The latest report from Chainalysis reveals that cryptocurrency services have lost over $2.17 billion in 2025, exceeding the total amount stolen in the entire year of 2024. Moreover, 2025 is on track to become the worst year in history.

The report emphasizes that an increasingly large portion of stolen funds comes from personal wallet breaches. Furthermore, the use of physical violence against cryptocurrency owners has also increased this year.

Cryptocurrency Crime Reaches New Heights in 2025

In the latest mid-year 2025 update on cryptocurrency crime, Chainalysis highlights that with nearly half the year remaining, 2025 is already worse than 2024.

"Prominent theft activities are the primary concern in 2025. While other illegal activities tend to be mixed year by year, the increase in cryptocurrency thefts represents both an immediate threat to ecosystem participants and a long-term challenge for the industry's security infrastructure," the report stated.

The blockchain data platform reveals that 2022 remains the worst year in history in terms of total value stolen from services. However, it took 214 days to accumulate $2 billion in stolen funds.

In stark contrast, 2025 reached a similar amount in just 142 days. By the end of June 2025, the YTD stolen value was 17% higher than in 2022.

Regarding scandals, rug pulls, and cryptocurrency crime: Don't miss the dark side of crypto, sign up for the Crypto Crime Files newsletter by Editor Mohammad Shahid, here.

Crypto Funds Stolen in 2025. Source: Chainalysis

Crypto Funds Stolen in 2025. Source: ChainalysisChainalysis predicts that if the current trend continues, the amount stolen from cryptocurrency services could exceed $4.3 billion by year-end, posing a significant threat to security and trust in the cryptocurrency ecosystem.

However, the report points out that the largest incident driving this increase is the $1.5 billion Bybit hack, reportedly carried out by the North Korean Lazarus group. This breach accounts for approximately 69% of the total funds stolen from services in 2025.

"This large breach is part of a broader pattern of North Korea's cryptocurrency activities, increasingly becoming central to the regime's strategy for evading sanctions. Last year, the total known losses related to North Korea were $1.3 billion (previously the worst year in history), making 2025 their most successful year to date," Chainalysis noted.

Cryptocurrency Theft Trends Highlight Increasing Risks for Individuals

Beyond large-scale breaches, attackers have shifted focus to individual users this year. Personal wallet breaches account for 23.35% of total funds stolen YTD. Chainalysis observed three main trends in these breaches.

First, Bitcoin theft dominates the stolen value. Second, the medium loss from breached Bitcoin wallets has increased over time, indicating attackers are targeting higher-value holdings. Third, the number of victims on non-Bitcoin and non-EVM chains like Solana has increased.

The report shows that while Bitcoin holders are less likely to be targeted compared to those holding assets on other chains, when they become victims, losses are typically larger.

This trend is particularly concerning in regions with high cryptocurrency adoption, such as North America. This region leads in both Bitcoin and altcoin theft, with Europe dominating Ethereum and stablecoin losses.

APAC (Asia-Pacific) ranks second in total BTC stolen and third in Ethereum. CIS (Commonwealth of Independent States and Central Asia) ranks second in altcoin and stablecoin theft value.

"So far in 2025, the US, Germany, Russia, Canada, Japan, Indonesia, and South Korea top the list of highest victim counts by country, while Eastern Europe, MENA, and CIS saw the fastest growth from the first half of 2024 to the first half of 2025 in total victims," the report stated.

