Written by: J1N, Techub News

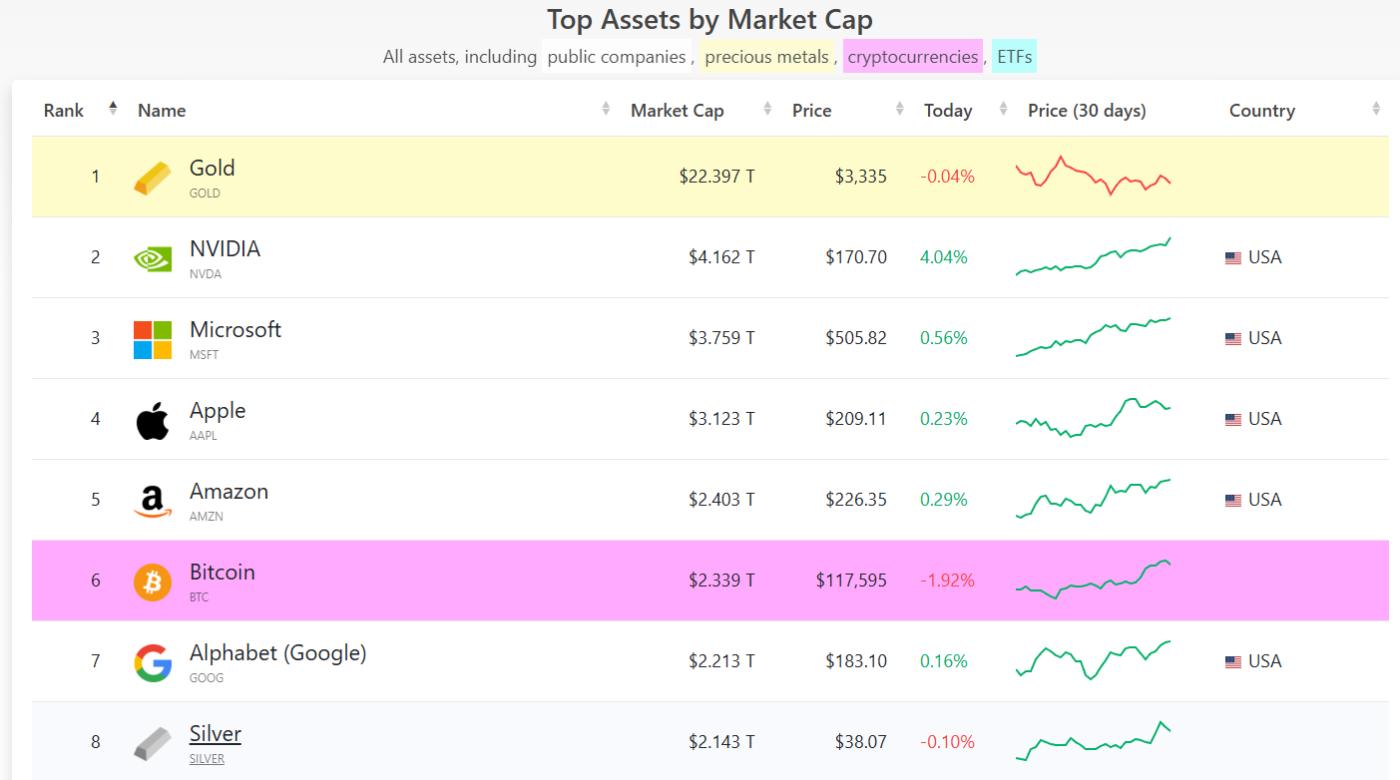

Binance data shows that Bitcoin reached $123,218 on Monday, hitting a new all-time high, and surging nearly 13% over the past week. At the time of writing, Bitcoin has pulled back to $117,700. Its market capitalization currently stands at $2.339 trillion, second only to Amazon's $2.4 trillion, ahead of Silver's $2.2 trillion and Alphabet (Google)'s $2.19 trillion.

