Written by: Alex Liu, Foresight News

In June, the Solana chain was bustling with activity. Platforms like Pump.Fun, LetsBonk.Fun, Jupiter Studio, Raydium LaunchLabs, and Believe were pulling out all the stops to compete for market share in the LaunchPad (token issuance platform) track, with over 1 million new tokens bursting forth like fireworks, causing an explosive growth in on-chain asset issuance.

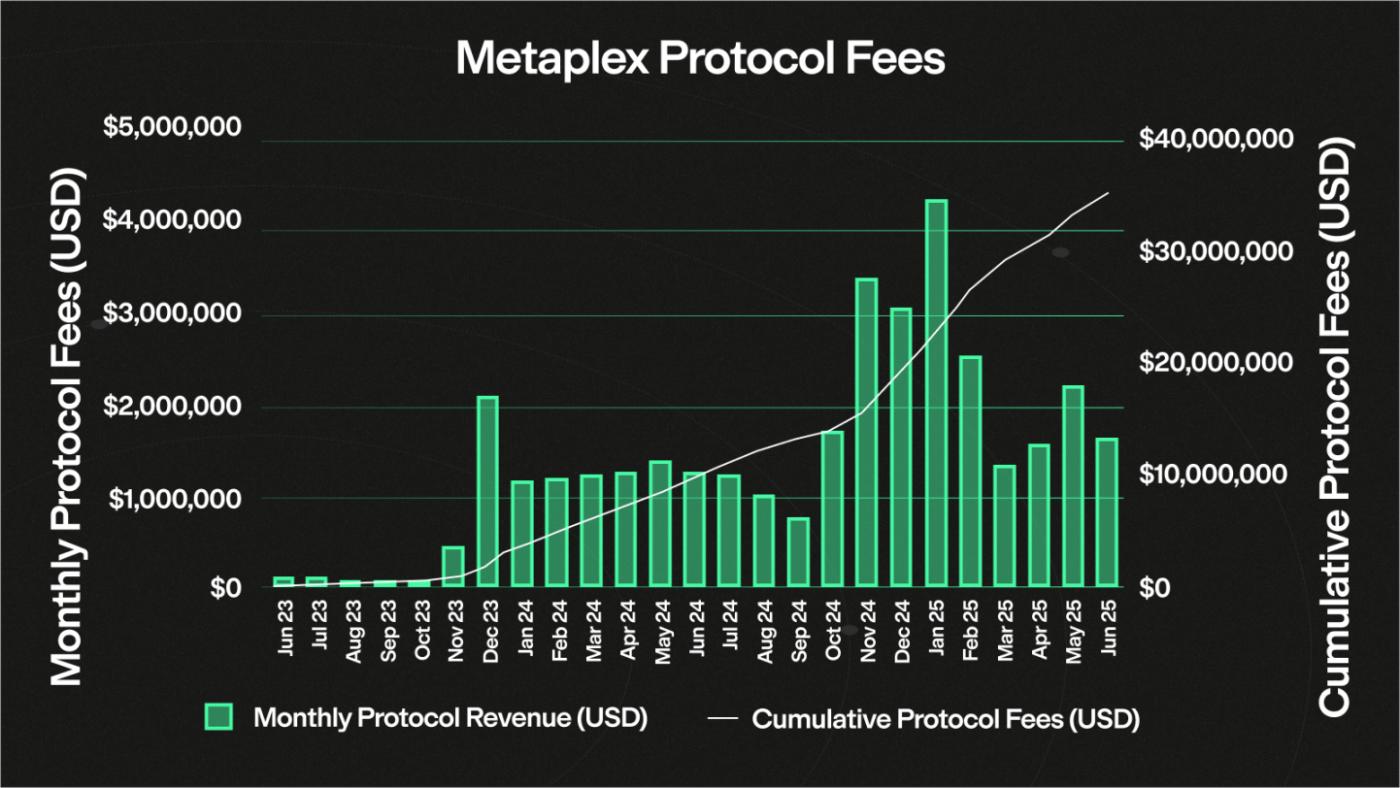

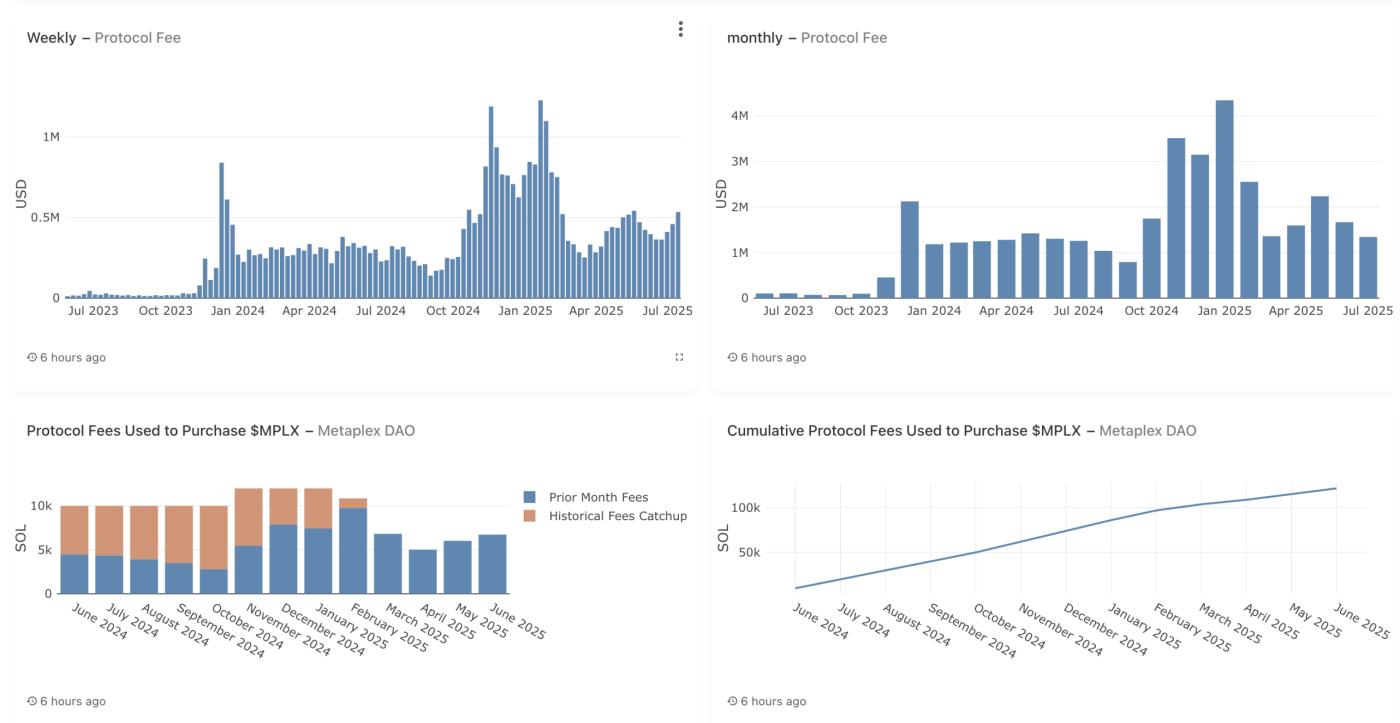

While everyone's attention was focused on the meme tokens that became overnight sensations, Metaplex, the infrastructure layer supporting 99% of asset creation in the Solana ecosystem, was quietly becoming the hidden winner - the Metaplex protocol generated $1.7 million in revenue this month, of which $1.1 million was used to repurchase its native token MPLX, with the monthly repurchase volume accounting for nearly 1% of the token's total circulation.

Metaplex Protocol Fees

Metaplex is more than just a synonym for Non-Fungible Tokens. Today, it is growing from a standard definer to the infrastructure of an "internet capital market" as a Solana asset issuance protocol. Its latest protocol, Genesis, has further expanded Metaplex from "asset creation" to the "entire token issuance process", returning the power of Launchpad to developers and users.

From NFT Protocol to Asset Issuance Infrastructure: Metaplex's Evolution

Metaplex was initially known for defining and promoting the Non-Fungible Token standard on Solana. As early as 2021, it launched Candy Machine - the earliest and most widely used Non-Fungible Token minting program on Solana. It allowed project parties to conduct Non-Fungible Token sales in a chain-based deterministic manner, supporting parameter settings such as price, time, and whitelist, becoming almost the "default interface for Solana Non-Fungible Token minting".

