Written by: kkk

On July 19, MEI Pharma (stock code: MEIP), a US pharmaceutical company, announced a strategic transformation, promoting the establishment of a dedicated Litecoin treasury strategy. Currently, over $100 million in funds have been committed to this project.

As part of the transaction, the biotech company will appoint Litecoin founder Charlie Lee to its board of directors. GSR will also obtain a board seat and play a key role in the company's digital asset and fund management advisory committee. Additionally, the Litecoin Foundation has invested in MEI Pharma, as the company's treasury strategy highly aligns with the foundation's core mission of promoting global Litecoin adoption.

Following the announcement, MEIP's stock price surged 83.37% in pre-market trading on Friday, continuing the previous day's 16.58% increase, briefly touching $9 and currently stabilizing at $6.30. The day's trading volume exceeded 13 million shares, far surpassing the past three months' daily average of 26,000 shares. This change not only reflects the market's positive expectations for the company's blockchain transformation but also marks the launch of another "Altcoin MicroStrategy" model after mainstream crypto assets like ETH, SOL, and BNB, ushering in a new chapter of institutional allocation for Litecoin (LTC).

MEI Pharma Completes Strategic Transformation: First Listed Enterprise to Establish Litecoin Strategic Reserve

MEI Pharma, Inc. is a biopharmaceutical company focusing on small molecule drug compound research and development, with core R&D projects including CDK inhibitor Voruciclib for treating B-cell malignancies and mitochondria-targeted anti-cancer drug ME-344. The company was established on December 1, 2000, with headquarters in San Diego, California, USA.

On July 19, 2025, MEI Pharma announced its alignment with blockchain finance, initiating a new round of private investment in public equity (PIPE) transaction and planning to incorporate Litecoin (LTC) into its corporate asset allocation, becoming the first listed biotech enterprise to use LTC as a primary financial reserve asset.

According to the announcement, this round of financing is jointly led by Titan Partners Group and crypto trading company GSR, planning to issue 29,239,767 common shares or equivalent prepaid warrants at $3.42 per share, with a total financing scale of approximately $100 million. The transaction is expected to be completed around July 22, 2025, subject to customary regulatory and delivery conditions.

Behind this financing is not just a capital operation, but a deeper strategic transformation. The company stated that it had systematically evaluated the sustainability of traditional biotech business models and decided to embrace blockchain and DeFi, planning to reorganize its corporate treasury with Litecoin as the core asset and establish long-term cooperation with the Litecoin Foundation and GSR.

Charlie Lee responded to this collaboration, saying: "Since Litecoin's creation in 2011, we have always adhered to the principles of being fast, secure, and decentralized. I'm pleased to see a listed company like MEI embracing these principles. This not only demonstrates increasing institutional confidence in LTC but also lays the groundwork for its further expansion in traditional capital markets."

Why Choose Litecoin

Litecoin is one of the earliest Altcoins in the market, created by former Google engineer Charlie Lee in 2011. Its core architecture is based on Bitcoin's open-source code with multiple optimization upgrades. Compared to Bitcoin, Litecoin generates blocks faster, uses Scrypt Proof of Work (PoW) algorithm, and is more suitable for mining with ordinary hardware, lowering participation barriers. Its total supply is set at 84 million, with deflationary attributes similar to Bitcoin—block reward halving occurs every 840,000 blocks.

As a first-generation Altcoin representative, Litecoin has always been committed to improving on-chain transaction efficiency and scalability, with advantages like low fees and fast processing. In recent years, Litecoin has gradually expanded its payment usage scenarios, including travel companies, convenience stores, real estate agencies, and online e-commerce. In 2021, the Litecoin Foundation announced a partnership with a financial services provider to issue a Visa debit card, allowing users to instantly convert LTC to USD for consumption payments, further solidifying its utility value.

Since Litecoin's creation in 2011, Charlie Lee has been the core driving force behind this ecosystem. He not only advocates technological innovation but has also led multiple key upgrade processes—including Litecoin's selective privacy feature integration and SegWit activation. Charlie Lee has also invested significantly in Lightning Network experiments, mining pool collaboration, and developer community building, laying a solid foundation for Bitcoin and Litecoin network's long-term development.

Now, his deep involvement in MEI Pharma's Litecoin treasury has once again boosted market confidence in the "Litecoin Treasury" strategy. As the Litecoin Foundation emphasized in its announcement: "For 14 years, Litecoin has consistently provided a stable, low-cost, and easily accessible network for millions of users." This MEI collaboration not only means Litecoin's first inclusion in a US listed company's financial structure but is also a strategically significant institutional financial experiment conducted under the founder's direct participation.

