Strategy Purchases Additional 4,980 BTC Worth $531.1 Million, Raising Total Holdings to Nearly 600,000 BTC, Confirming Long-Term Bitcoin Investment Strategy. Strategy, the largest Bitcoin-holding company among listed firms, has just consolidated its position with a significant purchase of $531.1 million, equivalent to 4,980 BTC, as the cryptocurrency market shows clear signs of recovery. According to the filing submitted to the US Securities and Exchange Commission (SEC) last Monday, the transaction was executed in the week ending Sunday, with an average price of $106,801 per Bitcoin.

Strategy, the largest Bitcoin-holding company among listed firms, has just consolidated its position with a significant purchase of $531.1 million, equivalent to 4,980 BTC, as the cryptocurrency market shows clear signs of recovery. According to the filing submitted to the US Securities and Exchange Commission (SEC) last Monday, the transaction was executed in the week ending Sunday, with an average price of $106,801 per Bitcoin.

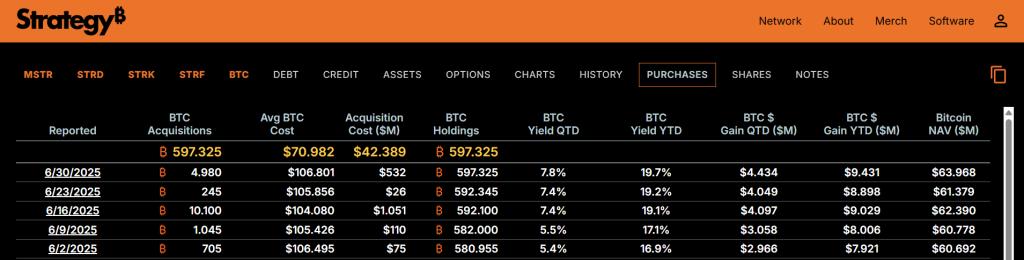

This move occurred as Bitcoin's price rose from $101,000 to over $108,000, bringing Strategy's total Bitcoin holdings to a record 597,325 BTC. The company has spent approximately $42.4 billion on this Bitcoin amount, corresponding to an average purchase price of $70,982 per coin.

Since the beginning of this year, Strategy has purchased a net total of 85,871 BTC, valued at around $9.5 billion, reflecting the company's rapid and continuous accumulation. Currently, the return on total Bitcoin holdings is around 19.7%, moving closer to the 25% yield target set for the end of 2025.

Alongside the latest purchase, blockchain analysts discovered an internal transaction transferring 7,383 BTC (approximately $796 million) from the company's wallet to three new addresses. The Lookonchain analysis platform suggests this transaction may be aimed at optimizing asset custody, confirming it is not a selling action.

Strategy's long-term investment philosophy continues to be reinforced through CEO Michael Saylor's statement. He recently reposted an interview from 2020, where he shared that the decision to heavily invest in Bitcoin is for the next generation. "I am buying Bitcoin for the person who will succeed me in the next 100 years," Saylor emphasized. "I have no intention of selling. Even if the price increases 100 times, I cannot find an asset better than what I currently own."

This consistent stance shows that Strategy's purchase decisions are not short-term reactions to market developments, but part of a long-term and coherent investment strategy that the company has clearly established.