The Japanese bond market, which had long been dormant, has awakened global investors, crossing the 3% mark for the first time since 2000.

Although this seems like a local change, analysts warn that it could mark the beginning of a broader liquidation crisis affecting risky assets, including Bitcoin.

Japan's Bond Shock Sends Warning to Global Markets

Japan's long-term interest rates have crossed an important threshold, causing shockwaves in global markets. For the first time since 2000, Japan's 30-year government bond yield increased 10 basis points to 3.065%.

Many analysts have pointed out this development, seeing it as the first signal of a broader liquidation crisis. This surge represents a significant reversal for an economy long symbolizing ultra-loose monetary policy and near-zero interest rates.

Analysts warn this could be an early warning for global markets, especially for risky assets like Bitcoin (BTC).

Japan has maintained extremely low interest rates for years, a move that helped global markets maintain liquidation and risk acceptance. Notably, this cheap capital has driven everything, including cryptocurrencies.

"Japan's 30-year bond yield surpasses 3%, unseen since 2000. The world's most indebted, oldest, chronically low-inflation economy is leading global bond markets downward. Wake up, the US might not be far behind. Perhaps it's not Japan reacting to the world, but the world about to follow Japan," market analyst Fernando Pertini wrote.

In this context, the tone on financial social media has shifted from curiosity to concern, with Barchart expressing the market's general anxiety.

These impacts are particularly worrying for the cryptocurrency market. BitBull, a renowned market analyst, suggests this development could mark a turning point for the entire cycle.

"Japan's 30-year bond yield just crossed 3% for the first time in decades. Sounds undramatic... but it's a big signal... Now that rates are rising, that means money could start tightening broadly. Less money flowing = more pressure on risky assets like BTC and altcoins. This could be the Black Swan Event of this cycle," BitBull expressed.

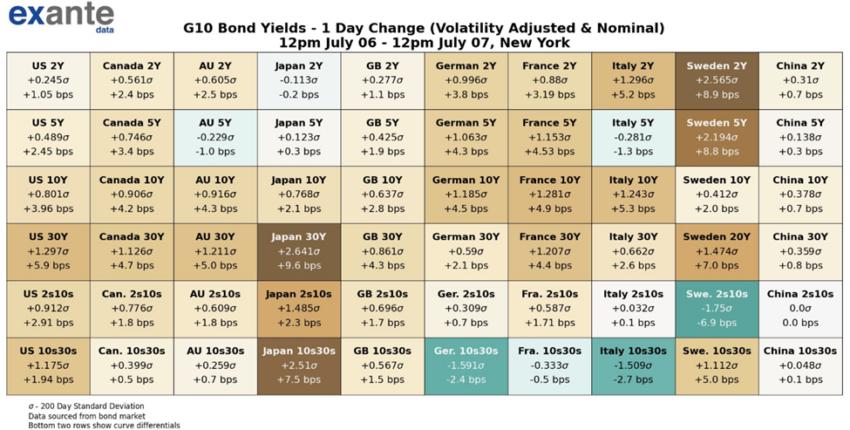

Exante Data confirmed that Japan's 30-year yield was the most statistically significant movement among G10 bond markets in the past 24 hours, supporting this view.

"The largest move in the past 24 hours is: Japan 30Y. G10 bond yields with a 2 standard deviation move during this period include: Japan 30Y, Sweden 2Y, Japan 10s30s, Sweden 5Y," the company noted.

G10 bond yields. Source: Exante Data on X

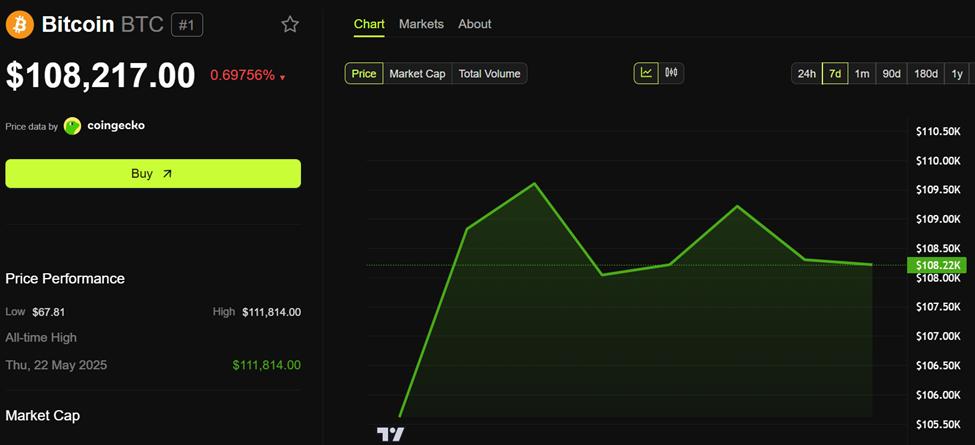

G10 bond yields. Source: Exante Data on XHowever, despite macro tremors, Bitcoin remains unusually stable. At the time of writing, BTC is trading at $108,217, within a narrow range.

"...although spot momentum is slowing, Bitcoin's technical positioning and broader bull market remain structurally intact. BTC continues to hold above the critical psychological $100,000 support, bouncing from $98,000 during the war-related dip and has established strong support levels around $106,500," said Shawn Young, Head of Research at MEXC Research, to BeInCrypto.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoBitcoin's Unusual Stability Could Attract Risk-Averse Investors

David Puell, an analyst at Ark Invest, highlighted this rare calmness amid broader volatility, noting it could attract risk-averse investor groups.

"Starting from 05 and 10/2023, the 6-month and 1-year deviations of both broad volatility and extreme tail are consistently positive without interruption, unlike previous bull markets.... We believe this is exactly what will attract a risk-averse investor," Puell wrote.

Meanwhile, corporate accumulation continues. Genius Group, a public company positioning itself as a "Bitcoin-priority" education company, has increased its treasury target tenfold. CEO Roger Hamilton emphasized the company's belief in a X (Twitter) post.

"We are now seeing the price appreciation of Bitcoin we bought for our Bitcoin Treasury, and we are delighted to announce this significant increase in our Bitcoin Treasury target to 10,000 Bitcoin," Hamilton revealed.

With global bond markets sending warnings and institutional investors increasing Bitcoin investments, Japan's yield shock may not just be a local event.

Based on analysts' collective perspective, this could mark the beginning of a new macro reality.