For the third time this year, Bitcoin's market capitalization has surpassed Alphabet, Google's parent company, demonstrating its recent strong performance. This upward trend is marked by Bitcoin reaching a new price threshold of 100,000 USD and the broader cryptocurrency industry achieving significant legislative successes in the United States.

Matthew Sigel, Head of Digital Assets Research at global investment firm VanEck, describes Bitcoin overtaking tech giants like Google as "poetic justice". For him, this is a sign that the investment world has finally recognized Bitcoin's value.

Bitcoin's Rise Against Tech Giants

This has been a great year for Bitcoin, and the broader cryptocurrency community is enjoying its success. This has also put traditional technology on high alert.

This Friday, Bitcoin's market capitalization reached 2.13 trillion USD, surpassing Alphabet by 30 billion USD. Although the difference is small, its significance is enormous, especially since this is not the first time Bitcoin has overtaken Alphabet.

YTD, Bitcoin has achieved similar milestones twice before, once in April and once in May, taking Alphabet's position as the fifth-largest global asset and closely following Amazon.

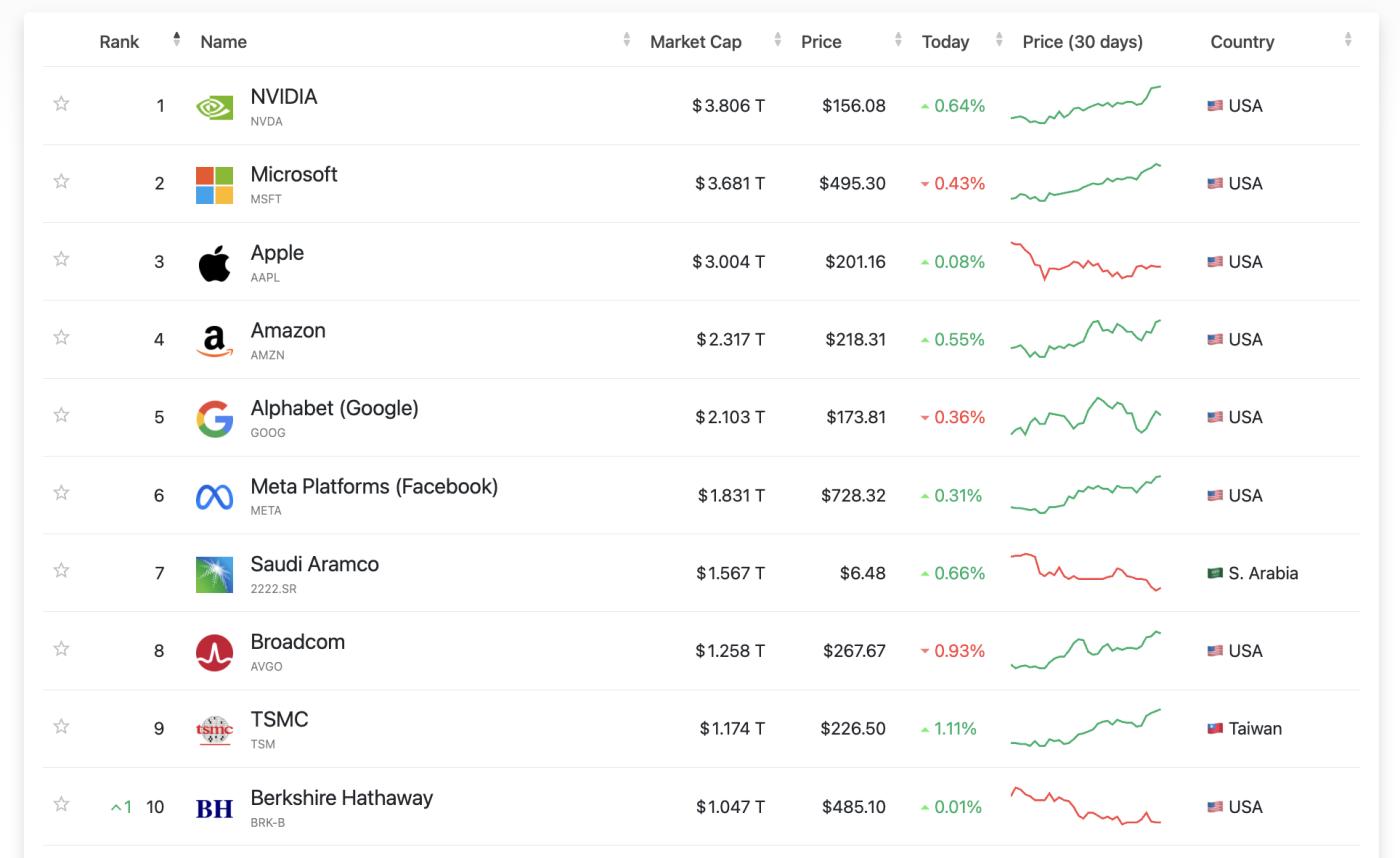

Largest companies by market capitalization. Source: CompaniesMarketCap.

Largest companies by market capitalization. Source: CompaniesMarketCap.Meanwhile, cryptocurrency stocks are also celebrating their own price surge.

Cryptocurrency Stocks Growing Due to Legislative Victories

Stocks of companies heavily involved in blockchain have seen recent growth. Coinbase's stock has increased 53% YTD, reaching a high of 379 USD.

Coinbase stock price. Source: Google Finance

Coinbase stock price. Source: Google FinanceOther cryptocurrency-related stocks, including Bitcoin Strategy's treasury holding company, also rose as Bitcoin's price climbed to 106,000 USD. Mining companies like Riot and Mara also profited.

This strong price increase was also driven by other notable events, such as the U.S. Senate recently passing the GENIUS Act. This passage marks an important legislative shift towards cryptocurrency-supportive policies in an industry previously facing a hostile environment.

According to Sigel, the increase in cryptocurrency stock values indicates a clear and significant change in Bitcoin's reputation, consolidating its position as a viable investment.

"Cryptocurrency stocks are rising because Wall Street finally understands: the tools of the onchain economy are no longer a scientific experiment. They are toll stations on a new financial superhighway," he told BeInCrypto.

For him, these events show Bitcoin's increasing prominence while revealing the weakness of its long-standing competitors.

A Poetic Justice for Bitcoin

The news about Bitcoin's market capitalization reminded Sigel of an article he wrote eight years ago when he worked as a portfolio strategy analyst at another investment bank. It was titled "Google is Evil."

The main theme of the article strongly criticized the massive market power and social influence of large technology companies.

Sigel argued that giants like Google and Facebook operate like harmful monopolies with negative societal impacts. He particularly condemned Google's "rental behavior", asserting that it uses its dominant position to control cultural narratives and undermine democratic principles.

He concluded the article by revealing that he made his first Bitcoin purchase, though through a trust. He paid 306 USD to participate.

Sigel's first Bitcoin purchase. Source: Matthew Sigel.

Sigel's first Bitcoin purchase. Source: Matthew Sigel.Bitcoin's underlying infrastructure and decentralized nature remain the primary benefits that Sigel continues to defend. For him, Bitcoin consistently surpassing Google reflects that this technology has finally received its deserved recognition.

"Regarding Bitcoin overtaking Google, it's truly poetic justice. One side sells your data, the other sells you freedom. In a world flooded with surveillance and debt, investors are choosing scarcity and autonomy," he said.

If Sigel's predictions about Bitcoin are as accurate as those in his 2017 article, Bitcoin holders will benefit greatly.