1. Introduction: Listed Companies Competing to Allocate Bitcoin and Crypto Assets

In 2025, the crypto market is recovering, with Bitcoin prices repeatedly hitting new highs, currently standing around $111,192. Some listed companies are incorporating digital assets like Bitcoin into their balance sheets as strategic reserves. A report shows that 61 listed companies primarily outside the digital asset sector have adopted a "Bitcoin Treasury Strategy" by allocating part of their cash reserves to Bitcoin. Many companies are attempting to replicate MicroStrategy's successful example. This software company has continuously purchased Bitcoin since 2020 and now holds Bitcoin reserves worth over $63 billion, with its stock price soaring over 30 times since 2020. Bitcoin's price breaking $110,000 this year has driven this wave of "Bitcoin Treasury" trend. Many followers have doubled their Bitcoin holdings within just two months, collectively holding nearly 100,000 Bitcoins.

More notably, this wave is spreading from Bitcoin to other mainstream cryptocurrencies like Ethereum and Solana. Companies adopting crypto asset treasury strategies have diverse motivations: on one hand, to combat inflation and avoid fiat currency depreciation risks, and on the other hand, to earn returns by holding and staking crypto assets while attracting a new generation of investors. For example, NASDAQ-listed SharpLink Gaming raised $425 million in the second quarter of 2025 and purchased 176,271 Ethereum, becoming the public company with the most Ethereum globally. Similarly, consumer goods company Upexi recently announced establishing a Solana treasury, buying and holding Solana tokens to enhance company visibility and achieve growth. Upexi's strategy officer Brian Rudick pointed out that from a shareholder perspective, if a company raises funds, it's better to allocate some to digital assets that the market favors rather than investing in traditional businesses. Proven fact shows that companies boldly embracing crypto assets often receive positive responses from capital markets, outperforming peers.

However, for enterprises or investors, buying large amounts of cryptocurrencies in the open market at once is not easy: this could drive up purchase costs and even cause market impact. Therefore, more institutions are seeking more strategic and progressive asset accumulation tools. In traditional finance, a famous structured product helps investors gradually accumulate target assets—which is the Accumulator product we'll introduce today. This article will popularize the operating principles, advantages, and risks of Accumulator, explore why it's becoming a "secret weapon" for companies deploying digital assets, and briefly introduce Matrixport's advantageous services in this field.

2. What is Accumulator?

... [rest of the text continues in the same professional translation style]In summary, the DCA strategy is simple and suitable for all market conditions, but it may increase the cost of building positions in bull markets and lead to being trapped in bear markets; the put option selling strategy is suitable for volatile markets, earning profits by collecting premiums or buying at low prices, but it may not be able to buy coins in bull markets; Accumulator is more suitable for institutional investors with a long-term bullish outlook, buying at low prices and stopping at high prices, balancing the cost of building positions and risk control.

Therefore, for institutions with long-term BTC allocation needs, the Accumulator strategy balanceslow-price entryandpreventing chasing high prices in bull markets, compared to DCA and put option selling, it has more advantages in an oscillating upward market.

