Currently, Turkey's crypto focus still appears to be hedging against the risk of fiat currency depreciation.

Written by: Bright, Foresight News

On July 5th, according to Financefeeds, the Turkish Capital Markets Board (CMB) has taken legal action to block 46 cryptocurrency-related websites, including the decentralized exchange PancakeSwap. The CMB's reasoning was simple: these platforms provide "unauthorized crypto asset services" to Turkish residents.

Turkey, once the fourth-largest crypto market globally with annual trading volumes close to $200 billion and with cryptocurrency trading legalized, has once again tightened its grip on the crypto market.

Since March 2025, the CMB has begun comprehensive regulation of crypto asset service providers operating in Turkey, establishing a new licensing and compliance framework. Additionally, the cryptocurrency anti-money laundering regulations issued by the Turkish government in December 2024 were officially implemented in February, requiring users to submit complete identity information to service providers when executing crypto transactions exceeding 15,000 Turkish lira (approximately $425). Simultaneously, unregistered wallet addresses are strictly regulated, with significant restrictions on using native crypto functions.

Probing Under High Inflation

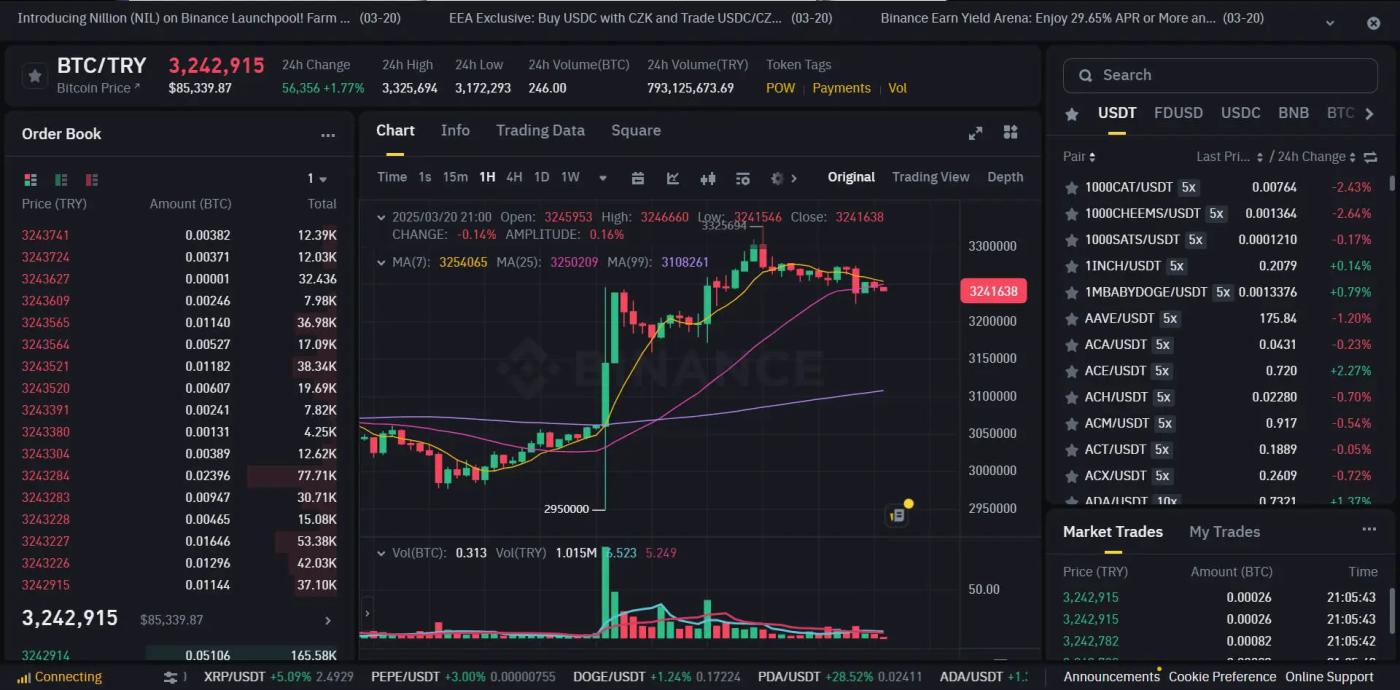

On March 19, 2025, Ekrem Imamoglu, the Istanbul mayor and President Erdogan's rival, was arrested, causing panic among local investors. The Turkish lira (TRY) plummeted 10% to a new historical low of 41:1 (TRY:USD) around 4 PM. Approximately an hour later, a crypto fiat hedge trend emerged, with BTC/TRY trading volume surging significantly on Binance.

