From the beginning of June, Cardano has been trading in a narrow range, facing strong resistance around $0.59 while finding stable support near $0.55.

However, a historical pattern similar to previous market cycles of ADA is beginning to emerge, suggesting that this altcoin may be in the final stage of a correction before witnessing a price reversal.

ADA Enters Final Accumulation Stage

In a post on 07/07 on X, cryptocurrency analyst Javon Marks noted that ADA's price movements are currently reflecting the structure of its final large accumulation phase, before the strong surge in 2021.

In the price chart Marks added to the post, he drew out the similarity between ADA's previous and current market cycles and noticed that from 2018 to 2020, the coin went through a three-wave correction and formed a rounded Dip, ultimately leading to a strong breakout above $3.09 in 2021.

Cardano Fractal Pattern. Source: Javon Marks on X

Cardano Fractal Pattern. Source: Javon Marks on XSince 2022, a similar structure has gradually emerged, with ADA once again completing a multi-wave correction and forming a price base. This repetition suggests the coin may be preparing for another major surge if this pattern holds.

Such fractal patterns are often seen in long-term market cycles, where investor behavior and market psychology occur in recurring stages. If ADA continues to reflect its historical structure, a breakout from the current accumulation zone could pave the way for a price increase phase, pushing prices to previous highs and beyond.

According to Marks, if this pattern holds, "this could lead to an increase of over 383% from here..."

ADA Traders Bet on Breakout

Although Marks' forecast is more long-term, the short-term outlook—despite recent corrections—is not too bad.

According to Coinglass, the coin's funding rate remains positive, indicating that traders are betting on continued price increases and remain confident in the asset's short-term trend. At the time of writing, this rate was 0.0054%.

ADA Funding Rate. Source: Coinglass

ADA Funding Rate. Source: CoinglassThe funding rate is a periodic payment between traders in Futures Contracts to keep the contract price in line with the spot price. When the funding rate is positive, there is higher demand for long positions compared to short selling.

This trend suggests that many traders are betting on ADA breaking out of its narrow range and recording new increases in the short term.

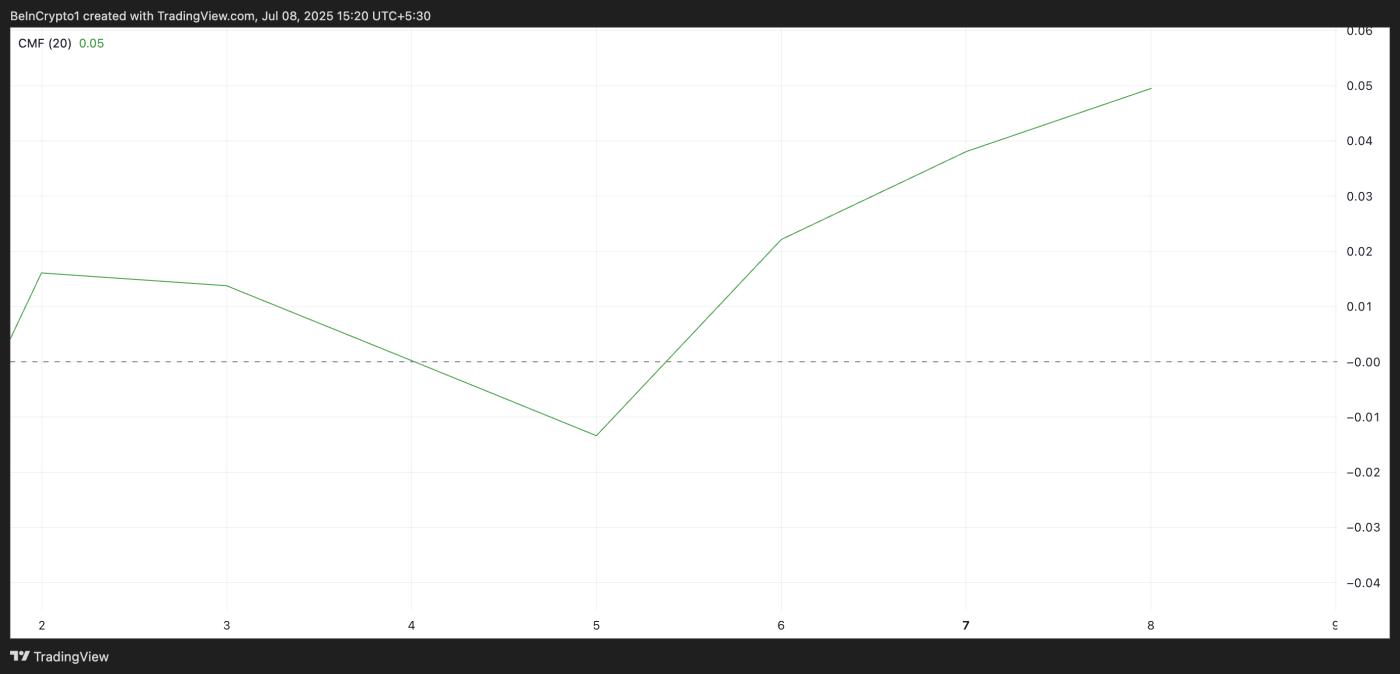

Moreover, while its price is stagnating, ADA's Chaikin Money Flow (CMF) has increased, indicating growing buying pressure. At the time of writing, this volume indicator, which tracks money flowing in and out of an asset, was at 0.05 and trending upward.

Cardano RSI. Source: TradingView

Cardano RSI. Source: TradingViewWhen the CMF indicator increases while the asset price remains flat, this indicates accumulation. This draws a scenario where ADA investors are gradually buying in with expectations of a future breakout.

Will ADA Hold $0.58? Market Watches $0.593 Resistance Level for Clues

At the time of writing, ADA is trading at $0.58. If market sentiment becomes optimistic and demand increases rapidly, the coin's price may attempt to break through the resistance level at $0.593.

A barrier breakout could trigger an extended surge towards $0.64.

Cardano Price Analysis. Source: TradingView

Cardano Price Analysis. Source: TradingViewOn the other hand, if strong selling activity occurs, it could push Cardano's price down to the support level at $0.55.