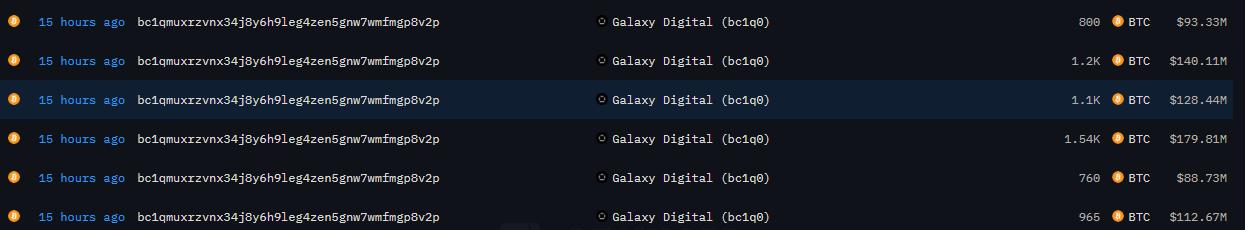

On the second day after Bitcoin broke its historical high, the Satoshi Nakamoto era Bit address (bc1qmuxrzvnx34j8y6h9leg4zen5gnw7wmfmgp8v2p) awakened after 14 years of dormancy. According to Arkham monitoring, the address transferred approximately 40,010 BTC to Galaxy Digital within the past day, valued at around $4.6 billion. The address currently holds 30,000 BTC, worth about $3.54 billion. The address held 80,000 BTC at a price below $30 in 2011, realizing over 4,000 times profit so far.

Additionally, the US BTC spot ETF had a strong start in July, attracting $3.6 billion in inflows to date. According to ichaingo, the last two trading days of last week saw a record $2.2 billion in net inflows, the largest two-day net inflow on record. Institutional fund inflows are often long-term and non-speculative, less likely to experience short-term selling, thus providing some support for the current rebound.