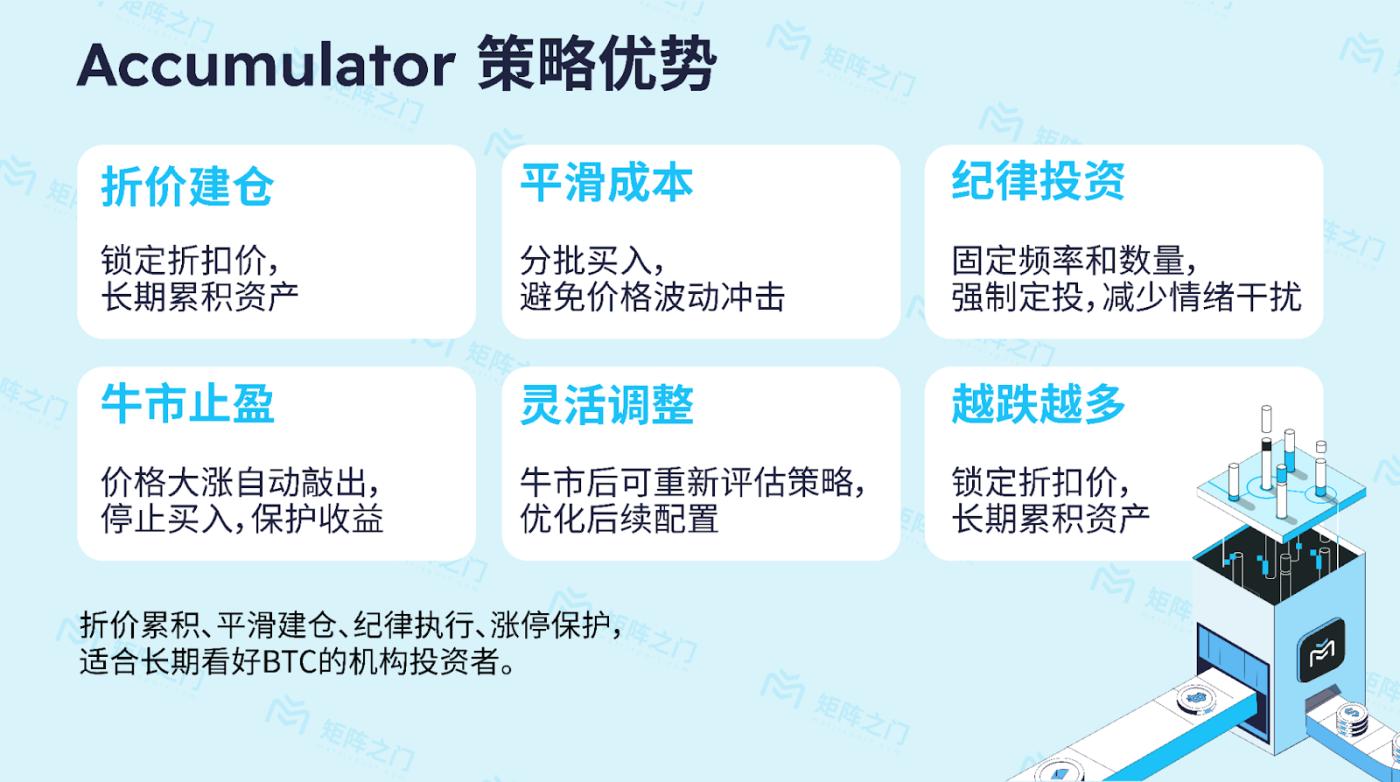

5. Advantages: Discounted Accumulation and Disciplined Investment

6. Risks and Precautions

Despite the many advantages of Accumulator, investors must fully recognize its risks to avoid falling into blind spots:

Market Downside Risk: The biggest risk of Accumulator isprice decline. If the underlying asset price falls significantly below the strike price, investors still need to continue buying at a strike price higher than the market price, which will result in floating losses. This has been demonstrated in previous cases. Therefore, the premise of using the Accumulator strategy is that investors are bullish on the underlying asset in the long term and have sufficient funds and patience to continue fulfilling the contract even with interim account losses.

Loss of Right of Regret: Once the Accumulator contract is signed, investors take on the obligation to buy,and cannot unilaterally exit midway(unless triggered to knock out). This means that even if the market environment or company strategy changes, you cannot stop buying like in a regular spot trade. For enterprises, this is a commitment that requires careful decision-making.

Opportunity Cost: In extreme market conditions (whether a sharp rise or fall), the preset mechanism of Accumulator may cause investors to miss better operation opportunities. For example, if the market crashes, buying the dips directly in the secondary market is obviously more cost-effective than buying at the strike price, but Accumulator does not allow you to temporarily change the price or increase buying intensity, with limited flexibility. Conversely, if the market rises rapidly, triggering a knock-out and continuing to rise, investors may not have bought the planned position due to contract termination, thus missing out on some of the gains.

