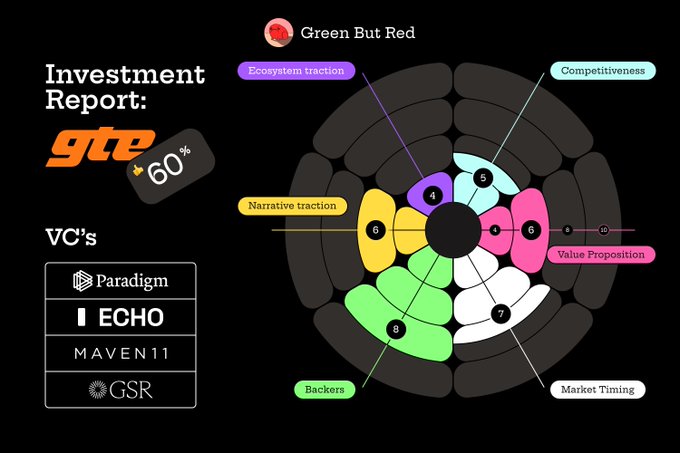

VC @Paradigm just led a fresh $15M Series A for @GTE_XYZ in June 2025, bringing total funding to $25.9M Here’s what makes this DEX on @MegaETH worth watching—and where the real risks are. Project Snapshot @GTE_XYZ is a next-gen decentralized exchange built on @MegaETH, an @Ethereum-compatible L2 focused on speed and scale. GTE’s promise: CEX-level performance, fully on-chain, with a central limit order book (CLOB) and a vertical stack covering everything from token launches to perpetuals. Funding Timeline: • $1.5M pre-seed • $6.94M seed • $2.5M community round on @Echodotxyz (largest in Echo’s history) • $15M Series A led by @Paradigm (June 2025) Value Proposition – 6/10 What’s the pitch? • GTE aims to deliver the speed and trading experience of @Binance or @Coinbase, but with full decentralization and self-custody. • Their CLOB can allegedly handle 100,000 orders per second at 1ms latency—something no DEX has pulled off at scale. • It’s a one-stop shop: token launches, spot trading, and perpetuals, all on a single platform. Where’s the catch? • None of this is proven on mainnet yet; testnet hype doesn’t always translate to real usage. • Competing with giants like @Uniswap and @dYdX means GTE must execute perfectly—there’s no room for error. Bottom line: The idea is strong, but the value is all potential until GTE shows it works for real traders, at real scale. Competitiveness – 5/10 What sets GTE apart? • CLOB architecture (not AMM), meaning pro traders get the precision and speed they want. • Vertical integration—everything from token launch to advanced trading in one place. But… • @Uniswap ($3B+ daily volume) and @dYdX ($2B+ daily) have first-mover advantage and deep liquidity. • GTE’s entire model relies on @MegaETH, an unproven L2 that isn’t live yet. Summary: GTE’s vision is bold, but it’s fighting for attention in a market full of heavyweights. Ecosystem Traction – 4/10 What’s working: • 700,000 testnet users and a record-setting $2.5M @Echodotxyz community raise show strong early interest. • Backed by top VCs and crypto traders. What’s missing: • No mainnet, no real trading volume, no proof of user retention. • Testnet numbers are nice, but the real test is mainnet adoption and sustained liquidity. Takeaway: Great start, but all eyes are on whether GTE can convert hype into real usage. Narrative Traction – 6/10 Tailwinds: • DEXs are booming—27.9% of crypto trading now happens on-chain, and the “CEX risk” narrative is stronger than ever. • @Paradigm ’s exclusive lead on the Series A is a huge vote of confidence. Headwinds: • The DEX sector is crowded and evolving fast. • Web3 trading tools still face skepticism from both retail and pro traders. In short: GTE is riding the right trends, but must prove it’s more than just another DEX with a slick pitch. Backers – 8/10 Who’s in? • @Paradigm (Tier 1, DeFi kingmakers) • @GSR_io, @Wintermute_t (market-making pros) • @RobotVentures, @Maven11Capital , @FlowTraders (DeFi and TradFi expertise) • Also $2.5M raised from the community via @Echodotxyz Why it matters: This isn’t just money - it’s strategic firepower. These backers know how to build, scale, and sustain liquidity on trading platforms. Market Timing – 7/10 Why now? • DEX volumes are at all-time highs, and regulatory pressure keeps pushing users from CEXs to on-chain solutions. • @MegaETH’s L2 launch aligns with real demand for faster, pro-level DeFi trading. Risks: - GTE’s success is tied to @MegaETH’s mainnet launch. If the tech underdelivers or is delayed, GTE’s window could close fast. - The competition isn’t standing still - @Uniswap and @dYdX are innovating every quarter. Bottom line: The timing is good, but the execution window is tight. What Users Can Do Now • Join the testnet: Try out the platform, provide feedback, and position for possible airdrops. • Follow the project: Stay active on Discord and Twitter for launch updates. • Watch for mainnet: The real verdict comes when GTE goes live and faces the market. Final Score: 36/60 (60%) Recommendation (but NFA!): Yellow frog / WAIT GTE has the right team, big backers, and a compelling vision. But until mainnet is live and real traders show up, it’s all potential. Watch closely—if they deliver, this could be a breakout. If not, it’s just another DEX with good marketing.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content