Subsequently, Metaplex also promoted the Compressed Non-Fungible Tokens standard, as well as protocols like Bubblegum and Token Metadata, spanning creation, indexing, and ownership proof.

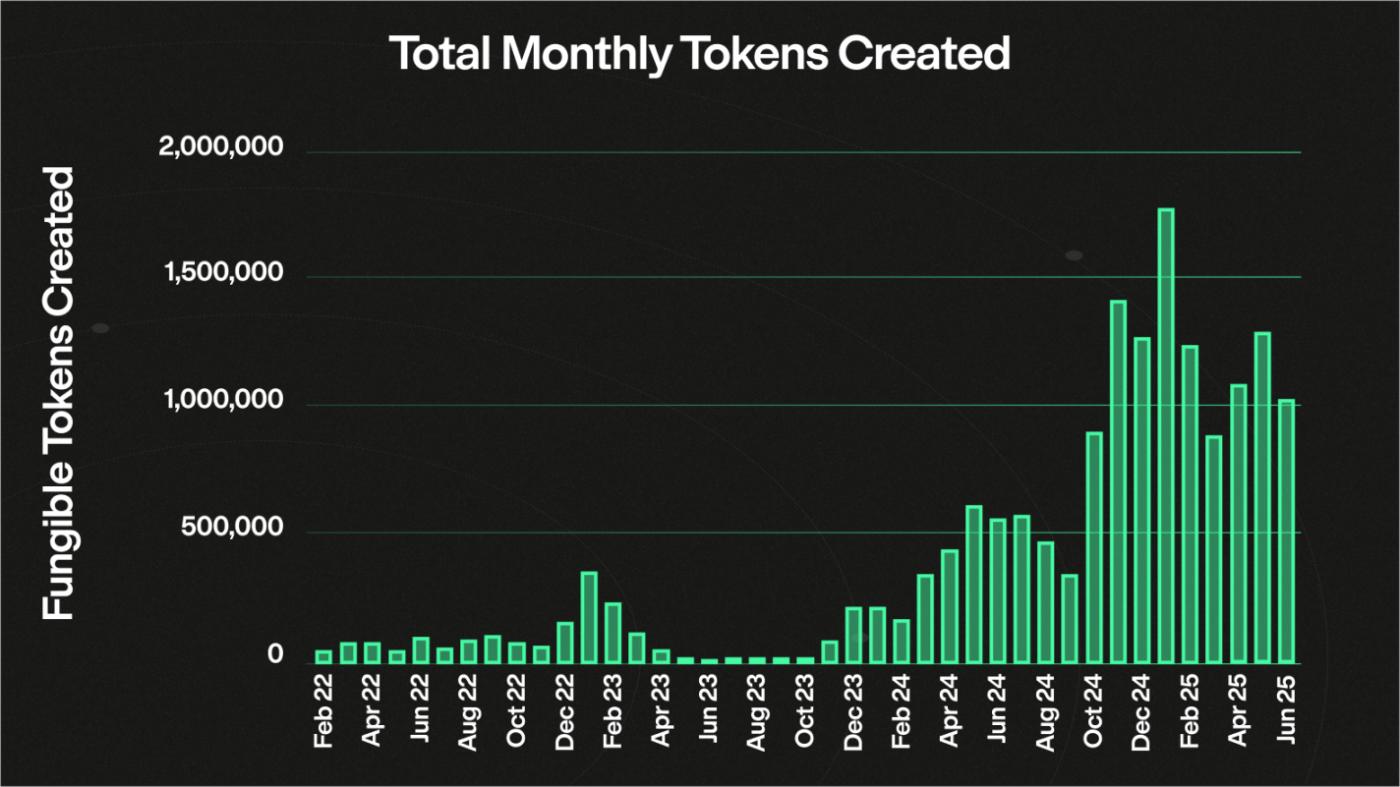

As of June this year, the Metaplex protocol has created over 920 million digital assets, with a cumulative transaction volume exceeding $10 billion, and over 11.5 million independent signed wallets. In June alone, over 1.1 million new tokens were created through Metaplex's Token Metadata standard, with 96% being regular fungible tokens outside of Non-Fungible Tokens, involving asset issuance platforms such as Pump.Fun, Bonk, Raydium, Jupiter, Believe, Meteora, TimeDotFun, and others.