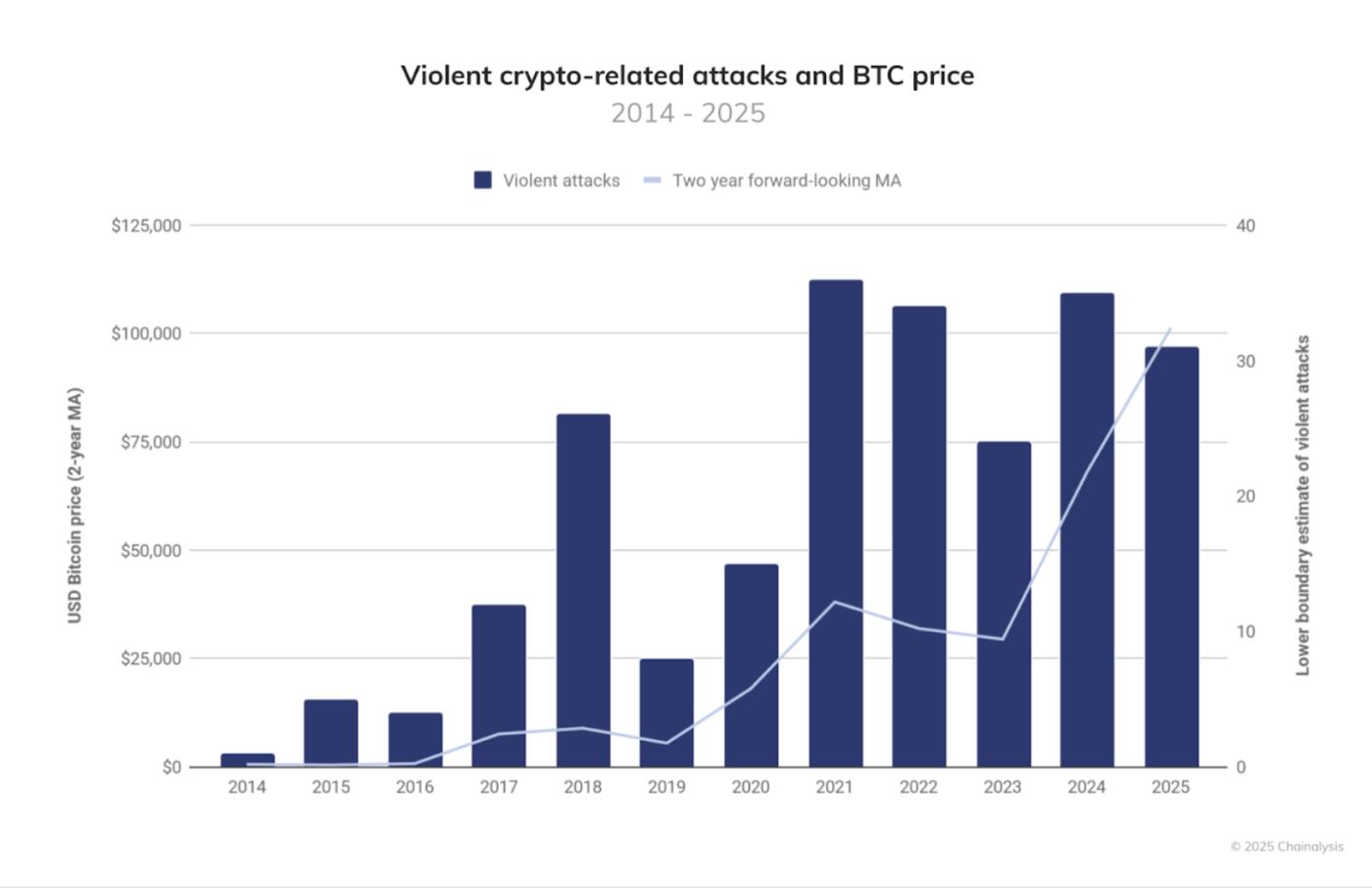

Meanwhile, Chainalysis also emphasized the worrying trend of 'wrench' attacks against cryptocurrency owners. Wrench attacks essentially involve using physical violence or threats to force victims to disclose private keys or transfer assets, bypassing digital security measures by directly targeting individuals.

BeInCrypto previously reported on the increase in kidnappings of cryptocurrency moguls, which is closely related to Bitcoin's price increase. Interestingly, the report also reveals a correlation between these incidents and Bitcoin price volatility.

"Our analysis reveals a clear correlation between these violent incidents and Bitcoin's moving price forecast, indicating that future asset value increases (and perception of future appreciation) can trigger additional opportunistic physical attacks on known cryptocurrency holders," Chainalysis commented.

Increasing Violence Against Cryptocurrency Holders. Source: Chainalysis

Increasing Violence Against Cryptocurrency Holders. Source: ChainalysisThe report warns that, based on current trends, 2025 is expected to have significantly more physical attacks on cryptocurrency holders, potentially double the number of the next highest recorded year, with unreported crime likely concealing the true extent of the problem.