is a situation where the arrow is on the string and has to be fired. We tell the story and the logic at the same time.

February 6, 2025: BNB Chain officially released a token creation tutorial video and deployed TST test tokens. Under the meme craze, the community began to hype it up, mistakenly believing that TST had "official endorsement", and the price rose rapidly. At this time, TST was already a pioneer of the BSC meme. The capital market always has a premium for the concept of "first" , and TST's status is actually quite important. However, in the early chaotic stage, neither the project nor the market had a clear logic for TST.

On February 7, @cz_binance did something mysterious, posting a statement that TST has nothing to do with Binance, asking everyone not to hype it up. In fact, from the perspective of this technical male boss, I can understand his idea. CZ is a person who values real value . Whether it is the creation of the BSC chain or his series of investment styles, he is not very interested in the entire meme nihilism hype. Publishing this statement is also a classic NFA avoidance. But my cousin overlooked a problem. We actually started this habit in 2017. The more the big guys post to deny something, the more authentic people will think this thing is. Many projects at that time took advantage of V God’s denial comments. My cousin may not remember the habit at that time. So after TST posted a post to avoid suspicion and plummeted 70%, the weird V came up and stopped. The most terrifying thing is that the discussion about him reached its peak. At this time, the core logic of pulling the market comes:

In the second stage, TST rose 10 times with an open pull. I intervened at this stage. Everyone asked why it rose. Do you remember our second model of open dealer trading? "The arrow is on the string and has to be shot." The eyes of the entire network are focused on TST. At this time, it has been priced as the BSC meme leader. If Binance does not pull up this coin, then everyone will not believe in Binance in the future, which is equivalent to completely giving up the on-chain meme track and even the entire chain future.

At this time, the investment logic is very simple, that is, betting on the Binance team. You should know that at that time, there was a lot of criticism about Binance on the Internet, saying that its market share was seriously eroded, it could not keep up with the trend, its girlfriends were messing around, and it was corrupt, and it was almost gone. But as an old leeks, I believe in Binance very much. Some trust does not need to be logical. I have witnessed @binancezh coming back from desperate situations countless times. I don’t need to bet like a little angry youth that they will admit defeat this time. With this cognition and the clear card dealer’s market pattern, I feel very relieved to pay money. Everyone knows the story behind. Now there are a lot of Binance fans on Twitter. @heyibinance has slapped the faces of all those who doubted that Binance would collapse. Binance continues to crush major exchanges. However, the peak produces hypocritical support, and strong logic is a loyal believer. I hope everyone can also be discerning and firmly invest in good projects.

The pullback after the end of the pull-up stage is a very standard flag-shaped consolidation, and then the secondary stage is left to the market to play.

Binance's marketing idea of "letting the market speak" can be described as concise, efficient and elegant. Compared with the overwhelming Sun-style marketing and the bg marketing that mobilizes the masses, Binance's marketing that speaks through the market is, in my opinion, the most difficult, but most direct approach.

For example, the TST mentioned above, after TST, memes on BSC flourished, and Binance Wallet also soared. Until today, the alpha new series is also affected by the boost of TST at that time. This is a super classic idea of driving a nest. Let me give you another simple example, ORDI. Binance’s second-stage pull of Ordi actually wants to tell everyone that although OKX has monopolized the inscription issuance market, the real secondary pricing is still here. This wealth-making action is also very effective. Until today, Binance’s coin-listing wealth-making effect is affected by the pull of that year.