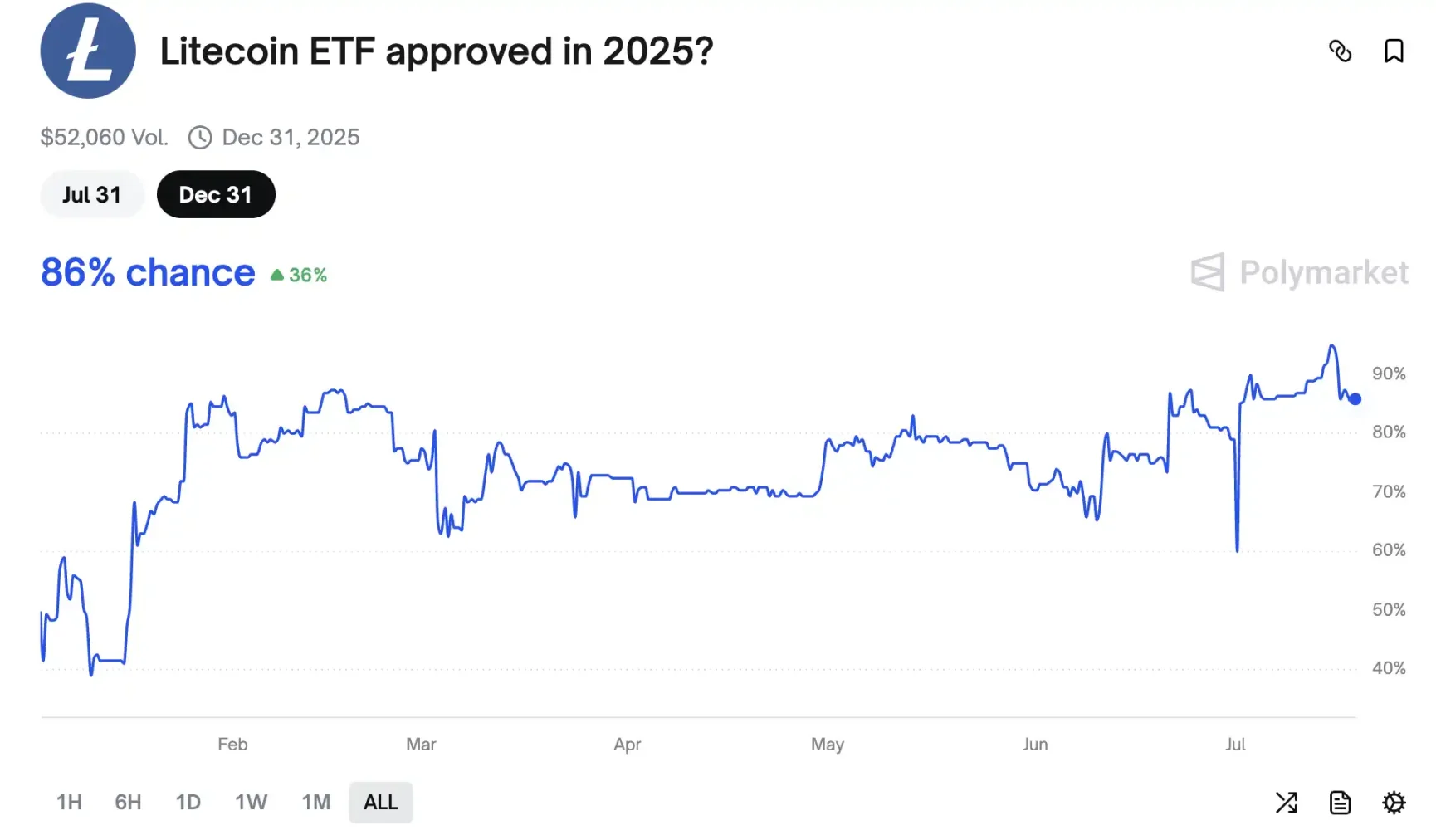

Simultaneously, institutional expectations for Litecoin are rapidly heating up. According to decentralized prediction platform Polymarket, by the end of 2025, the probability of the US Securities and Exchange Commission (SEC) approving a Litecoin spot ETF is as high as 86%. This not only reflects investors' optimistic expectations about Litecoin's regulatory prospects but also indicates its gradual entry into the "mainstream asset" category amid the compliance wave.

Once the spot ETF is approved, Litecoin will join Bitcoin and Ethereum as a core asset in traditional financial investment portfolios, providing institutional funds with a legal and compliant allocation path. This will enhance LTC's market liquidity and valuation anchoring while further strengthening its market positioning as a "payment-type digital asset", becoming a bridge connecting the on-chain world with Wall Street capital.

Summary

With MEI Pharma becoming the first listed company to incorporate LTC into its financial reserves, following mainstream tokens like Ethereum, BNB, and SOL in the "MicroStrategy mode", Litecoin has officially joined this institutional accumulation camp, announcing the launch of another Altcoin "treasury pathway". On the day of the announcement, Litecoin strongly broke through the downward channel, rising over 6% within 24 hours, briefly reaching $106 and subsequently continuing to $115. This not only marks a reassessment of LTC's asset attributes but also further reinforces the role of "Altcoin MicroStrategy" as a driver of this bull market's capital. Coupled with ETF concepts and accelerated institutional positioning, the Altcoin season is quietly beginning.