Product Complexity: Accumulator is an over-the-counter structured derivative with complex contract terms, including strike price, barrier price, observation frequency, settlement cycle, and other parameters. Some Accumulators may even have additional clauses (such asdouble accumulation clause: when the price is below a certain level, the purchase amount per period is doubled), increasing the product's complexity and risk. Therefore, investors need to ensure they fully understand the contract details and assess whether their risk tolerance matches the product. If lacking experience in this area, it is best to seek guidance from professional institutions.

Overall, Accumulator is suitable for investors whoare bullish on long-term value, expect price range fluctuationsandhave the ability to bear short-term volatility risks. For example, many enterprises are willing to gradually buy Bitcoin and other assets as strategic reserve assets through such products because they have a long-term perspective and strong financial capabilities to withstand short-term account pressure while hoping to build positions at lower costs and in a more stable manner. If you are considering using Accumulator, be sure to conduct stress tests and risk scenario analyses to ensure that even if the market moves unfavorably, the enterprise's financial situation can remain calm.

7. Why Do Corporate Finances Favor Accumulator?

For enterprises incorporating digital assets into their financial strategy, Accumulator provides a unique solution that meets their needs:

Tool for Large-Scale Purchases: Corporate coin purchases are often substantial. Buying directly on an exchange not only may push up the price but also easily attract market attention (and potentially be targeted by speculators). Accumulator allows enterprises topurchase in small amounts multiple times, like breaking a large purchase into dozens of small purchases, with better concealment and operability. Market participants find it difficult to detect the "big plan" behind each small purchase, thereby reducing market impact and slippage costs.

Cost-Controlled and Budget-Friendly: Corporate finance typically needs to execute investments within budget. Through Accumulator, CFOs can lock in purchase prices and total planned investment before the contract, giving clarity on future expenses. As long as the price does not trigger a knock-out, the plan will be steadily executed without being forced to increase the budget due to market price increases. Additionally, if market conditions exceed expectations (high prices trigger knock-out), subsequent budgets can be saved, and the company can choose to wait or invest in other purposes, with flexibility.

Long-Term Layout, Reducing Human Interference: Many companies are optimistic about the long-term value of Bitcoin and other crypto assets, but daily price fluctuations and media noise can interfere with decisions. Accumulator is equivalent to setting anautomated investment planin advance, excluding the influence of human subjective emotions. Management does not need to monitor daily or struggle with when to buy, only executing the predetermined actions periodically. This "long-term custody" strategy helps companies adhere to long-term strategies without wavering due to short-term fluctuations.

Financial Flexibility and Returns: As mentioned earlier, once the accumulated assets reach the target position, the company not only gains the potential appreciation of the digital assets but can also use them forpledged lending, earning interestand other purposes to generate further returns. Many companies implementing crypto treasury strategies pledge over 95% of their ETH to obtain blockchain validation rewards. Therefore, using Accumulator for position building will not hinder the company's future financial operations on held crypto assets; instead, it opens up more diverse capital operation spaces.

In summary, Accumulator helps enterprisesexecute crypto asset allocation strategies more intelligently: acquiring chips without disrupting the market and sending a professional and prudent signal to investors. This explains why we see more and more institutions inquiring about and adopting such tools for digital asset investment.