I didn’t expect to write so many words about the open dealer hand. My personal favorite is the American strong dealer hand in Chapter 2. Maybe there are too many small stories in the open dealer hand example. The length is not short, but it should be easy for everyone to read. Next, let’s briefly talk about the classic Wyckoff development model:

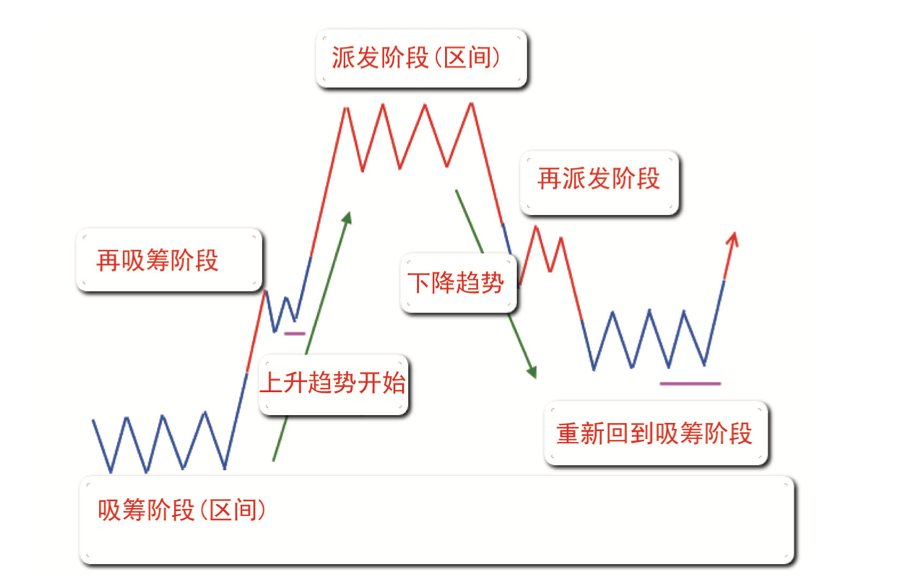

4. Wyckoff Pattern

This section teaches technical analysis. If you want to study Wyckoff's technique in depth, you can read several books. Here we will briefly talk about the macro structure of the entire market.

"From the beginning of the 20th century to the present, many of the most fundamental market judgment principles followed by famous financial institutions are summarized from Dow Theory and Wyckoff Theory, but they just don't say it out loud. They prefer mass traders to use technical indicators such as moving averages or MACD, because they know deeply that the users of these presentation tools are the source of their profits."

A complete trend cycle can be divided into the following four main stages: Accumulation, Markup, Distribution, and Markdown. As shown in the following figure:

During the accumulation phase, the main force gradually buys assets in the low price area and builds positions, and the price is usually in a sideways or narrow range of fluctuations.

Goal: The main force quietly accumulates enough chips to prepare for subsequent rises.

In the rising stage, the price breaks through the accumulation range and enters an upward trend. The main force pushes the price up to make a profit.

Goal: The main force makes a profit by pushing up prices while attracting more buying orders.

During the distribution phase, the main force gradually sells its positions in the high-price area and distributes chips to retail investors, and the price enters the sideways or oscillating range again.

Goal: The main force completes high-level shipments and prepares for a downward trend.

In the falling stage, the price falls below the distribution range and enters a downward trend. The main players basically clear their positions and the market is oversupplied.

Target: When the price returns to a low level, the main force may start to accumulate funds again, forming a new cycle.

The Ethereum 2017 round is quite classic, let's take a look at the actual market. I won't mark the stages on the chart, after reading the above analysis, you can find out which stage each interval corresponds to.

It should be noted that, first, in actual trading, there are many variations of Wyckoff patterns , and there are almost no complete textbook-like trends. It is still the so-called "those who learn from me will live, and those who imitate me will die ." It is most important to be flexible after mastering the logic. Second, the main force also knows this set of analysis methods, so in actual trading, the main force's deception is very scary, and there are many false moves . This is something that must be practiced , and experience can only be accumulated in actual combat. Finally, NFA, Dyor.

5. Miscellaneous Talks

The above summarizes several classic development models. Compared with the ever-changing market, my experience is insignificant. Finally, I will talk about some possible regularities in the market. I don’t know much about them, but I share them for your reference. The so-called regularity means that there is a logical support behind it and it operates according to the principle. This kind of market trend is related to us. For pure retail trading or PVP, I think you should not take on porcelain work without diamond drills. Experts are welcome to feel free to discuss.