In fact, under "Erdogan economics" - stimulating investment through low interest rates and promoting exports through currency depreciation - the Turkish lira has dramatically depreciated over 80% in five years. Extreme inflation and international capital withdrawal have repeatedly struck the Turkish economy. The Economist commented: "He is trying to cure cancer with stimulants."

The Turkish public has long had a countermeasure: "gold under the mattress". In the third quarter of 2024, the Turkish Central Bank estimated that Turkish households owned physical gold worth over $311 billion, compared to the central bank's gold reserves of only $86.5 billion. From January to April 2025, Turkey's current account deficit was $20.3 billion, up from $14.5 billion a year earlier, with $6.27 billion attributable to gold trade. These gold assets disappear into private households after entering Turkey, no longer circulating.

Since 2022, besides gold, Turkish investors have rapidly turned to cryptocurrencies to seek more stable and convenient value storage methods. Despite Bitcoin experiencing a bear market in 2022, dropping 64% due to Fed rate hikes and the FTX collapse, Turkish investors remained highly active in the crypto market. Doge became one of the most popular trading assets in the Turkish market, with its trading volume even exceeding the combined BTC and ETH between October and November 2022, reaching $380 million. Although the Erdogan government initially warned the public against cryptocurrencies, local residents have viewed crypto as an anti-inflation tool.

Subsequently, Turkish authorities joined the wave of promoting widespread cryptocurrency use to break free from dependence on external economies and SWIFT, seeking financial system autonomy and stability.

Embracing EU Compliance, Yet Seemingly Outdated

The background for Turkey's cryptocurrency legalization is complex. On one hand, the rapid growth of the crypto market and global regulatory trends have forced Turkey to confront the legitimacy and regulatory issues of this emerging financial instrument. On the other hand, Turkey aims to enhance financial inclusivity through cryptocurrencies, especially in areas lacking banking services, where crypto debit cards can help users bypass traditional banking systems for convenient financial services.

On December 25, 2024, the Turkish government issued an announcement clarifying the main provisions of the new anti-money laundering regulations, focusing on transaction thresholds, risk transaction handling, and unregistered wallet restrictions, seeking to enhance cryptocurrency transaction transparency and security.

This regulation coincided with the European Crypto Assets Market Regulation (MiCA) taking effect on December 30, 2024. MiCA is considered the world's first comprehensive crypto asset regulatory framework, detailing provisions for crypto asset issuance, service provider authorization, operations, reserve and redemption management, and anti-money laundering (AML) supervision. Additionally, MiCA integrates the Travel Rule (TFR), requiring crypto asset service providers (CASP) to include sender and receiver information for each transfer to enhance traceability.

Turkey has copied all regulatory provisions. However, as the United States gradually becomes a crypto compliance highland and continuously "unbinds" the crypto industry, Turkey's compliance process is clearly falling behind historical progression.

At least regarding stablecoin applications, Turkey has shown no signs of "unbinding". Since 2021, the Turkish government has recognized crypto trading attributes but has consistently prohibited using cryptocurrencies as payment tools. This means that while investors can trade freely, they cannot directly apply cryptocurrencies to daily consumption scenarios, with the stablecoin payment market of over a trillion dollars remaining untapped.

However, despite new regulations restricting certain trading activities, the Turkish government remains open in crypto tax policies. The government has not taxed crypto asset profits, only levying a 0.03% transaction tax, which is quite trader-friendly.

In summary, like Argentina and other countries with rapidly depreciating fiat currencies, Turkey's crypto focus remains hedging against currency depreciation risks. Turkish residents' demand for cryptocurrencies is more about exchanging visibly depreciating lira for USD-pegged on-chain stablecoins. After all, the Turkish Central Bank's foreign exchange reserves have already turned negative. Compared to the traditional black market's high fees and low security, on-chain, highly liquid stablecoins have become the preferred value storage method. Compared to Turkey's traditional "gold under the mattress" reserves, "stablecoins under the pillow" are gaining popularity. TRON's dedicated layout in Turkey's payment and exchange sectors alone sufficiently illustrates the market's extensive demand.

However, for stablecoin cross-border payments and stock tokenization applications, Turkey has yet to become an innovation hub.