Number of Fungible Tokens Created by Metaplex Monthly

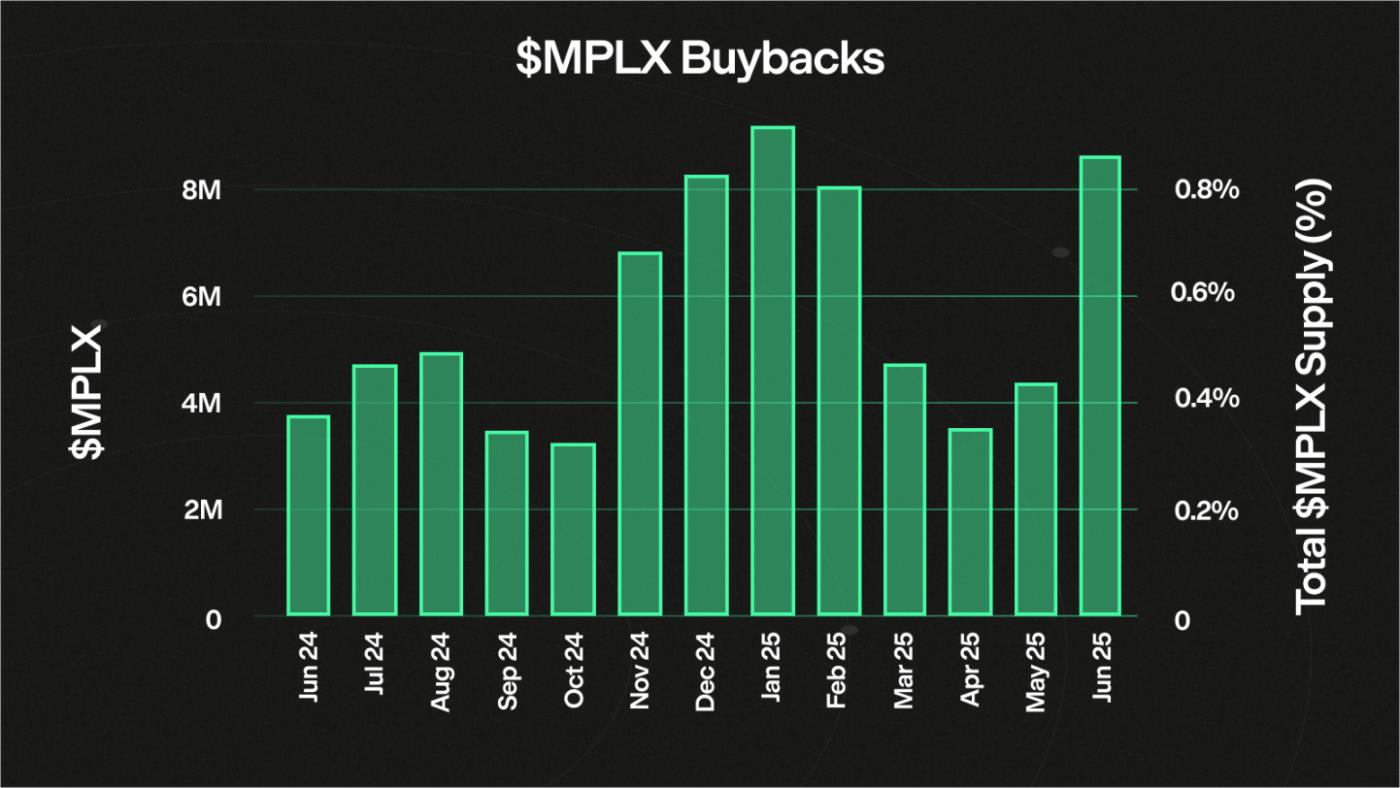

Each token's birth is a call to the Metaplex protocol. Each call brings revenue to the protocol. The June repurchase is not an isolated incident. According to official data, Metaplex's current average monthly revenue is around $2 million, with 50% used for MPLX repurchase. This sustainable token economic mechanism creates one of the few "non-air" projects in the Web3 protocol with "real income + deflationary pressure".