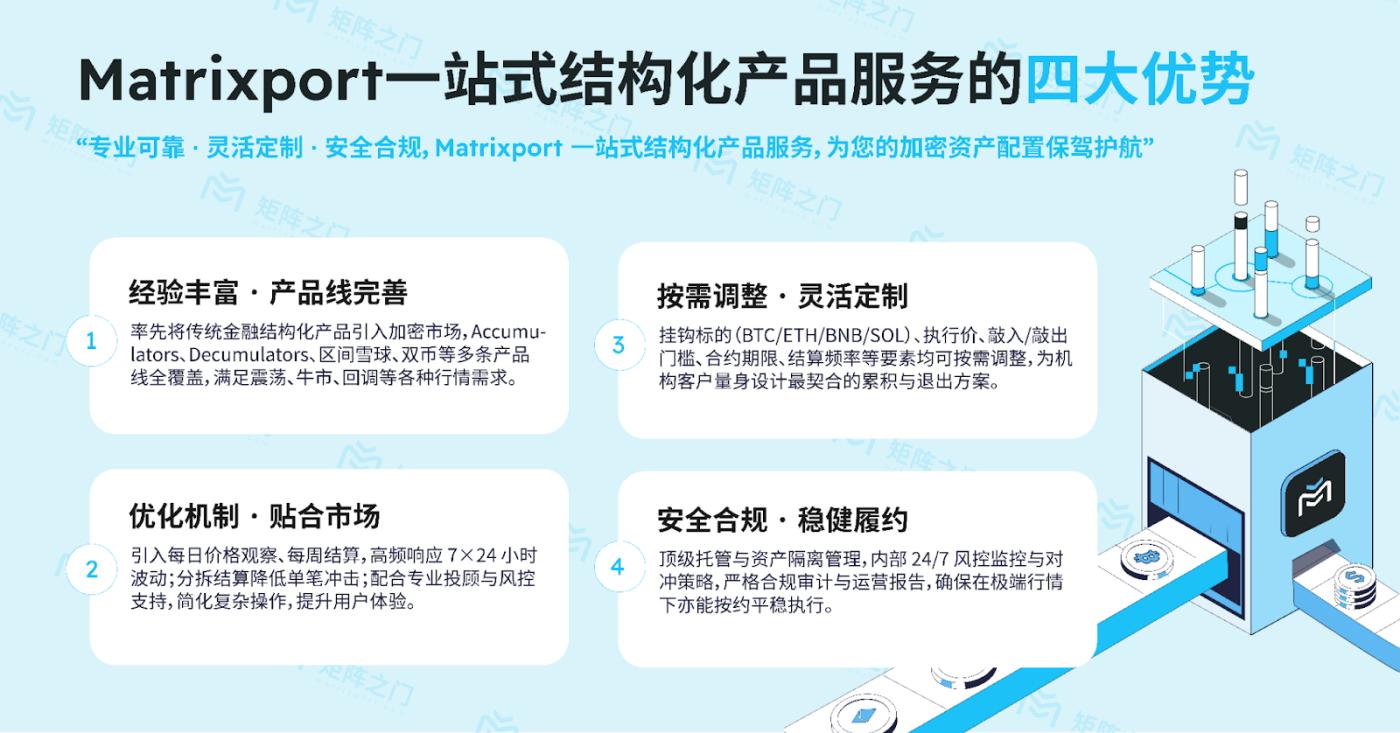

8. Matrixport's Four Advantages: One-Stop Structured Product Services

9. Conclusion

As digital assets like Bitcoin move towards the mainstream, more and more enterprises are incorporating them into their long-term development strategies. On the path to configuring crypto assets,how to buy, how to buy, and at what price to buyare issues that enterprises need to carefully consider. Simple and crude one-time purchases often come with high costs and significant risks; using structured financial tools to layout strategically is undoubtedly a smarter choice.

Accumulatoris precisely such an innovative tool that helps enterprises and investorssystematically accumulate crypto assets at low costs. By locking in discounted prices for batch purchases, setting stop-loss and take-profit mechanisms, Accumulator provides investors with opportunities to obtain ideal average prices in volatile markets. However, as we discussed, it also requires users to have confidence in the market and risk tolerance. For enterprises firmly bullish on the long-term value of digital assets like Bitcoin, Accumulator offers a compromise: achieving steady growth of strategic positions without being rash or impulsive.

We hope this popular science article can help readers understand the principles and application scenarios of the Accumulator product. The key is to make everyone realize that in the rapidly changing crypto market, skillfully using financial tools can yield twice the result with half the effort. Matrixport is willing to be your partner in exploring the digital asset world, providing support and services for your financial innovation journey. If your enterprise is considering deploying crypto assets, you might want to learn about structured product portfolios including Accumulator—this could be the key move in your next success story.

(Risk Warning: Digital assets and their derivatives have high volatility and high risks, and investment decisions should be made with caution. The content of this article is for popular science and communication purposes only, and does not constitute any investment advice.)