5.1 Washing Qian Pan

The scale of the gray industry is so huge and the profits are so lucrative that it is beyond my imagination. It can be said that I am shocked. The crypto that involves Q-washing often has an astonishing increase in the market. There are two categories that you can study on your own.

The first type is black market currencies, such as Bitcoin in 2013, and Monero XMR, Hype, and Trx today. These public chain currencies are very convenient for black market settlement or counter-trading, and have great potential in the post-Bitcoin era. I have also been studying them recently, and may write an article to talk about them later.

The second category is the money laundering scheme itself, such as Bome which increased five times in one day. There are also many hackers who like to convert funds into eth. They may find on-chain meme on Ethereum to carry out cross-matching. I am not very familiar with the clues on the chain, but there may be some hooks.

5.2 VC Coin

VC coins are very good targets for short. Let’s first talk about why the price always falls after Binance lists the coins, which has almost become an unshakable trading opportunity of giving away money. The fundamental reason is that the chip structure is too loose . Before the listing, there were airdrops and launch pads that distributed a lot of coins to retail investors. After the listing, the dealer naturally had no reason to help retail investors, and everyone sold to each other, causing a fall.

The situation of VC coins in this market is even more serious. Since VCs have a large number of uncirculated tokens, they are eager to sell them. At the same time, VC coins often have the bad habit of being overvalued, which makes it difficult to find new dealers to take over. Therefore, short some low-quality VC coins is a good choice.

5.3 Asian Series Banker Plate

The logic of Asian market makers and American market makers is almost the same, but there are such tokens, their rise and fall speed is often very fast, even in my opinion too fierce, it may go through the trend of American market makers for two months in three days. At the same time, it is very coincidental that the project parties, market making teams, or institutions of such tokens are often Asian. For example, the Chinese Renminbi, I gave it a weird name called Asian market makers, such as Trump and Milecoin, one is operated by North American market makers, and the other is operated by Asian market makers. There are even rumors that the Argentine President Milecoin was issued by a Shenzhen group. The pattern and sickle speed are completely different.

For example, TRX, if you follow the American logic of pulling the market as I said in the second picture, in fact, each stage is roughly consistent, but the speed is too fast. It is reasonable to suspect that the traders are some vigorous post-00s. People like me who are born in 2004 and are serious about trading cryptocurrencies can no longer compete with young people who are serious about trading cryptocurrencies. In this fast-food market, you really want a scumbag instead of a warm man, and you want to go for the heart instead of the heart.

Alas, when will we Asians be able to last longer and learn from the Americans? It’s over too quickly, before we can react.

There are many other types of secondary disks, but that’s all we will talk about today. Everyone is welcome to discuss in the comment section.

Conclusion

Sun Tzu's Art of War, "The Art of Emptiness and Reality": "There is no constant state of war, and there is no constant shape of water." This article on the Art of War on the Plate has nearly 10,000 words. The main purpose is to share logic and experience with you. But of course, we make a summary of the development model of the plate, which will be helpful for future secondary transactions. If it doesn't work, read this article like a cheat sheet, which is better than gambling without rules. But as a trader, I still want to remind everyone not to follow the map, and not to talk about war on paper. A lot of knowledge is experienced in actual combat.

Market is like a battlefield

Finally, let me end with a poem by Chairman Mao.

“I read the June 30th edition of the People’s Daily and learned that Yujiang County had eliminated schistosomiasis. My mind was full of thoughts and I couldn’t sleep at night. The breeze was blowing, the sun was shining through the window, and I was gazing at the southern sky, and I was happy to write.

Green waters and green mountains are in vain; Hua Tuo is helpless against the little insects!

Thousands of villages are covered with dead bodies, and tens of thousands of houses are deserted with ghosts singing.

Sitting on the ground, I can travel eighty thousand miles a day, and I can see a thousand rivers in the sky.

The Cowherd wanted to ask the God of Plague about the matter, but he was just as sad and happy as the passing waves.