Percentage of Monthly MPLX Token Repurchase to Total Token Supply

Solana Launchpad War: Metaplex's "Hidden Victory"

Returning to the Launchpad war on Solana. In this "grand melee", most retail investors and traders only noticed the rise of LetsBonk.Fun, Pump.Fun's continued loss of leading edge, Believe's gradual decline, and Jupiter Studio's struggle, but few noticed that:

The underlying asset creation of these platforms is almost entirely driven by the Metaplex standard.

Structurally, Metaplex provides not a single product, but a set of standards and toolchains similar to an "infrastructure SDK" - Token Metadata, Compressed Non-Fungible Tokens, Core Non-Fungible Tokens, MPL-404, etc., becoming the unified asset issuance layer of the entire Solana Launchpad ecosystem.

If you believe that the trend of asset creation on Solana will continue (whether for speculation, gaming, governance, identity, or points), you can almost assert that Metaplex will be the core infrastructure.

It does not define the narrative, but no matter what narrative, it will ultimately fall on its protocol.

Genesis: The Key to Opening the "On-Chain Capital Market"

In July 2025, Metaplex announced the launch of a new protocol, Genesis, which is a key step in extending its product system - from "asset creation" to the "complete issuance process", providing Solana developers, project parties, and Launchpads with a comprehensive open and composable token issuance protocol (Onchain Token Offering Protocol, OTO).

Genesis aims to solve a series of core problems faced by traditional Token Generation Events (TGE): front-running attacks due to oracle delays, lack of transparency in manually deployed contracts, trust loss due to inconsistent contract logic, and chaotic asset distribution methods.

Its core capabilities include:

- Configurable Issuance Mechanism: Supporting Launch Pool (fair pool), Auction, Presale, etc., allowing project parties to flexibly choose a model that suits their own rhythm;

- Transparent Token Economics: All distribution rules, lock-up plans, and vesting logic can be verified on-chain;

- Prevent Front-Running: Time window control, sealed bidding, and other mechanisms to prevent BOT (robot) purchases and insider trading;

- Integrated Management: Supporting airdrops, token claims, liquidity migration, UI configuration, and other tools, greatly reducing development and maintenance thresholds;

- Compliance Support: Supporting wallet whitelisting, geographical restrictions, KYC blocking, and other settings (source: Genesis official documentation).

