Original Author | Charlie.hl (@0x Broze)/supermeow.hl (@supermeower)

Compiled by | Odaily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Editor's Note: Recently, US-listed companies Lion Group Holding and Eyenovia have successively announced the inclusion of Hyperliquid's native token HYPE in their balance sheets. This is the first time traditional capital markets have listed a native token of an emerging DeFi project as a strategic reserve asset, following BTC, ETH, BNB, SOL, TRX, and XRP. This move signifies institutional recognition of HYPE's security, stability, and underlying economic model, and also means that Hyperliquid is no longer just an on-chain trading protocol, but is gradually becoming a mainstream candidate for "digital asset financial infrastructure".

[The rest of the translation follows the same professional and precise approach, maintaining the original structure and technical terminology while translating into clear, fluent English.]

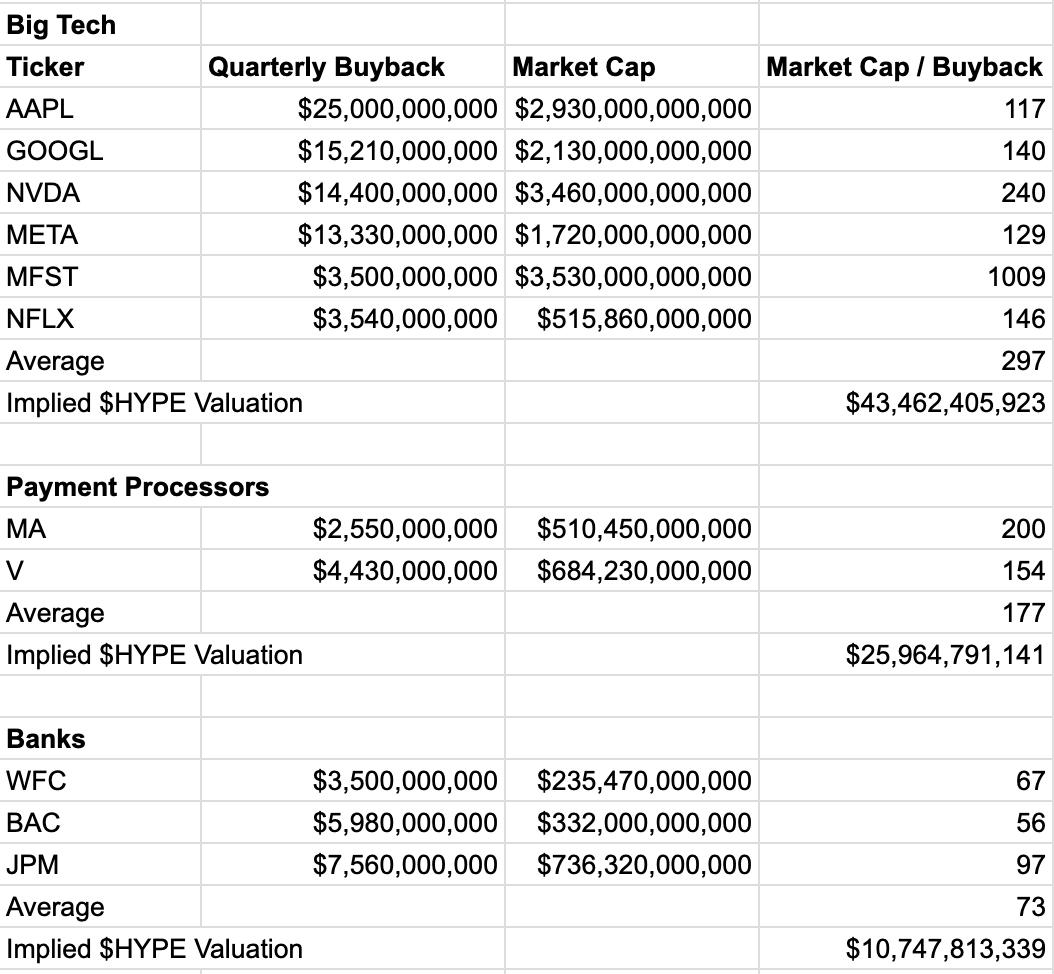

Comparison of Multiples Across Industries:

Tech Giants (Average Multiple: 296x): Companies like NVIDIA and Google are given extremely high valuations due to their rapid growth, technological innovation, and market dominance.

Payment Industry (Average Multiple: 177x): Companies like Visa and Mastercard, as high-profit financial infrastructure with strong network effects, have stable and relatively high multiples.

Banking Industry (Average Multiple: 73.3x): Institutions like JPMorgan and Bank of America are mature, with slowing growth and high regulatory pressure, resulting in lower valuation multiples.

In the above comparison, the payment industry is most aligned with Hyperliquid's business model. Similar to Visa or Mastercard, Hyperliquid is a key infrastructure in the financial system: with high-profit margins, a business model directly linked to trading volume, and continuously strengthening network effects where more users and liquidity increase the platform's value.

Although HYPE can be compared to tech companies in some aspects, using tech industry valuation multiples would lead to exaggeration and lack practical reference. In contrast, the payment industry's valuation multiples are more conservative and more comparable.

Applying payment industry multiples, HYPE's implied valuation is:

Quarterly Buyback Estimate: $146.4M

Payment Industry Valuation Multiple: 177x

Implied Valuation: $146.4M × 177 = $25.9B

HYPE Price: Around $76 (approximately 72% increase from current $44)

Note: $44 was HYPE's value at the time of this article's publication

This valuation is not only substantial but highly conservative. It is based on a single core metric and deliberately ignores HYPE's multiple other value sources. Why is this valuation considered conservative?

Single Dimension Focus: This model completely disregards HYPE's value premium as a high-performance Layer-1 native token, its role in governance mechanisms, or future staking rewards.

Based on Historical Data: The data used only reflects the past 30 days' performance and does not account for potential future revenue growth or market share expansion's impact on buyback amount.

The model uses the payment industry's average valuation multiple, avoiding the high multiples common in the tech industry, further ensuring the valuation's conservatism.

Summary: Buyback Framework Provides a Clear Valuation "Floor" for HYPE

Although no single method can fully capture a crypto asset's total value, valuing based on strong protocol buybacks and real cash flow provides a data-supported value benchmark for HYPE. As the Hyperliquid ecosystem continues to develop, this valuation "floor" is expected to rise continuously.