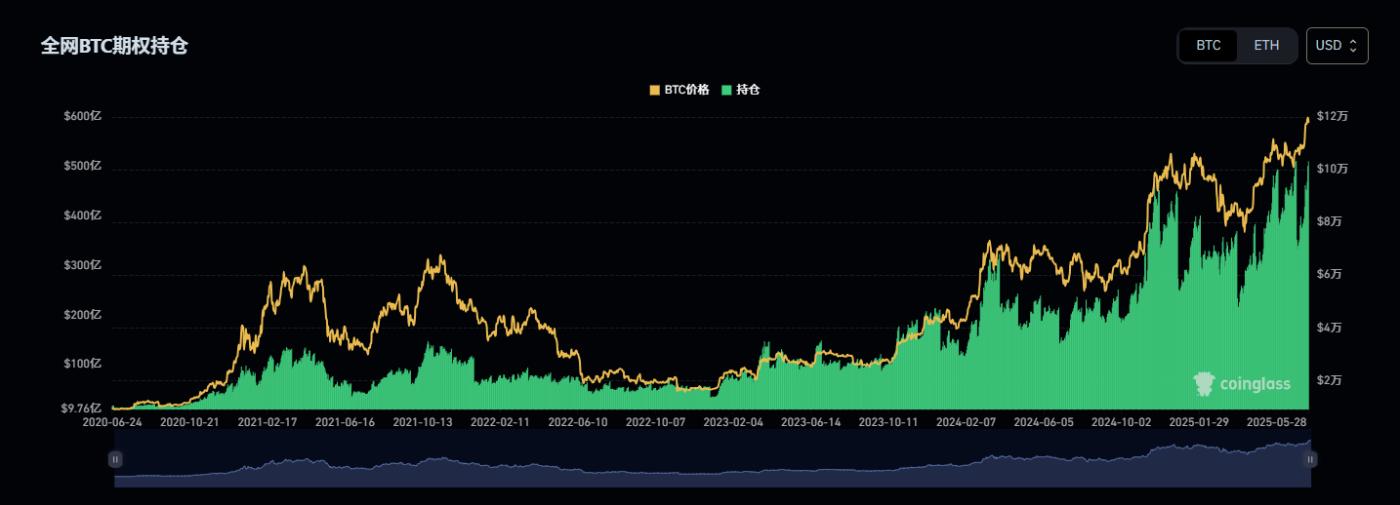

Meanwhile, Coinglass data shows that as of Tuesday, BTC options open interest exceeded $50 billion, hitting a historical high. The continued rise of this indicator typically means more large institutions are participating in BTC purchases, as larger investors tend to hold larger long-term positions and use options for hedging.

BTC Options Open Interest

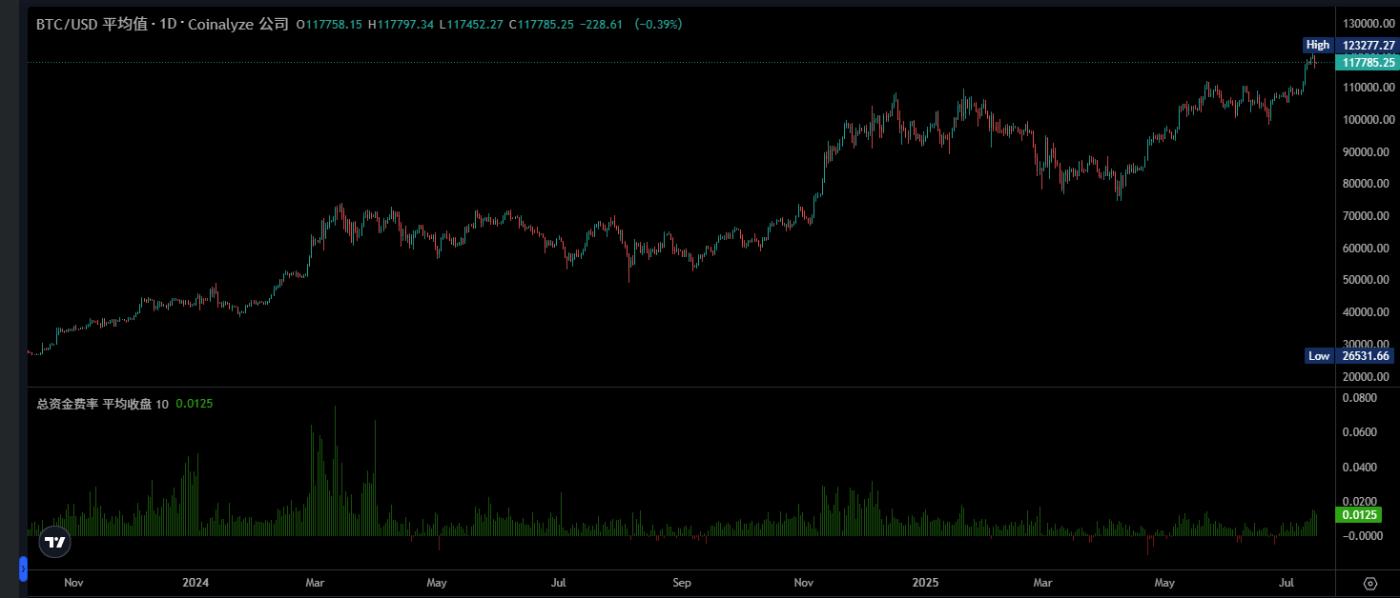

Furthermore, the funding rate for BTC perpetual contracts remains low. Coinalyze data indicates the current daily average funding rate is 0.01%, far below the peak of 0.08% before breaking the previous high of $69,000 and the 0.04% when first breaking $100,000 at the end of last year. The low funding rate suggests a significant reduction in market speculative demand compared to previous periods.