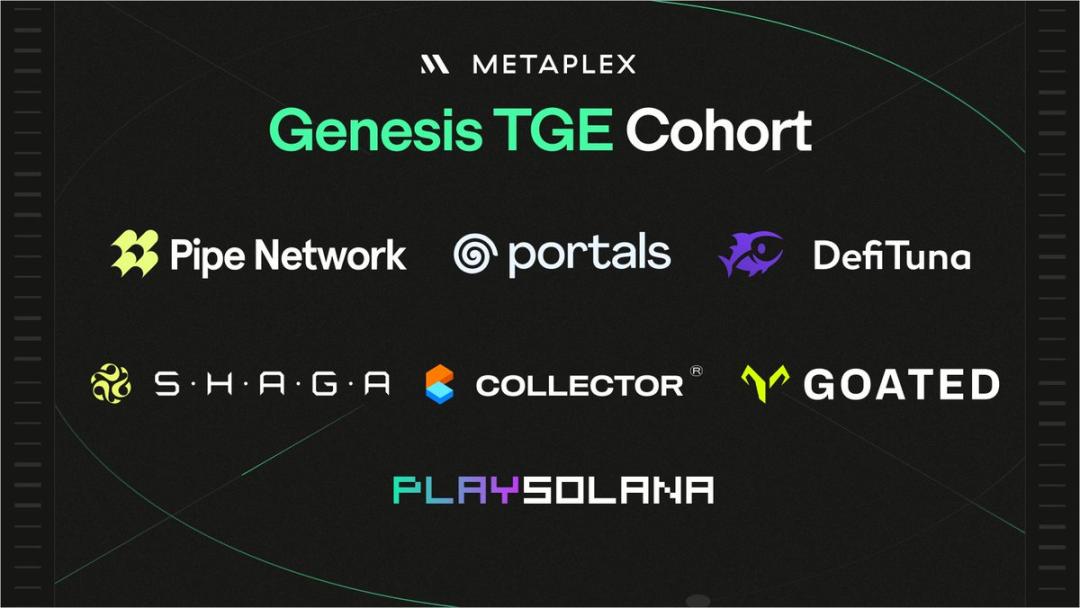

Metaplex Genesis First Batch of TGE Projects

Its powerful features have attracted 7 projects including DeFiTuna, Pipe Network, Portals, and Play Solana to become the first pioneers to use Genesis for TGE. On July 22, the first project using the Genesis platform for TGE, DeFiTuna, completed its entire token sale of TUNA in just 4 minutes, with the whitelist phase filling up in 3 minutes and the public round filling up in 1 minute, involving 628 wallets. With Metaplex's technical support, the entire process was smooth and error-free.

Genesis will also provide developer support for Apps and Launchpads planning to integrate it, with the first batch of integrated projects including top Solana ecosystem projects like Raydium, Jupiter, Kamino, Drift, Meteora, and AXIOM.

Metaplex Genesis Online Integration Partners

Genesis is not just a set of contracts or UI tools, but a new narrative foundation: anyone with an idea and an internet connection can launch an open and transparent on-chain fundraising.

As Stephen Hess, a Metaplex Foundation member, said: "The ultimate legacy of the crypto economy is to bring Silicon Valley's promise to everyone with an internet connection."

Token Economics + Infrastructure: MPLX's Value Reassessment

In a crypto market where valuation and fundamentals are increasingly decoupled, Metaplex is one of the few protocols that still has "cash flow".

- Monthly Average Revenue: Around $2 million (mainly from asset creation and protocol calls);

- Protocol Profit Sharing: Cumulative profits exceed $36 million, with 50% used for MPLX repurchase, having accumulated over $20 million in repurchases;

- Repurchase Entity: Metaplex DAO, deciding monthly repurchase scale through governance voting;

- Repurchase Effect: Repurchase volume in June 2025 was about 1% of the token supply, the second-highest in history.

It's worth noting that Metaplex DAO has become the largest MPLX holder, holding a total of 231 million tokens, accounting for 23% of the total token supply. Of which: initially allocated (TGE): 160 million tokens; accumulated through protocol repurchase: 74 million tokens; allocated to ecosystem incentives and development: about 3 million tokens.

Protocol Fees and Continuous Token Buyback, Data Source

In July, MPLX completed its launch on Binance Alpha and Bitget Onchain, and is advancing integration with more centralized platforms. Early this morning, the largest listed exchange in the United States, Coinbase, announced that MPLX will be included in its token listing roadmap. With increasing exposure and recognition, Metaplex is gradually transitioning from a "developer community asset" to a globally recognized base asset.

Compared to other protocol-less income projects on Solana, Metaplex's revenue capability and token support make it more scarce. With annual protocol revenue of $20 million and a market value of less than $200 million, it could even be considered severely undervalued compared to some asset issuance platforms that were once "overvalued", making it a "hidden gem" in the Solana ecosystem. Recently, MPLX has been under price pressure due to the conclusion of the Binance Alpha trading competition on July 20 and the upcoming token rewards, but from a long-term perspective, this can also be seen as an opportunity to increase exposure.

Outlook: Genesis is the Beginning of a New Wave of On-chain Entrepreneurship

If 2021 was the year of Non-Fungible Token, and 2023-2024 are the narrative shifts of DePIN and AI, the keyword for 2025 will likely be "Onchain Capital Formation".

And Genesis is one of the fundamental infrastructures supporting this narrative. It is not a Launchpad, but a protocol that allows everyone to "create their own Launchpad".

In the future, whether it's a meme coin creator, an Indie game studio, an AI application development team, or a global brand, they can complete asset creation, issuance, distribution, and liquidity building through Metaplex in an integrated closed loop.

This is not a vain idealism, but a current reality. With Genesis's support, the next wave of crypto entrepreneurship may not be born in San Francisco, London, or Shanghai, but launched directly on-chain.

The key to the internet capital market has been inserted, and Metaplex has ignited the spark.